BIS global liquidity indicators at end-December 2018

- The annual growth rate of US dollar credit outside the United States declined for a fourth consecutive quarter.

- Euro credit outside the euro area and yen credit outside Japan continued to expand rapidly.

- The annual growth rate of credit to emerging market and developing economies (EMDEs) declined across all three major currencies (US dollar, euro and yen).

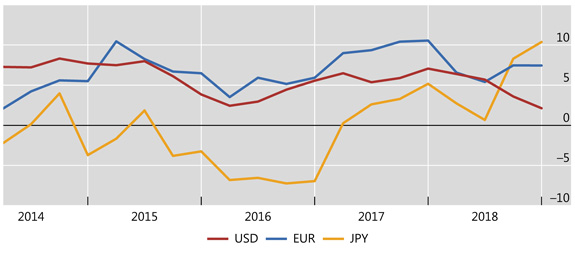

US dollar credit growth continues to slow as euro and yen credit expand rapidly

Graph 1: Annual percentage change of foreign currency credit to non-resident non-banks (interactive graph).

Source: BIS global liquidity indicators (Tables E2.1, E2.2 and E2.3).

The annual growth rate of US dollar credit to non-bank borrowers residing outside the United States slowed further during the past year (Graph 1, red line), resulting in an outstanding stock of $11.5 trillion at end-2018. The 2% annual growth rate recorded as of end-Q4 2018 was the lowest since the Great Financial Crisis (GFC). This reflected a sharp deceleration in the annual growth rate of dollar-denominated debt securities, which fell to 4% at end-2018, compared with an average of 9% over the past decade. Both components of foreign currency1 US dollar-denominated credit (debt securities and bank loans) grew more slowly than dollar credit to borrowers in the United States in 2018 (Annex Graph A3).

Meanwhile, euro-denominated credit to non-bank borrowers outside the euro area (blue line) continued to expand at a rapid annual pace (7%), reaching an outstanding stock of €3.2 trillion (equivalent to $3.7 trillion) at end-2018. The main driver was the growth in bank loans, which rose by 10% year on year, while the annual growth rate of international debt securities stayed roughly unchanged (6%). Euro-denominated credit to advanced economies outside the euro area accelerated, while that to EMDEs decelerated.

In parallel, yen-denominated credit to non-bank borrowers outside Japan also grew rapidly, at an annual rate of 10%, reaching ¥49 trillion ($0.4 trillion) at end-2018 (yellow line).

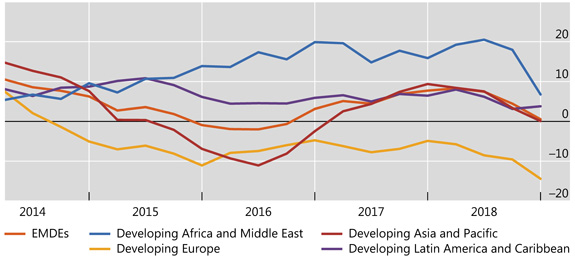

US dollar credit growth to EMDEs stalls

Graph 2: Annual percentage change in US dollar-denominated credit to non-banks by counterparty country (interactive graph).

Source: BIS global liquidity indicators (Table E2.1).

Foreign currency credit to EMDEs decelerated across all three major currencies. Between end-Q3 and end-Q4 2018, the annual growth rates of euro- and yen-denominated credit fell from 13% to 8% and from 12% to 9%, respectively. Meanwhile, the annual growth rate of US dollar-denominated credit to EMDEs fell from 4% to 1% (Graph 2, orange line). The outstanding stock at end-2018 stood at $3.6 trillion, representing 31% of global foreign currency dollar credit.

The overall slowdown in US dollar-denominated credit to EMDEs was due mainly to bank loans, which contracted by 5% year on year. In contrast, the annual growth rate of US dollar-denominated international debt securities moderated to 8% at end-2018, down from 16% a year before.

There were considerable differences in the evolution of US dollar-denominated credit among EMDE regions. Near zero annual growth was observed for developing Asia and the Pacific (red line), which accounts for the largest proportion of US dollar credit to EMDEs. Meanwhile, credit to developing Europe continued the downward trend seen over the past four years, falling by 14% during 2018 (yellow line). In contrast, the annual growth rate of US dollar credit to Latin America and the Caribbean stabilised, at around 4% (purple line). Credit to developing Africa and the Middle East grew at an annual rate of 7% as of end-2018. This represented a sharp decline from the most recent peak of 21% recorded at mid-2018 (blue line).

1 In the context of the BIS global liquidity indicators (GLIs), "foreign currency" credit is defined as credit denominated in a currency that is different from the domestic currency of the borrower. For example, "foreign currency US dollar-denominated credit" is defined as US dollar-denominated credit to non-bank borrowers outside the United States.