BIS international banking statistics at end-September 2019

- Global cross-border bank claims continued to expand rapidly, growing at 9% year on year.

- As in previous quarters, the expansion was mainly due to claims on the non-bank sector, which grew at 12% year on year. The growth in claims on non-bank financial institutions was particularly strong (+17%).

- European banks' cross-border lending, which went through a prolonged contraction after the Great Financial Crisis (GFC) of 2007-09, has been expanding again since the start of 2018.

Expansion of global cross-border lending continues

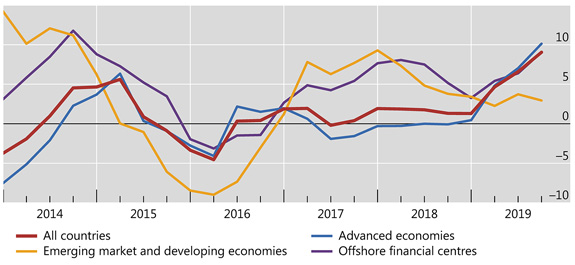

Graph 1: Annual percentage change in banks' cross-border claims by counterparty region (interactive graph).

Source: BIS locational banking statistics (Table A1).

The BIS locational banking statistics show that banks' global cross-border claims grew by $660 billion during Q3 2019, reaching $31 trillion at end-September. The resulting year-on-year (yoy) growth rate of 9% was the highest since end-March 2008 (Graph 1, red line).

The global expansion was driven mainly by claims on advanced economies, which increased by $577 billion in Q3, or 10% yoy (Graph 1, blue line). Lending to offshore financial centres also continued to grow rapidly, by $74 billion in Q3, or 9% yoy (Graph 1, purple line), reaching $5 trillion at end-September 2019.

By contrast, claims on emerging market and developing economies contracted by $6 billion in Q3, which brought their yoy growth rate down to 3% (Graph 1, yellow line). The biggest individual-country decreases were in claims on China (-$33 billion), Turkey (-$9 billion) and Mexico (-$4 billion).

Double-digit growth in claims on non-banks

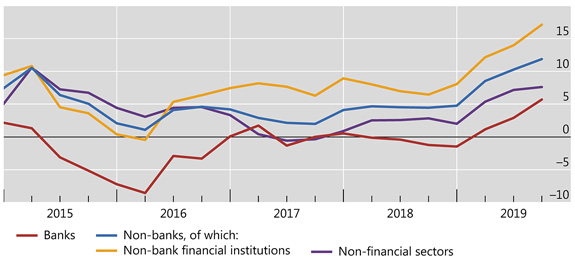

Graph 2: Annual percentage change in banks' cross-border claims by counterparty sector (interactive graph).

Source: BIS locational banking statistics (Table A1).

As in previous quarters, cross-border claims on non-banks continued to expand rapidly (Graph 2, blue line). They rose by $380 billion in Q3 2019 (+12% yoy) and reached $15 trillion at end-September 2019. The growth in claims on non-bank financial institutions (+17% yoy) has been particular strong (Graph 2, yellow line), outpacing the growth in claims on all other counterparty sectors. Cross-border interbank lending, expanded at 6% yoy, its highest annual growth rate since the GFC (Graph 2, red line).

European banks' cross-border lending to non-banks expanding again

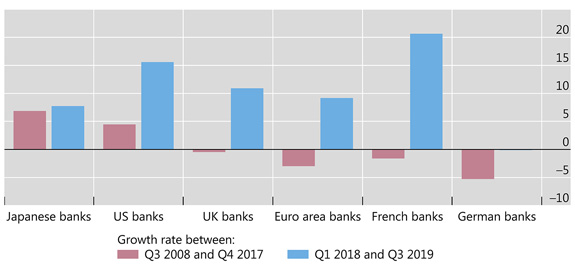

Graph 3: Annualised average quarterly percentage changes (adjusted for exchange rate fluctuations and breaks in series) in cross-border claims on non-banks, by nationality of reporting banks (interactive graph).

Source: BIS locational banking statistics (Table A4).

The locational banking statistics by nationality suggest that the post-GFC contraction in European banks' cross-border lending has reversed since the start of 2018 (Graph 3).

The period after the GFC saw considerable divergence between the cross-border activities of European and non-European banks. Banks headquartered in Europe decreased their international presence considerably.1 Between mid-2008 and end-2017, German banks' cross-border claims on non-banks contracted at an average annual rate of 5%; and those of French banks declined at 2% per year. By contrast, Japanese and US banks' claims grew at average annual rates of 7% and 4%, respectively.

Since the start of 2018, European banks' cross-border lending has been expanding again. Between Q1 2018 and Q3 2019, the average annual growth rate of cross-border claims on non-banks was 11% for UK banks and 9% for euro area banks as a whole. However, there is a substantial degree of heterogeneity among major bank nationalities from the euro area. On the one hand, French banks' claims expanded at an average annual rate of 21%. On the other, the claims of German banks remained virtually unchanged during the same period.

1 For more details, see R McCauley, A Bénétrix, P McGuire and G von Peter, "Financial deglobalisation in banking?", BIS Working Papers, no 650, June 2017.