BIS residential property price statistics, Q3 2019

1. Summary of latest developments

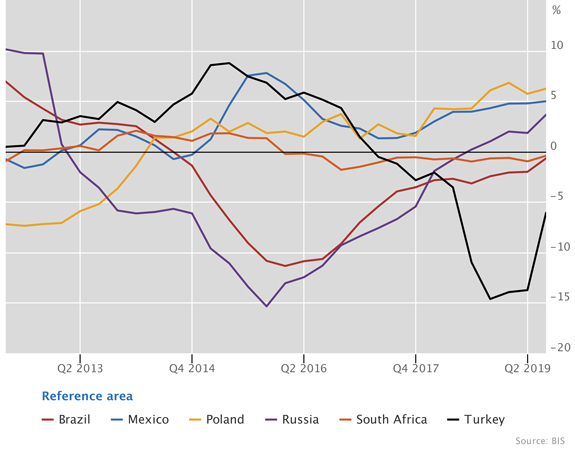

- Global real residential property prices1 increased by 1.4% year on year in aggregate in the third quarter of 2019, reflecting subdued developments both in advanced (1.5%) and emerging market economies (1.3%). Among the various regions, real prices increased most strongly in the euro area, central and eastern Europe and Latin America but fell in the Middle East and Africa. Within the G20 economies, Germany, Mexico, Russia saw the strongest annual real house price inflation in the third quarter. At the other end of the scale, prices declined furthest in Australia and Turkey.

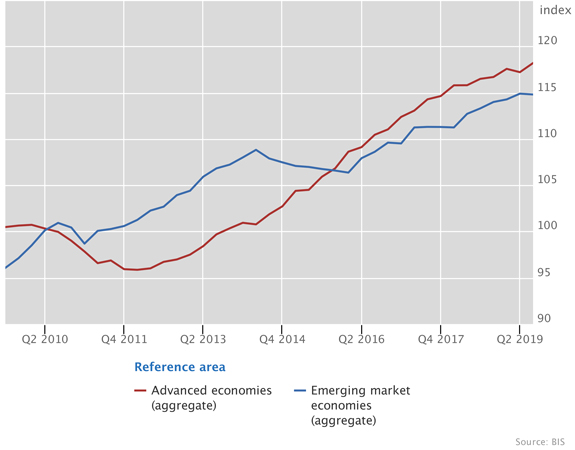

Aggregate developments in real residential property prices

Graph 1: 2010 = 100 (interactive graph).

Source: BIS residential property price statistics.

- In real terms, residential property prices are well above their immediate post-crisis levels in both advanced and emerging market economies, by 18% and 15%, respectively. Since the aftermath of the 2007-09 Great Financial Crisis, prices have increased the most in non-European advanced economies, emerging Asia and, to a lesser extent, non-euro area advanced European countries and Latin America. In contrast, they have remained significantly below their post-crisis levels in central and eastern Europe.

Regional developments in real residential property prices, in per cent, Q3 2019

2. Advanced economies

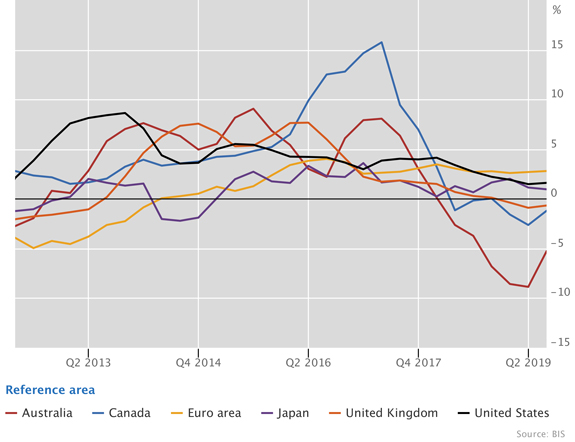

Real residential property prices in advanced economies

Year-on-year changes

Graph 2: interactive graph.

Source: BIS selected residential property price series based on quarterly average data

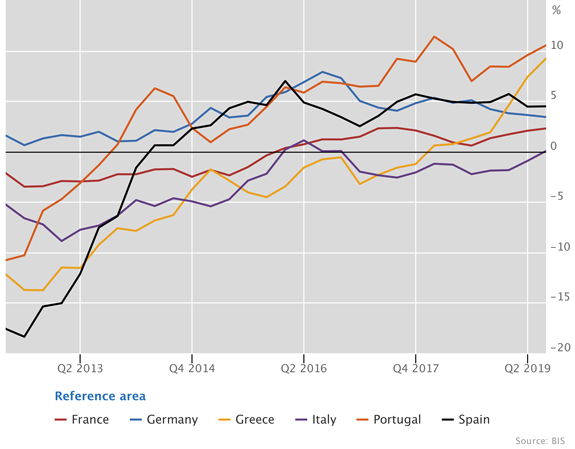

Real residential property prices in euro area member states

Year-on-year changes

Graph 3: interactive graph.

Source: BIS selected residential property price series based on quarterly average data.

In aggregate for the group of advanced economies, the growth of real residential property prices picked up from 1.2% to 1.5% annually from the second to the third quarter of 2019. Real prices rose the most in the euro area (almost 3%) and increased by 1-2% in Japan and the United States. They fell moderately in Canada and in the United Kingdom and continued to decline in Australia (-5%) (Graph 2). Within the euro area, real prices surged, by around 10% in Greece and Portugal. Prices also increased in Spain (+4%), Germany (+3%) and France (+2%); after several years of negative growth, they stabilised in Italy (Graph 3).

3. Emerging market economies

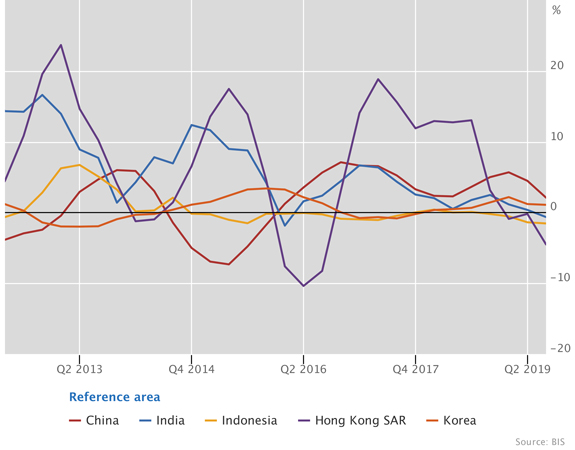

Real residential property prices in emerging Asia

Year-on-year changes

Graph 4: interactive graph.

Source: BIS selected residential property price series based on quarterly average data.

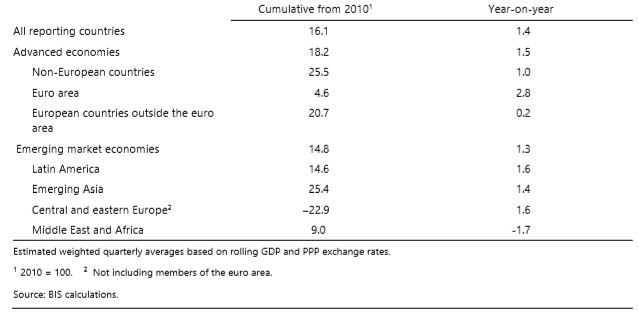

Real residential property prices in other emerging market economies

Year-on-year changes

Graph 5: interactive graph.

Source: BIS selected residential property price series based on quarterly average data.

Real residential property prices growth eased to 1.3% year on year in emerging market economies in the third quarter of 2019, driven mainly by developments in China (+2%) and India (-1%). Among the other Asian economies, prices remained stable in Korea, and fell in Indonesia. In Hong Kong SAR prices started to decline (-5%) after the significant expansion observed over the past few years. (Graph 4).

Real prices were up in Latin America in aggregate (+1.6%), driven by a marked increase of 5% in Mexico. In Brazil, the prices almost stabilised after an extended period of decline.

Turning to central and eastern Europe, aggregate real prices rose by 1.6% on average, led by the recovery in Russia (+4%) and continued strong growth (6-10%) in medium-sized economies such as the Czech Republic, Hungary and Poland. However, prices continued to decline in Turkey (-6%) (Graph 5).

1 Real residential property prices refer to nominal residential property price indicators deflated by the Consumer Price Index. Global aggregates are weighted aggregates of selected advanced economies (Australia, Canada, Denmark, the euro area, Iceland, Japan, New Zealand, Norway, Sweden, Switzerland, the United Kingdom and the United States) and emerging market economies (Brazil, Bulgaria, Chile, China, Colombia, Croatia, the Czech Republic, Hong Kong SAR, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, North Macedonia, Peru, Philippines, Poland, Romania, Russia, Singapore, South Africa, Thailand, Turkey and the United Arab Emirates), based on PPP exchange rates.