John Iannis Mourmouras: Some reflections on post-globalisation and Trump's trade war

Keynote speech by Professor John Iannis Mourmouras, Deputy Governor of the Bank of Greece, at a conference jointly organised by the Society of International Economic Law and the European University of Cyprus, Nicosia, 14 April 2018.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Your Excellency, Ambassador Mavroyiannis,

Former Minister, Professor Flogaitis,

Esteemed colleagues,

Dear students,

Ladies and Gentlemen

First of all, I would like to thank the organisers, the Society of International Economic Law and the European University of Cyprus for the kind invitation to address a conference that features such a dynamic group of participants, comprising distinguished Professors, but also young scholars from the legal profession with promising futures. It is the second time in the recent past that I am addressing a law conference. The first time was a speech on the future of the Economic and Monetary Union (June 2016) addressed to members of the Committee on International Monetary Law of the International Law Association (MoComILA) upon the invitation of my good friend, Professor Christos Gortsos, Chair of the Board of Directors of the ILA's Greek branch. In my keynote speech today, I will discuss the issue of globalisation and its diminishing role in today's world, an era that has become known as post-globalisation and also talk about the worrying prospect of a global trade war and its implications.

After a brief introduction presenting the waves of globalisation throughout history, I will present my hypothesis on the future of globalisation and whether it has come to an end. The third section of my speech relates to the economic aspect of post-globalisation, that is, its economic effects with particular emphasis on trade and finance. The fourth section addresses the aspect of politics and security in the new multipolar world as regional poles thrive. The fifth section discusses the adverse distributional effects of globalisation. The sixth section takes a closer look into the populist phenomenon as a reaction to globalisation, particularly in our continent, Europe. In the final section of my speech, I discuss the prospect of a global trade war being triggered by the latest unilateralist moves and shift in the United States' trade policy under President Donald Trump.

1. Introduction

In order to set the background for my speech today, we are now at an inflection point for the process of globalisation, which started in the late 19th century. A lot has been said about globalisation. Some consider it a curse, others a blessing. Two noteworthy quotes are the following:

"The US basically wrote the rules and created the institutions of globalisation." (Joseph Stiglitz)

"It has been said that arguing against globalisation is like arguing against the laws of gravity." (Kofi Annan)

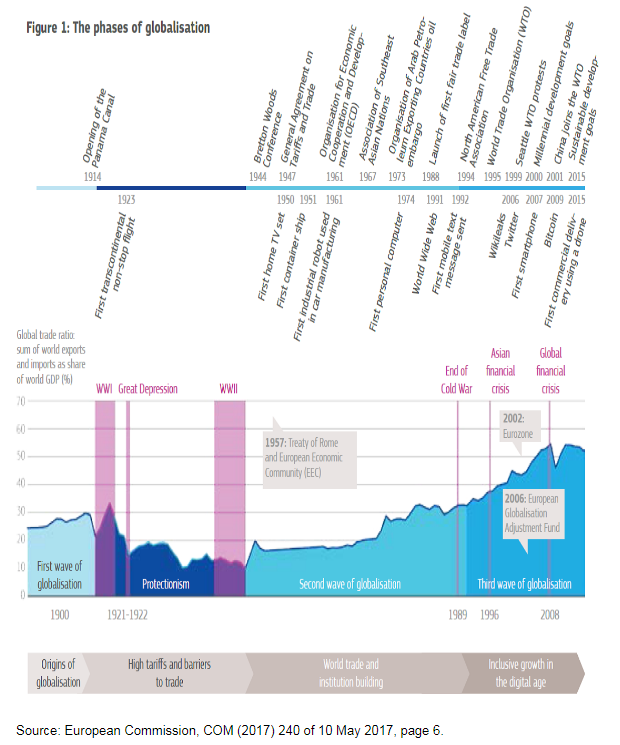

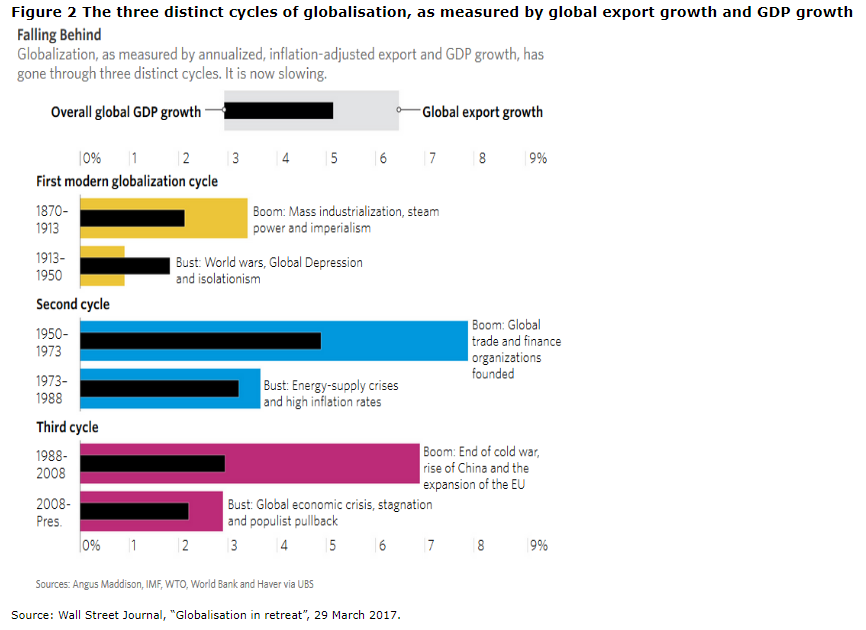

To begin with, a little bit of history: The first wave of globalisation, from 1870 to 1913, was linked to colonialism, industrialisation and substantial gains in productivity from cross-border linkages with steam-powered rail and shipping, which considerably lowered trade costs and eased the movement of goods. This wave collapsed abruptly as the world descended into war. In the interwar period with the 1929 Great Depression, economies resorted to inward-focused measures, erecting trade barriers; isolationism and protectionism were responsible for about half of the decline in global trade. The second wave followed after the end of World War II, when a new rules-based global order based on multilateral agreements and financial institutions such as the General Agreement on Tariffs and Trade, the OECD, NATO, and the European Economic Community, which united the old enemies of the war, France and Germany. The US dollar gained a dominant role as an anchor after the 1944 Bretton Woods conference, where the Allies decided that the US dollar, backed by gold, would be the international reserve currency to which exchange rates would be fixed.

The third and last wave of globalisation dates from the early 1990s, as shown in Figure 1. This wave of globalisation following the end of the Cold War and the collapse of communism has been marked by increased international integration, economic growth driven by increased global trade flows, and the predominance of supranational institutions, such as the World Trade Organisation (WTO), the North American Free Trade Association (NAFTA), and the World Bank, in the global multilateral order based on the rule of law. Trade liberalisation has been a key driver of global GDP growth over the past decades, allowing countries to import goods that are relatively more expensive to produce. During the same period, there were dramatic policy shifts in advanced countries such as the US and the UK with tax cuts and deregulation packages implemented by President Reagan and Prime Minister Thatcher, respectively. Emerging countries such as China and India experienced rapid economic growth and entered the global trade system. The European Union became the world's largest single market for goods, services, capital and workers, while Japan witnessed an economic stagnation driven by its rapidly ageing population.

2. My hypothesis on the future of globalisation

The world economy has now entered a new era known as 'post-globalisation', which has the following features: higher rates of unemployment (which has been particularly acute in the European continent), a surge in migration flows, and rising income inequality. These may be attributed to the uneven distribution of the income gains of globalisation across different parts or countries of the world and, most importantly, different segments of the population within the same country.

My hypothesis with regard to the future of globalisation rests on two pillars: Firstly, its adverse distributional effects are behind the rise in populism, albeit sporadically (thankfully not everywhere in the world), with a leading example being the US under the sui generis populism of its President, Donald Trump. Populism is unfortunately not a US exception; it has been on the rise also over this part of the little pond, not least in the UK (with the Brexit vote) and Italy (and the win of two populist parties at the latest elections), but also in European countries like Poland, Hungary, Austria, etc.

The second pillar of my maintained hypothesis is that we are not facing an end of globalisation, or 'deglobalisation' as some may call it, but a new kind of globalisation with new regional poles or centres that will start to take the place of the existing multilateralist rules-based global order. The shift towards a multipolar world with strong regional spheres of influence, by definition, implies a reduced role for globalisation, but I will go into that later. Right now I will focus on specific aspects of the post-globalisation era; first of all, on the uneven distribution of the benefits of globalisation which has led to the strong rise of anti-globalist forces of populism in various countries around the world. I will also discuss the surge in regional blocs to the detriment of existing global alliances that have so far helped to stabilise the world and maintain the rules-based global order, and, finally, the prospect of a global trade war, in light of the latest international developments.

3. The economic aspect of post-globalisation

3.1 Distinction between the dimensions of trade and finance

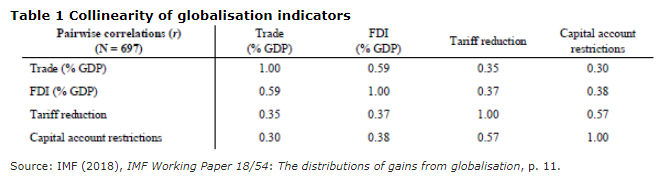

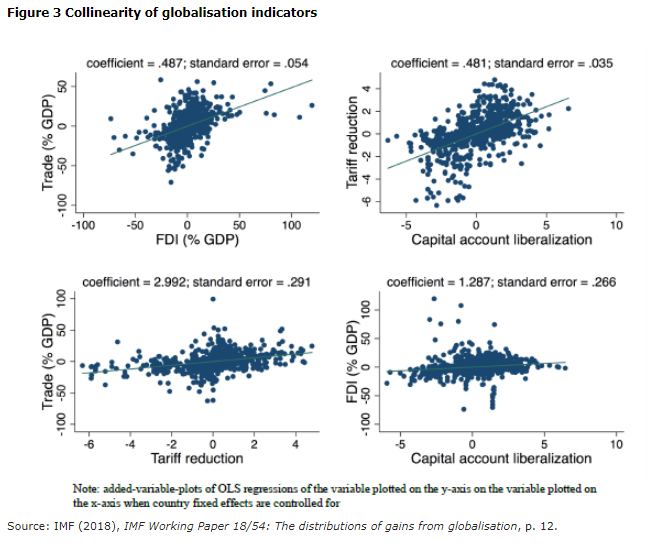

Globalisation is a multidimensional process that affects all aspects of economic, political and social life. For the purposes of this speech, I would like to make the distinction between two different dimensions of globalisation: trade and finance (these are also referred to in the relevant literature as the de jure and de facto dimensions of globalisation), on which I will provide some evidence later on. The first relates to economic liberalisation in the sense of increased volumes of trade through the removal of (de jure) barriers to imports, customs tariffs, etc. The second is related to (de facto) cross-border capital flows, foreign direct investment, portfolio investment and income payments to non-residents, liberalised through lower taxes on commercial transactions and the removal of capital account restrictions.

3.2 On the reduced role of globalisation (evidence)

The dimension of trade

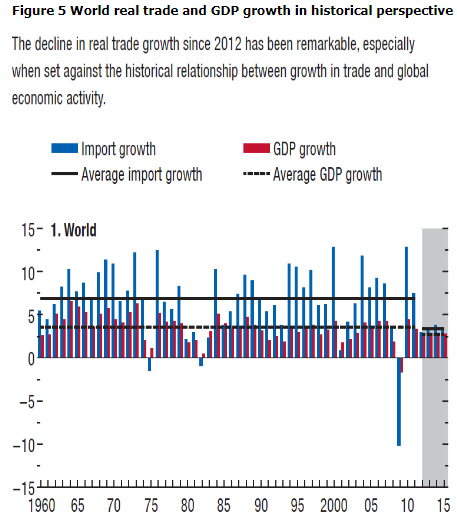

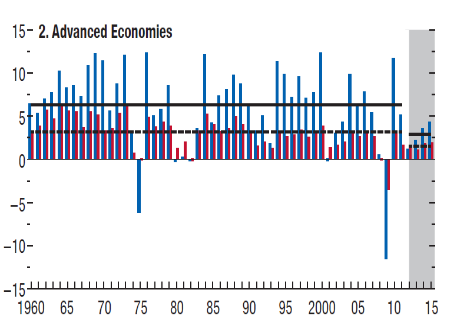

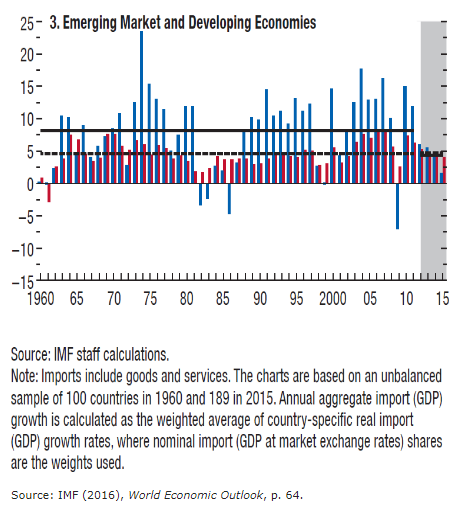

An increasing body of evidence suggests a slowing trend in globalisation for the past decade or so, at least in terms of trade flows, which are the most basic representation of globalisation.

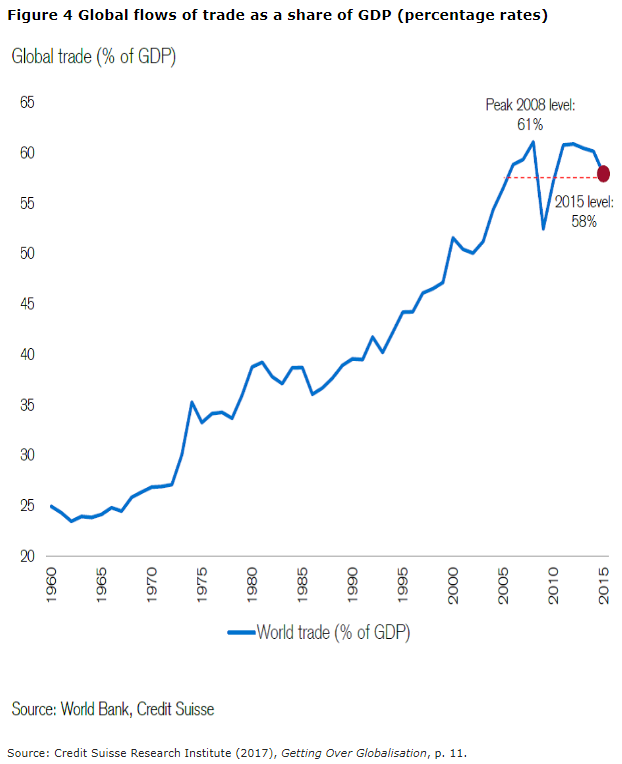

As shown in Figure 4 above, according to World Bank and OECD national accounts data, global flows of trade in goods and services measured as a share of gross domestic product (GDP) had been on a steady rise until 2008, when they reached their upper limit at about 61% of GDP and have remained sluggish, having fallen further to 56% in 2016 (from 58% in 2015).

The dimension of finance

The emergence of information and communication technology, or ICT, in banking and financial markets, along with the liberalisation of financial and capital accounts that allows foreign investors into more countries, unleashed a huge wave of foreign capital movements starting in the 1980s. Now the rapid pace of financial integration has slowed down, but continues. In order to get the full extent of the slowdown in globalisation, we also need to take into account the dimension of finance, through indicators such as capital flows and FDI.

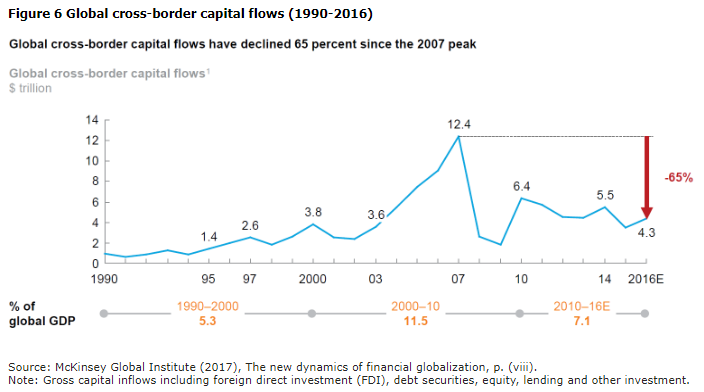

Cross-border capital flows show that today globalisation is in retreat. Having reached their peak at 12.4% of GDP in 2007, that is, before the onset of the global financial crisis, global cross-border capital flows have been following a steady downward trend, to 4.3% in 2016 (see Figure 6 below).

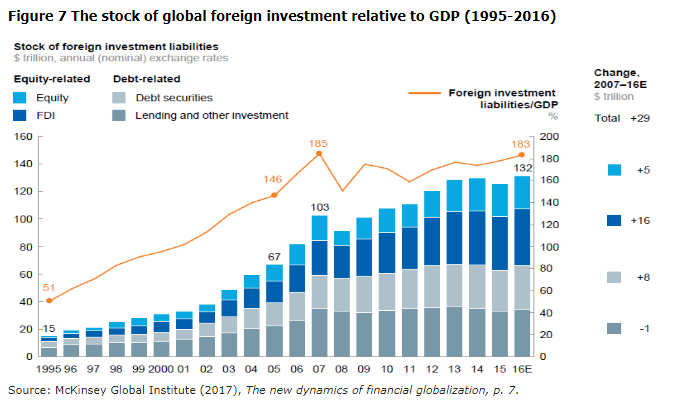

Indeed, the flow of new cross-border investment has been declining relative to GDP, which shows that globalisation might be slowing down. But the stock of (existing) foreign direct investment (or FDI) relative to global GDP shows that globalisation has not come to a halt. Financial globalisation is becoming more stable, given that the more stable FDI flows account for a larger share of capital flows today than they did a decade ago, and the more volatile cross-border lending flows, principally short-term interbank lending and other purchases of complex debt securities that were behind the global credit bubble, have declined since 2007. More countries are participating in capital reallocation and risk-related regulation has become stricter, reducing the risk of a balance-of-payments crisis.

Between 1990 and 2000, the stock of foreign investment liabilities relative to GDP more than doubled, from 42% of world GDP to 96%. Having almost doubled between 2000 and 2007, to 185% of GDP (the 'financial market peak'), the stock of foreign investment liabilities as a share of GDP fell only slightly after the global financial crisis, to $132 trillion or 183% of world GDP (see Figure 7 below).

Especially with regard to financial services which follow the rapid pace of technological innovations, known under the generic term 'Fintech', we should expect more integration. Already available digital technologies reduce transaction costs and increase the ease of capital transfers (signalling a trend towards perfect capital mobility). Just like the Internet revolutionised communications and the way we work, travel and do business, blockchain technologies, to be discussed in this afternoon's session, are expected to transform finance by enabling direct international money transfers without intermediaries and high transaction costs.

The emergence of global value chains through intangible flows of services and data and the transfer of technology from developed to emerging economies and vice versa should change the speed of financial globalisation.

In the post-globalisation era, a country's technological capabilities should be the most important determinant of its long-term development and its ability to reap the benefits of the broader financial interconnectedness around the world.

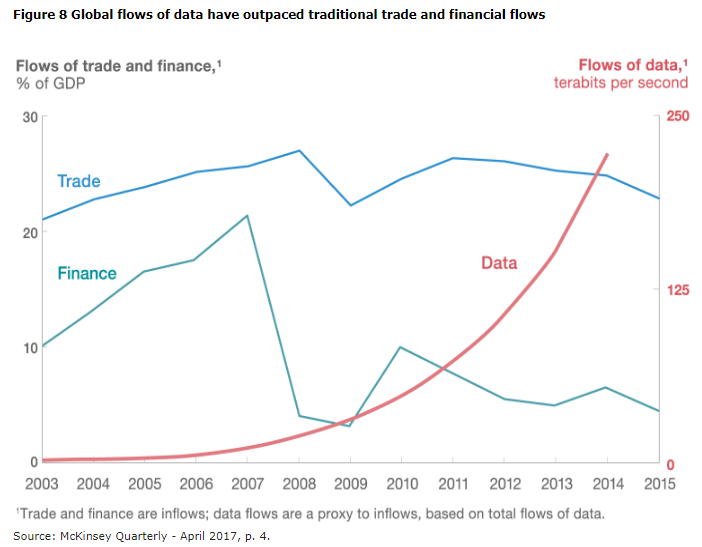

As a result of the rapid knowledge-driven technological change, the face of globalisation will be very different in the following decades. In the figure below, one can see that global flows of data have outpaced traditional trade and financial flows (see Figure 8).

3.3 An increased role for regional poles

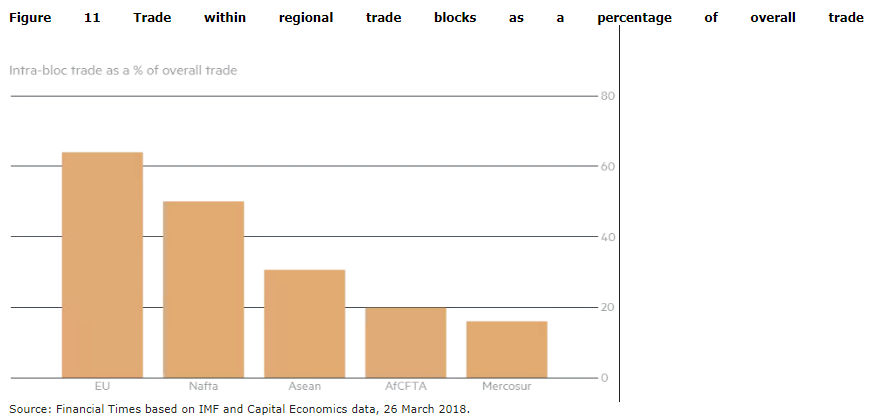

The rise of powerful regions is visible in economic terms, as the centre of gravity of the economy has been moving to the east. This new multipolarity leads to new relationships of interdependence between nations, widening their common interests and creating new regional blocs around the world's major superpowers.

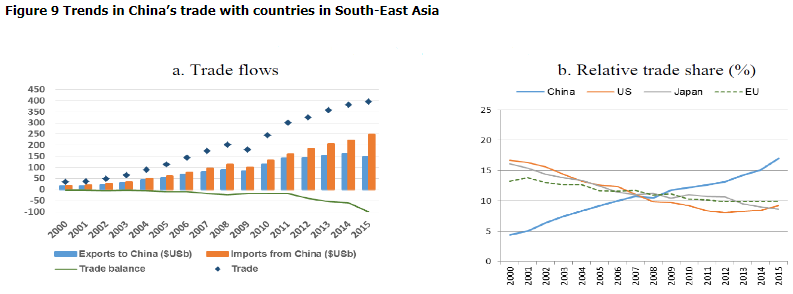

The rise of China is certainly indicative of the shift to a multipolar world away from a world exclusively dominated by the economic power of the US, along with its western European allies. China has already become an economic superpower and the economies comprising the Association of Southeast Asian Nations (ASEAN), now the world's fourth largest trading bloc in terms of GDP, have significantly benefited from the China's rise, given that China is ASEAN's most important trade partner.

Trade volume between China and ASEAN countries hit a record high in 2017 at US $514.8 billion, having recorded the fastest growth pace (13.8%) year-on-year between China and any of its major trading partners. Total ASEAN trade has increased by about US$1 trillion between 2007 and 2014, with intra-ASEAN trade comprising the largest share of ASEAN's total trade by partner. China's exports to ASEAN countries reached US $279.1 billion in 2017, up by 9% year-on-year, while imports grew by 20% year-on-year to stand at US $235.7 billion. China is also Africa's largest economic partner in terms of goods trade, infrastructure financing and new FDIs.

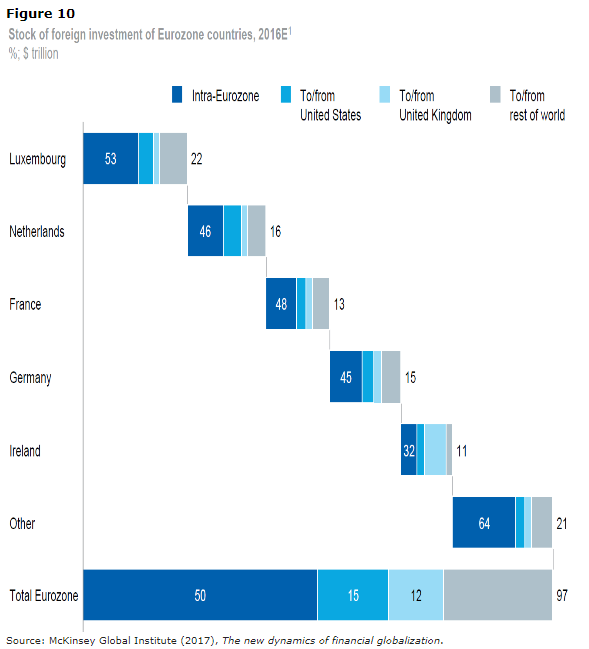

Trade regionalism is also evident in our own continent. Figure 10 shows that half of eurozone cross-border investment is within the region!

4. The aspect of politics and security

Globalisation has multiple benefits. It contributes to economic growth, creates export-oriented jobs, helps the transition of more countries to capitalism and democracy, which in turn has a potential to enhance growth and improve the well-being of people suffering from tyranny and civil war, but also reducing the number of weak or failed states that host terrorists and criminal cartels. It has also linked potential adversaries in mutually beneficial relationships, thus making the prospect of war less appealing and creates hopes for a more peaceful world.

In the post-globalisation era, the universal push towards democratisation seems to have reached its limits. Some of the most striking examples of the stronger focus on isolationism are the UK vote in favour of its exit from the EU and the Trump Presidency in the US. Donald Trump won the US presidential elections by countering his opponent's more globalist approach with a campaign built on the principle of "America first", a slogan which was initially used by Congressman Charles Lindbergh for promoting the case for the US to stay out of the war against Nazi Germany. In the Brexit campaign, the "Leave" camp appealed to voters by promising to take back control of their national destinies and sovereignty previously relinquished to the "technocratic" European Union.

Post-globalisation also has the potential to affect the existing global governance system comprising institutions, rules and alliances, which have underpinned global prosperity since World War II. One such institution is the 164-member World Trade Organisation, the cornerstone of the multilateral trading system. The WTO has seen its stature diminish lately and now faces an uncertain future, partly also as a result of rising protectionist trade practices and interventionist economic policies (as opposed to free market policies) that are even adopted by some of the world's great powers, circumventing the multilateral system's rules and bypassing the WTO's central role as an arbitrator in global trade conflicts. Yesterday's sessions on contemporary issues in the WTO and the institutions and governance of international economic law offered some useful insights into the future of the organisation, that are particularly poignant at this turning point for globalisation.

The economic and political expansion of regional poles such as China has marked a shift away from the conventional US hegemony and towards authoritarianism around the world, e.g. in Turkey. The third globalisation era following the end of the Cold War has indeed been a time of unprecedented stability under America's primacy. China has already demonstrated that it seeks a more visible role on the world stage and wants to put itself at the heart of globalisation - as outlined in President Xi's speech to the World Economic Forum in Davos a year ago. This rhetoric has been supported by China's 'Belt and Road Initiative', which has received more than $50 billion in financing since its inception in 2013. Another major project is China's ASEAN Silk Road, the high-speed rail line expected to run from Kunming to Singapore and run through Laos, Thailand, Malaysia and Singapore. Despite geopolitical tensions arising from China's claims over the South China Sea and the authoritarian regime in North Korea, ASEAN unity has largely been restored as more countries have either warmed to China or at least indicated a greater acceptance of its clout against the background of reduced US commitment and the latest unilateralist decisions by President Trump. It is clear that the modern distortions in the world economy and disruptions in the global order need to be addressed through close cooperation and maintained regional balances of power, rather than bilaterally. Just a quick note here on the alarming increase in Chinese military spending: it has now exceeded US$400 billion dollars, i.e. it has doubled in ten years, and to give you a point of reference: Russia's military spending is estimated at around $200 billion and that of the United States at US$600 billion.

Looking at the other major geopolitical pole, tensions between Russia and the West (US, Canada, EU) are as high as they have been for years. A fortnight ago, we saw the largest coordinated expulsion of Russian diplomats since the Cold War from more than twenty countries, members of NATO and the EU, as a retaliatory measure against the use of a Russian nerve agent in the UK, violating the prohibition of chemical weapons under the 1997 Chemical Weapons Convention, an international convention that Russia had agreed to and signed. Or the recent blow-for-blow developments unfolding in Syria, a joint attack of the US, the UK and France was launched last night and the rest of the world is following with grave concern about what comes next.

5. On the adverse distributional effects of globalisation

Before coming to perhaps more boring economic data and figures, let me make a short pause here for a joke, which actually shows that economists and lawyers have lots in common!

A university committee was selecting a new dean. They had narrowed the candidates down to a mathematician, a statistician and a lawyer. Each was asked this 'tricky' question during this interview. How much is 'two plus two'? The mathematician immediately answered, "Four". The statistician also answered almost immediately, "Four, plus or minus two percent (the statistical error)". Finally, the lawyer stood up and motioned silently for the committee members to gather close to him and in an emotional tone he replied: "How much do you want 'two plus two' to be?" By the way, this could also be an economist's answer to the same question!

5.1 World income inequality

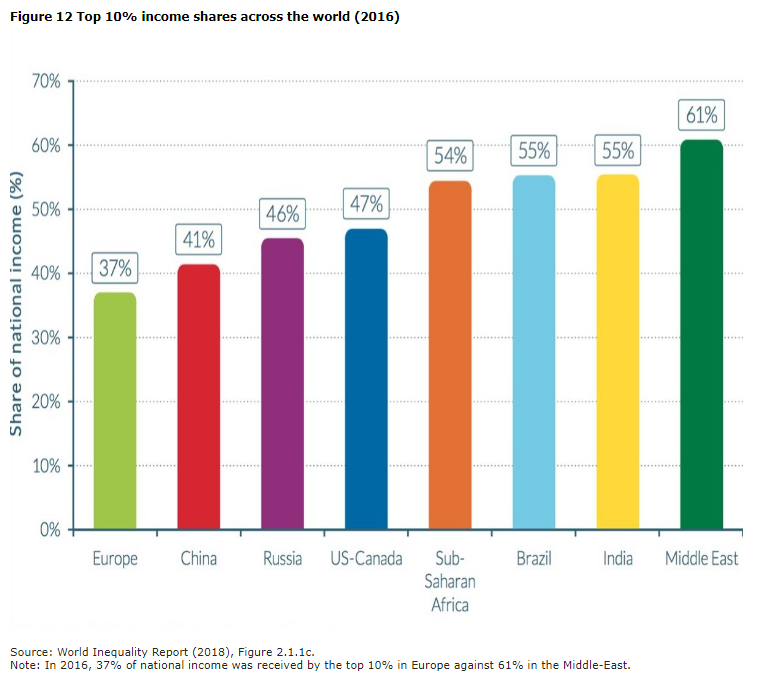

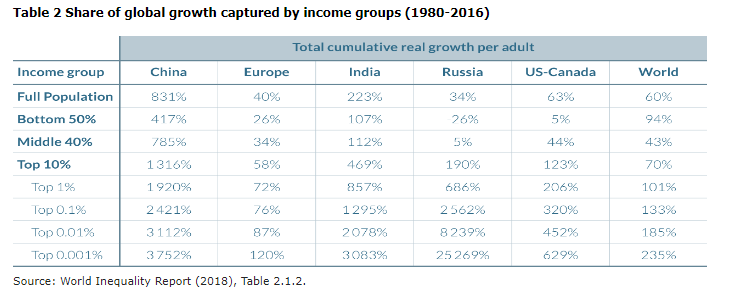

The globalisation process has brought prosperity to large parts of the world's population, lifting more than 500 million people out of poverty in developing countries. But the world has concurrently experienced a significant rise in inequality. Since 1980, income inequality has increased rapidly in North America and Asia, increased more moderately in Europe, and stabilised at very high levels in the Middle East, Africa and Brazil, as shown in the following figure (see Figure 12).

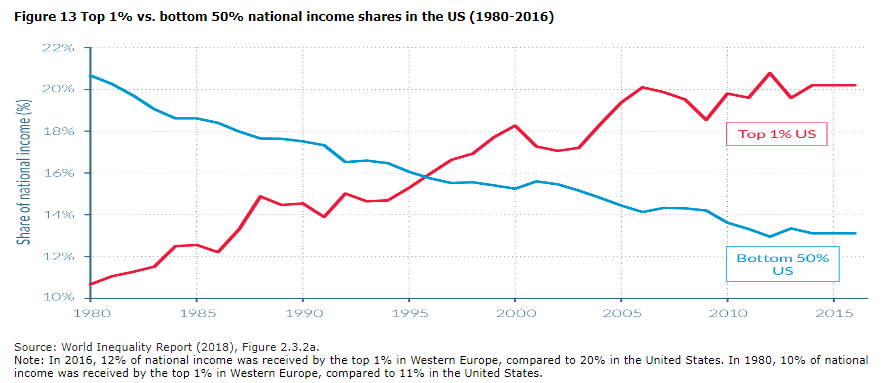

In other words, the distribution of the benefits of globalisation has been uneven and unbalanced between various parts of the world. Rising inequality is obviously a global phenomenon, with wide variability despite similar experiences with globalisation and technology. Even in advanced countries, there have been parts of the population that have not been able to reap the rewards of globalisation, also known as the 'left-behind'. Strong income growth for a large share of the world's population in poor countries, and especially the recent growth of a wealthier middle class in China, has been accompanied by the stagnation of incomes across the lower and middle classes in some advanced countries, e.g. the US. According to World Inequality Lab (WID) data, the United States has become the most unequal country, surpassing in 2007 the inequality peak recorded in 1928. The 'superrich' of the US, or the group of people belonging to the top 1% of income in the US, now hold 20% of the country's national income up from 11% of the national income in 1980. At the same time, there has been a dramatic collapse in the income share of the bottom 50%, which had 21% of income in 1980, falling to 13% in 2016 (see Figure 13).

5.2 Persistent economic divergences in Europe

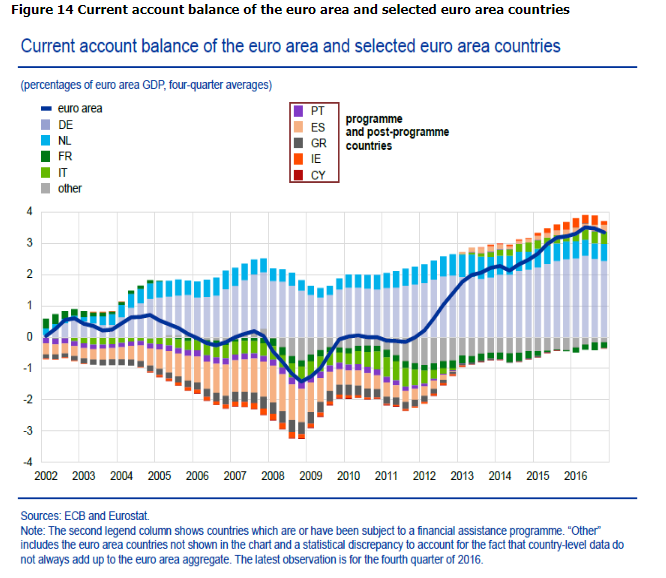

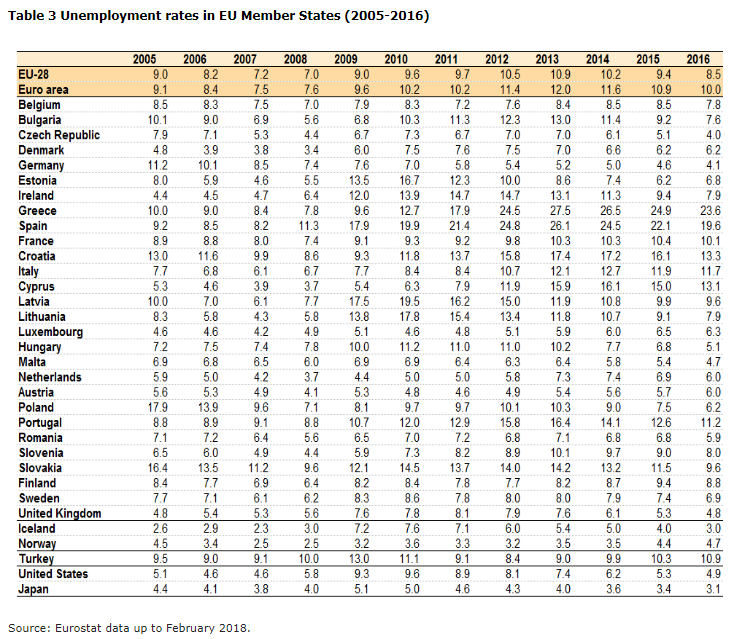

The European Economic and Monetary Union (EMU) was expected to foster greater macroeconomic convergence on the basis of nominal and fiscal indicators of harmonisation, that is, inflation, long-term interest rates, exchange rate stability, the fiscal deficit, and the government debt to-GDP-ratio. However, the euro area sovereign debt crisis has exposed trends of economic divergence. While there has been nominal convergence of inflation and interest rates, there is still evidence of divergence in relation to GDP per capita, unemployment rates, and current account balances.

Real convergence of per capita income levels has not occurred among the original euro area members since the advent of the common currency. Income convergence stagnated in the early years of the common currency and has reversed in the wake of the global economic crisis.

In contrast with countries in the core of the eurozone with high GDP per capita and relatively low unemployment led by Germany, countries in the periphery, of which four have had to undergo year-long economic adjustment programmes, have large debt burdens, high unemployment rates and experienced drastic declines in their standards of living as a result of austerity measures which dampened economic activity and increased social hardship undermining economic and political stability. Germany, the Netherlands and Luxembourg record sizeable and persistent current-account surpluses, while periphery countries have had a tendency for current-account deficits, as shown in Figure 14.

The convergence machine has brutally stopped in the southern part of the EU and has moved into reverse in Greece, Portugal and Spain, whereas in Italy it has been falling behind since the early 1990s.

Regional unemployment rates since 2008 show that labour markets in the Spanish and Greek regions have been hardest hit. According to Eurostat data as at April 2017, five Greek regions (Ipeiros, Dytiki Ellada, Thessalia, Sterea Ellada and Kriti) experienced falls in their employment rates between 2006 and 2016 that were greater than 10 percentage points; the largest was 11.9 percentage points in Kriti. Among all 28 EU regions where the fall exceeded 4 percentage points, 20 were in Greece and Spain (10 each), while five others were also in euro-periphery countries: two in Italy, one in Portugal, one in Ireland and there was also one here in Cyprus. Germany was the only country where unemployment rates have declined in all regions since 2008.

6. The rise of pupulism

6.1 Populism and economic globalisation

The existing version of globalisation is a very easy scapegoat and has often been seen as synonym to job losses, income inequality, social injustice, the erosion of national identities and local traditions, as well as low standards in terms of the protection of the environment, labour safety and personal data (privacy) and lax fiscal policies, with the pre-dominance of all-powerful multinational corporations aiming at maximum profit. At this point, I have a few remarks as a macroeconomist in favour of free trade. Trade and commercial exchanges in general are associated by their very nature with job displacement and have an impact on the distribution of income that may result in the loss of income for some population groups.

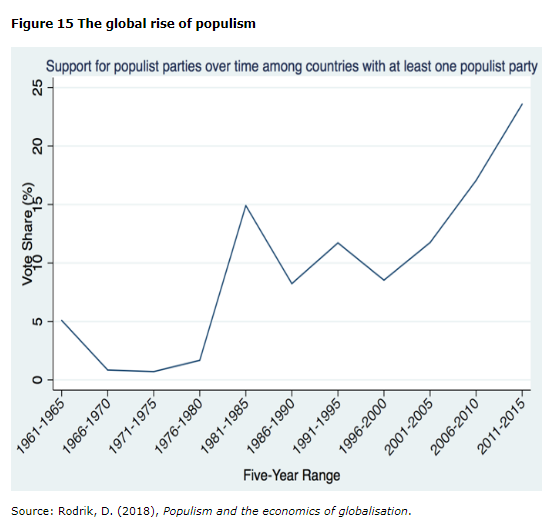

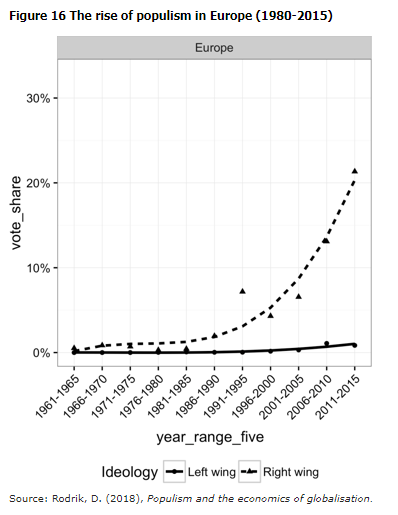

As part of the process of globalisation, international trade may come in contrast to established norms in a domestic economy. Popular discontent has been targeted at economic globalisation, choosing to disregard the economic benefits arising from the globalisation process. It is true that it is very easy to blame trade for effects that in reality may be more attributed to technological advances and the spread of automation. According to the IMF, only around a quarter of the overall decline in the labour share of income that occurred in advanced economies between 1990 and 2015 was due to increased globalisation, while around half can be attributed to technological change. The picture is different when it comes to emerging economies, where participation in global value chains was the key driver of declines in labour shares. As shown in the following figure (Figure 15), populism is not a recent phenomenon, but has been on the rise over the past decades.

The populist phenomenon has been particularly triggered by the discontent of the so-called "left-behind" of the globalisation process, i.e. those who have failed to fully benefit from past economic growth. In Europe, the populist phenomenon is mainly fed by immigration fears and the shock caused by the massive refugee influxes from war-torn countries bordering the European Union.

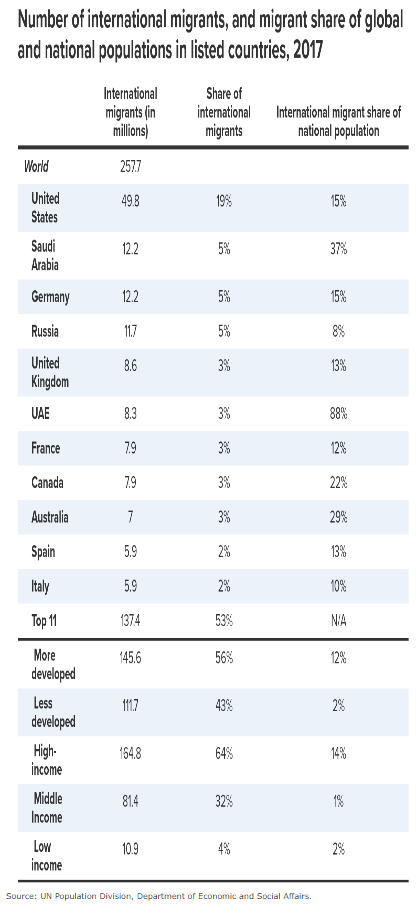

Especially with regard to the migration crisis, it is one of the most contentious aspects of globalisation. The share of international migrants among residents of more developed countries rose from less than 10% in 2000 to 14% in 2017. In Germany, international migrants now account for 15% of the population according to UN data (see Table 4 below).

Table 4 Number of international migrants (millions) and migrant share of global and national populations in listed countries (2017)

Such rapid migration can have disruptive effects without the appropriate policies that would address the new challenges. Given the rise of inequality and the emerging cleavage between the "losers" and the "winners" of globalisation, the political balance of power has changed in many countries in Europe. Public opinion, which has been turning more towards new political parties created across Europe, offering a mix of xenophobia and populism, with a notable example being the Alternative for Germany (AFD), which won 13.3% at the German Federal elections, as the third biggest party. The populist phenomenon has been reinforced by public opinion dissatisfaction with traditional political parties, a strong decline in trust in the EU and a generalised lack of interest in politics as indicated by the very low voter turnout in elections over the past decades. As shown in Figure 16 below, the rise in populism in Europe over two decades has been more than four-fold, from below 5% in the late 1980s to more than 20% in 2011-2015.

6.2 Recent examples of European populism

As populist parties win a rising share of the electorate, but not the overwhelming majority of votes in national elections, there has been a repeated pattern of inconclusive electoral results in many EU countries over the past few years. As a result, government formation has become even more difficult, but even in countries with a strong tradition of coalitions such as Germany!

Italy

Following the unprecedented long-drawn negotiations for the formation of a coalition in Berlin, Italy is now at a political standstill, facing a drawn-out period of political consultations between the President of the Republic and the parliamentary groups to form a coalition. The lack of clarity around governments' actions particularly in terms of their fiscal and trade policies has increased downside risks to trade and growth. Two Eurosceptic and strongly anti-establishment parties have come out as the two biggest parties, the centre-right League (having won up to 50% in the wealthy north) and the 5 Star movement (winner of more than 50% in the troubled south, where poverty rates have increased by half since the crisis). The classic political division between 'right-wing' and 'left-wing' variants of populism does not apply in this case. The League's opposition to globalisation mostly focuses on resentment against foreigners, whereas the 5 Star movement mostly appealed to voters by proposing a universal basic income for all. Despite their major political and economic differences, the two parties might form an all-populist government and ultimately manage to completely wipe mainstream parties off the electoral map of Italy. We should not take this prospect lightly, as Italy can be seen as a miniature representation of Europe.

UK

Another disguised version of populism taking advantage of the Brexit prospect can be seen in the promise for broad-scale renationalisation, which would mean a return to the 1970s, by the British opposition party leader, who has announced his intention to return to the model of nationalisation of banks, water industries, transport etc. through the back door. Based on the pretext of market failures identified in their privatisation, full government control of such industries would be disastrous for the UK economy and the world, with a 'megatone' effect, 10 times bigger than Brexit.

In Austria, a far-right party forms part of the government coalition and in Hungary, the right-wing eurosceptic, populist Viktor Orban has been elected once again to lead his country. Mr Orban has focused on a message against migration and the need to protect Hungary's interests from what he perceives as outside interference from the EU and the UN, for instance! In Poland, the populist President has caused trouble with ignoring the rule of law and trampling on democratic principles. In light of all the above, it is clear that populism is no longer a marginalised trend, but is coming increasingly into the mainstream.

Section 7 Trump's trade war

7.1 Some figures on Trump's trade war

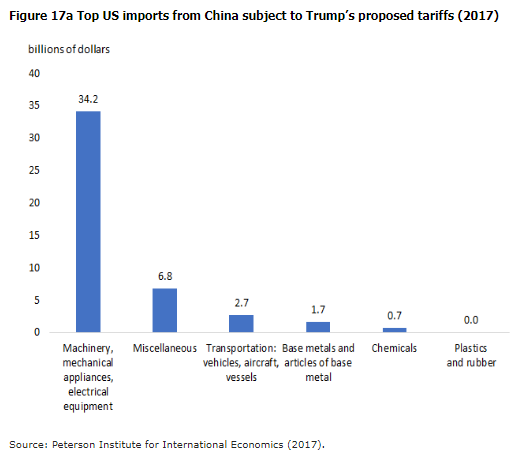

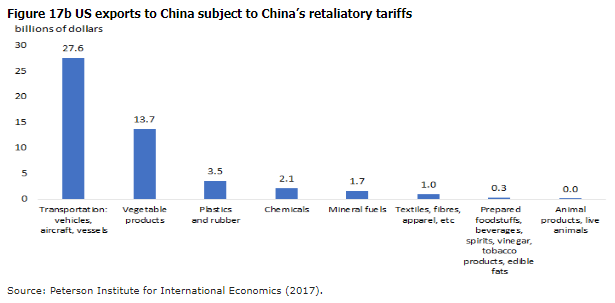

Coming now to the prospect of a global trade war, on 23 March, the US President decided to impose tariffs on imports from some countries, including China, of steel at 25% and of aluminium at 10% on national security grounds which are estimated by the Peterson Institute to cover $46.2 billion of US imports from China in 2017 (see Figure 18a). This justification is carefully chosen given that national security considerations are explicitly exempted from trade issues over which the WTO dispute settlement mechanism is competent. The US also threatened tariffs on other Chinese products estimated to be worth US $150 billion. US moves have already provoked retaliatory measures by China, which announced it will impose retaliatory tariffs targeting a limited number of American goods, which would cover an estimated $49.8 billion of US exports to China (see Figure 18b).

At the moment, the proposed tariffs will apply to less than 7% of total US imports and, according to calculations by Fitch, their impact on China's economy will knock a mere 0.3% off China's GDP growth rate (China's GDP growth target this year is 6.5%).

An escalation into a trade war is thus a real danger and it could likely have significant negative effects on global activity, raise price pressures given that trade wars are stagflationary (meaning that they simultaneously damage growth and stimulate inflation) and could spill over into broader international tensions, and there is always danger of an intensification in trade frictions in the next downturn (be it US or global).

Both countries' lists are, for now, just threats. Over the next two months, America's list will be open for public consultation (there is no deadline for the tariffs to come into force). China has said that it will wait for America to move. China's President Xi seems to have offered an olive branch to the US President. In a speech at a high-profile event last Tuesday he promised increased imports, accelerated access to China's insurance and other financial sectors, lower tariffs (e.g. on imported cars) and greater protection for intellectual property, which is the hot potato in the US-China trade fight.

7.2 The reasons behind President Trump's decisions and why he is wrong

President Trump's decisions confirm his long-standing protectionist 'America First' agenda, based on a desire to protect US workers and specific US industries. He also claims that the US tariff list was drawn up in response to China's alleged theft of American firms' intellectual property from outsourcing the production of myriads of goods to China. Take for instance my iPhone: it has been designed and developed by Apple in California, but its assembly takes place in China. Now the Americans accuse China of stealing the design of their technology. But the question is why do they outsource their production in the first place? Copying technology is not new in world history. It is how Japan became a global force in car production, copying Mercedes and Ford production and now produces better cars than the Germans and the Americans (Toyota). And that was an era when there was no outsourcing from either Germany or the US.

So why is the Trump Administration really introducing such protectionist measures? Trump is the first post-war US president to challenge the conventional wisdom that the global economy has enjoyed unprecedented prosperity thanks to free trade and the free movement of capital. To be more precise, President Trump is pursuing two irreconcilable objectives: on the one hand, he wants to eliminate the US trade deficit in general and, in particular, its US$375 billion trade deficit with China and, on the other hand, he is also pursuing an expansionary budget policy. President Trump has introduced tax cuts that will increase the budget deficit by US$1.5 trillion over the next decade and approved a congressional bill that will increase public spending by US$300 billion over the next two years, according to the Congressional Budget Office (CBO).

Trump seems to think that trade wars are easy to win, but the history of trade wars has shown us that they have no winners. The most famous example of the self-defeating effects of protectionism is the Tariff Act of 1930, which raised tariffs on over 20,000 goods [average tariffs went up from 38% to 45%, and the effective tariff rate rose from 14% to 20%]. It was first conceived when the US economy was still growing and had full employment, but entered into effect a year after the economic downturn had begun. The US's trade partners were quick to respond with their own tariffs and a global trade war broke out in 1931. World trade fell by a third, with dire effects on the global economy. In the case of the US, American exports fell by 60% from 1929 to 1933 and this exacerbated the Great Depression. The tariffs were repealed in 1934. After this catastrophic experience, the US became a strong supporter of free trade, helping to create and strengthen the WTO rules-based system.

Another analogy is when Germany and France imposed tariffs on US chicken imports in the early 1960s, starting what became known as the 'chicken wars'. The United States retaliated by imposing tariffs on an array of goods, including French brandy, light trucks and Volkswagen buses. Despite pressures, the Europeans did not give in, and the US was thus considered the loser of that war.

A more recent tariff episode was under the Obama Administration. In 2009, President Obama phased in increased tariffs on imports of Chinese car and light truck tires (35% in the first year, 30% in second, 25% in third). China's WTO complaint against them was rejected, so China retaliated with tariffs on US chicken imports (ranging from 50-105%), which reduced US poultry exports by $1 billion (a 90% collapse). And as regards the argument on jobs and the domestic industry, the winners from the 2009 tire safeguards were alternative foreign exporters (in Asia and Mexico), while domestic US tire producers were secondary beneficiaries.

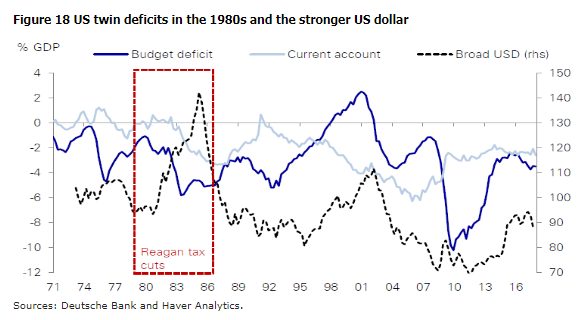

That is why the liberal consensus is that trade wars are bad for everybody. Another reason why Trump is wrong is his misleading focus on trade deficits; it overlooks the fact that the total trade deficit reflects the shortfall in savings by households, businesses and the government, i.e. the excess of their combined spending over their income. A necessary condition, therefore, for narrowing the US trade deficit is to achieve a higher savings rate relative to the US investment rate. At a time when the level of savings is very low, the prospective deterioration in the US current account deficit of around US$150 billion a year (due to the spending bill signed into law last month) will almost inevitably reduce the overall level of savings. This will also cause the trade deficit to widen, bringing to mind the Reagan Administration, under which the US experienced twin deficits, i.e. a fiscal and a current account deficit.

If tariffs are imposed to a large extent and they are persistent, a trade war will break out, which may lead to competitive devaluations between the US and China. We've seen all this before through currency wars and beggar-thy-neighbour policies.

In economic theory and history, rising twin deficits may only be resolved by a stronger currency, as was the case of the stronger dollar in the 1980s under President Reagan and post-German reunification with a stronger Deutschmark (see Figure 18).

Today, economic theory and investment portfolio developments point to a strong US dollar, but measures of protectionism (the opposite pole to globalisation) focusing on the domestic economy self-interest and not taking account of the interconnections in a global economy, negatively affect the US dollar exchange rate.

The US current account deficit can be funded by countries with large current-account surpluses coming from private sector investors in Japan and Europe, who have been pushed out of their domestic markets as a result of extensive quantitative easing programmes by their respective central banks. But, as central banks start tapering their asset purchases and wind down their unconventional easing monetary policies, there is little prospect for increased demand. At the moment, markets seem to expect that the US President's trade threats will be negotiated down in the end. But if the situation escalates and markets start to believe a serious trade war is imminent, US stock prices could fall further, hurting the US economy, even if President Trump ultimately doesn't follow through with his plans.

Conclusion

The US President's decision to impose higher trade tariffs represents a significant change in US trade strategy. It has caused widespread fears that a trade war might go unchecked, but markets seem to hope that further escalation will be avoided. The heightened risk of a transatlantic trade war, as a result of rising protectionism, is mainly US driven and it is up to President Trump to show his willingness to compromise and up to China to keep taking actions to address US grievances. It would be a collective policy failure if the multilateral trade system were to collapse.

As discussed earlier, this multilateral global order is already undergoing a major transition with the emergence of strong regional poles. In light of the evidence provided above, I hope that my maintained hypothesis has convinced you that we are not facing an end of globalisation, but a new kind of globalisation with new regional poles or centres emerging already. In any event, the rivalry between the 20th century's superpower, the United States, and the 21st century's emerging superpower, China, both economically and politically, will shape the post-globalisation era and decide the future of the entire world.

Thank you very much for your attention!