History - the BIS during the Second World War (1939-48)

Declining business activity and controversial neutrality

In the late 1930s, effective international cooperation became more difficult because of the growing political and military tensions. During this period, the BIS was instrumental in shipping gold from Europe to the safety of New York, mostly on behalf of European central banks (more than 140 tonnes of gold were transported between June 1938 and June 1940).

With the declaration of war between Germany on the one hand and France and the United Kingdom on the other in September 1939, it was no longer possible for representatives of these belligerent countries to attend BIS meetings. Board members were nevertheless convinced that the BIS ought to be kept alive to assist in financial and monetary reconstruction after the war. The last prewar meeting of the Board of Directors took place in Basel in June 1939. After that further Board meetings were suspended for the duration of the war.

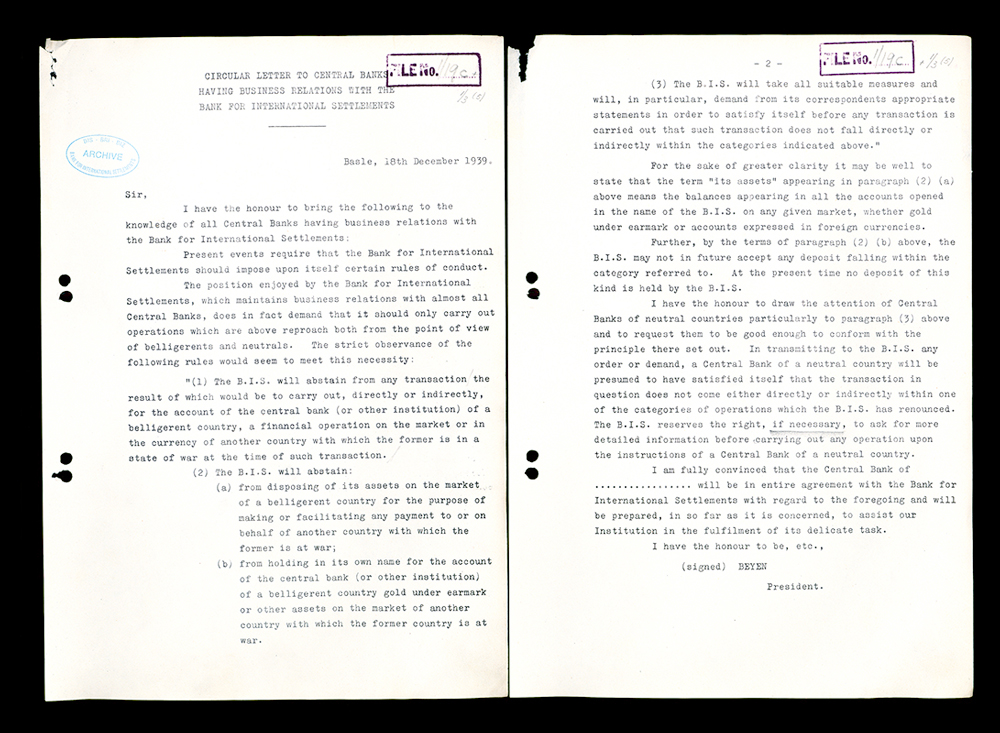

The BIS adopted a neutrality declaration excluding banking operations that might benefit one belligerent party to the detriment of another, but decided to maintain its banking services to assist central banks and to fulfil the Bank's own obligations so far as was consistent with neutrality. The Bank's precarious position - having on its Board central bank representatives of countries that were at war with one another as well as of neutral countries, and being cut off from direct communications with many of its members - gave rise to a number of difficult decisions. The most controversial of these dated from before the war, when, in March 1939, the BIS decided to honour an order received from the Czechoslovak National Bank to transfer part of its gold reserves held in a BIS account at the Bank of England in London to a German Reichsbank account. The transfer order had been issued days after German troops had occupied Prague - as it later transpired, under duress.

From 1940 onward, the volume of BIS banking operations declined rapidly. However, throughout the war, the BIS continued to receive interest payments from the German Reichsbank in respect of the investments the BIS had made in German bonds back in 1930-31. The largest part of these interest payments were made in gold.

The legacy of the war

Investigations after the war revealed that the Reichsbank had used large quantities of gold stolen from central banks in the occupied territories to make wartime payments to a number of institutions including the Swiss National Bank and the BIS. This gold had been remelted at the Prussian mint to conceal its origin. In this manner, during the war, the BIS received 3.7 tonnes of gold from the Reichsbank which, it emerged from German records captured after the war, had originally been looted from the central banks of Belgium and the Netherlands. The BIS cooperated fully with the postwar investigations led by the Allied Tripartite Commission for the Restitution of Monetary Gold and returned 3.7 tonnes of gold to the Commission in 1948.

In July 1944, a United Nations conference met at Bretton Woods in the United States to discuss the postwar international monetary system. The Bretton Woods Conference adopted a resolution calling for the abolition of the BIS "at the earliest possible moment", because it considered that the BIS would have no useful role to play once the newly created World Bank and International Monetary Fund were operational. European central bankers held a different opinion, and successfully lobbied for maintaining the BIS. By early 1948, the BIS liquidation resolution had been put aside. It was understood that henceforth the BIS would focus foremost on European monetary and financial matters.