The 'real' illusion: How monetary factors matter in low-for-long rates

Article by Mr Claudio Borio, Head of the Monetary and Economic Department of the BIS, Mr Piti Disyatat, Director of Research, Bank of Thailand, Mr Mikael Juselius, Research Adviser, Monetary Policy and Research Department, Bank of Finland, and Mr Phurichai Rungcharoenkitkul, Senior Economist, Monetary and Economic Department, Bank for International Settlements, in VoxEU.org, published on 18 October 2018.

Has the decline in real (inflation-adjusted) interest rates over the last 30 years been driven by variations in desired saving and investment, as commonly presumed? And is this a useful way of thinking about the determination of real interest rates more generally, at least over long horizons? This column finds that this is not the case by systematically examining the relationship between several saving-investment drivers and market real interest rates (as well as estimates of natural rates) since the 1870s and for 19 countries. By contrast, a clear and robust role for monetary policy regimes emerges. The analysis has significant implications for the notion of monetary neutrality and policymaking.

The idea that the decline in real (inflation-adjusted) interest rates since the 1980s reflects fundamental saving-investment drivers has become, as it were, part of the intellectual furniture of the economics profession (Bean et al. 2015). It underlies some of the most popular macroeconomic hypotheses of the past decade: the saving glut (Bernanke 2005), secular stagnation (Summers 2014), and the safe asset shortage (Caballero et al. 2017), among others. Put differently, and leaving short-term fluctuations aside, the decline is seen as tracing an equilibrium path that reflects a decline in the natural interest rate - the rate that prevails when output is at potential, so that inflation is stable.

This state of affairs is hardly surprising. The mainstream of the current economics profession, harking back to the classical tradition, subscribes to the notion that money is neutral in the long run - that it can influence only prices and not real variables (e.g. Wicksell 1898). To be sure, historically this notion has not gone unchallenged, including by none other than Keynes (1936). Even so, non-neutrality has gone out of fashion following the monetarist ascendancy (e.g. Friedman 1968) and the subsequent new neo-classical synthesis that underpins, for instance, the now dominant DSGE modelling strand (e.g. Goodfriend and King 1997).

But how strong is the empirical evidence for the view that saving-investment fundamentals have been the main driver of real interest rates over the past 30 years? Probably less than we think. But before turning to the empirical findings of our recent paper (Borio et al. (2017), it is useful to examine critically the type of evidence available in favour of the saving-investment view.

The saving-investment view: Limitations of the current evidence

A key limitation of the available evidence is that it relies critically on a number of maintained hypotheses, i.e. hypotheses assumed to be true as a basis for the tests. Consider the two main approaches.

The first approach simply assumes that, over the relevant sample, the market rate tracks the natural interest rate. It thus abstracts entirely from a discussion of the behaviour of prices and inflation - thus also assuming monetary neutrality. In its less formal variant, it then tells plausible stories based on visual inspection of the data (e.g. Bean et al. 2015); in its more formal one, it relies on more articulated models and calibrates parameters to see whether they can produce results roughly consistent with the data (e.g. Rachel and Smith 2017, and references in Borio et al. 2017).

The approach suffers from three drawbacks. First, it doesn't provide independent evidence that the market rate has actually tracked the natural rate. Second, it never really tests the underlying saving-investment framework of interest rate determination - the approach either takes it implicitly as the starting point of the analysis or embeds it more explicitly in a formal model. Third, it simply seeks to replicate the main stylised features of the data, rather than estimating relationships more tightly - the bar is set too low.

The second approach seeks to filter out the unobservable natural rate from market rates. Here, the behaviour of inflation provides a key signal (e.g. Holston et al. 2016). Taking the Phillips curve as the maintained hypothesis, the approach draws a simple but critical inference: if inflation rises, output must be above potential; if it declines, output must be below potential. Given that the real interest rate influences aggregate demand, the next step is to infer that whenever inflation rises, the market rate is below the natural rate, and vice versa when inflation declines.

The main drawback of this approach is that the Phillips curve has proved very elusive for quite some time now, as indicated by the rather weak link between inflation and economic slack (Stock and Watson 2007, Borio 2017, Forbes et al. 2018). This makes any firm inferences suspect. Indeed, recent work has found that financial cycle proxies capture cyclical output variations better than inflation (Borio et al. 2016, Kiley 2015). Moreover, filtering approaches typically relate the unobserved natural rate to other unobservable variables, such as potential growth and preferences, providing many degrees of freedom when carrying out the tests. Thus, the maintained hypothesis ends up having a decisive influence on the results. As with calibration, the risk of 'overfitting' in any given sample is material.

The saving-investment view: Beyond the current evidence

In order to break out of this circularity, in recent work we allow the data to speak more freely. In addition, we go beyond the traditional period used to discuss the decline in real interest rates (from the early 1990s or, in some cases, early 1980s), to limit the risk of spurious (trend-like) relationships.

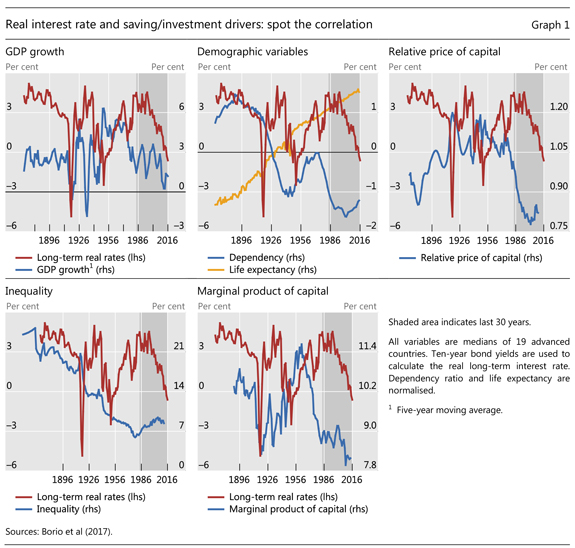

Specifically, we go back to the 1870s for 19 countries, and we examine the relationship between real interest rates and the 'usual suspects': growth, productivity, demographics, income distribution, the relative price of capital, and the marginal product of capital. We do this for both real long-term and short-term interest rates, as well as for the most popular estimate of the short-term natural rate, based on the behaviour of inflation, à la Holston et al. (2016).

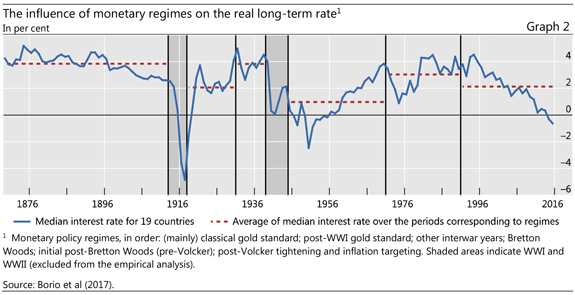

While the usual suspects appear to work reasonably well since the early 1980s (shaded area in Graph 1), at least qualitatively, the relationships do not hold before then. Over the longer sample, no consistent pattern emerges - a sign that the relationships in the more recent period may be spurious. Even a simple visual inspection of the data suggests that this may the case (see Graph 2) - no systematic link is discernible before the 1980s. The link is absent even during phases in which inflation was quite stable, such as the gold standard. More formal econometric evidence supports this finding. And the lack of a stable relationship is a very robust feature of the data - it survives a battery of tests, including, for instance, alternative definitions of the saving-investment factors, alternative inflation expectations, the inclusion of a risk premium, and allowing explicitly for global factors.

The findings are in line with previous work that has followed a similar approach, but on a smaller set of variables or countries. For instance, Hamilton et al. (2015) and Lunsford and West (2017) generally find that the link between saving-investment drivers and real interest rates is tenuous at best.1

Beyond the saving-investment view: The role of monetary regimes

If saving-investment drivers may not be the main explanation, what else could be? Our empirical tests suggest that monetary regimes may be at least part of the answer.

We divide the sample into different monetary regimes: the classical gold standard, the post-WWI gold standard, the rest of the interwar years, the Bretton Woods period, the initial post-Bretton Woods (floating) period (pre-Volcker), and the inflation-control period (from the Volcker tightening). We exclude war years (as well as the immediate postwar ones, for robustness) and we control for the saving-investment drivers. We find that the levels of real interest rates differ in economically and statistically significant ways across regimes. The trends in real rates also appear to differ. This is illustrated in Graph 2. The importance of monetary policy regime survives even if we control for a common unobserved global factor, in which case we mainly exploit cross-country differences with respect to the regimes.

How could one interpret the decline in real rates since the 1980s from a perspective that highlights the possible role of monetary regimes? At this stage, one can only speculate; still, a possible narrative would stress three factors.

The first factor is the gradual normalisation of interest rates after the Volcker shock that ended the Great Inflation. This suggests that the starting point is rather unrepresentative and already embeds a key monetary policy imprint.

The second factor is an asymmetrical policy response to financial developments that contributed to outsized financial cycles (e.g. Borio and Disyatat 2014). In particular, asymmetrical responses were in evidence around the financial boom and bust of the 1980s-1990s and the one that surrounded the Global Crisis. As long as inflation remained low and stable, there was no incentive for central banks to tighten policy during the financial booms in either case. But there was a strong incentive to respond aggressively and persistently to fight the bust and stave off any deflation threat.

The third factor, especially post-Global Crisis, is strenuous central bank efforts to push a stubbornly low inflation rate up towards target, as the disinflationary tailwinds before the crisis, linked to supply side factors such as globalisation, turned into unwelcome headwinds after it, keeping inflation lower than desired. Difficulties in generating second-round effects, with wages chasing prices, would imply that reductions in interest rates have a largely temporary effect on inflation. Thus, repeated cuts would end up reducing real interest rates further and further even as inflation remains persistently below target.

Conclusion

Our findings indicate that the link between saving-investment drivers may well be looser than is generally held. By contrast, the role of monetary regimes appears to have been underestimated. If correct, these findings have significant theoretical and policy implications, casting doubt on such strongly held views as money neutrality and the reliability of natural interest rates as policy guides (Borio et al (2018)). They also suggest that there are important differences between the long-term drivers of nominal interest rates and of inflation that need to be better understood.

As Mark Twain is reputed to have said, "It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so."

References

Bean, C, C Broda, T Ito and R Kroszner (2015): "Low for long? Causes and consequences of persistently low interest rates", Geneva Reports on the World Economy, no 17, Geneva: ICMB and London: CEPR Press.

Bernanke, B (2005): "The global saving glut and the US current account deficit", remarks at the Sandridge Lecture, Virginia Association of Economists, Richmond, Virginia, 10 March.

Borio, C (2017): "Through the looking glass", OMFIF City Lecture, London, 22 September.

Borio, C and P Disyatat (2014): "Low interest rates and secular stagnation: is debt a missing link?", VoxEU, 25 June.

Borio, C, P Disyatat and M Juselius (2016): "Rethinking potential output: embedding information about the financial cycle", Oxford Economic Papers, vol 69, no 3, July, pp 655-77.

Borio, C, P Disyatat, M Juselius and P Rungcharoenkitkul (2017): "Why so low for so long? A long-term view of real interest rates", BIS Working Papers, no 685, December.

Borio, C, P Disyatat, and P Rungcharoenkitkul (2018): "What anchors for the natural rate of interest?", paper presented at the Federal Reserve Bank of Boston 62nd Annual Conference What are the consequences of long spells of low interest rates?, Boston, 7-8 September.

Caballero, R, E Fahri and P-O Gourinchas (2017): "The safe assets shortage conundrum", Journal of Economic Perspectives, vol 31, no 3, Summer, pp 29-46.

Forbes, K, L Kirkham and K Theodoridis (2018): "A trendy approach to UK inflation dynamics", MIT-Sloan Working Papers, no 5268-18.

Friedman, M (1968): "The role of monetary policy", The American Economic Review, vol 58, no 1, pp 1-17.

Goodfriend, M and R King (1997): "The New Neoclassical Synthesis and the role of monetary policy", in

B Bernanke and J Rotemberg (eds), NBER Macroeconomics Annual, vol 12, Boston: MIT Press.

Hamilton, J, E Harris, J Hatzius and K West (2015): "The equilibrium real funds rate: past, present, and future", presented at the US Monetary Policy Forum, New York, 27 February.

Holston, K, T Laubach and J Williams (2016): "Measuring the natural rate of interest: international trends and determinants", Federal Reserve Board, Finance and Economics Discussion Series, no, 2016-073.

Keynes, J (1936): The general theory of employment, interest and money, London: Macmillan. Reprinted 1967, London: Macmillan.

Kiley, M (2015): "What can the data tell us about the equilibrium real interest rate?", Federal Reserve Board, Finance and Economics Discussion Series, no 2015-077.

Lunsford, K and K West (2017): "Some evidence on secular drivers of safe real rates", mimeo.

Rachel, L and T Smith (2017): "Are low real interest rates here to stay?", International Journal of Central Banking, vol 13, no 3, pp. 1-42.

Stock, J and M Watson (2007): "Why has US inflation become harder to forecast?", Journal of Money, Credit and Banking, vol 39, no 1, pp 3-33.

Summers, L (2014): "US economic prospects: secular stagnation, hysteresis, and the zero lower bound", Business Economics, vol 49, no 2, pp. 65-73.

Wicksell, K (1898): Geldzins und Güterpreise. Eine Untersuchung über die den Tauschwert des Geldes bestimmenden Ursachen, Jena: Gustav Fischer (translation, 1936: Interest and prices. A study of the causes regulating the value of money, London: Macmillan).

1 Hamilton et al. (2015) found only a weak relationship between real interest rates and trend GDP. Lunsford and West (2017) take into account a broader set of saving-investment factors but consider just the US. They find that only one demographic variable has significant explanatory power.