Grant Spencer: Low inflation and its implications for monetary policy

Speech by Mr Grant Spencer, Deputy Governor of the Reserve Bank of New Zealand, to the Institute of Directors, Auckland, 5 December 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Thank you to the Institute of Directors for inviting me to speak here in Auckland. Today I will discuss the low inflation environment we are experiencing here in New Zealand and in many other countries.

To start, I would like you to think about the mobile phone in your pocket, because it represents some of the global trends I will refer to. It is a symbol of how manufacturing has become global, how costs of production have been lowered, particularly for technology-based goods and services, and how we are now connected to global markets through digital devices and the internet. These are themes I will return to.

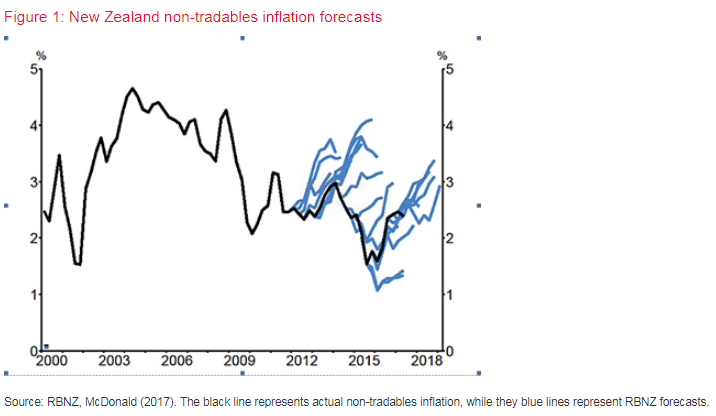

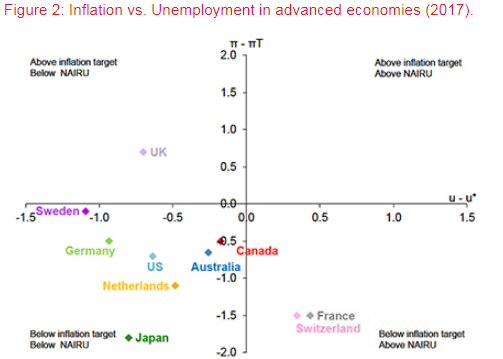

Since the Global Financial Crisis in 2008 we have seen persistently low inflation both internationally and at home. Inflation has surprised on the downside relative to forecasts from economic models (figure 1). And it has persisted in recent years despite falling unemployment rates here and in most of the advanced economies. This global pattern is depicted in figure 2.

Source: OECD, RBNZ calculations. Scatter plot shows 2017 data1

In response to very weak activity and low inflation following the GFC, many central banks allowed their policy interest rates to fall to zero and below, and injected significant stimulus through quantitative easing. Despite the persistent application of very easy monetary policy and a recovery of demand in the major economies, inflation has been slow to move up towards central bank targets (typically 2 percent p.a.) In New Zealand we avoided zero policy interest rates and quantitative easing, but have also maintained a very easy monetary policy stance since the GFC.

If this low inflation is a global phenomenon, we need to consider global factors to understand the potential causes. In the initial post-GFC period, the clear common driver was weak demand as households and firms restricted spending and consolidated their positions in the wake of severe financial stress. However, with the persistence of low inflation as activity recovered, we also need to consider broader supply-side factors, such as the changing pattern of production across the world and the impact of digital technology. We need to consider how these global factors and also domestic developments might be affecting the shape of the New Zealand economy and the pricing behaviour of individuals and firms.

I will first talk about some of the key global supply-side trends that have contributed to low inflation internationally. I will then discuss how the domestic inflation process may be changing and how the Phillips curve may be flattening (more on that later). Finally I will discuss the policy implications of these developments and some of the associated risks.

Global factors and low inflation

The increasing globalisation of the world economy - the breaking down of barriers between product and factor markets - has been a major contributor to low inflation in advanced economies.2 Globalisation over the past ten years has had many aspects. Significant among these have been the expansion of global supply chains, the rapid growth of China, and the growth of the digital economy.

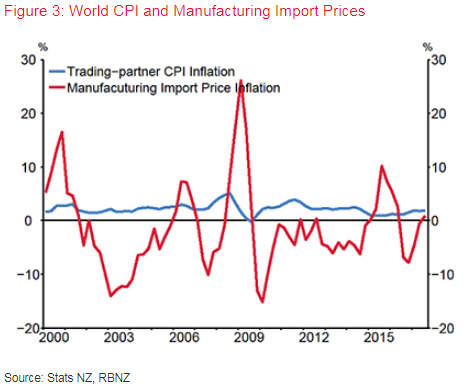

The expansion of global supply chains has led to the outsourcing of labour-intensive stages of production to cheaper locations in emerging economies. To follow my earlier phone example, Apple has close to 123,000 employees in the US, but over 700,000 world-wide. The iPhone is designed in the United States; it uses components sourced from several countries including South Korea, Taiwan, and Japan; and is assembled in China. Outsourcing and supply chain integration of this sort has lowered the price of a wide range of manufactures sold across the world (figure 3). It has also placed downward pressure on the wages of lower skilled jobs in advanced economies. Both have translated to less inflationary pressure in the advanced economies.

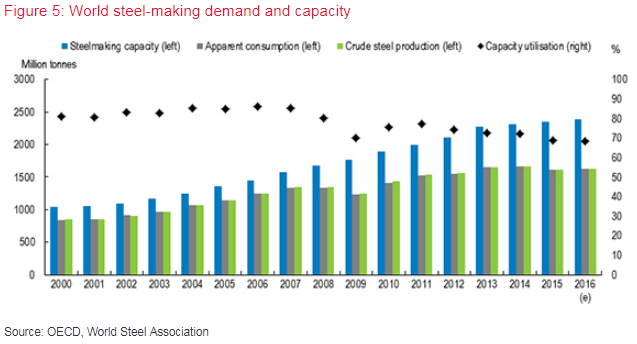

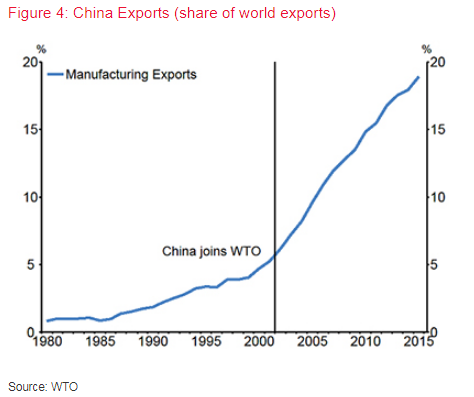

A number of emerging economies have participated in the expansion of global supply chains. However, the huge scale and growth of China's economy has had a profound effect. Since joining the World Trade Organisation (WTO) in 2001, China has quickly become the largest exporting nation in the world, with around 13 percent of merchandise exports and 18 per cent of manufacturing exports (figure 4). Apart from exports, China's other main growth engine has been its high levels of investment which has contributed to excess capacity in some key sectors such as steel (figure 5). This capacity expansion has had a restraining effect on prices of industrial materials and, in turn, a wide range of manufactured goods.

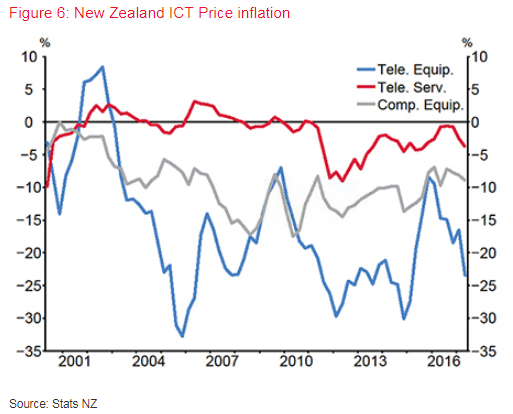

A third factor contributing to low global inflation is the rise of the digital economy. Prices of ICT goods and services (Information, Communications and Technology) have fallen world-wide, as unit costs have fallen and supply has expanded. The falling price of ICT globally has been reflected in New Zealand CPI components (figure 6), where prices of computing and telecommunication equipment and services have largely been falling since 2000. Advancements in technology also mean that consumers get more for less. Since the first commercialised 8-bit microprocessor was introduced in 1974 there has been 20 doublings of technology for the same price, according to Moore's Law, generating a growth factor of 1,048,576. This brings me back to the iPhone, which has 240,000 times as much power as the computer used to power the Voyager deep space probe launched in 1977. In short, these tremendous advances in computing power are bringing down the price of technology and related services.

Perhaps more significantly, the new digital distribution channels and falling price of computers and phones have lowered barriers to entry across a whole range of markets. Companies utilising digital channels are growing rapidly as they challenge incumbent firms. Online sales are growing market share in general retailing, financial services, travel services, education and health services. The result is increased competition to meet the needs of consumers and producers and downward pressure on both input and output prices. The new digital channels are significantly altering the competitive landscape in some sectors, particularly in traditional sheltered markets where producers are being newly exposed to competition from online providers.

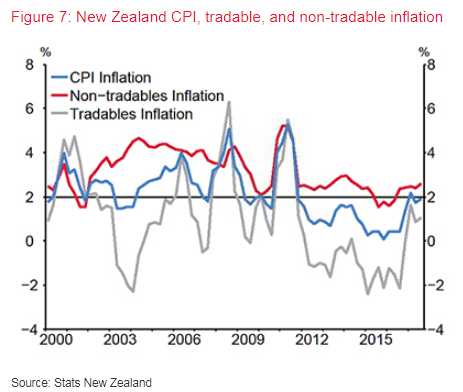

These three significant global factors have contributed to a negative inflation trend for the prices of imports and other tradable goods in New Zealand over the past decade. Commodity prices have added a cyclical component to the trend (figure 7). These global factors have also contributed to reduced inflation in "non-traded" sectors which have become increasingly exposed to competitive pressures.

The Phillips Curve and domestic pricing behaviour

The Phillips Curve underpins how central banks think about inflation.3 Devised by New Zealander Bill Phillips while teaching at the London School of Economics, the Phillips Curve relates inflation to measures of economic slack such as unemployment. The greater the degree of economic slack, the lower the inflationary pressure.

Currently, many advanced economies are experiencing unemployment rates below perceived "neutral" levels but are not seeing the expected inflation response (figure 2).4 This has led central banks to re-evaluate their models. Has there been a breakdown in how we measure economic activity and capacity? Is there a breakdown in the relationship between inflation and economic slack? Or have low inflation expectations been a more dominant driver? All of these issues appear to be relevant.

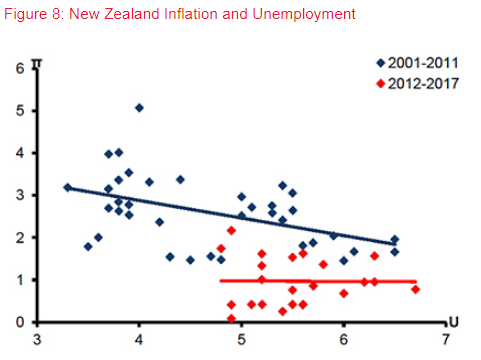

In New Zealand, the link between measures of domestic slack and inflation has proved elusive in recent years. Simply plotting the unemployment and inflation data (figure 8), it can be observed that there is now less inflation for a given level of unemployment and less apparent responsiveness of inflation to changes in unemployment. However, it is also clear that the overall relationship between unemployment and inflation has been quite weak and that other causal factors, both international and domestic, have been playing an important role.5

Source: Stats NZ, RBNZ. Chart excludes volatile CPI observations affected by the New Zealand GST increase in 2010.

The measurement of economic slack is becoming more difficult. Total potential output - or capacity - is not directly observable and it may be that the increasing flexibility and mobility of labour is causing us to understate our measures of capacity. We will increasingly need to refer to a range of labour market indicators in addition to unemployment when assessing the extent of slack in the labour market.

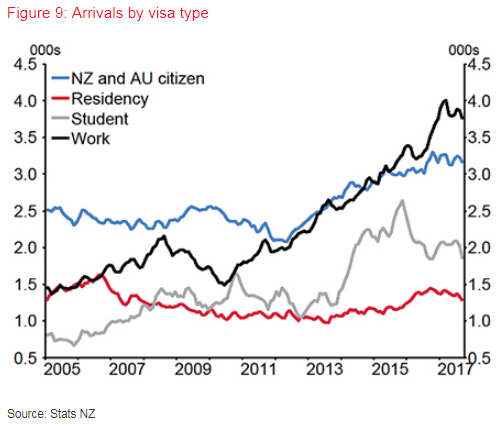

There is not much doubt that an increase in international labour mobility has also affected wage inflation in New Zealand. In some of the traditional non-traded sectors like construction there is now greater scope for employers to meet skill shortages through international hires, even though recent stretch in the construction industry has seen wage costs increasing for certain occupations and skills. On a national scale, we have experienced ongoing high levels of inward migration. Over the past 3 years, the population has grown by around 6 percent, of which less than a third is from natural growth. An increasing share of the inward migration has been on work visas (figure 9), thus contributing to higher productive capacity. In this way, emerging excess demand for labour has been moderated on the supply side as a result of increased international labour mobility.

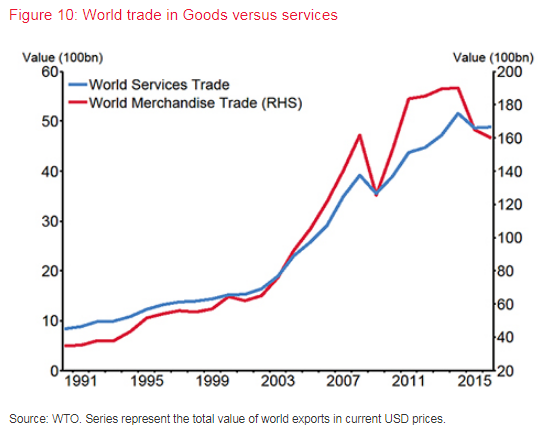

With the New Zealand economy becoming generally more integrated with the global economy, we are likely to see less variability in measures of economic slack and also less variability in labour costs, consistent with a flattening of the Philips Curve. New Zealand has always been a price taker for goods traded in the international markets. It now appears that, with labour mobility and globalisation effects, we are increasingly a price taker in "non-traded" goods and services (figure 10). For example, suppliers of education and tourism services are now operating in increasingly competitive international markets. They are facing international competition for their services and also for their labour inputs. Both sectors have been growing as a share of GDP.

A crucial factor in the Phillips Curve relationship is inflation expectations. If firms and workers expect higher inflation to result from current capacity pressures then they will more quickly bid up prices and wages. Given the absence of such behaviour, we have looked closely at the role of expectations in price-setting behaviour.6 This research shows that, in an environment where inflation has been low for some time, businesses have been placing greater weight on past inflation in setting prices. That is, in a low inflation world, businesses tend to use last year's inflation outcome as a reasonable estimate of next year's inflation. This adds further momentum to low inflation and reinforces the role of inflation expectations in the flattening of the Phillips curve.

In summary, the global trends discussed earlier, together with an increasingly open New Zealand economy and low inflation expectations, appear to be changing the nature of the price formation process in New Zealand. Traded goods prices have been affected directly by the global trends, particularly for manufactures. Non-traded prices have also been affected as a result of a more globally integrated economy and by the momentum of low inflation expectations. The result has been lower average inflation and a flatter Phillips curve. While the scale and permanence of these changes remain very uncertain, they do have implications for how we approach monetary policy.

Policy implications of low inflation

How might these developments impact monetary policy? Do we need to tweak our approach, or rethink our framework? The first thing to say is that these changes to the inflation process are uncertain and it is unclear how long lasting they will be. Also, with long-term inflation expectations anchored at 2%, there remains broad confidence in the effectiveness of the current framework. We should therefore be cautious about making any recommendations for change.

I have talked today about the main developments affecting the low inflation record: a favourable and long-lasting global supply shock arising from supply-chains, the rise of China and the digital economy; and a domestic economy that is now more integrated with the global economy. Both are important but have somewhat different implications for monetary policy.

Lower world inflation

The positive global supply shock has increased global production while dampening world inflation. From New Zealand's perspective the shock has lowered import price inflation, particularly for manufacturers, and increased national income as import prices have fallen relative to export prices. However, while the higher terms of trade have supported aggregate demand, the dominant effect on CPI inflation has been the lower import price inflation.

Our policy approach to this weakness in imported inflation has been to less than fully offset. The weakness was not expected to be so persistent and it has been overlaid with uncertain and cyclical commodity price movements. Also, the existing easy monetary policy stance and positive terms of trade effects were expected to add to domestic inflation pressures. The persistence of the shock has resulted in CPI inflation running below the 2% target mid-point for a considerable period. Such a policy response to external supply shocks is consistent with our flexible inflation targeting framework. More recently we have been assuming greater persistence in low global inflation and this is contributing to our current flat track for future OCR levels.

In our recent November Monetary policy statement, we assume that weak global inflation will persist in line with the forecasts of the international institutions. This now puts some risk on the upside for inflation and interest rates. If the assumption proves incorrect and global inflation picks up in response to increased global growth, then we would likely see higher international interest rates, a lower NZ dollar exchange rate and higher traded goods inflation. This would put upward pressure on domestic interest rates, as portrayed in "Scenario 1" of our November policy statement.

Flatter Phillips curve

The policy response to the second development - a more globally integrated domestic economy and a potentially flatter Phillips curve - is less clear. We have insufficient evidence to say that the flattening of the Phillips curve is permanent rather than temporary. And we have not yet observed how wages and prices respond to a very tight capacity situation.

However, if this change is long lasting and New Zealand firms are increasingly integrated with global markets, then domestic 'non-traded' inflation may become less responsive to monetary policy changes. In the extreme case, New Zealand would be a fully open economy with all prices and wages set in international markets. The exchange rate would become the main conduit for monetary policy to achieve its price stability objective.

The other potential cause of the "flattening effect" is the strength and persistence of low inflation expectations, making it more difficult for monetary policy to affect actual inflation through changes in aggregate demand and economic slack.

While the extreme case of a flat Phillips curve is more expositional than real, it may be the case that deviations from the 2% CPI inflation target will be harder to close, in the sense of requiring larger policy changes and larger movements in economic slack, as measured by unemployment and the output gap. Given that the PTA says we must avoid unnecessary instability in output, interest rates and the exchange rate, and also have regard to the efficiency and soundness of the financial system, this suggests that we should be patient in bringing CPI inflation back to the 2 percent target. This indeed is the approach we have been taking in recent years.

In the context of the November Monetary Policy Statement, non-traded inflation is forecast to pick up from late 2018 in response to increasing capacity pressures. If this response does not eventuate then we would have to consider a further easing of policy to generate additional domestic demand pressure, particularly if global inflation remains low in line with our forecasts. However, we would need to be careful not to generate unwarranted instability in output, the exchange rate or indeed household debt.

It is fair to say that our flexible inflation targeting approach is becoming more flexible. In pursuing our long term price stability objective, relatively more weight is being attached to the stabilisation of output and employment in the short to medium term. In this respect the Reserve Bank's direction is consistent with the Government's initiative to introduce a dual mandate for monetary policy. However, we should recognise that such an approach can only be sustained if inflation expectations remain low and stable. Monetary policy will only have greater scope to stabilise the real economy if its long term commitment to price stability is maintained.

Conclusion

Inflation has been persistently low since the GFC, both in New Zealand and globally. Initially this was related to a long period of weak demand as firms and households repaired their balance sheets. However the low inflation has persisted as activity has recovered and unemployment has fallen. A consistent pattern across many countries suggests that global supply-side factors have been at work. I spoke of three such factors: global supply chains, the rise of China and the digital economy. These developments have contributed positively to the global economy and have been evident locally in low traded goods inflation and a rising terms of trade.

The domestic economy and inflation process have also been affected by the trend towards a more globally integrated economy, increased labour mobility and the momentum of low inflation expectations - which have likely flattened the New Zealand Phillips curve. While the degree and perseverance of this effect are very uncertain, they appear to have reduced the responsiveness of inflation to changes in economic slack.

The Reserve Bank's flexible inflation targeting approach to monetary policy has tended to look through the positive global supply shock, although persistent low global inflation is now incorporated in the Bank's future policy track. Monetary policy has also been patient in light of the apparent Phillips curve flattening. The combined effect of these developments has seen inflation running below the 2% target mid-point for some time.

To the extent that the leverage of monetary policy over domestic inflation may have reduced, this suggests a cautious approach when responding to inflation deviations from target and careful attention to our assessment of economic slack. It may be appropriate for monetary policy to put relatively more weight on output, employment and financial stability relative to inflation. However, this can only be sustained if monetary policy's long term price stability credentials are maintained.

References

Auer, R., Borio, C., & Filardo, A. (2017). The globalisation of inflation: the growing importance of global value chains. Globalisation and Monetary Policy Institute Working Paper no. 300. Federal Reserve Bank of Dallas.

Armstrong, J., & Karagedikli, O. (2017). The role of non-participants in labour market dynamics. Reserve Bank of New Zealand Analytical Note, AN2017/01. RBNZ.

Armstrong, J. & McDonald, C. (2016). Why the drivers of migration matter for the labour market. Reserve Bank of New Zealand Analytical Note, AN2016/02. RBNZ

Culling, J. (forthcoming). Low global wage growth. Reserve Bank of New Zealand Analytical Note.

Duhigg, C., & Bradsher, K. (2012). How the U.S. Lost Out on iPhone Work. The New York Times.

Jacob, P. (forthcoming). The flattening of the New Zealand Phillips curve: Rounding up the suspects. Reserve Bank of New Zealand Analytical Note.

Karagedikli, O. & McDermott, J. (2016). Inflation expectations and low inflation in New Zealand. Reserve Bank of New Zealand Discussion Paper, DP2016/09. RBNZ.

McDonald, C. (2017). Does past inflation predict the future?. Reserve Bank of New Zealand Analytical Note, AN2017/04. RBNZ.

Phillips, A. (1958). The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1861-1957. Economica, 25(100), 283-299.

Vehbi, T. (2016). The macroeconomic impact of the age and composition of migration. Reserve Bank of New Zealand Analytical Note, AN2016/03. RBNZ.

Williams, R. (2017a). Business cycle review: 2008 to present day. Reserve Bank of New Zealand Bulletin, 80, 3. RBNZ.

Williams, R. (2017b). Characterising the current economic expansion: 2009 to present day. Reserve Bank of New Zealand Bulletin, 80, 3. RBNZ.

1 Unemployment gaps are calculated as the difference between unemployment and the OECD's NAIRU estimate. Core inflation gaps are calculated as the difference between core inflation and target inflation. Core measures used are consumer price inflation excluding food and energy, while the US measure is the personal consumer expenditure (PCE) measure excluding food and energy.

2 Auer et al. (2017) discuss the globalisation of inflation in more depth.

3 Phillips (1958).

4 Culling (forthcoming) & Box C in the November 2017 MPS discuss factors associated with the apparent disconnect between inflation and unemployment.

5 See Armstrong et al., (2017). A number of explanations exist. It could be that the level of unemployment consistent with stable inflation has fallen. Alternatively, that central bankers have been successful in anchoring inflation expectations. Jacob (forthcoming) finds that increases in the volatility of supply shocks may have contributed to an apparent flattening of the Phillips curve.

6 See Karagedikli & McDermott (2016) for research on Phillips curve specifications and the time-varying nature of price setting. McDonald (2017) shows real-time forecasts of non-tradables inflation using various Phillips curve specifications. Also, Box B in the August 2017 MPS discusses the implications of inflation expectations for monetary policy.