Old and new risks in the financial landscape

Abstract

Risks in the financial system have evolved against the backdrop of persistently low interest rates in advanced economies. Despite substantial efforts to strengthen their capital and liquidity positions, advanced economy banks still face market scepticism. As a result, they have lost some of their traditional funding advantage relative to potential customers. This adds to the challenges stemming from the gradual erosion of interest income and banks' growing exposure to interest rate risk, which could weaken their resilience in the future. By contrast, EME banks have so far benefited from market optimism amid buoyant conditions that may be masking the build-up of financial imbalances. For their part, insurance companies and pension funds have faced ballooning liabilities and muted asset returns. Asset-liability mismatches are weakening institutional investors and threaten to spill over into the real economy. As these investors offload risks onto their customers and banks retreat from traditional intermediation, asset managers are taking on an increasingly important role. Regulatory authorities are carefully monitoring the financial stability implications of the growing asset management sector.

Full text

Changes to risk perceptions, new regulatory frameworks and persistently low interest rates in advanced economies have shaped the post-crisis behaviour and business models of financial institutions. Banks are still adapting to new regulation and striving to regain market confidence, while institutional investors shed traditional exposures. In parallel, the growing influence of asset managers is altering the contours of systemic risk.

Advanced economy banks are still underperforming their emerging market economy (EME) peers. Banks have ploughed a good part of their profits into regulatory capital, which bodes well for the future. But, despite these improvements, markets remain sceptical about firms operating in a difficult environment amid low interest rates and subdued economic activity. If they persist, these conditions will erode profits and further increase banks' exposure to interest rate risk, calling their resilience into question. By contrast, EME banks still enjoy market confidence, as buoyant domestic conditions continue to mask growing financial imbalances (Chapter III).

The prolonged period of low interest rates has been particularly challenging for institutional investors. In the face of ballooning liability values and muted asset returns, insurance companies have explored new investment strategies and have increasingly offloaded risks onto their customers. Even though these measures have paid off so far, they may not be enough to counter future headwinds stemming from plateauing equity valuations and the erosion of fixed income returns. Confronted by similar difficulties, pension funds are posting large and widening deficits that could take a toll on the real economy.

Market-based intermediation has filled the gap left by strained banks. In particular, the asset management sector has grown rapidly, supporting economic activity but also raising new risks. Even when asset managers operate with low leverage, their investment mandates can give rise to leverage-like behaviour that amplifies and propagates financial stress. In recent years, asset managers have catered to the needs of yield-hungry investors by directing funds to emerging market economies. This has added fuel to financial booms there, possibly exacerbating vulnerabilities. More generally, the potential impact of asset managers on financial stability has placed them on regulators' radar screen.

This chapter is organised as follows. After reviewing banks' recent performance and progress in building up their resilience, the first section discusses their medium-term challenges. The following two sections perform a similar analysis, focusing on insurance companies and pension funds. The last section outlines new types of risk raised by the asset management sector and discusses possible policy responses.

Banks: market perceptions drive or mask challenges

Divergent conditions have determined banks' performance in advanced and emerging market economies. Even as subdued economic growth, low interest rates and substantial litigation costs were sapping their profits, advanced economy banks responded to the regulatory overhaul by strengthening their balance sheets. However, persistent market scepticism undermined these institutions' funding cost advantage - the very basis for their intermediation function. By contrast, EME institutions retained market confidence and benefited from domestic financial booms, some of which are now in their late stages.

Recent performance and efforts to rebuild financial strength

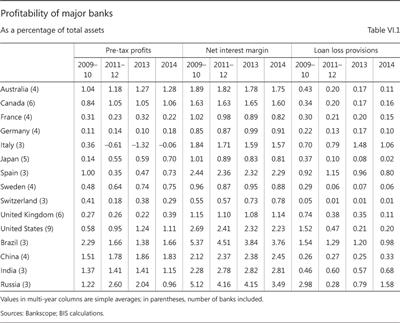

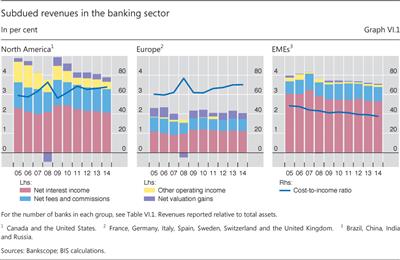

The banking sector has posted mixed results over the past six years. While the profits of US banks have been high and robust, those of many European institutions were much lower in 2014 than immediately after the crisis (Table VI.1). In the background, net interest income - banks' main source of revenue - has declined slightly on both sides of the Atlantic (Graph VI.1, left-hand and centre panels). As these banks did not counter subdued revenues by cutting operating expenses, cost-to-income ratios rose steadily between 2009 and 2014 (blue lines). By contrast, EME banks have posted falling cost-to-income ratios and - with the exception of Russian institutions - have kept their profits high.

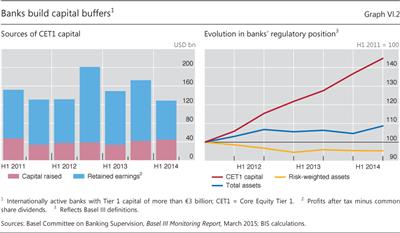

Profits have been the main driver of steady improvements in the regulatory capital positions of both advanced economy and EME banks. Retained earnings underpinned the bulk of the 45% increase in large banks' Core Equity Tier 1 (CET1) capital between mid-2011 and mid-2014 (Graph VI.2, red line). On the back of slightly declining risk-weighted assets, the corresponding CET1 regulatory ratios rose from roughly 7% to 11% over the same period. For this to represent an unequivocal improvement in banks' resilience, the decline in average risk weights - indicated by the widening gap between the blue and yellow lines - should reflect a conservative approach that favours less risky borrowers.

Certain strategic choices do reveal banks' increased conservatism. For instance, post-crisis reassessments of cost and benefit trade-offs have induced many banks to scale down or to announce a downsizing of their investment banking units. This recalibration of business models has contributed to a cutback in market-making activities (Box VI.A). Likewise, lessons from the crisis and a recent regulatory overhaul have led banks to tread carefully in securitisation markets (see also Box VI.B).

That said, concerns remain that the general decline in risk weights is partly the result of opportunistic reporting. To economise on equity capital, banks have an incentive to bias their risk estimates downwards. To reassure investors and observers that banks do not succumb to this incentive, supervisors need to be in a position to regularly, transparently and convincingly validate risk estimates.

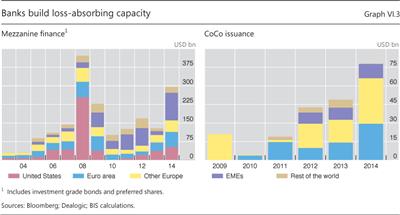

On the liabilities side, banks have taken advantage of low interest rates to issue securities that are in the middle of the capital structure and can thus absorb losses (Graph VI.3, left-hand panel). Net issuance of subordinated debt and preferred shares - or mezzanine finance instruments - spiked in 2008, largely due to US government-sponsored recapitalisations. Subsequently, the bulk of net issuance stemmed from European and EME banks, with a temporary drop in 2013 reflecting the anticipation of new regulatory standards in China. Part of the global activity in mezzanine finance is in contingent convertible bonds (CoCos) that could qualify as regulatory capital (Graph VI.3, right-hand panel). So far, CoCo issuance has been limited to a small number of banks in specific countries.

Even though much of banks' mezzanine funding will not count towards regulatory capital, the recent increase in issuance is in line with new policy initiatives to streamline the resolution of failing banks. A Financial Stability Board consultative document outlines ways in which global systemically important banks (G-SIBs) should build their loss-absorbing capacity for resolution. These proposals aim to secure self-contained bank restructurings that reduce the system-wide repercussions of failures as well as the burden on taxpayers (Box VI.C).

Challenges and risks ahead

The sustained low interest rate environment in advanced economies clouds banks' outlook. Since the cost of deposits and other funding quickly hits a lower bound in such an environment, declining returns on newly acquired securities, compressed term premia, and falling lending rates in competitive loan markets steadily erode net interest income (Box VI.D). The resulting squeeze on profitability would weaken the main source of capital, ie retained earnings, and hence banks' resilience.

Box VI.A

Market-making in retreat: drivers and implications

Recent indications of reduced market liquidity (Chapter II) have drawn policymakers' and analysts' attention to important providers of such liquidity: specialised dealers, also known as market-makers. There are various drivers of market-makers' perceived retrenchment. Some relate to dealers reassessing their own risk-taking behaviour and the viability of their business models post-crisis. Others have to do with new regulations, which aim to bring the costs of market-making and other trading-related activities more closely in line with the underlying risks and with the risks that these activities generate for the financial system. Attaining this policy goal would ensure a transition to an environment with possibly lower, but more robust, market liquidity.

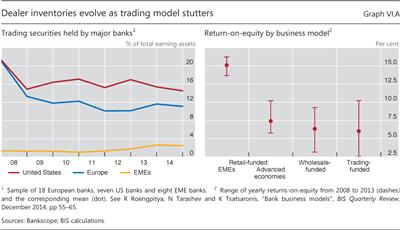

Market-makers are important providers of liquidity services. By committing their own balance sheets, they stand ready to act as buyers or sellers to complete client-initiated trades in the presence of transitory supply-demand imbalances. It is generally acknowledged that underpriced market-making activities contributed pre-crisis to "liquidity illusion", ie the misleading impression that liquidity would always be abundantly available. After the subsequent bust, market liquidity was eroded by the decline in banks' inventories of corporate bonds and other trading securities (Graph VI.A, left-hand panel; see also Graph II.11, left-hand panel). Understanding the drivers of this recent development is necessary for assessing the robustness of market liquidity going forward.

For one, market-making lost steam post-crisis partly as a result of dealers' waning tolerance for the valuation and funding risks of warehoused assets. In many jurisdictions, dealers have raised the risk premia they demand and have overhauled their risk management to better account for the cost-benefit trade-offs of alternative business lines. This has increased the price of market-making services - especially in less liquid markets, such as those for corporate bonds - although to varying degrees across countries and client types.

In many jurisdictions, dealers have raised the risk premia they demand and have overhauled their risk management to better account for the cost-benefit trade-offs of alternative business lines. This has increased the price of market-making services - especially in less liquid markets, such as those for corporate bonds - although to varying degrees across countries and client types.

In addition, post-crisis strains have pushed banks to reassess their business models. The findings of such assessments do not flatter market-makers. In recent years, institutions engaging mostly in commercial banking activities have been more efficient and have produced generally higher and less volatile profits than those employing a trading- and investment banking-based strategy - the business model most closely associated with market-making services (Graph VI.A, right-hand panel). In response, some banks have abandoned or significantly scaled back their trading activities, while others - recently, German and UK institutions - have announced major restructurings of their investment banking units.

In response, some banks have abandoned or significantly scaled back their trading activities, while others - recently, German and UK institutions - have announced major restructurings of their investment banking units.

According to a recent survey, major dealers see regulatory reforms as another driver of market-making activities. In particular, they point to the restraining effect that leverage and capital requirements have on low-margin and balance sheet-intensive businesses, such as repo-funded trading activities. They also refer to the increasing cost of warehousing fixed income inventories.

In particular, they point to the restraining effect that leverage and capital requirements have on low-margin and balance sheet-intensive businesses, such as repo-funded trading activities. They also refer to the increasing cost of warehousing fixed income inventories.

However, the net impact on market liquidity depends on a number of additional factors. One is the capacity of market-makers to reap the cost-saving benefits of new trading technologies. Another is the ability of other market participants to fill any gap left by traditional market-makers. This also determines to what extent increased market-making costs are passed through to clients and, ultimately, to the broader investor community.

From a policy perspective, a key question is whether the trends under way in market-making will help avert liquidity crises. For this to be the case, these trends should align the price of market-making services in normal times with the high costs of evaporating liquidity in bad times. Admittedly, price realignments are unlikely to prevent an exceptionally large shock from bringing financial markets to a halt. But they should discourage financial behaviour that takes market liquidity for granted and naively rules out an eventual price collapse, even as excesses are building up. By reducing market participants' vulnerability to ordinary liquidity shocks, this would make it less likely that such shocks could feed on themselves and undermine system-wide liquidity.

See Committee on the Global Financial System, "Market-making and proprietary trading: industry trends, drivers and policy implications", CGFS Papers, no 52, November 2014.

See Committee on the Global Financial System, "Market-making and proprietary trading: industry trends, drivers and policy implications", CGFS Papers, no 52, November 2014.  See R Roengpitya, N Tarashev and K Tsatsaronis, "Bank business models", BIS Quarterly Review, December 2014, pp 55-65.

See R Roengpitya, N Tarashev and K Tsatsaronis, "Bank business models", BIS Quarterly Review, December 2014, pp 55-65.  See Appendix 4 of the publication cited in footnote

See Appendix 4 of the publication cited in footnote  .

.

Persistently low interest rates also increase banks' exposure to the risk of interest rate increases. Just as falling yields have supported asset valuation gains in recent years, an eventual normalisation would generate losses. Banks' equity capital would shrink, as the value of their short-duration liabilities is largely insensitive to interest rate changes. This stands in contrast with the benefits of interest rate rises for life insurers and pension funds, whose assets are typically of much shorter duration than their liabilities (see below). It also underscores the importance of policy initiatives to build regulatory safeguards against interest rate risk in the banking book.

Recent loan losses suggest that the challenges of some advanced economy banks extend beyond profit margins and interest rate risk. In particular, large Italian and Spanish banks have repeatedly posted loan losses well above those of their peers (Table VI.1). Industry analysis has attributed the 2014 losses only partly to the balance sheet clean-up triggered by the ECB's asset quality review, emphasising instead that the losses may need to rise further before declining.

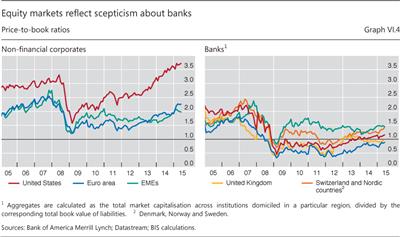

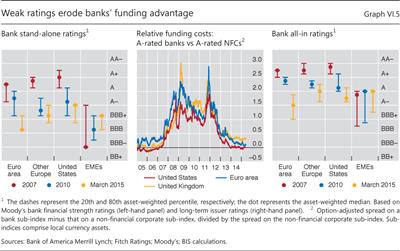

Price-based indicators suggest that markets have a less favourable view of advanced economy banks than of their EME counterparts. Against the background of general optimism, evident in high price-to-book ratios in the non-financial sector (Graph VI.4, left-hand panel), equity investors appear lukewarm about US, Swiss and Nordic banks and rather pessimistic about UK and euro area banks (right-hand panel). Rating agencies take a similar view: stand-alone ratings - which measure resilience in the absence of external support - deteriorated markedly during the subprime and sovereign crises for both European and US banks and have not rebounded since (Graph VI.5, left-hand panel). By contrast, EME institutions boast on average high price-to-book ratios and improving stand-alone ratings. It remains to be seen, however, whether this vote of confidence will persist should local conditions weaken (Chapter III).

By failing to reassure markets in recent years, advanced economy banks have lost much of their funding advantage, so crucial for their success. Two self-reinforcing drivers are responsible for this loss of ground. First, greater uncertainty about advanced economy banks both during the financial crisis and post-crisis led credit market participants to charge them substantially more than similarly rated non-financial corporates (NFCs) up to 2012 (Graph VI.5, centre panel). This markup narrowed subsequently, but it still affects euro area and, especially, UK banks. Second, while NFC ratings have remained largely stable since the crisis, banks have seen a sustained deterioration of their all-in ratings, which capture both inherent financial strength and external support (Graph VI.5, right-hand panel). The resulting loss of funding advantage could partly explain the decline in banks' traditional intermediation activities and the concurrent ascent of market-based funding sources (see below).

Box VI.B

The risks of structured finance: regulatory responses

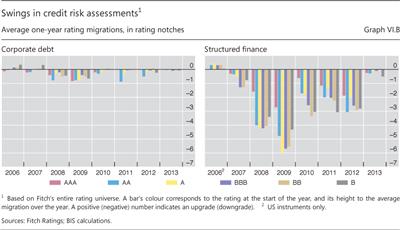

The crisis exposed serious flaws in the securitisation market. Abrupt downgrades of fixed income securities in 2008-09 forced banks to quickly raise capital to cover unshed exposures. While corporate bonds were marked down by less than one notch on average, the corresponding downward revision for similarly rated securitisation tranches was as high as three to six notches (Graph VI.B). And while downgrades for corporate bonds slowed after 2009, they extended into 2012 for securitisation tranches. This disparity revealed that faulty risk models had inflated the ratings of certain senior tranches, thus artificially reducing regulatory risk weights. Furthermore, the unwarranted assumption that risks could be estimated with a high degree of precision raised the likelihood that tranches in the middle of securitisations' capital structure were severely undercapitalised.

Recent revisions to the securitisation framework take these lessons into account. The new framework includes "comply or explain" provisions to incentivise banks to reduce their reliance on external ratings. It also limits the number of available approaches to computing bank regulatory capital and simplifies their hierarchy. Importantly, the revised framework introduces regulatory safeguards against undercapitalisation while maintaining risk sensitivity, ie while requiring higher capital for riskier securitisation exposures.

The new framework includes "comply or explain" provisions to incentivise banks to reduce their reliance on external ratings. It also limits the number of available approaches to computing bank regulatory capital and simplifies their hierarchy. Importantly, the revised framework introduces regulatory safeguards against undercapitalisation while maintaining risk sensitivity, ie while requiring higher capital for riskier securitisation exposures.

Consistent with the spirit of risk-sensitive regulation, less complex and more transparent securitisations should be subject to lower capital requirements. Accordingly, the Basel Committee on Banking Supervision and the International Organization of Securities Commissions have jointly proposed a list of criteria to help develop simple and transparent asset pools.

That said, risk assessments for such pools will still be surrounded by considerable uncertainty. Ignoring this would materially raise the likelihood that tranches are severely undercapitalised.

What makes securitisation tranches special is that they can concentrate uncertainty. Focusing on simple and transparent securitisations, Antoniades and Tarashev show that irreducible uncertainty about the true default probabilities in the underlying asset pool would surface predominantly in tranches of intermediate seniority, the so-called mezzanine tranches. Ignoring this, the Basel II framework gave rise to cliff effects, whereby small estimation errors led to disproportionately large swings in the capital requirements for these tranches. This opened the door to severe undercapitalisation and mispricing of risks. The introduction of capital safeguards for mezzanine tranches in the revised framework is thus a welcome step towards addressing an important source of fragility in the financial system.

Ignoring this, the Basel II framework gave rise to cliff effects, whereby small estimation errors led to disproportionately large swings in the capital requirements for these tranches. This opened the door to severe undercapitalisation and mispricing of risks. The introduction of capital safeguards for mezzanine tranches in the revised framework is thus a welcome step towards addressing an important source of fragility in the financial system.

Basel Committee on Banking Supervision, Basel III: Revisions to the securitisation framework, December 2014.

Basel Committee on Banking Supervision, Basel III: Revisions to the securitisation framework, December 2014.  Basel Committee on Banking Supervision and Board of the International Organization of Securities Commissions, Criteria for identifying simple, transparent and comparable securitisations, consultative document, December 2014.

Basel Committee on Banking Supervision and Board of the International Organization of Securities Commissions, Criteria for identifying simple, transparent and comparable securitisations, consultative document, December 2014.  A Antoniades and N Tarashev, "Securitisations: tranching concentrates uncertainty", BIS Quarterly Review, December 2014, pp 37-53.

A Antoniades and N Tarashev, "Securitisations: tranching concentrates uncertainty", BIS Quarterly Review, December 2014, pp 37-53.

The recent sovereign debt crisis - together with national authorities' treatment of sovereign exposures - has contributed to a decline in European banks' corporate lending.1 Against the basic philosophy of global regulatory standards, home authorities have permitted requirements on banks' sovereign exposures to be less stringent than on corporate exposures with similar risk characteristics (Box VI.E). Thus, when risk premia on government bonds shot up during the sovereign debt crisis, the associated capital and liquidity charges barely moved. Euro area banks in particular took advantage of the resulting profit opportunities and substituted sovereign bonds for corporate lending. Entities without access to market-based funding, such as small and medium-sized enterprises, have borne the brunt of this credit displacement.

Box VI.C

Loss-absorbing capacity for banks in resolution

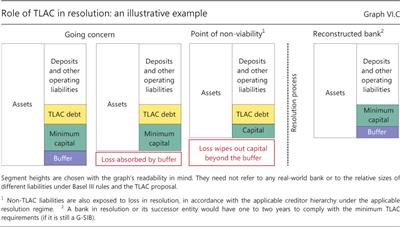

Post-crisis regulatory reforms seek to reduce the economy's exposure to financial system strains. They have two complementary objectives: ensuring minimum standards of resilience, so that financial firms are less likely to fail, and diminishing the impact on the system and the economy in case they do fail. The first objective is embedded in the more stringent Basel III capital and liquidity standards for going-concern banks; the second in measures to improve the efficiency of resolution when a bank reaches the point of non-viability. In the light of the second objective, the Financial Stability Board has issued a list of key principles for efficient resolution and has proposed new standards on the adequacy of the loss-absorbing capacity of global systemically important banks (G-SIBs) in resolution: Total Loss-Absorbing Capacity (TLAC).

The TLAC requirements would supplement the loss-absorbing capacity of Basel III regulatory capital. In general terms, a normally functioning bank would have enough capital to meet its regulatory minimum and buffer requirements and sufficient TLAC liabilities (Graph VI.C, first panel). Capital buffers are the bank's first line of defence: they absorb initial losses and allow the institution to provide uninterrupted intermediation services (second panel). A going-concern bank meets its minimum capital requirements and is judged able to respond to adverse shocks by replenishing its capital buffers - for instance, through retained earnings. However, large and persistent losses can cause the bank to breach its minimum requirements, at which point it is likely to be judged unable to recover and hence non-viable (third panel). A non-viable bank would enter the process of resolution, during which TLAC debt is "bailed in", ie converted into equity or written down. This allows authorities to recapitalise the troubled institution - or a successor entity that assumes its operations - in a manner that commands market confidence and provides key services (fourth panel). Ultimately, TLAC is a prefunded source of capital, available to facilitate a non-disruptive resolution process.

The TLAC proposal specifies how banks should build this additional loss- absorbing capacity. While resources eligible for Tier 1 or Tier 2 regulatory capital would help meet the TLAC requirement for resolution, there is an expectation that at least one third of the requirement would be met with debt liabilities. To be readily bailed in, these liabilities should satisfy a number of criteria. Key among them is that legal arrangements clearly specify the subordinated status of TLAC debt to other liabilities of a more operational nature - such as deposits and derivative and other trading exposures of counterparties. This would reduce the risk of legal challenge or compensation claims. Other criteria state that TLAC debt should be unsecured and have a remaining maturity of more than one year in order to ensure that sufficient amounts remain available as the bank approaches the point of non-viability. The goal of the TLAC proposal is that a failing bank's resolution does not draw on taxpayer funds and is smooth, whether it takes the form of a recapitalisation and restructuring or of an orderly wind-down.

The level of TLAC requirements would be determined with reference to existing regulatory metrics. TLAC securities would need to be at least equal to the greater of (i) 16-20% of the bank's risk-weighted assets; and (ii) twice the level of capital that satisfies the bank's Basel III leverage ratio requirement. The amount would be a minimum, with national authorities free to impose additional requirements on institutions in their jurisdiction. The implementation date for TLAC requirements is not yet fixed and will not be before January 2019.

and (ii) twice the level of capital that satisfies the bank's Basel III leverage ratio requirement. The amount would be a minimum, with national authorities free to impose additional requirements on institutions in their jurisdiction. The implementation date for TLAC requirements is not yet fixed and will not be before January 2019.

Critically, the effectiveness of TLAC depends on it being complementary to other elements of the prudential framework and resolution regime. The proposed design is compatible with Basel III rules. It preserves the integrity of capital and liquidity standards and supports their objective of boosting the resilience of banks as going concerns. TLAC resources will be used after the firm has crossed the point of non-viability and will help resolution authorities restore Basel III buffers in a restructured institution. In addition, TLAC will need to work well with existing and emerging resolution regimes as well as with various organisational structures. As the rules are finalised and target quantities calibrated, it will be important to maintain sufficient flexibility in the framework to accommodate resolution regimes and strategies that differ across jurisdictions and firms.

Financial Stability Board, Adequacy of loss-absorbing capacity of global systemically important banks in resolution, consultative document, November 2014.

Financial Stability Board, Adequacy of loss-absorbing capacity of global systemically important banks in resolution, consultative document, November 2014.  The final rules will specify an exact number in this range.

The final rules will specify an exact number in this range.

Insurance companies: tackling low interest rate headwinds

While the impact of low interest rates has not played out fully in the banking sector, it has already generated important headwinds for insurance companies. For one, the persistence of low rates has taken a toll on companies' profitability by depressing the yield on new investments. In parallel, new accounting rules for the discounting of future obligations have replaced the higher interest rates of the past - prevailing when contracts were signed - with the lower current rates, thus boosting the value of liabilities. Against this backdrop and despite favourable investor sentiment in equity markets, credit ratings signal concerns about insurers.

Box VI.D

Monetary policy and bank profitability

Prolonged monetary accommodation may harm bank profitability. This is because lower short-term interest rates and a flatter yield curve squeeze net interest income, as they respectively sap banks' margins and returns from maturity transformation. And this is not offset by the beneficial effect of lower interest rates on loan loss provisions, through lower debt service costs and default probabilities. Nor is it offset by increased non-interest income, stemming from lower rates' positive impact on securities valuations. Indeed, Demirgüç-Kunt and Huizinga, using aggregate banking sector data from 80 industrial and developing countries, find that a reduction in interest rates generally reduces bank profitability. Alessandri and Nelson obtain similar results for UK banks.

using aggregate banking sector data from 80 industrial and developing countries, find that a reduction in interest rates generally reduces bank profitability. Alessandri and Nelson obtain similar results for UK banks.

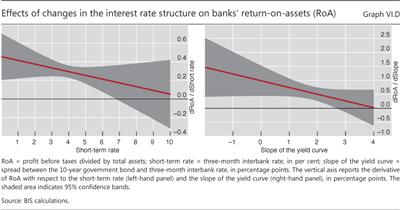

Using data for 109 large international banks headquartered in 14 major advanced economies, recent BIS research has confirmed this result. However, the BIS study also finds that the effect on bank profitability of changes in the interest rate structure - ie the short-term rate and the slope of the yield curve - becomes stronger as interest rates fall and yield curves flatten. For the short- term rate, this non-linear effect reflects, among other things, a reduction of the "deposit endowment effect" on bank profitability at low interest rates: as the deposit rate cannot fall below zero, at least to any significant extent, the mark-down (the difference between the market rate and the deposit rate) is compressed at very low policy rates. For the slope of the yield curve, the non-linearity may stem from the demand for long-term loans and bank services, and from provisions. Graph VI.D shows that the lower the short-term interest rate and slope of the yield curve, the greater their effect on the return-on-assets (RoA). For example, a cut in the short-term policy rate from 1% to 0% is estimated to cause the RoA to fall by 0.4 percentage points over one year, twice the reduction associated with a decrease in the short-term rate from 7% to 6% (left-hand panel). Similarly, a reduction in the slope of the yield curve from -1 to -2 percentage points erodes the RoA by 1.2 percentage points over one year, while the effect is only half that size if the slope goes from 2 percentage points to 1 percentage point (right-hand panel).

However, the BIS study also finds that the effect on bank profitability of changes in the interest rate structure - ie the short-term rate and the slope of the yield curve - becomes stronger as interest rates fall and yield curves flatten. For the short- term rate, this non-linear effect reflects, among other things, a reduction of the "deposit endowment effect" on bank profitability at low interest rates: as the deposit rate cannot fall below zero, at least to any significant extent, the mark-down (the difference between the market rate and the deposit rate) is compressed at very low policy rates. For the slope of the yield curve, the non-linearity may stem from the demand for long-term loans and bank services, and from provisions. Graph VI.D shows that the lower the short-term interest rate and slope of the yield curve, the greater their effect on the return-on-assets (RoA). For example, a cut in the short-term policy rate from 1% to 0% is estimated to cause the RoA to fall by 0.4 percentage points over one year, twice the reduction associated with a decrease in the short-term rate from 7% to 6% (left-hand panel). Similarly, a reduction in the slope of the yield curve from -1 to -2 percentage points erodes the RoA by 1.2 percentage points over one year, while the effect is only half that size if the slope goes from 2 percentage points to 1 percentage point (right-hand panel).

According to these estimates, the negative effect on bank profitability caused by the decrease in the short-term rate was more than compensated for by the increase in the slope of the yield curve in the first two years after the outbreak of the Great Financial Crisis (2009-10). Overall, these changes, other things equal, contributed to an increase in the RoA of 0.3 percentage points on average for the 109 banks in the sample. In the next four years (2011-14), the further fall in short-term rates and the flattening of the yield curve contributed to a cumulative reduction in the RoA of 0.6 percentage points. These results hold after controlling for different business cycle conditions and bank-specific characteristics such as size, liquidity, capitalisation and incidence of market funding.

A Demirgüç-Kunt and H Huizinga, "Determinants of commercial bank interest margins and profitability: some international evidence", World Bank Economic Review, no 13(2), 1999, pp 379-408.

A Demirgüç-Kunt and H Huizinga, "Determinants of commercial bank interest margins and profitability: some international evidence", World Bank Economic Review, no 13(2), 1999, pp 379-408.  P Alessandri and B Nelson, "Simple banking: profitability and the yield curve", Journal of Money Credit and Banking, no 47(1), 2015, pp 143-75.

P Alessandri and B Nelson, "Simple banking: profitability and the yield curve", Journal of Money Credit and Banking, no 47(1), 2015, pp 143-75.  C Borio, L Gambacorta and B Hofmann, "The influence of monetary policy on bank profitability", BIS Working Papers, 2015 (forthcoming).

C Borio, L Gambacorta and B Hofmann, "The influence of monetary policy on bank profitability", BIS Working Papers, 2015 (forthcoming).

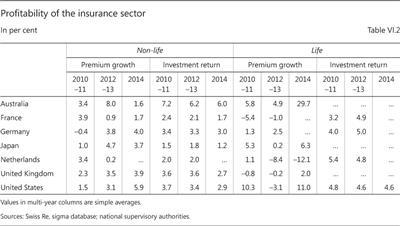

Property-and-casualty firms' subdued performance in 2014 was the outcome of opposing forces. For instance, strong premium growth supported profitability in a number of countries (Table VI.2). Between mid-2013 and mid-2014, it contributed to a slight drop - to 94% - of European non-life insurers' combined ratio, ie the sum of underwriting losses, expenses and policyholders' dividends divided by premium income. However, elevated expenses and catastrophe losses at US companies wiped out much of their gains from premium growth, leading to a 99% combined ratio. Meanwhile, steady and widespread declines in investment returns have depressed non-life insurers' profitability in nearly all major centres.

Despite challenges stemming from their heavy reliance on investment income, life insurers have reported improving performance. Cost-cutting and a greater contribution from new business lines, notably the sale of asset management products, have been instrumental. According to industry estimates, the sector's return-on-equity has risen, from below 10% in 2012 to roughly 12% in 2014.

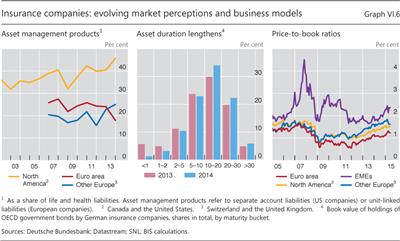

Some trends in the life insurance sector have been consistent with more conservative risk management. For instance, the growing share of asset management products in the liabilities of North American, Swiss and UK life insurers (Graph VI.6, left-hand panel) indicates offloading of financial risk to customers. On the assets side, European companies have been increasing the duration of their bond portfolios (centre panel), thus narrowing duration gap estimates.2 While such estimates suggest an improvement in balance sheet strength, they should be interpreted with caution given their sensitivity to assumptions about discount rates and policyholder behaviour.

Box VI.E

Regulatory treatment of sovereign exposures: towards greater risk sensitivity

The Basel framework calls for minimum regulatory requirements commensurate with the underlying risks. This is the basic philosophy of the framework. That said, a number of national jurisdictions implement preferential treatment of sovereign exposures, notably in relation to non-financial corporate exposures. This weakens the risk sensitivity of regulatory requirements.

This is the basic philosophy of the framework. That said, a number of national jurisdictions implement preferential treatment of sovereign exposures, notably in relation to non-financial corporate exposures. This weakens the risk sensitivity of regulatory requirements. As the resulting distortions can undermine financial stability, they have prompted policy initiatives to reassess the approach to sovereign exposures in bank regulation.

As the resulting distortions can undermine financial stability, they have prompted policy initiatives to reassess the approach to sovereign exposures in bank regulation.

In its clearest form, the preferential treatment applies to exposures that are in the borrowing sovereign's domestic currency and are funded by the bank in the same currency. National authorities have the option - but not the obligation - to allow for much lower risk weights on such exposures than on exposures to private corporations with similar risk characteristics. Often, and regardless of the sovereign's rating, the reduced risk weight is zero. This is currently the case under the standardised approach to credit risk in the banking book, as well as under both the current and proposed approaches to specific risk in the trading book.

When it comes to the treatment of liquidity risk, sovereigns are and are likely to remain attractive investments. One example relates to the regulatory approach to zero-risk-weight sovereign exposures: they qualify without limitations as high-quality liquid assets for banks' liquidity requirements. Or, take the proposed trading book rules, which require banks to evaluate the risk of their exposures over specific horizons. While the estimated risk increases mechanically with the evaluation horizon, this horizon is lower for more liquid securities that are easier to sell at times of stress. Given the high historical liquidity of sovereign securities, the associated evaluation horizons are proposed to be two to three times shorter than those required for equally rated corporate securities.

In addition, sovereign exposures have been exempt from concentration limits in regulatory rules on large exposures. It is thus hardly surprising that they have played an important role in banks' balance sheets. In a worldwide sample of 30 large banks, the share of sovereign exposures in the banking book expanded from roughly 12% in 2004 to 20% at end-2013. And in the euro area's geographical periphery, banks' holdings of their own sovereign's debt have increased steadily as a share of total assets: from 3% in 2008 to above 8% at end-2014.

And in the euro area's geographical periphery, banks' holdings of their own sovereign's debt have increased steadily as a share of total assets: from 3% in 2008 to above 8% at end-2014.

This has strengthened the interdependence of banks and sovereigns. For decades, banks have relied on implicit and explicit sovereign support to improve their ratings and lower their funding costs. More recently, the preferential regulatory treatment of sovereign exposures has allowed banks that were themselves under strain to extend lifelines to troubled governments. The destabilising effect of the two-way links came to the fore during the 2010-11 sovereign debt crisis, which took financial distress to new heights.

Such experiences have prompted a reassessment of the regulatory treatment of sovereigns. Initial steps in this direction relate to the treatment of sovereign support for banks in the standardised approach to credit risk. Proposed changes to this approach would not allow a lending bank to reduce the risk weight on its interbank exposure by referring to the rating of the borrowing bank's sovereign. If implemented, these changes would align the lending bank's capital charge - and ultimately the lending rate - more closely with the borrowing bank's riskiness. In addition, forthcoming leverage ratio requirements will provide, inter alia, a backstop for the size of sovereign exposures for a given level of bank capital. But further work is needed on the regulatory treatment of sovereign exposures themselves.

In addition, forthcoming leverage ratio requirements will provide, inter alia, a backstop for the size of sovereign exposures for a given level of bank capital. But further work is needed on the regulatory treatment of sovereign exposures themselves.

It is important to recognise that sovereigns' preferential status rests on a misleading argument. The argument hinges on central banks standing ready to monetise domestic currency sovereign debt in order to prevent defaults on this debt. As recent events in the euro area show, however, such a solution cannot apply in a currency zone subject to macroeconomic conditions that do not happen to be aligned with the needs of a particular sovereign under stress. The argument is also weakened by a number of historical defaults on local currency sovereign debt, mostly in emerging market economies. And, even when monetisation does prevent a sovereign default, it undermines central bank independence and market confidence in the domestic currency. This, in turn, could lead to high inflation and a currency crisis, which would also adversely affect the banking system. All these considerations underscore the merits of seeking a closer alignment between regulatory requirements for sovereign exposures and the likelihood of sovereign distress.

Basel Committee on Banking Supervision, Basel II: International convergence of capital measurement and capital standards: A revised framework - Comprehensive version, June 2006.

Basel Committee on Banking Supervision, Basel II: International convergence of capital measurement and capital standards: A revised framework - Comprehensive version, June 2006.  See Bank for International Settlements, "Treatment of sovereign risk in the Basel capital framework", BIS Quarterly Review, December 2013, p 10.

See Bank for International Settlements, "Treatment of sovereign risk in the Basel capital framework", BIS Quarterly Review, December 2013, p 10.  Basel Committee on Banking Supervision, Fundamental review of the trading book: outstanding issues, consultative document, December 2014.

Basel Committee on Banking Supervision, Fundamental review of the trading book: outstanding issues, consultative document, December 2014.  Based on BCBS data.

Based on BCBS data.  See European Systemic Risk Board, Report on the regulatory treatment of sovereign exposures, 2015.

See European Systemic Risk Board, Report on the regulatory treatment of sovereign exposures, 2015.  Basel Committee on Banking Supervision, Revisions to the standardised approach for credit risk, consultative document, December 2014.

Basel Committee on Banking Supervision, Revisions to the standardised approach for credit risk, consultative document, December 2014.

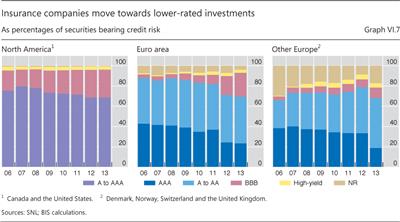

At the same time, the risk profile of insurance companies' assets has deteriorated in recent years, albeit from a conservative starting point. Pressed by regulation and institutional mandates to hold predominantly investment grade securities, insurance companies have seen their asset distribution shift from the best to the worst ratings in this range (Graph VI.7). The shift could be partly due to a slide in the credit quality of outstanding securities. But it is also consistent with active search for yield. And while US firms have operated mainly in the corporate and mortgage markets, their European peers have searched for yield in sovereign bonds. National authorities have in fact encouraged this behaviour to the extent that they have allowed insurance companies - as they have banks - to apply zero risk weights even to sovereigns with low and deteriorating ratings.

Equity markets and rating agencies point to different perceptions of the insurance sector. Price-to-book ratios have been on the rise in major advanced economies since 2011 and have increased from an already high level in EMEs since mid-2014 (Graph VI.6, right-hand panel). This could reflect improving financial strength but also general market euphoria (Chapter II). By contrast, insurers' ratings deteriorated substantially during the financial crisis and have hardly recovered since. A likely driver is a concern that the growth of fees and premia - quite important in supporting insurers' recent profits - will eventually run its course.

Pension funds: growing deficits

Financial market conditions, added to demographic changes, have put a heavy strain on pension funds. Central to the funds' woes are persistently low interest rates, which depress both investment returns and discount rates. Lower discount rates, in turn, raise the present value of funds' liabilities more sharply than that of their assets, which are typically of much shorter duration. This widens pension fund deficits and may ultimately affect the economy at large.

Discount rates vary substantially across countries. According to industry reports on company-sponsored pension funds in advanced economies, they ranged from 4% in North America to 1.5% in Japan in 2013. This reflects differences in local market conditions and in accounting standards. Most accounting approaches pin the discount rate to either the expected long-term return on the fund's assets or the prevailing market yields on low-risk securities, such as highly rated bonds. Either way, the discount rate typically drops with bond yields but to an extent that varies across jurisdictions and between sectors in the same jurisdiction.

US funds provide a good example of the impact of accounting standards. For instance, according to national sources, the average return-based discount rate of US public pension funds can be 300 basis points higher than the rate reported by some of their private sector counterparts. To put this in perspective, a 400 basis point reduction in the discount rate would increase the value of the liabilities of a typical US pension fund by more than 80%. That said, recent and pending changes to US accounting standards are expected to narrow the gap.

In the face of ultra-low interest rates, policy measures have offered temporary relief. For instance, regulators allowed discount rate increases in 2012, partly in response to industry concerns that the prevailing rates had decoupled reported funding ratios from pension plans' intrinsic funding conditions. This measure was either direct - eg discount rate floors in Sweden and higher long-term discount rates in Denmark - or indirect - eg the use of longer, 25-year horizons for the computation of rate corridors in the United States. Likewise, US regulatory amendments in 2012 made it advantageous for funds to offload contracts to insurance companies and to make lump sum payments to plan participants.

Such shifts in contractual obligations are part of a long-standing risk management strategy in the sector. In a trend seen in most major markets, defined contribution (DC) plans, under which members bear the investment risks, have grown more than defined benefit (DB) plans, which guarantee a certain income to members. Concretely, DC plans saw their share in aggregate pension fund liabilities increase from an estimated 39% in 2004 to 47% in 2014. This trend is likely to continue as pension funds address increases in life expectancy estimates that raise the present value of their obligations.

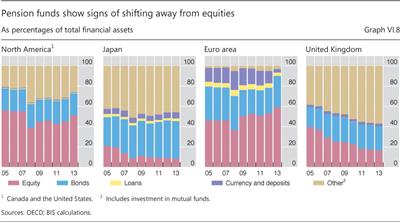

In parallel, pension funds have responded to declining asset returns by shedding their exposure to traditional risks and loading up on so-called alternative investments. These include real estate, hedge funds, private equity and commodities. Industry estimates reveal that the share of such investments in pension fund asset portfolios has risen - from 5% in 2001 to 15% in 2007 and 25% in 2014 - mirrored by a 20 percentage point drop in the equity share. UK pension funds are important drivers of this shift (Graph VI.8, right-hand panel), as are US funds, whose disposal of equities has reportedly been masked by strong valuation gains.

Despite official support and their own efforts, pension funds are facing growing problems. For instance, funding ratios at end-2014 were below pre-crisis levels in both the United States and Europe. And the situation is set to worsen if low interest rates persist, further depressing both asset returns and the discount rates applied to liability valuations. For the US sector, industry research has found that a 35 followed by a 60 basis point decline in the discount rate and correspondingly low asset returns would lower the average funding ratio by roughly 10 percentage points, to about 70%, in two years.

Funding strains at pension funds could have broader repercussions. In the case of DB plans, the fund's liabilities are a contractual obligation of the fund's sponsor, eg a manufacturing corporation or a services firm. Thus, since unsustainable deficits translate sooner or later into expenses for the sponsor, they would hurt companies' profits and possibly undermine their solvency. For their part, DC plans can have similar effects but through different channels. A drop in the value of a DC plan's assets means a decline in the future income stream of its members. If such an outcome is widespread, it would lead to an increase in the saving rate and hence a decline in aggregate demand.

Risks morph post-crisis in the financial system

The financial landscape has evolved substantially post-crisis. While banks have lost ground as intermediaries, asset managers - which run mutual, private equity and hedge funds, among others - have increasingly catered to the needs of yield-hungry investors. As a result, new types of risk have gained prominence.

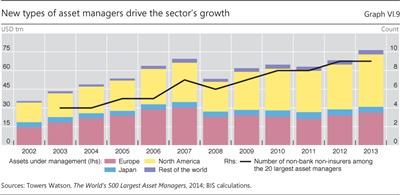

The asset management sector has grown considerably over the past decade. Despite a mid-crisis hiatus, which mirrored mainly valuation losses, global assets under management (AUM) rose from roughly $35 trillion in 2002 to $75 trillion in 2013 (Graph VI.9). The sector remains highly concentrated, with the top 20 managers accounting for 40% of total assets.

The sector's composition has changed over time. By region, North American asset managers have increased their market share by 11 percentage points over the last decade. They now account for more than half of total AUM and approximately two thirds of the assets managed by the top 20 managers. By type, independent managers have been rapidly displacing bank- and insurer-owned managers at the top (Graph VI.9, black line).

As risk-taking migrates away from the banking sector, asset managers have played a pivotal role together with their customers and these customers' investment consultants. In their recommendations, investment consultants reportedly attribute substantial weight to assets' latest performance. Thus, as the returns on EME assets were higher than those on advanced economy assets in the crisis aftermath, investment consultants' recommendations are likely to have contributed to the strong flows into EME funds in recent years (Chapter II).

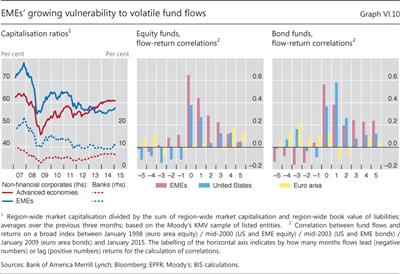

Abundant bond financing has substantially reduced EME companies' capitalisation ratio, ie market capitalisation divided by the sum of market capitalisation and the book value of liabilities. Despite buoyant equity markets, massive borrowing by EME banks and non- financial corporates between 2010 and 2014 lowered significantly their capitalisation ratios to levels last seen at end-2008, in the midst of the global financial turmoil (Graph VI.10, left-hand panel). Even though this trend reversed partly at the start of 2015, it has undermined firms' loss-absorbing capacity, leaving EMEs vulnerable to funding reversals.

This vulnerability has evolved alongside the growing reliance of EMEs on market-based financing channelled through internationally active asset managers (Chapter III). In general, asset managers' business models - eg benchmarking to market indices and attributing great importance to relative performance - and the investment structures that they offer - eg collective investment vehicles - incentivise short-sighted behaviour that can be destabilising in the face of adverse shocks. In the case of managers investing in EME assets, this issue is all the more pronounced.3 EME funds rely on significantly fewer and more correlated benchmarks than their advanced economy counterparts. As a result, financial shocks are more likely to simultaneously affect a wide range of investors in EME funds, leading to concerted in- and outflows.

Fund flows that amplify price swings would be destabilising. The potential for such dynamics transpires from the historical relationship between returns on broad indices and fund flows (Graph VI.10, centre and right-hand panels). In the case of US and EME funds, inflows follow in the footsteps of high returns (bars to the right of zero) and are likely to strengthen the rise in contemporaneous returns (bars at zero). In such a scenario, fund inflows support persistent equity or bond booms. However, this mechanism would work in the opposite direction as well. In a downturn, outflows would exacerbate sub-par returns and persistently depress markets.

Looking forward, the fundamental question is whether asset managers can take over intermediation functions that banks have shed. Financial institutions' success in performing such functions depends on their capacity to take temporary losses in their stride. But this capacity has recently declined in the asset management sector, where retail investors have been replacing institutional investors as the ultimate risk bearers. Retail investors have smaller balance sheets, shorter investment horizons and lower risk tolerance, and hence a smaller loss-absorbing capacity. The investment behaviour of UK households during the recent financial crisis is consistent with this.4

These issues become more important as the assets managed by an individual company grow in size. The decisions taken by a single large asset manager can potentially trigger fund flows with significant system-wide repercussions. To delve into this issue, the Financial Stability Board and the International Organization of Securities Commissions have published a proposal on how to identify non-bank non-insurer global systemically important financial institutions.5

More recently, the policy debate has considered asset management companies (AMCs) as a distinctive group that gives rise to new financial risks. AMCs' incentive structures have received particular attention, as they can generate concerted behaviour and thus amplify financial market fluctuations. Restrictions on investment portfolio shifts could limit incentive-driven swings and, by effectively lengthening asset managers' investment horizons, could stabilise their behaviour in the face of temporary adverse shocks. Similarly, caps on leverage could contain the amplification of shocks. Furthermore, redemption risk can be addressed by liquidity buffers and - in the spirit of recent amendments to US money market fund rules - by restrictions on rapid redemptions from managed funds. This could insulate asset managers from hasty swings in retail investor sentiment, thus boosting the sector's loss-absorbing capacity.

A complementary policy response would aim to restore the vibrancy of institutions that were successful intermediaries in the past. Banks are the prime example. Regulatory initiatives under way that aim to increase banks' resilience and transparency would improve their intermediation capacity, not least by helping them regain market confidence. And as resilience depends critically on the ability to generate sustainable profits, it would be supported by growth-enhancing reforms and a timely normalisation of monetary policy in advanced economies as well as by further initiatives to restrain financial imbalances in emerging market economies.

1See B Becker and V Ivashina, "Financial repression in the European sovereign debt crisis", Swedish House of Finance, Research Paper, no 14-13, 2014.

2See European Insurance and Occupational Pensions Authority, Financial Stability Report, December 2014, p 37.

3See K Miyajima and I Shim, "Asset managers in emerging market economies", BIS Quarterly Review, September 2014, pp 19-34.

4See A Haldane, "The age of asset management?", speech given at the London Business School, April 2014.

5Financial Stability Board and International Organization of Securities Commissions, Assessment methodologies for identifying non-bank non-insurer global systemically important financial institutions, consultative document, March 2015.