BIS global liquidity indicators at end-December 2019

- US dollar credit to non-bank borrowers outside the United States grew by 6% in 2019, to reach $12.2 trillion at end-2019.

- The annual growth rate of euro-denominated credit outside the euro area slowed to 6%, while that of yen-denominated credit outside Japan turned negative (-1%).

- In 2019, euro-denominated credit overtook US dollar-denominated credit as the largest stock of foreign currency credit to emerging Europe.

- The debt securities share in US dollar credit outside the United States has risen considerably over the past decade across a number of major borrowing regions.

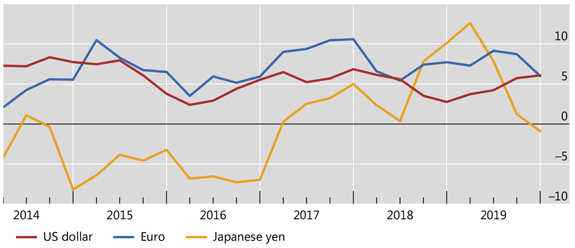

Graph 1: Annual percentage change of US dollar-, euro- and yen-denominated credit to non-resident non-banks (interactive graph).

Source: BIS global liquidity indicators (Table E2.1, E2.2 and E2.3).

US dollar-denominated credit to non-banks outside the United States grew by 6% during 2019 (Graph 1, red line). This brought the outstanding amount of USD-denominated credit outside the United States to $12.2 trillion as of end-2019.

Growth in euro-denominated credit to non-banks outside the euro area (blue line) slowed to 6% year on year (yoy), reaching €3.4 trillion (equivalent to $3.8 trillion). Credit denominated in Japanese yen to non-banks outside Japan contracted at 1% yoy (yellow line). Bank loans were the main driver of the deceleration observed for both currencies (Graph A3, right-hand panels).

US dollar-denominated credit to non-banks in emerging market and developing economies (EMDEs) grew by 5% during 2019. Euro-denominated credit to those borrowers expanded at an even faster clip (10% yoy). It has consistently expanded more rapidly than USD credit for more than five years. Nevertheless, the outstanding stock of euro-denominated credit to EMDEs (€763 billion, equivalent to $857 billion) was still considerably smaller than its US dollar counterpart ($3.9 trillion).

US dollar-denominated credit expanded in all but one EMDE region during 2019. Credit to Africa and the Middle East, which has been growing at double-digit rates since mid-2015, rose by 14% in 2019. Credit to emerging Asia-Pacific and Latin America also expanded, by 4% and 3%, respectively, during 2019.

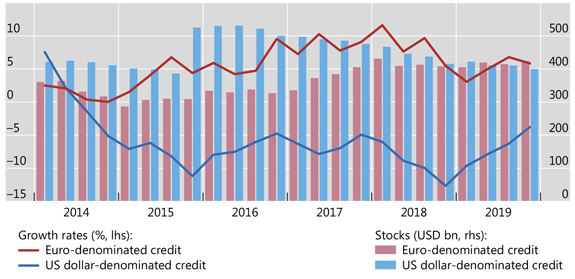

Graph 2: Euro- and US dollar-denominated credit to non-banks in emerging Europe (interactive graph).

Source: BIS global liquidity indicators Table E2.1 and Table E2.2.

By contrast, US dollar-denominated credit to emerging Europe declined by 4% during 2019 (Graph 2, blue line). This brought down its outstanding stock to $400 billion at end-2019 (blue bars). Dollar credit to emerging Europe has contracted at an average annual rate of 7% since 2014. During the same period, euro-denominated credit to the region expanded at an average annual rate of 6% (red line). As a consequence, the outstanding stock of euro-denominated credit to emerging Europe has surpassed its US dollar counterpart, and stood at €377 billion (equivalent to $423 billion, red bars) at end-2019.

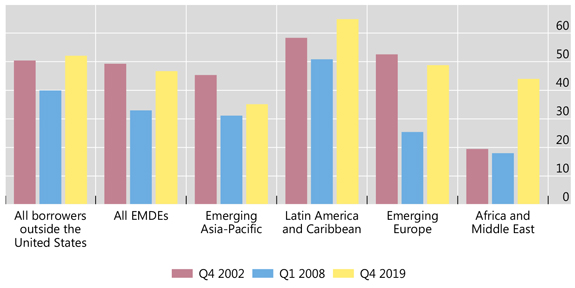

Graph 3: Share of debt securities in total USD credit to non-banks, by borrower region (in %).

Source: BIS global liquidity indicators (Table E2.1).

The instrument composition of foreign currency credit contains important clues regarding the potential impact of the Covid-19 pandemic on international credit markets. On the one hand, debt securities tend to have longer maturities, reducing rollover risk. On the other hand, lengthier duration of longer-maturity bonds makes borrowers' balance sheets more sensitive to changes in long-term interest rates and exchange rates.1

During the run-up to the Great Financial Crisis (GFC) of 2007-09, the share of debt securities in total US dollar-denominated credit outside the United States fell considerably, from 50% at end-2002 to 40% at end-Q1 2008 (Graph 3). After the GFC, this share increased steadily, reaching 52% at end-2019, as a part of a broader global trend of financial intermediation shifting away from bank loans to bond markets.2

This share also increased considerably for the subgroup of EMDE borrowers - from 33% at end-Q1 2008 to 47% at end-2019. The post-GFC trend towards greater reliance on bond markets has manifested itself in all major EMDE regions, albeit with different intensities. The shift towards bond markets has been most pronounced in emerging Europe and Africa and the Middle East, where the shares of debt securities rose from 25% and 18% at end-Q1 2008 to 49% and 44% at end-2019, respectively. The corresponding share for Latin America, which has historically always been relatively large, reached a record high of 65% at end-2019. The post-GFC shift towards bond markets was least pronounced in emerging Asia, where the share of debt securities increased only marginally, from 31% at end-Q1 2008 to 35% at end-2019, but remained considerably below its end-2002 level (45%).

1 Hofmann, I Shim and H S Shin, "Emerging market economy exchange rates and local currency bond markets amid the Covid-19 pandemic", BIS Bulletin no 5, April 2020.

2 S Shin, "The second phase of global liquidity and its impact on emerging economies", proceedings of the Asia Economic Policy Conference on Prospects for Asia and the global economy, Federal Reserve Bank of San Francisco, 3-5 November 2013, pp 215-24.