BIS international banking statistics at end-June 2017

- Cross-border bank credit contracted by $91 billion between end-March and end-June 2017, despite continued growth in credit to non-bank financial institutions.

- Lending denominated in euros was especially weak, falling by $161 billion in Q2 2017.

- Cross-border lending to China rose for the third quarter in a row, up $78 billion in Q2, taking its annual growth to 25%.

Cross-border credit contracts despite growth in lending to non-bank financials

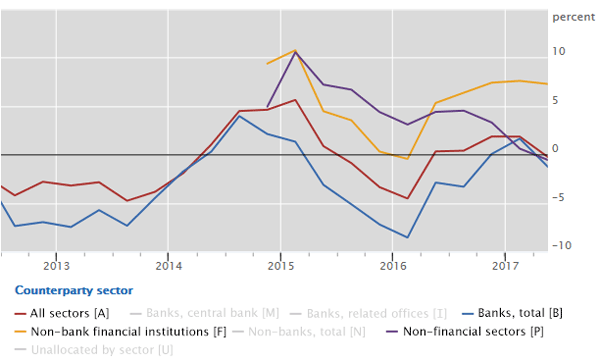

Graph 1: Annual percentage change in banks' cross-border claims (interactive graph).

Source: BIS locational banking statistics (Table A6.1).

The rebound in international banking activity seen at the start of 2017 proved temporary. Cross-border bank credit weakened again in Q2 2017, contracting by $91 billion from the previous quarter. This reduced the annual growth rate from about 2% at end-March 2017 to zero at end-June 2017 (see Graph 1).

The overall weakness in international banking activity in Q2 2017 was driven by declines in cross-border claims against banks (-$74 billion) and non-financial borrowers (-$111 billion). In contrast, credit to non-bank financial institutions increased, continuing the expansion that started in early 2016. The latest quarterly increase of $127 billion took its annual growth rate to 7% at end-June 2017. The largest increases in Q2 2017 were to non-bank financial institutions in the United States ($47 billion) and the United Kingdom ($43 billion).

Euro lending falls while sterling lending expands

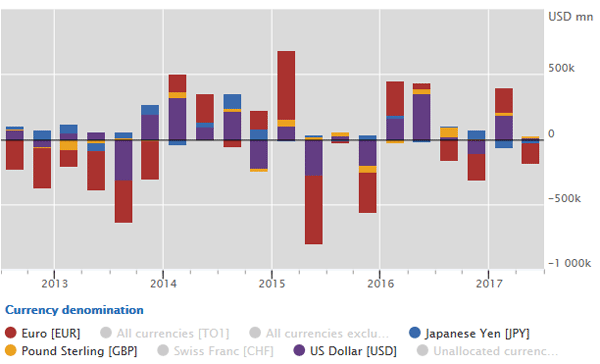

Graph 2: Adjusted changes in banks' cross-border claims (interactive graph).

Source: BIS locational banking statistics (Table A6.1).

Lending denominated in euros was especially weak. After adjusting for breaks in series and exchange rate movements, euro-denominated cross-border claims declined by $161 billion between end-March and end-June 2017, which reduced their annual growth rate to -4%. The fall in euro-denominated claims was concentrated against borrowers in the euro area (-$124 billion) and the United Kingdom (-$32 billion).

In contrast, cross-border credit in sterling expanded by $13 billion in the second quarter of 2017, continuing a trend which started in mid-2016 (see Graph 2). Meanwhile, US dollar- and yen-denominated claims were broadly flat in Q2 2017.

Lending to most emerging market economies declines, except to China

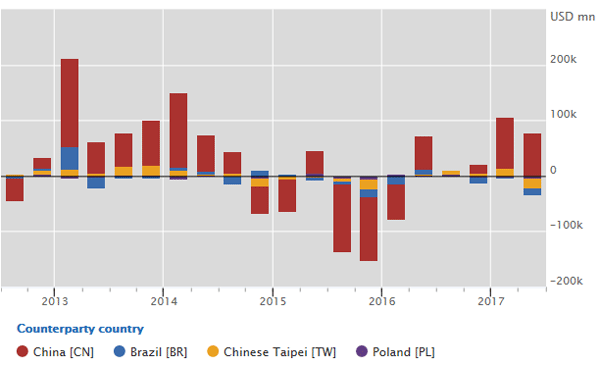

Graph 3: Adjusted changes in banks' cross-border claims (interactive graph).

Source: BIS locational banking statistics (Table A3).

Whereas banks' cross-border claims on advanced economies fell by $178 billion in Q2 2017, those on emerging market economies (EMEs) increased by $69 billion. This expansion primarily reflected a $78 billion rise in lending to China (see Graph 3). In contrast, cross-border credit to most other EMEs declined. The largest contractions were against borrowers in Chinese Taipei (-$16 billion), Brazil (-$13 billion) and Poland (-$5 billion).

Consolidated bank claims on China climb again

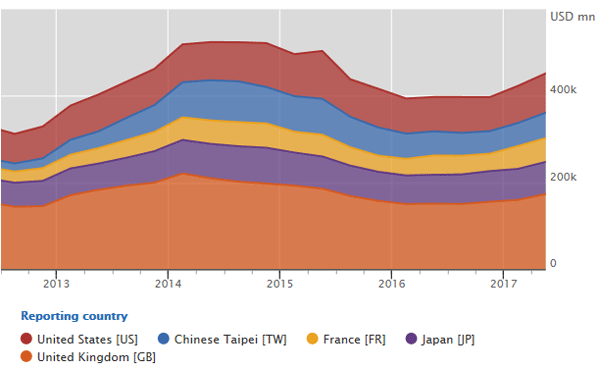

Graph 4: Banks' outstanding foreign claims on an ultimate risk basis (interactive graph).

Source: BIS consolidated banking statistics (Table B4).

The Q2 2017 rise in lending to China was the third consecutive quarterly increase. It took the annual growth rate to 25%, which was a marked turnaround from the large contractions in 2015 and early 2016. Most of the latest increase in cross-border claims on China took the form of interbank lending as well as intragroup activity between the mainland and overseas offices of Chinese and foreign banks. Even if intragroup activities are excluded, foreign banks' claims on China are once again increasing. According to the BIS consolidated banking statistics (which include foreign banks' cross-border claims on China as well as the local claims of their mainland affiliates), the outstanding consolidated claims of foreign banks rose to $750 billion on an ultimate risk basis at end-June 2017, up from a low of $656 billion in early 2016 but still below their 2014 peak. The banking systems with large claims on China include the United Kingdom, the United States, Japan, Chinese Taipei and France (see Graph 4).