BIS global liquidity indicators at end-December 2021

Key takeaways

- Issuance of international debt securities continued to drive growth in global foreign currency credit to non-bank borrowers.

The BIS global liquidity indicators (GLIs) track credit to non-bank borrowers, covering both loans extended by banks and funding from global bond markets through the issuance of international debt securities (IDS). The main focus is on foreign currency credit denominated in three major reserve currencies (US dollars, euros and Japanese yen) to non-residents, ie borrowers outside the respective currency areas. The GLIs monitor growth in this credit relative to that denominated in those same currencies to residents within these currency areas (as reported in national financial accounts).

Further reading

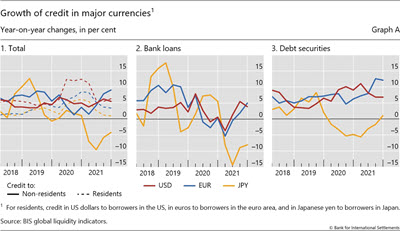

At end-2021, growth in foreign currency credit in dollars and euros remained strong on a year-on-year (yoy) basis (Graph A.1). Dollar credit to non-bank borrowers outside the United States stood at $13.4 trillion, 5% higher than at end-2020. Growth in euro credit to non-bank borrowers outside the euro area gathered further pace, with 9% yoy growth bringing the stock to €4 trillion ($4.9 trillion). In contrast, growth in yen credit to non-bank borrowers outside Japan remained negative at -4% yoy, leaving the amount outstanding at ¥46.6 trillion ($0.4 trillion). In all three currencies, issuance of IDS continued to outpace bank lending (Graphs A.2 versus A.3). While loans in dollars and euros grew at 4% and 5% yoy, respectively, bond funding expanded at 7% and 12% yoy. Bond market funding in yen stabilised, while loans in yen continued to contract.

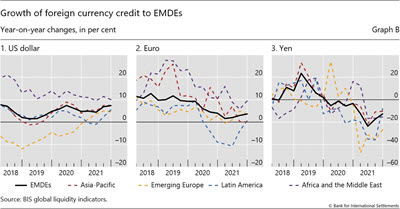

At end-2021, credit to non-banks in Emerging Market and Developing Economies (EMDEs) denominated in dollars and in euro grew at 7% and almost 4% yoy, respectively, bringing the stocks to $4.2 trillion and €0.8 trillion (Table E2-USD and E2-EUR). For both currencies, this reflected more credit being extended to borrowers in all regions, including Latin America (Graphs B.1 and B.2). Albeit small in amount, yen-denominated credit to EMDEs continued to decline at a rate of 13% yoy (Table E2-JPY), bringing the stock to ¥7 trillion ($61 billion), with borrowers in China accounting for the bulk of this decline (-21% yoy). This was in sharp contrast with the 9% yoy increase registered for dollar credit to China, resulting in a much larger total of $545 billion at end-2021 (Table E2-USD).

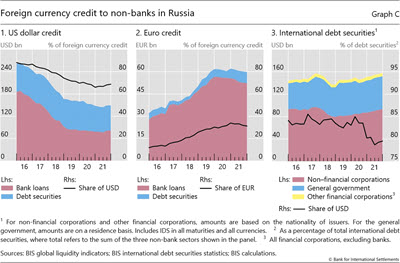

The BIS GLIs also show the amount of foreign currency credit extended to Russia (Graph C). At end-2021, the dollar-denominated component amounted to $149 billion: $82 billion in the form of bank loans and $67 billion as IDS. The dollar share in total foreign currency credit extended to Russia has been declining since 2014, reflecting the retreat of US banks and other dollar lenders (Graph C.1 and Graph 5). In contrast, the share of euro credit has trended up over this period (+19% since end-2015), based on a stock of €60 billion in Q4 2021. Despite robust growth in euro bond issuance in recent years, euro borrowers in Russia continue to rely more on banks than on bond markets: in Q4 2021, debt securities accounted for only 13% of foreign currency credit in euros (Graph C.2).

Issuance of IDS by Russian non-bank borrowers has been robust over the past two years, increasing the stock to a face value of $158 billion at end-2021 (Graph C.3). Debt securities denominated in dollars still made up 80% of this total, compared with only 13% for euro-denominated debt ($20 billion). Non-financial corporations were the largest issuer sector: their $94 billion in IDS outstanding (primarily from their offshore subsidiaries) thus exceed the amount outstanding of the general government ($58 billion) and other financial corporations ($6 billion) combined.

For more details, see the GLI methodology

For more details, see the GLI methodology

The BIS ceased receiving data from public authorities in Russia after 28 February 2022. Where possible, data publication will be continued if the BIS is able to use data from public or commercial sources.