Another year of monetary policy accommodation

Abstract

Monetary policy continued to be exceptionally accommodative, with many authorities easing or delaying tightening. For some central banks, the ultra-low policy rate environment was reinforced with large-scale asset purchase programmes. In the major advanced economies, central banks pursued significantly divergent policy trajectories, but all remained concerned about the dangers of inflation running well below inflation objectives. In most other economies, inflation rates deviated from targets, being surprisingly low for some and high for others. The deviation of inflation from expected levels and questions surrounding the sources of price changes underscore an incomplete understanding of the inflation process, especially regarding its medium- and long-term drivers. At the same time, signs of growing financial imbalances around the globe highlight the risks of accommodative monetary policies. The persistence of those policies since the crisis casts doubt on the suitability of current monetary policy frameworks and suggests that resolving the tension between price stability and financial stability is the key challenge. This puts a premium on accounting for financial stability concerns much more systematically in monetary policy frameworks.

Full text

Monetary policy continued to be exceptionally accommodative over the past year. Many authorities eased further or delayed tightening. Central bank balance sheets remained at unprecedentedly high levels; and they grew even larger in several jurisdictions where the ultra-low policy rate environment was reinforced with large purchases of domestic and foreign assets.

Monetary policies in the major advanced economies diverged, as the US economy strengthened relative to the euro area and Japan. But sharp declines in the prices of oil and other commodities and continued weakness in the growth of wages heightened concerns about the persistence of below-target inflation and at times even the dangers of deflation.

The differing cyclical positions of the major advanced economies and the associated exchange rate shifts complicated policy choices for other advanced economies as well as for emerging market economies. Inflation outturns were quite diverse: many central banks were combating low inflation while a smaller number faced the opposite problem. The deviation of inflation from expected levels and questions surrounding the supposed drivers of price changes underscored uncertainties about the inflation process. For some economies, the strong appreciation of their currencies against the euro and the yen reinforced growing disinflation pressures. The reduction in policy rates, in a few cases to negative levels, further raised financial vulnerabilities. The lower bound for policy rates, and financial stability considerations, limited the scope for further easing.

Another year of exceptionally expansionary monetary policy raises the question of whether existing policy frameworks are fit for their intended purpose. Historically high debt levels and signs of financial imbalances point to an increasing tension between price stability and financial stability. Against the backdrop of divergent monetary policies, the risk of competitive easing should not be underestimated (see also Chapter V).

This chapter first reviews the past year's developments in monetary policy. It then assesses what is known and what is not known about the inflation process and explores the degree to which monetary policy frameworks could be adjusted to more systematically incorporate financial stability considerations.

Recent monetary policy developments

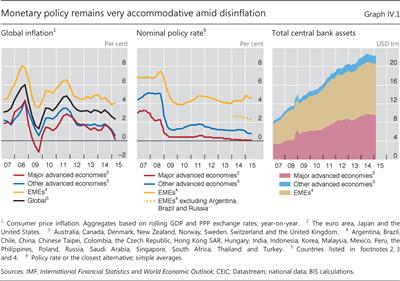

Monetary policy remained exceptionally easy in most economies in the period under review. The sharp drop in oil prices, alongside smaller declines for other commodity prices, pushed down inflation (Graph IV.1, left-hand panel). Lower inflation and the slowdown in economic activity led most central banks to cut policy rates (Graph IV.1, centre panel). Central bank balance sheets in the aggregate continued to grow in domestic currency terms and were around record highs in US dollar terms despite the dollar's appreciation (Graph IV.1, right-hand panel). A small number of emerging market economies raised rates, some to fight sharp depreciation pressures on their currencies.

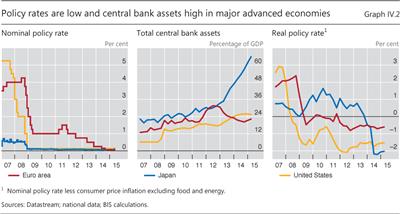

The divergence of policy trajectories in the major advanced economies was a prominent theme during the year. The Federal Reserve kept its policy rate unchanged at 0-0.25% (Graph IV.2, left-hand panel) and concluded its two-year asset purchase programme in October (Graph IV.2, centre panel). The decision to end the programme after purchasing about $1.6 trillion of government bonds and mortgage-backed securities reflected a better outlook for the labour market and the economy more broadly. The Federal Reserve also indicated that it would be likely to start raising its policy rate before the end of 2015.

In contrast, the ECB eased policy further to address concerns about the risks of prolonged low inflation, including a downward drift in longer-term inflation expectations. In September 2014, the ECB cut the rate on the deposit facility further below zero (-0.2%). In early 2015, it launched a large-scale asset purchase programme. Aimed at acquiring a monthly average of €60 billion in public and private sector securities, the programme was slated to last at least until end-September 2016 and until inflation was consistent with achieving the ECB's inflation objective of less than, but close to, 2% over the medium term.

The Bank of Japan also sharply expanded its asset purchase programme, as the prospect of achieving its 2% inflation objective had become more challenging. It raised the target for the annual expansion of the money base under the quantitative and qualitative easing programme (QQE) by ¥10-20 trillion, to ¥80 trillion. It also shifted purchases to longer maturities to compress bond yields. As a result, its balance sheet grew to around 65% of GDP in early 2015, up from 35% at the programme's start in April 2013.

The extraordinary degree of monetary accommodation in the major advanced economies is highlighted by very low inflation-adjusted interest rates at short and long horizons. Real policy interest rates calculated using core inflation (headline consumer price inflation excluding food and energy) remained well below zero (Graph IV.2, right-hand panel). Long-term government bond yields were also below inflation in many economies. Forward curves for policy rates indicated that markets expected this highly unusual environment to persist for quite some time.

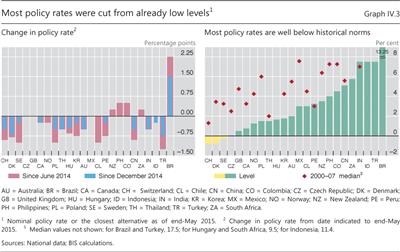

Central banks outside of the major advanced economies were left to factor these very accommodative, but increasingly divergent, monetary policies into their own policy decisions. The divergence raised the spectre of sharp shifts in exchange rates. At the same time, the drop in commodity prices lowered inflation pressures around the globe. Against this backdrop, most central banks eased policy (Graph IV.3, left-hand panel). As a result, policy rates generally continued to be well below historical norms and even negative in several economies (Graph IV.3, right-hand panel).

The reasons behind the policy decisions varied. Many central banks eased policy aggressively given concerns about very low inflation or deflation, or exchange rate developments. In particular, the central banks of Denmark, Sweden and Switzerland pushed down their policy rates well into negative territory. The negative rate in Denmark helped ease pressure on its exchange rate peg to the euro. The Swiss National Bank abandoned its exchange rate floor against the euro when its balance sheet approached 90% of GDP; the negative policy rate helped mitigate the impact of the appreciation pressures on the currency.

With inflation and its policy rate around zero, the Czech National Bank reiterated its commitment to an accommodative stance and to maintaining its exchange rate floor until the second half of 2016. The central banks in Hungary and Poland eased policy as they experienced deflation despite strong real economic activity. The Bank of Thailand reduced its policy rate as inflation turned negative, and the Bank of Korea cut its policy rate to a historical low as inflation fell towards zero.

Central banks in a number of commodity exporting economies also cut policy rates. Among them, the central banks in Australia, Canada and Norway eased as inflation declined along with commodity prices, even though core inflation remained close to target. They also faced the prospect of weaker economic activity as commodity-producing sectors were adversely affected, despite some offset from currency depreciation. The central banks of New Zealand and South Africa tightened policy in mid-2014 in response to higher inflation prospects; thereafter, they kept rates unchanged as inflation pressures eased and, in New Zealand, because of concerns about the implications of the strength of the exchange rate.

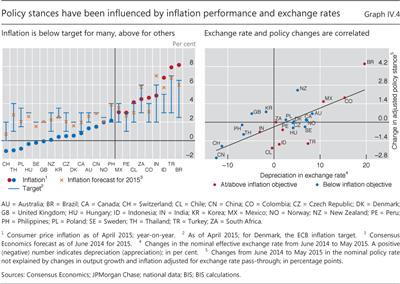

In contrast, commodity-exporting economies in Latin America faced inflation pressures (Graph IV.4, left-hand panel). In much of the region, inflation was above target in 2014 and was forecast to remain high. Even so, the central banks of Chile and Peru lowered rates in the second half of 2014 as the drop in metal and oil prices heralded weaker price pressures and slower growth. In Mexico, where inflation was running in the middle of its target range, rates were kept unchanged. The central bank of Colombia raised rates to address high inflation. In Brazil, rising inflation and concerns about the stability of capital flows caused the central bank to tighten policy significantly despite weak output.

In China and India, the central banks eased, but policy rates were still close to recent historical norms. China's central bank cut interest rates and reduced required reserve ratios to counter a slowing pace of economic activity. The growth of monetary and credit aggregates had slowed modestly, in part as a result of tighter regulation of shadow banking. The easing in India came against the backdrop of a deceleration of inflation from a high single digit pace, strong economic growth, and an improved fiscal situation. The authorities in India also announced a new monetary policy framework agreement, with a 4% target for consumer price inflation from early 2016 onwards.

On balance, last year's monetary policy developments outside the major advanced economies appear to have been driven mainly by inflation and exchange rate developments (Graph IV.4, right-hand panel). Economies with inflation running well above target felt stronger currency depreciation pressures and had a tighter policy stance than would otherwise be implied by domestic inflation and output developments alone. The converse was true for those facing currency appreciation pressures.

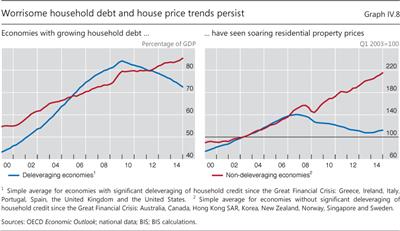

Finally, signs of financial imbalances (Chapter III) are presenting many of these economies with financial stability concerns. Since the Great Financial Crisis, deleveraging has progressed in some economies, but in others, housing prices and debt remain very high and in many cases have grown further. Post-crisis developments in credit and asset prices have featured prominently in central bank communications, and many central banks have highlighted the risk that low policy rates might contribute to the build-up of financial imbalances. Overall, however, short-term macroeconomic factors have been the dominant justification for policy decisions; financial developments have been far less prominent.

What drives inflation?

In many economies, inflation fell during the past year from already low levels. These recent changes in headline inflation largely reflected volatile fluctuations in oil and food prices and exchange rates, factors that are often considered short-term (or proximate) drivers of inflation. Core inflation, which excludes food and energy prices, has been relatively low for some time, which raises important questions about the effects of other drivers of inflation, namely the medium-term (or cyclical) and long-term (or secular) drivers. Despite decades of research and experience, the inflation effects of the cyclical and secular drivers remain much less clear than those of the proximate drivers.

Proximate drivers

The short-term effect of commodity prices and exchange rates on inflation is generally well understood. Energy is given a large weight in the consumer price index (CPI) of various countries, so changes in energy prices have a strong and immediate impact on headline inflation. The price of energy can change markedly over short periods, as it did in the past year. Changes in food prices tend to be less volatile but can still have a significant effect, especially in emerging market economies, where food accounts for a larger share of the basket of goods and services that make up the CPI.

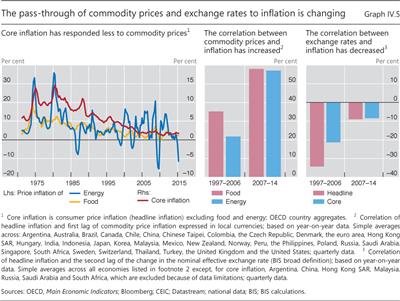

The degree to which changes in commodity prices pass through to other prices has declined over time. In the 1970s and 1980s, for example, increases in oil prices led to price increases for other goods, thereby tending to raise core inflation and inflation expectations. In the past two decades, however, these so-called "second-round" price effects on core inflation have become much more muted (Graph IV.5, left-hand panel) even as the effect of commodity prices on overall inflation has grown (Graph IV.5, centre panel).

Changes in exchange rates are also an important proximate driver of headline and core inflation. Imported items, or those that are subject to international competition, represent a large share of CPI baskets. Because the price of many of these items is set in global markets, changes in the exchange rate affect domestic costs.

Despite the increasing share of tradable items in the CPI over the past couple of decades, exchange rate pass-through to both headline and core inflation has declined (Graph IV.5, right-hand panel). Several factors appear to have contributed to this decline. One is better-anchored inflation expectations. With inflation low and stable, firms and households are less likely to expect central banks to accommodate exchange rate movements that would lead to persistent deviations of inflation from target. Evidence points to some additional factors that may be reducing the pass-through effect of exchange rate changes: the advent of integrated supply chains, which give multinational firms a greater ability to absorb exchange rate changes; easier access to cheaper hedging; and a shift in the composition of imports towards items, such as manufactured goods, whose prices display a lower pass-through.

Cyclical drivers

The relationship between inflation and the business cycle, captured by measures of economic slack such as the unemployment gap, rests on strong theoretical foundations. However, the empirical relationship is generally far weaker and has been evolving along with changes in the global economy and financial system. For example, the post-crisis behaviour of inflation highlights the sometimes tenuous link between inflation and economic slack. Inflation was stronger than expected in 2010-11, given the severity of the crisis and the recession-induced excess capacity. Later on, even as labour markets strengthened and the global economy continued recovering, core inflation in many advanced and emerging market economies was either falling or running below central bank objectives.

The weakness of the empirical link between inflation and the business cycle has a number of explanations. First, spare capacity may be mismeasured, as it is not directly observed and must be estimated. For example, in the labour market, the unemployment rate is observable, but cyclical or structural changes in labour force participation can alter the unobserved effective amount of underutilised labour. Second, different methodologies and assumptions for estimating economic slack in the labour market or in the economy as a whole can produce quite different results. Third, many measures of spare capacity are subject to real-time errors, and so a clear picture of slack at a given time may become possible only at a much later date.

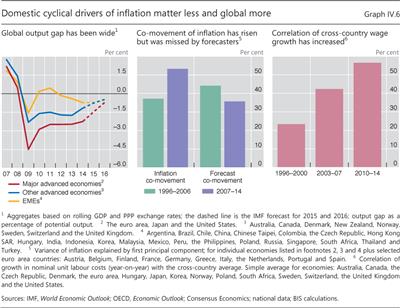

At the same time, evidence - often underappreciated - increasingly indicates that inflation now responds less to domestic cyclical activity and more to global movements than it has in the past. For example, the global output gap (Graph IV.6, left-hand panel) appears to have become more important in driving inflation. In fact, the effect of global spare capacity is now estimated to be larger than that of domestic spare capacity (see the 84th Annual Report).1 Similarly, the post-crisis share of cross-country inflation explained by a single common factor has increased, a development seemingly unforeseen in private sector forecasts (Graph IV.6, centre panel). In other words, global drivers of inflation are apparently becoming more important, but they are not particularly well understood.

The higher responsiveness of inflation to global conditions reflects several factors, including the greater integration of product and factor markets. And since this greater integration can influence the pricing power of domestic producers and the bargaining power of workers, the effect of global conditions on inflation goes well beyond their direct impact through import prices.

The effect of common global trends is also visible in labour markets. Domestic unit labour costs have become more correlated across economies even outside of recessionary periods (Graph IV.6, right-hand panel). This development is consistent with evidence that inflation has become less sensitive to changes in spare domestic capacity or, in other words, with evidence that domestically oriented Phillips curves have become flatter.

Uncertainty about the link between inflation and domestic spare capacity suggests greater risks for monetary policymaking: central banks may miscalibrate their policy if they place too much weight on past correlations that underestimate the role of global factors.

Secular drivers

Understanding the effects of the secular (or long-term) drivers of inflation is critical to assessing inflation trends. The main secular drivers are inflation expectations, wage trends, globalisation and technology. Arguably, these drivers have generally had a disinflationary impact, although their strength has been subject to considerable debate. Each of these drivers has been influenced by a range of policy choices and structural changes.

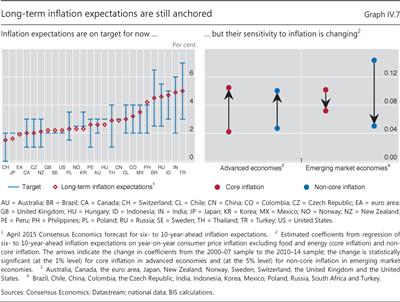

Inflation expectations have drifted down as monetary policy regimes have successfully become more focused on inflation control. Indeed, long-term inflation expectations are now tightly aligned with central banks' explicit objectives (Graph IV.7, left-hand panel). The attainment of low, well-anchored inflation expectations has been seen as a key achievement, especially because they influence longer-run pricing decisions and contract setting.

Nonetheless, the understanding of what determines inflation expectations is still incomplete and continues to evolve. For example, a current concern is that inflation expectations may have become less well anchored, especially in economies with a policy rate near the effective lower bound, slow growth, and inflation running persistently below target. In advanced economies, inflation expectations have seemingly become more sensitive to short-term inflation (Graph IV.7, right-hand panel). This behaviour appears to be consistent with the research, which generally finds that while inflation expectations are influenced by central bank objectives, they are also affected by past inflation. However, this backward-looking element of long-term inflation expectations has historically tended to respond rather slowly to changes in inflation.

The measurement of inflation expectations is also subject to considerable uncertainty. Questions remain about whether financial-market-based measures accurately reflect changing inflation expectations or whether these measures are distorted by spurious market-specific factors (Chapter II). Moreover, the inflation expectations of firms and workers are likely to be more relevant in price determination than those of professional forecasters. Unfortunately, measures for firms and workers are not always available, and when they are, they often are of questionable quality and display significant volatility.

Wage trends have also changed over recent decades. For example, the indexation of wages to inflation is much less prevalent now than it was in the 1970s, which accounts for some reduction in inflation persistence. Wage dynamics have also changed as a result of increased labour competition in advanced economies. The competition initially came from the greater integration of low-cost emerging market economies (including formerly state-controlled economies) into the global trading system. The competition spread and intensified as global integration strengthened and the range of goods and services that could be traded internationally widened, in part as a result of new technologies (eg via outsourcing). This partly explains why, for a number of advanced economies, labour's share of national income has declined steadily over the past 25 years. More generally, technological advances that have allowed the direct substitution of capital for labour have played a similar role. Think, for instance, of computers, software and robotics automating previously manual processes.

The emergence of cheaper competitors has made labour and product markets much more contestable. Accordingly, the pricing power of the more expensive producers and the bargaining power of labour have been reduced - disinflationary forces whose effects go well beyond those suggested by the increase in global trade and integration. Thus, globalisation and technological change together have contributed to persistent, if hard to measure, disinflationary tail winds.

In sum, various inflation drivers have been shaping the inflation process in ways that at times have been difficult to fully understand. The heightened uncertainty has naturally carried over to inflation forecasting.2 While the quantitative importance of the proximate drivers of inflation is relatively well understood, they can change unpredictably. There is considerable uncertainty about the overall impact of cyclical and secular factors, even as the relevance of global factors is rising relative to domestic ones. The uncertainties inevitably complicate policy, especially in frameworks that are tightly defined around inflation targets over short horizons.

Integrating financial stability concerns into monetary policy frameworks

The persistence of exceptionally easy monetary policy some eight years after the eruption of the financial crisis raises questions about its efficacy and, ultimately, about the suitability of current monetary policy frameworks. To be sure, price stability remains the cornerstone of monetary policy. However, the nature of the risks to price stability has been evolving. Worries over high inflation have been replaced of late with concerns about very low inflation and possibly deflation even in the context of high and rising debt and frothy asset prices. In this environment, resolving the tension between price stability and financial stability is the key challenge if economies are to avoid the problems that arose before the financial crisis. That is, can central banks preserve price stability while more systematically accounting for financial stability considerations?

One lesson from the financial crisis is that ignoring the financial cycle can be very costly. In the run-up to the crisis, credit and asset prices soared even as inflation remained low and stable. Since the crisis, similar patterns have again emerged in some economies (Graph IV.8 and Chapter III). The pre-crisis experience illustrated that financial vulnerabilities can build up even when inflation is quiescent. Low inflation can provide a false signal of overall economic stability.

Despite the recent experience, the role of financial stability concerns in monetary policy is still subject to major disagreements. A common view is that macroprudential policies should be the first line of defence against financial imbalances; monetary policy should simply be a backstop, responding to financial stability concerns only after macroprudential policies have done all they can.

This view is supported by a sort of separation principle. Only macroprudential tools (eg loan-to-value ratios, countercyclical capital buffers, etc) are to be used against slow-moving financial booms and busts; monetary policy would then be left to focus on its traditional countercyclical role of managing inflation and business fluctuations.

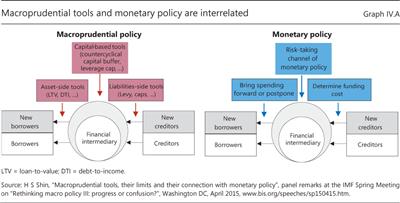

The separation principle is intuitively appealing and has the merit of simplifying policy assignments; but it becomes less compelling if one considers the way in which macroprudential policy and monetary policy jointly influence financial activity. Box IV.A highlights the close interrelationship between macroprudential and monetary policies as well as the similarity in their transmission mechanisms. To be sure, their reach differs markedly. But both of them fundamentally influence funding costs and risk-taking, which in turn affect credit, asset prices and the macroeconomy.

Moreover, while assessments differ, the experience with macroprudential tools is, on balance, not very supportive of the separation principle. It is not clear that targeted macroprudential tools can be as effective as policy rates in preventing excessive risk-taking in all parts of the financial system. The policy rate is the key determinant of the universal price of leverage in a given currency; it affects all financing in the economy and is not susceptible to regulatory arbitrage. In this sense, policy interest rates are more blunt but have a more pervasive effect. In light of this, the exclusive reliance on macroprudential tools to tame financial booms and busts is risky - all the more so if monetary and prudential tools are pulling in opposite directions. Experience suggests that the two sets of tools are most effective when used as complements, leveraging each other's strengths.

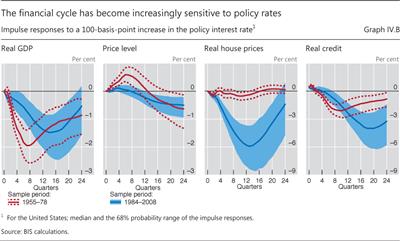

A recent empirical analysis indicates the potential usefulness of monetary policy in this context (Box IV.B). Policy rates appear to have a significant effect on credit and asset prices, especially property prices. And this effect seems to have been growing since the mid-1980s, following financial liberalisation. It is no coincidence that the amplitude and length of financial cycles has considerably increased since then (see the 84th Annual Report). Moreover, the same analysis finds that, after explicitly accounting for the effect on credit and property prices, monetary policy has had a reduced effect on output. Together, these findings suggest that a monetary policy focused on managing near-term inflation and output may do so at the cost of higher fluctuations in credit and asset prices than in the past.

A common argument against using monetary policy to address financial stability concerns is the lack of good metrics with which to track the financial cycle and financial stability risks more generally. The problem is indeed serious, but the past decade has seen considerable progress in devising and improving such metrics. One practical approach has been to track credit and asset price trends. More generally, the challenge is not specific to monetary policy. And the very establishment of macroprudential policy frameworks, in which central banks often play a key role, is predicated on the presumption that the need for good metrics can be tackled successfully.

Box IV.A

Monetary policy and macroprudential policy: complements or substitutes?

Macroprudential policies aim to (i) strengthen the resilience of the financial system and (ii) mitigate financial booms and subsequent busts. How well do macroprudential policies interact with monetary policy in addressing the second of these two concerns?

Both monetary policy and macroprudential policy influence the financial intermediation process, operating on the assets, liabilities and leverage of intermediaries (Graph IV.A). For instance, both policies can induce a reallocation of spending over time by influencing the cost and availability of credit for consumers and firms. These policies, however, differ in scope and impact. Macroprudential policy often targets specific sectors, regions or practices (eg through loan-to-value limits and debt-service ratio rules), whereas interest rates have a more pervasive impact on private sector incentives and on the financial system.

An important policy question is whether monetary and macroprudential policies should in general pull in the same direction (ie as complements) or in opposite directions (ie as substitutes). Some recent discussions of macroprudential policies treat the two sets of policies as substitutes: while monetary policy is kept loose, macroprudential policy is invoked to mitigate the resulting financial stability implications, at least for particular sectors or types of borrowing. But when these policies are pulling in opposite directions, economic agents are simultaneously facing incentives to borrow more and to borrow less, suggesting tensions in the policy mix. Initial theoretical research points to monetary and macroprudential policies being best used mainly as complements, not substitutes, although results can vary by the nature of the adverse development.

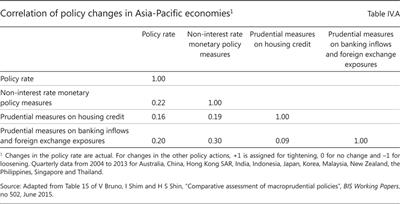

Indeed, experience indicates that these tools tend to be used together as complements. A recent study of Asia-Pacific economies documents that monetary policy and macroprudential policies over the past decade have been used to pull in the same direction, as indicated by the positive correlations reported in Table IV.A. Furthermore, the empirical evidence indicates that tighter macroprudential policies together with higher interest rates have been effective in reducing real credit growth. Statistical questions remain about whether and when macroprudential policies have been on average more powerful than monetary policy.

See H Hannoun, "Towards a global financial stability framework", speech at the SEACEN Governors' Conference, Siem Reap, Cambodia, 26 February 2010.

See H Hannoun, "Towards a global financial stability framework", speech at the SEACEN Governors' Conference, Siem Reap, Cambodia, 26 February 2010.

At the same time, the difficulties with the more familiar yardsticks used in the pursuit of price stability should not be underestimated. Economic slack and inflation expectations are not observed directly; they have to be estimated, and the estimates are subject to considerable uncertainty and bias. In fact, recent evidence suggests that using information about the financial cycle, such as the behaviour of credit and property prices, can produce better estimates of potential output and underlying slack in real time than traditional methodologies, which often draw on the behaviour of inflation (Box IV.C). Indeed, ahead of the financial crisis, the methodologies widely used in policymaking generally failed to detect that output was above its sustainable level. Estimates that take the boom in credit and property prices into account can help to correct this bias.

By the same token, metrics informed by the state of the financial cycle may also help calibrate monetary policy, even though this will necessarily be a matter of trial and error. As outlined in Chapter I, a general strategy would call for more deliberate and persistent monetary policy tightening during financial booms, even if near-term inflation is low or declining. All else equal, Taylor rules not adjusted for the state of the financial cycle could set a sort of lower bound, as they have been calibrated with inflation, not financial imbalances, in mind (Box IV.C). During financial busts, the strategy would be to ease less aggressively and persistently. The restraint in easing would reflect the weaker influence of expansionary monetary policy when (i) the financial system is impaired, (ii) the private sector has taken on too much debt and (iii) the misallocation of resources accumulated during the boom weighs on potential output (Chapters I and III and the 84th Annual Report). And this approach would also reflect the understanding that forceful easing with limited effectiveness produces unintended effects on the financial system and the economy, domestically and internationally (Chapters III, V and VI). Calibration issues would loom large, but - as in the pursuit of price stability, and especially until sufficient experience is accumulated - there is no alternative to gradual experimentation.

Box IV.B

Monetary transmission to output, credit and asset prices

After the Great Inflation of the 1970s, economies and financial systems worldwide changed markedly. Low inflation rates became the norm in many countries, and financial liberalisation and globalisation progressed rapidly. In particular, housing finance arrangements evolved substantially and have become more integrated with capital markets through the spreading of securitisation, rising loan-to-value ratios and the advent of credit tied to home equity. Also, bond markets have deepened, facilitating firms' access to capital market funding, and financial globalisation has considerably broadened the investor base. As a result, the level of debt relative to income has risen significantly. Moreover, non-bank lenders are a much larger source of credit, and more debt is in the form of mortgages.

These developments could also have altered the transmission of monetary policy. Although studies for the United States suggest that the transmission has not changed much over time, their focus has been on the transmission to the real economy, largely ignoring the interrelationship with credit and asset prices.

their focus has been on the transmission to the real economy, largely ignoring the interrelationship with credit and asset prices.

A standard vector autoregression model (VAR) extended to include house prices and total credit to the private non-financial sector does find evidence of significant changes in transmission in the US economy (Graph IV.B). An unexpected increase of 100 basis points in the US policy rate is estimated to have a smaller impact on output in the recent period: a maximum impact of -2% is reached after eight quarters in the earlier period and -1.5% after 14 quarters in the later one. While the long-term impact for the price level is very similar, the reaction has become more muted. In contrast, the differential impact of monetary policy on house prices and credit across the two sample periods is substantial: for real house prices, the estimated maximum impact has soared by a factor of twelve (from -0.5% to -6%); and for total credit, it has doubled from -2% to -4%.

An unexpected increase of 100 basis points in the US policy rate is estimated to have a smaller impact on output in the recent period: a maximum impact of -2% is reached after eight quarters in the earlier period and -1.5% after 14 quarters in the later one. While the long-term impact for the price level is very similar, the reaction has become more muted. In contrast, the differential impact of monetary policy on house prices and credit across the two sample periods is substantial: for real house prices, the estimated maximum impact has soared by a factor of twelve (from -0.5% to -6%); and for total credit, it has doubled from -2% to -4%.

These findings suggest that credit and house price booms have become more sensitive to countervailing changes in monetary policy rates. Moreover, the output costs associated with policy tightening have generally fallen, given monetary policy's more muted impact on real output. Put differently, the results indicate that smoothing short-term swings in output and inflation now comes at the cost of greater swings in credit and property prices than in the past.

See eg G Primiceri, "Time varying structural vector autoregressions and monetary policy", Review of Economic Studies, vol 72, 2005, pp 821-52; and J Boivin, M Kiley and F Mishkin, "How has the monetary transmission mechanism evolved over time?", in B Friedman and M Woodford (eds), Handbook of Monetary Economics, vol 3A, North Holland, 2011, pp 369-422.

See eg G Primiceri, "Time varying structural vector autoregressions and monetary policy", Review of Economic Studies, vol 72, 2005, pp 821-52; and J Boivin, M Kiley and F Mishkin, "How has the monetary transmission mechanism evolved over time?", in B Friedman and M Woodford (eds), Handbook of Monetary Economics, vol 3A, North Holland, 2011, pp 369-422.  The VAR comprises five variables: log real GDP, log GDP deflator, log real house prices, the US policy rate (the federal funds rate) and log real credit. The monetary policy shock is identified using a Cholesky identification scheme with variables ordered as they are listed. For more details, see B Hofmann and G Peersman, "Revisiting the US monetary transmission mechanism", BIS Working Papers, forthcoming.

The VAR comprises five variables: log real GDP, log GDP deflator, log real house prices, the US policy rate (the federal funds rate) and log real credit. The monetary policy shock is identified using a Cholesky identification scheme with variables ordered as they are listed. For more details, see B Hofmann and G Peersman, "Revisiting the US monetary transmission mechanism", BIS Working Papers, forthcoming.  O Jorda, M Schularick and A Taylor, "Betting the house", Journal of International Economics, forthcoming, also find that loose monetary conditions lead to booms in real estate lending and house prices bubbles, especially in the postwar period.

O Jorda, M Schularick and A Taylor, "Betting the house", Journal of International Economics, forthcoming, also find that loose monetary conditions lead to booms in real estate lending and house prices bubbles, especially in the postwar period.

A more challenging concern is how best to balance the possible trade-offs between financial stability and macroeconomic stabilisation, ie price stability and near-term output stabilisation. To some extent, this is an issue of the relevant policy horizon. Financial vulnerabilities take considerable time to build up. And as witnessed in the aftermath of the financial crisis, a financial bust has long-lasting debilitating effects on the macroeconomy, including possibly for inflation. Hence, extending the horizon beyond the traditional two to three years helps reconcile financial stability with traditional objectives. After all, financial instability is a concern precisely because of the damage it imposes on the real economy. Given the uncertainties embedded in longer-term forecasts, the extension of the horizon should not be interpreted as extending point forecasts. Rather, it is intended as a means to examine more systematically the risks to the outlook posed by financial factors, given their longer fuse.

Even so, when it comes to tolerating deviations of inflation from objectives, the issue remains, how long is too long? The post-crisis period has shown that persistent disinflation, and even deflation, can go hand in hand with worrying booms in asset prices and credit. To be sure, this constellation is by no means unprecedented and was rather common during the era of the gold standard. Most famously, it prevailed during the 1920s, ahead of the Great Depression in the United States. But the constellation was far less common in the post-World War II, inflation-prone period and emerged again only after inflation came under tighter control.

Two well founded concerns, one specific and one more general, have discouraged policymakers from tolerating persistent deviations of inflation from numerical objectives.

The specific concern is deflation risk. Much of the recent policy debate has been predicated on the assumption that all deflations are pernicious and cause great economic damage. The sense is that a drop in aggregate prices will likely trigger a deflationary spiral. Output will fall and - especially if interest rates are stuck at the zero lower bound - expectations of continued price declines will raise inflation-adjusted interest rates, further depressing aggregate demand and output.

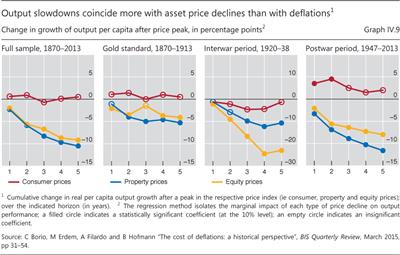

However, the historical record on the output costs of deflation is at odds with this widespread perception. The asserted link between deflation and subpar economic activity is actually rather weak and derives largely from the unique experience of the Great Depression. In fact, the evidence suggests that output is more closely linked to asset prices, especially property prices. Once asset prices are taken into account, the link between output and price deflation in goods and services becomes even weaker. In a review of the international experience since 1870, the link is evident only in the interwar years (Graph IV.9, third panel). Moreover, further analysis indicates that the really damaging interaction has not been between deflation and debt - so- called debt deflation - but between debt and declines in property prices.

This record also suggests that the costs of deflation may depend on its drivers. Deflation may indeed be a sign of sharp and persistent declines in demand, in which case it would coincide with economic weakness. But if deflation is driven by supply-side improvements, such as globalisation, greater competition or technological forces, output would tend to rise alongside real incomes, lifting living standards. And if deflation results from one-off price adjustments, such as a fall in commodity prices, it is also likely to be transitory.

This analysis indicates that the central bank's response to deflation risks needs to consider not only the sources of price pressures, but also the policy's effectiveness. Paradoxically, an aggressive response to avert a supply side-driven or temporary deflation could prove counterproductive in the longer run. It could be conducive to financial booms whose bust could seriously damage the economy as well as induce unwelcome disinflation down the road.

The more general concern about inflation deviating from target has to do with the loss of credibility and, ultimately, with mandates. Persistent deviations of inflation from the numerical objective may indeed undermine the central bank's credibility. If so, then the policy framework should explicitly provide for tolerance of such deviations when required to achieve longer-term objectives.

Much less clear, however, is whether allowing greater tolerance would require a reconsideration of mandates, which often are general enough and subject to varying interpretations. In particular, sustainable price stability, or macroeconomic stability more broadly, can be thought of as implicitly encapsulating financial stability, given the huge economic distortions and output losses associated with financial crises. But if revisiting mandates becomes necessary in some cases, it would need to be done with great care, as the process could lead to political economy pressures with unwelcome results.

Box IV.C

Measuring potential output using information about the financial cycle

The concept of potential output refers to the level of output produced when available resources, including labour and capital, are fully and sustainably employed. Deviations of actual output from potential - the so-called output gap - gauge the degree of slack in the economy. Potential output, which cannot be observed directly, is typically estimated with econometric techniques.

The econometric estimation techniques have traditionally relied heavily on inflation: all else equal, the level of output is seen as consistent with the full employment of labour when inflation does not have a tendency to rise or fall. Inflation is a key signal of sustainability. Even the potential output measures based on production functions, such as those calculated by the OECD or the IMF, partly rely on inflation to gauge imbalances in the labour market.

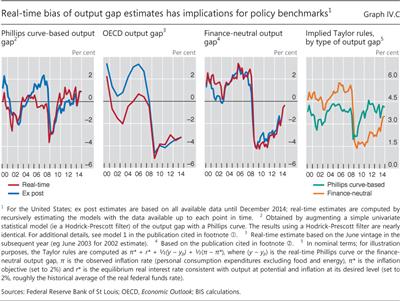

But the relationship between economic slack and inflation (the so-called Phillips curve) has weakened over recent decades (see Chapter III of the 84th Annual Report), thereby compromising the usefulness of inflation as an indicator of potential output. Accordingly, estimates of the output gap that rely on the Phillips curve may prove to be unreliable. That is, when the data are allowed to speak freely, the information content of inflation may indeed be quite low. In addition, traditional methods for estimating potential output are plagued by substantial uncertainty when used in real time, ie they are typically revised heavily as the future unfolds and more data become available. For example, in the mid-2000s, neither the Phillips curve approach nor the OECD's full production-function approach found that US output was at that time above potential; they reached that finding only later, when models were re- estimated with more data (Graph IV.C, first and second panels).

That is, when the data are allowed to speak freely, the information content of inflation may indeed be quite low. In addition, traditional methods for estimating potential output are plagued by substantial uncertainty when used in real time, ie they are typically revised heavily as the future unfolds and more data become available. For example, in the mid-2000s, neither the Phillips curve approach nor the OECD's full production-function approach found that US output was at that time above potential; they reached that finding only later, when models were re- estimated with more data (Graph IV.C, first and second panels).

The pre-crisis experience suggests that measures of financial imbalances could be helpful in identifying potential output. After all, even though inflation remained generally subdued, credit and property prices grew at unusually strong rates, sowing the seeds of the subsequent crisis and recession. Indeed, BIS research has found that including information about the financial cycle can yield more reliable measures of economic overheating. Such "finance-neutral" output gaps would, for instance, have indicated in real time that output was above potential in the mid-2000s in the United States, and such estimates would have been subject to smaller revisions as new data became available (Graph IV.C, third panel).

Such "finance-neutral" output gaps would, for instance, have indicated in real time that output was above potential in the mid-2000s in the United States, and such estimates would have been subject to smaller revisions as new data became available (Graph IV.C, third panel).

Reliable real-time estimates of the output gap would be useful to monetary policymakers, as economic slack plays a key role in policy setting. Consistent with its diagnosis of output being above potential, the finance-neutral output gap points to higher Taylor-implied policy rates during the run-up to the Great Financial Crisis (Graph IV.C, last panel).

The point is further developed in C Borio, P Disyatat and M Juselius, "A parsimonious approach to incorporating economic information in measures of potential output", BIS Working Papers, no 442, February 2014. The analysis finds that, under various model specifications, the contribution of inflation to the output gap is low unless strong prior information is included.

The point is further developed in C Borio, P Disyatat and M Juselius, "A parsimonious approach to incorporating economic information in measures of potential output", BIS Working Papers, no 442, February 2014. The analysis finds that, under various model specifications, the contribution of inflation to the output gap is low unless strong prior information is included.  C Borio, P Disyatat and M Juselius, "Rethinking potential output: embedding information about the financial cycle", BIS Working Papers, no 404, February 2013.

C Borio, P Disyatat and M Juselius, "Rethinking potential output: embedding information about the financial cycle", BIS Working Papers, no 404, February 2013.

This suggests that the first priority should be (i) to use the existing room for manoeuvre as much as possible and (ii) to build a constituency for a more systematic incorporation along the lines described above. In time, further and more fundamental adjustments to monetary policy frameworks could be considered.

On balance, arguments against incorporating financial stability considerations more systematically into monetary policy are based on valid concerns but are not fully convincing. In particular, the arguments tend to overestimate how much is known about the inflation process and to underestimate how much has been learned about financial instability. They may also tend to put too much faith in the ability of monetary policy to influence, and even fine-tune, inflation relative to its ability to influence financial, and hence macroeconomic, stability over the medium term.

If the ultimate criterion for a successful monetary policy is to promote sustainable economic growth and, in the process, help avoid major macroeconomic damage, then a rebalancing of policy priorities towards greater attention to financial stability would seem justified. The rebalancing would also take monetary policy closer to its historical origin and function.3 The challenges involved should not be underestimated. They raise tough questions. But relying exclusively on macroprudential tools to address financial instability may not be sufficiently prudent.

1See also C Borio and A Filardo, "Globalisation and inflation: new cross- country evidence on the global determinants of domestic inflation", BIS Working Papers, no 227, May 2007.

2Many central banks publish ranges around their inflation forecasts, often derived from their historical forecast errors. These ranges generally suggest odds of only three-in-four that inflation will be within a 2 percentage point interval at a one- year horizon. At longer horizons, the uncertainty tends to be even larger.

3See C Borio, "Monetary policy and financial stability: what role in prevention and recovery?", BIS Working Papers, no 440, January 2014.