BIS real residential property price statistics, Q2 2019

1. Summary of latest developments

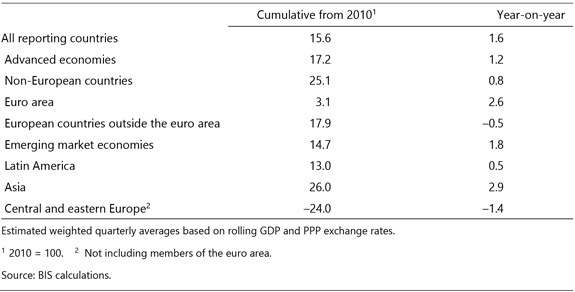

- Global real residential property prices1 increased by 1.6% year on year in aggregate in the second quarter of 2019 (and by 1.2% and 1.8% in aggregate for advanced and emerging market economies, respectively). This reflected a significant slowdown compared with the 2.1% increase registered in the first quarter.

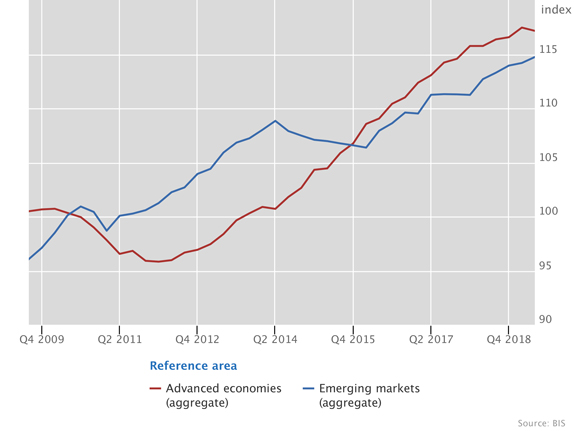

- In real terms, residential property prices are still well above their immediate post-crisis levels in both advanced and emerging market economies, by 17% and 15%, respectively.2

Aggregate developments in real residential property prices

Graph 1: 2010 = 100 (interactive graph).

Source: BIS residential property price statistics.

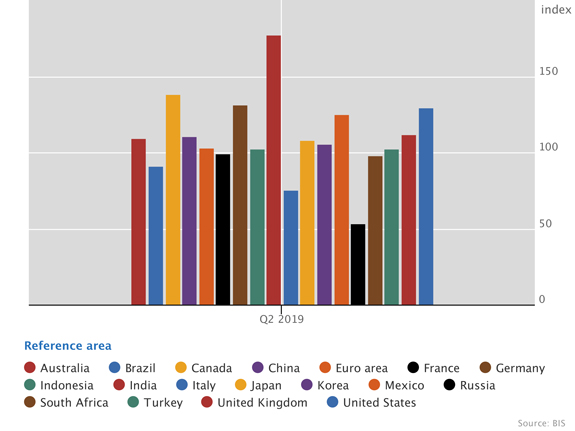

- Among G20 economies, Mexico and China saw the strongest annual real house price inflation in the second quarter of 2019. Prices also increased significantly in Germany and France. At the other end of the scale, prices declined the most in Turkey and Australia.

- Since the aftermath of the 2007-09 Great Financial Crisis (GFC), prices have increased the most in India and, to a lesser extent, in Canada, Germany, the United States and Mexico. In contrast, they have remained significantly below their post-crisis levels in Russia and Italy.

Real residential property price developments in selected countries since the GFC

Source: BIS residential property price statistics.

2. Advanced economies

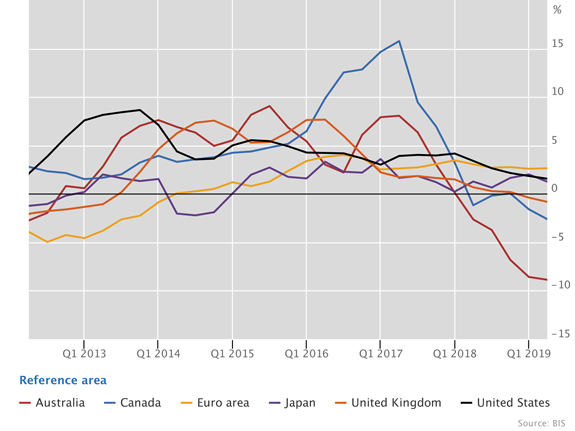

Real residential property prices in advanced economies

Year-on-year changes

Source: BIS selected residential property price series based on quarterly average data

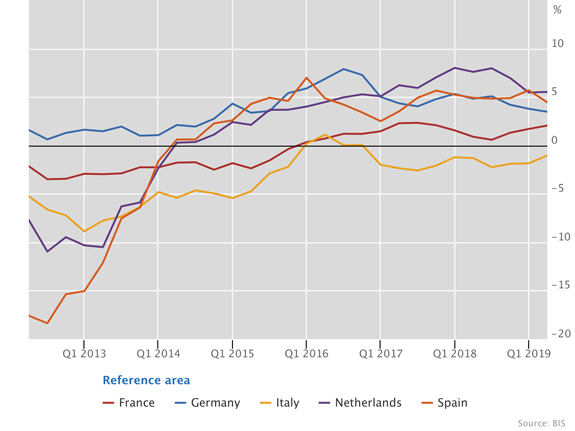

Real residential property prices in euro area member states

Year-on-year changes

Graph 4: (interactive graph).

Source: BIS selected residential property price series based on quarterly average data.

In aggregate for the group of advanced economies, the growth of real residential property prices slowed down, from 1.5% to 1.2% year on year from the first to the second quarter of 2019. Real prices rose the most in the euro area (+2.6%) and increased 1-2% in Japan and the United States. They fell moderately in the United Kingdom, more in Canada (-3%) and extended their sharp decline in Australia (-9%) (Graph 3). Within the euro area, real prices increased rapidly in the Netherlands (+5%), Spain (+4%), Germany (+3%) and, to a lesser extent, France (+2%). However, they kept falling in Italy (-1%) (Graph 4).

3. Emerging market economies

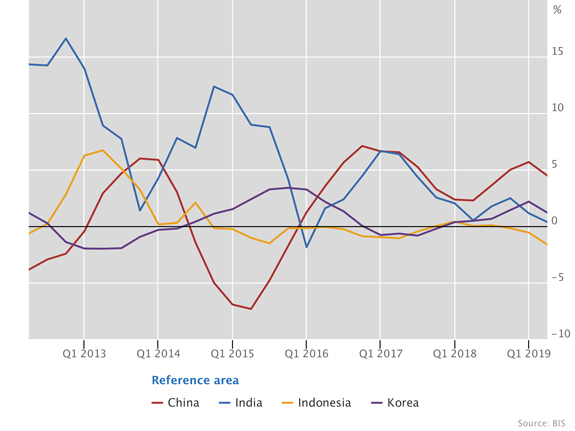

Real residential property prices in emerging Asia

Year-on-year changes

Graph 5: (interactive graph).

Source: BIS selected residential property price series based on quarterly average data.

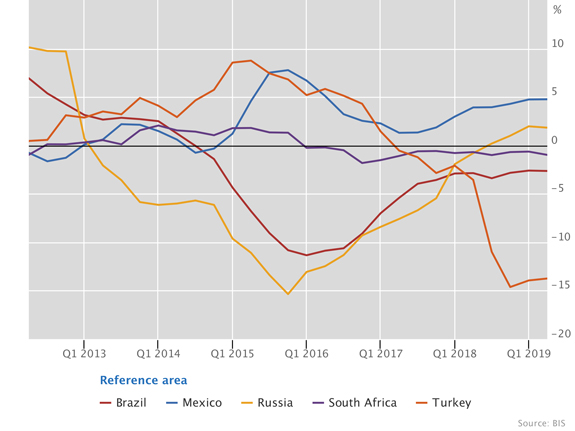

Real residential property prices in other emerging market economies

Year-on-year changes

Graph 6: (interactive graph).

Source: BIS selected residential property price series based on quarterly average data.

Real residential property prices increased by 1.8% year on year in emerging market economies in the second quarter of 2019. They were up by 2.9% in emerging Asia, led by a 4% price rise in China. Property price inflation slowed in India and Korea, and turned negative in Indonesia (-2%) (Graph 5).

In contrast, real prices remained more stable in Latin America in aggregate (+0.5%), where a marked increase of 5% in Mexico was offset by the continuing decrease in Brazil (-3%).

Turning to central and eastern Europe, aggregate real prices fell by 1.4% on average, led by a sharp decline in Turkey (-14%). In contrast, they continued to recover in Russia (+2%), a sign of stabilisation after the previous sharp decline observed from 2012 to 2018 (Graph 6).

Regional developments in real residential property prices, in per cent, Q2 2019