Payments are a-changin' but traditional means are still here*

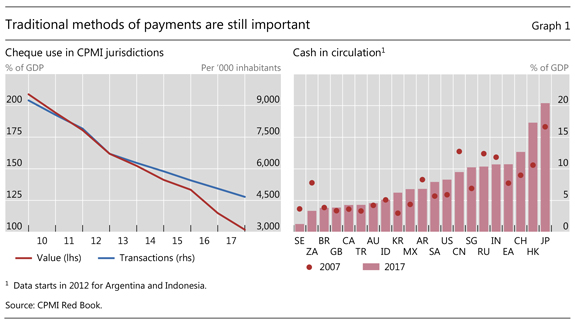

- Despite the promise of cashless societies, paper-based payments like cheques and cash still play important roles.

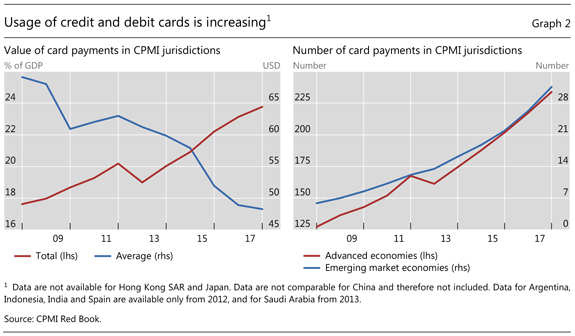

- Card payments are growing swiftly and being used for ever smaller payments.

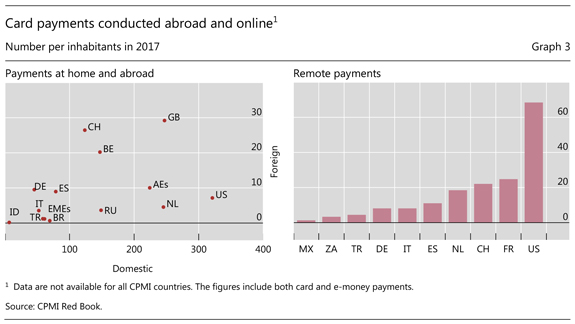

- Debit and credit cards are used more and more abroad - and online card payments are increasing everywhere, in particular in the United States.

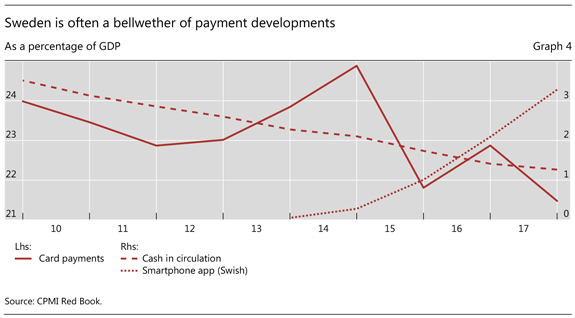

- In Sweden, a new mobile payment solution is gaining in popularity relative to credit and debit cards.

The world of payments is in a state of flux. Around the globe, novel technologies and new market entrants challenge the traditional bank-centric payment paradigms. Incumbent payment services providers are under pressure from startups as well as big tech firms. Cheaper, smarter and more versatile mobile devices are allowing new and more convenient ways to transfer money. Moreover, digitalisation is leading payers and payees to demand speedier payments anywhere and anytime.

Nevertheless, traditional payment methods still play important roles in most countries (Graph 1). Paper cheques, while declining rapidly in numbers, are still a popular choice for larger consumer or corporate payments in a number of jurisdictions, such as the United States (136% of GDP) and Korea (290% of GDP). Similarly, cash is still in demand, and circulation continues to grow in many jurisdictions. Cash in circulation varies considerably across CPMI member jurisdictions. It ranges from 1% of GDP in Sweden to 20% of GDP in Japan, and is above 5% of GDP in two thirds of CPMI countries.

Electronic ways to pay are growing swiftly and are being used for ever smaller payments. For example, the value of credit and debit card payments as a percentage of GDP has increased by over a third across the CPMI over the last decade and now amounts to 24% of GDP for these jurisdictions.1 The average card payment fell from $69 in 2007 to $48 in 2017 (Graph 2, left-hand panel).

In terms of usage, people in advanced economies used their payment cards 234 times per year on average in 2017 while people in emerging market economies used their cards 32 times (Graph 2, right-hand panel). The frequency of card usage varies greatly across countries, ranging from almost once a day to fewer than five times a year.

This edition of the Red Book provides new insights into card payments made when the holder is abroad. The number of card payments made abroad is increasing rapidly. For advanced economies, such usage is 10 times a year per person, while it is only once for emerging market economies. UK residents have the highest usage away from home, with 29 times on average followed by residents of Switzerland (Graph 3, left-hand panel). Not surprisingly, card payments made in foreign countries ($57) are on average larger than those made domestically ($48).

One driver of the increasing use of card payments is the explosion in online shopping and e-commerce generally. Such remote card payments are increasing everywhere and, on average, there are 31 such transactions per person annually across the CPMI.2 Usage ranges from one per year in Mexico and over 25 in France to 68 in the United States. The average value of remote card payments is $102, and in the United States such payments amount to 12% of GDP.

Sweden is often seen as a bellwether of payment developments. Cash demand has fallen for the better part of a decade as consumers and retailers have embraced electronic means. Stores and restaurants are increasingly reluctant to accept paper money. The use of payment cards is high, but appears to have plateaued or even peaked. At the same time, the mobile payment solution Swish is gaining in popularity, and payments processed through this mobile solution approach 3% of GDP. This increase roughly equals the drop in card payments (Graph 4).

* This analysis was prepared by Micka Jakobsen, Visiting Member of Secretariat, Committee on Payments and Market Infrastructures.

1 Includes cards with a credit, debit or delayed debit function.

2 Remote payments are those wherein the payment card used to perform the payment is not physically present at the payment terminal when the payment is initiated. Remote card payments are compiled for the overall number of card transactions and therefore include payments made with cards with a debit, delayed debit, credit or e-money function.