Simon M Potter: Reducing the size of the Federal Reserve's balance sheet - the benefits of moving gradually and predictably

Remarks by Mr Simon M Potter, Executive Vice President of the Markets Group of the Federal Reserve Bank of New York, to the National Association of Securities Professionals, New York City, 16 November 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Good afternoon and thank you for the kind introduction. I would also like to add my warm welcome to the New York Fed. We very much value the National Association of Securities Professionals' (NASP) efforts to promote professional excellence and encourage economic empowerment for people of color and women on Wall Street, and for our community, and are pleased to host this year's kickoff to the NASP's 21st Annual Symposium.This year's symposium is organized around the timely theme of "Keeping Pace when Market Dynamics Shift". In that vein, I welcome the opportunity to discuss with you some important changes that are in train with respect to the Federal Reserve's balance sheet, and how these may impact financial markets.

As always, the views I will express today are mine alone and do not necessarily reflect those of the New York Fed or the Federal Reserve System.1

Before I discuss the Fed's balance sheet I would like to briefly review some pilot programs we conducted over the last few years and their impact on our counterparty policy. As a number of you are aware, between July 2013 and December 2015, the New York Fed conducted two counterparty pilot programs with small firms, the first focused on treasury operations and the second on mortgage operations. As we announced at the time, we initiated these programs to explore ways to broaden access to open market operations and to determine the extent to which firms beyond the existing primary dealer community could augment the New York Fed's operational capacity and resiliency in its monetary policy operations. We very much appreciate the NASP's efforts to encourage eligible firms to participate.

The experience gained through these programs informed changes in the New York Fed's eligibility criteria for primary dealers, which were announced in November 2016. At that time, the minimum net regulatory capital (NRC) threshold for broker dealers was reduced from $150 million to $50 million. And to better align the capital threshold for banks with the new NRC thresholds, the minimum Tier 1 capital threshold for banks was raised from $150 million to $1 billion. At the same time, a 0.25 percent minimum Treasury market share threshold was introduced to more directly quantify the business capabilities of firms expressing interest in becoming a primary dealer.

Through these changes, the New York Fed is seeking to expand and diversify the pool of firms eligible to apply for primary dealer status, while also recognizing that a certain scale of activity is needed in order to be able to meet the many business obligations to which primary dealers must commit, in supporting the operations of the Federal Reserve and the Treasury. These changes offer the opportunity to increase capacity and further support competitive pricing for the Fed's open market operations. Going forward, the New York Fed will periodically review its counterparty policy.

Turning to monetary policy, at the conclusion of its September policy meeting, the Federal Open Market Committee (FOMC) announced that it would begin to reduce the size of the Federal Reserve's securities portfolio.2 Over the past month, the Fed took the first steps in a multiyear effort to bring the Federal Reserve's balance sheet to its longer-run size, by not reinvesting a portion of the securities repayments it received. In the remainder of my prepared remarks today, I will offer my views on this policy from a financial markets perspective, drawing on a fuller set of remarks I delivered last month, which can be found on the New York Fed's website.3

The message I'd like to leave you with today is one of confidence. I am confident that the FOMC's plan will reduce the size of the portfolio in a gradual and predictable, "no surprises" manner; that the FOMC's plan will promote good market functioning in the Treasury and agency mortgage-backed securities markets as the portfolio declines; and that it will not prove disruptive to the U.S. mortgage market or the U.S. Treasury's debt management program. And I am also confident that the plan's design, and the FOMC's clear communication prior to the plan's implementation, will mitigate the risk of sharp or outsized asset price reactions to the decline in the portfolio's size over time.

Of course, we cannot and should not prevent Treasury and agency MBS prices from reacting to relevant economic and financial developments, or indeed from gradually moving over time in response to the progressive decline in the size of the Federal Reserve's holdings and consequent increase in the amount of securities held by the private sector.

In fact, we very much want asset prices to respond appropriately and fully to economic and financial news. Over the coming years, such news could span a wide variety of topics, such as central bank policy in this country and abroad, the ongoing debate over fiscal policy, and the evolution of expectations for the longer-run neutral rate of interest.

That said, we do seek to mitigate the risk that our operational actions contribute to unnecessary surprise, disruption, or volatility.

There is of course always a risk that events could unfold differently from expectations. In particular, central banks have had little direct experience with the impact of such a reduction in holdings of domestic securities and in reserves. One relevant experience, of course, was the so-called "taper tantrum," in 2013 which showed that markets can have outsized reactions to changes in balance sheet policy even before they happen.

More generally, experience with asset purchase programs, both here and abroad, clearly demonstrates that market volatility can ensue from balance sheet policy changes that market participants perceive as surprising, unclear, or rapid, or are not adequately distinguished from short-term interest rate policy intentions. All of this indicates to me that, at policy turning points like these, central banks should carefully and clearly communicate their intentions, provide as much transparency as possible, focus on one tool at a time, and make transitions in policy implementation as slowly as overall macroeconomic policy objectives permit.4

The rest of my remarks will go as follows. First, I'll provide an in-a-nutshell summary of the structure of the Federal Reserve's balance sheet. Then, I will discuss why it is important that the decline in the balance sheet be gradual and predictable, and explain how the FOMC's plan provides this gradualism and predictability. I will then talk briefly about how the Federal Reserve is ensuring it is prepared for unexpected developments. We will then open things up for questions you may have.

The Fed's balance sheet, in a nutshell

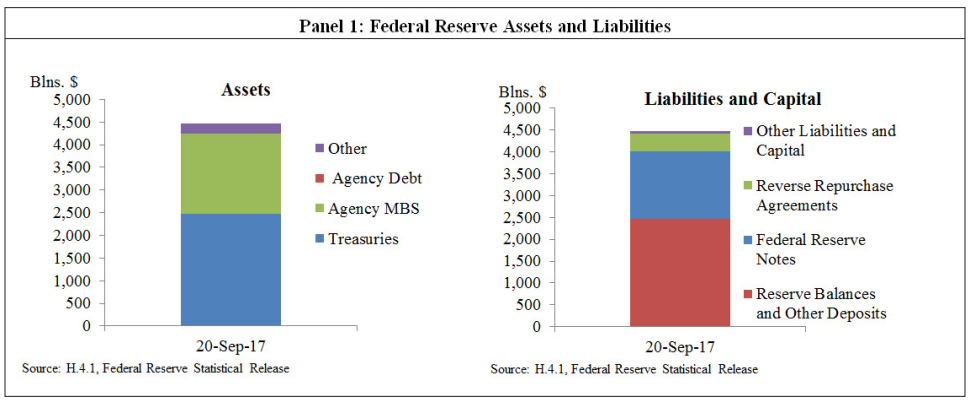

Let's begin by reviewing, at a high level, where the Fed's balance sheet is today. Panel 1 shows a summary of the Fed's assets and liabilities, as they are today. Substantially all of the $4.5 trillion of assets consist of Treasuries and agency MBS. On the other side of the balance sheet, the Federal Reserve has three main categories of liabilities: $2.6 trillion of bank reserves and other deposits, $1.5 trillion of paper currency, and about $400 billion of reverse repos.

Before the crisis, the balance sheet was much smaller, at around $900 billion. It reached its present size as a result of the FOMC's large-scale asset purchase programs. Those programs were undertaken to support the economic recovery by easing financial conditions to a greater extent than could be achieved solely through reducing the federal funds rate, once that instrument became limited by the zero lower bound on interest rates. These asset purchases greatly increased the size of the asset portfolio, and equally increased the size of the Federal Reserve's liabilities, largely through growing the stock of bank reserves.5 The composition of the balance sheet also changed. On the asset side, the most important compositional changes were the addition of agency MBS and a substantial increase in the maturity of the Fed's Treasury holdings.

For many years, the FOMC has made it clear that it did not intend for these changes to the balance sheet to remain forever.6 Instead, through its statements and its September 2014 Policy Normalization Principles and Plans, the FOMC indicated its intention that, in the longer run, the Federal Reserve will hold no more securities than necessary to implement monetary policy efficiently and effectively, and that it will hold primarily Treasury securities.The FOMC also communicated its intention to reduce the Federal Reserve's securities holdings in a gradual and predictable manner, primarily by ceasing to reinvest repayments of principal on its securities holdings.

Starting in its December 2015 statement, when the FOMC first started to raise its federal funds target range away from zero, the FOMC also indicated that it anticipated continuing reinvestment until normalization of the level of the federal funds rate was well under way. The FOMC's strategy of waiting to begin reducing the balance sheet until normalization of the federal funds rate was well under way has had several advantages. Most importantly, it reduced the likelihood that an unexpected adverse shock to the economy would have necessitated a return to the zero lower bound on the federal funds rate and potentially a reversal in balance sheet normalization. Second, the FOMC's approach promotes the use of the federal funds rate as the active monetary policy instrument, an instrument with which the FOMC has much greater experience. In addition, delaying balance sheet normalization allowed the FOMC to meaningfully assess the efficacy of its tools to control short-term interest rates with a large balance sheet, and thereby judge how patient it could afford to be in reducing the balance sheet to its longer-run level.7

Reducing the balance sheet's size

Over the past year, as the FOMC came to judge that normalization of the policy rate was well under way, with another rate increase in December 2016, and further increases in March and June 2017, FOMC deliberations turned to how balance sheet normalization might best be done.

As I noted earlier, for some time the FOMC has underscored that the balance sheet will be reduced in a way that is gradual and predictable, so as to avoid risks of surprise, disruption, or volatility, and would be achieved primarily by not reinvesting maturing principal. The FOMC's recently initiated plan does exactly this.8 Principal reinvestment will decline in a phased manner, an approach which provides for an appropriate pace of reduction in the balance sheet, and is quite straightforward to communicate.

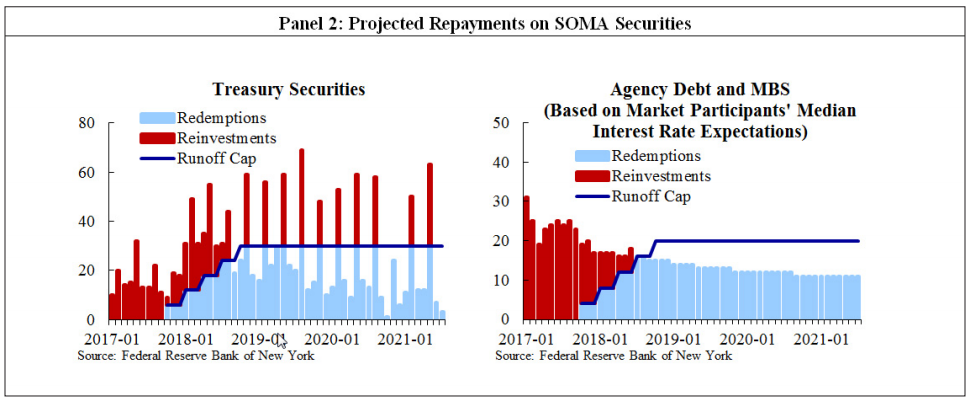

Specifically, principal maturities will be reinvested only to the extent that they exceed gradually increasing caps.9 For Treasuries, the cap initially will be $6 billion per month, and will increase in steps of $6 billion at three-month intervals over 12 months until the cap reaches $30 billion per month. Agencies follow a similar pattern, with a cap starting at $4 billion and rising in three-month steps to reach $20 billion. The FOMC also indicated that it anticipates that these caps will remain in place once they reach their respective maximums. Over time, as the Fed holds fewer securities, the private sector will gradually hold more. At the same time, Fed liabilities held by the private sector, in particular reserve balances, will decline equivalently.

Panel 2, which draws on a July 2017 update to the System Open Market Account annual report, illustrates how the caps will evolve in relation to anticipated maturities of Treasuries, on the left hand side, and agency MBS on the right. As can be seen, once the caps are fully phased in, in many months the caps are not expected to be binding, and so there would be no reinvestments in those months. However, the caps will be exceeded in months with large Treasury maturities, and we would reinvest the amount above the cap. For agency MBS, a change in conditions could encourage faster MBS repayments than are shown here, producing monthly paydowns larger than the 20 billion cap and thus some reinvestments-an issue I will return to later.

Policymakers have indicated that they want the portfolio's size to decline "in the background," and that the federal funds rate will be the primary instrument of monetary policy. Balance sheet normalization is expected to continue until the FOMC judges that the Federal Reserve is holding no more securities than necessary to implement monetary policy efficiently and effectively.

The FOMC has not specified how large the balance sheet should be at that point, other than an expectation that the level of reserve balances will be appreciably below that seen in recent years, but larger than before the financial crisis. My colleague Lorie Logan spoke in May on the many technical drivers of this ultimate level, which include the mode of policy implementation that the FOMC chooses in the longer run, possible increases in recent years in the financial system's demand for reserves and Federal Reserve reverse repo liabilities owing to new financial regulations and other factors, and the long-term evolution of demand for paper currency.10

Let me spend a few minutes discussing the importance of gradualism and predictability.

Gradualism

The case for gradualism in reducing the Fed's securities holdings rests on evidence, as well as potential risks, that an overly fast flow of securities into private hands could be disruptive to market functioning, as well as the FOMC's confidence that it can adjust its policy stance as needed through changes in the federal funds rate. In particular, there is evidence that the agency MBS market, due to the nature of its trading conventions, is prone to dislocation when market participants expect large transitions in central bank agency MBS flows.11 Such concerns can be self-fulfilling: if market participants are concerned that an abrupt shift in flow might be disruptive, they might, for example, withdraw from liquidity provision. An overly fast redemption flow of Treasuries could also create challenges in the government's management of public debt auctions and result in communication challenges.12

Rapid portfolio declines also could have unforeseen impacts on overnight money markets, for example by creating significant shifts in dealers' demand for overnight repo financing. We have seen such impacts in the past. This sort of volatility did not, and would not now, pose a major problem to markets or policy implementation, but it is something worth avoiding if possible. Rapid portfolio runoff could also make it more likely that bank reserves become scarce unexpectedly or more quickly than policymakers had anticipated.

Finally, overly fast portfolio runoff could introduce undesired noise into financial conditions. This could complicate policymakers' economic forecasting and make it more challenging to determine and communicate the appropriate monetary policy stance.

Predictability

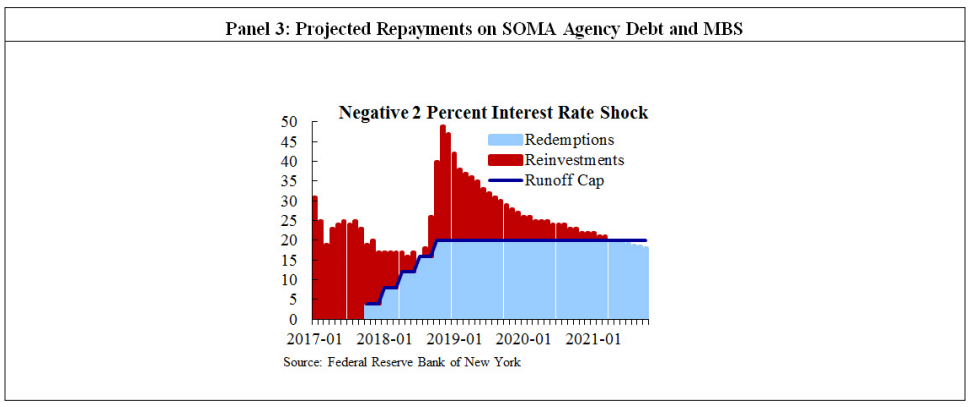

Predictability complements gradualism by promoting stability in market estimates for the future size of the balance sheet, and confidence that the FOMC will not unintentionally create market stress. It involves assuring the public that the flow of balance sheet reduction remains gradual across a range of economic scenarios, including ones quite different from our central forecast. Achieving predictability is complicated by uncertainty about agency MBS principal repayments, an issue I'll summarize briefly.

To an extent, unexpected changes in the pace of existing home sales contribute to uncertainty about MBS repayments. But by far the greatest source of aggregate uncertainty relates to refinancing. When homeowners get a new mortgage with a better interest rate, and pay off their old higher rate one in the process, existing agency MBS are paid off more quickly, and replaced with greater issuance of newly-minted agency MBS containing the new, lower-rate loans.

The benefit of the FOMC's redemption cap is that it limits the pace at which securities will flow back into private hands under scenarios in which interest rates fall much more than expected. To illustrate this, projections for agency MBS repayments under a scenario of lower interest rates are shown in Panel 3-as you can see, in this low rate scenario, the caps would still be exceeded even when fully phased in.

By providing market participants some certainty that the pace of balance sheet decline will be gradual across economic scenarios, this plan should help mitigate the risk of unexpectedly sharp shifts in asset prices, liquidity, or market functioning should markets begin to put greater weight on lower interest rate scenarios. Indeed, by promoting greater confidence in the stability and liquidity of the Treasury and agency MBS markets across economic outcomes, the FOMC's plan should result in lower risk and liquidity premia on these assets, relative to normalization plans that do not promote such confidence.

Being prepared for the unexpected

While I am confident that the FOMC's plan will work well, there's always the risk that events unfold differently than expected. In my view, we best prepare for the unexpected in two ways: we need to be operationally ready to change course when needed, and we need to remain analytically focused so we know when to recommend to policymakers that they do so.

For example, the FOMC has made it clear that it stands ready to resume reinvestment if a material deterioration in the economic outlook were to warrant a sizable reduction in the federal funds rate. The FOMC also indicated that it would be prepared to use its full range of tools, including altering the size and composition of its balance sheet, if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate.

Also, unexpected operational demands could emerge from technical developments within the Treasury and agency MBS markets. Even though it is shrinking, the Federal Reserve's portfolio is and will remain large, and market participants will look to the Federal Reserve to lend out on a collateralized basis some of its holdings of Treasuries and MBS from time to time in order to facilitate settlement, as is done by most other large fixed-income investors.13

Conclusion

Let me conclude now by reiterating the message of confidence with which I began my remarks. I am confident that the FOMC's gradual and predictable plan to normalize the balance sheet will reduce the balance sheet's size at an appropriate pace, that it will promote good market functioning, that it will not disrupt the mortgage market or Treasury debt issuance, and, importantly, that it will mitigate the risk of sharp or outsized asset price reactions. I am also confident that the Federal Reserve is well prepared, both operationally and analytically, to identify, understand, and address unforeseen circumstances over normalization as directed by the FOMC. Finally, by accomplishing all these things, I am confident that the FOMC's policy normalization plan should help promote the ongoing economic expansion.

Early signs on this front are encouraging, with no to very modest financial market volatility around balance sheet announcements and the reduction in the balance sheet to date. It's too early to declare success. However, should this stability continue, I believe the FOMC's approach may offer useful lessons to other central banks which anticipate reaching a time of transition in their policy stance. Thank you for your attention. I would welcome your comments and questions.

1 I would like to thank John Clark, James Egelhof, and Deborah Leonard, for their assistance in the preparation of these remarks, Adam Biesenbach for his assistance with the data, and colleagues in the Federal Reserve System for their insightful comments and suggestions.

2 The FOMC reaffirmed this policy in its November 1, 2017 statement and implementation note.

3 Potter, Gradual and Predictable: Reducing the Size of the Federal Reserve's Balance Sheet, October 11, 2017.

4 See Potter, Implementing Policy with the Balance Sheet, November 6, 2017, for further discussion of lessons from experience with balance sheet policy.

5 The maturity structure of the balance sheet was only loosely incorporated into the purchase plan. Purchases of Treasury securities were targeted at maturity sectors; within each sector, specific issues were selected for purchase using a relative-value approach based on a spline fitted to market prices. Sack, Implementing the Federal Reserve's Asset Purchase Program, February 9, 2011. Treasury securities acquired through reinvestment are purchased in proportion to issuance. Agency MBS purchases are distributed across instruments roughly in proportion to anticipated gross issuance of those securities at the time. Potter, The Implementation of Current Asset Purchases, March 27, 2013.

6 Early FOMC discussions of balance sheet normalization, then referred to as an "exit strategy," were predicated on an intention to return to, as put in the January 28, 2009, meeting transcript, "a more normal framework for conducting monetary policy," which meant a return to an asset and liability structure closely resembling that which prevailed before the financial crisis. Normalization-related matters were discussed in the minutes to most of the FOMC's 2009 meetings. In a January 2009 speech, The Crisis and the Policy Response, Chairman Bernanke provided extensive detail on the eventual normalization strategy, as envisaged at that time, including his expectation that the balance sheet would be reduced "to the extent necessary at the appropriate time."

7 See Potter, Money Markets at a Crossroads: Policy Implementation at a Time of Structural Change, April 5, 2017, for an assessment of the efficacy of these tools.

8 The Policy Normalization Principles and Plans indicates that the Committee did not anticipate selling agency mortgage-backed securities as part of the normalization process, although limited sales might be warranted in the longer run to reduce or eliminate residual holdings, and that the timing and pace of any sales would be communicated to the public in advance. Portfolio projections released in July 2017 do not include sales of any type over the forecast horizon.

9 Statement Regarding Reinvestment in Treasury Securities and Agency Mortgage-Backed Securities, September 20, 2017.

10 Logan, Implementing Monetary Policy: Perspective from the Open Market Trading Desk, May 18, 2017.

11 Kandrac, The Costs of Quantitative Easing: Liquidity and Market Functioning Effects of Federal Reserve MBS Purchases (2014).

12 The Treasury Borrowing Advisory Council considered this topic in its third-quarter 2017 meeting, including the potential impact of changes in central bank policy abroad. See the August 1, 2017, presentation by TBAC to the U.S. Treasury.

13 In addition to these topics, we at the Federal Reserve are following closely the potential for the decline in the balance sheet to affect other aspects of the structure of financial markets or the banking industry. As one example, we are paying attention to the possibility that a decline in the size of the balance sheet puts downward pressure on bank deposits. As discussed earlier, in general, balance sheet normalization removes an asset from the private sector that can be held only by banks (reserves) and replaces it with an asset that can be held by anyone (securities). It is possible that, on net in equilibrium relative to a counterfactual in which the balance sheet does not decline, (a) banks will hold fewer reserves; (b) banks will offset some of this decline by holding securities instead, and some by taking in fewer deposits; and (c) non-banks will replace those deposits with securities. The extent (if any) of any such decline in deposit activity on deposit and loan pricing will likely depend on a variety of factors, including the extent to which the decline comes from wholesale institutional deposit activity motivated by interest rate arbitrage. See Ihrig, Mize, and Weinbach, How does the Fed adjust its Securities Holdings and Who is Affected?, September 22, 2017