Luci Ellis: Where is the growth going to come from?

Text of the Stan Kelly Lecture by Ms Luci Ellis, Assistant Governor (Economic) of the Reserve Bank of Australia, Melbourne, 15 November 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

This speech has benefited from helpful discussion with and assistance from Liz Kendall. Several other colleagues also made some useful suggestions, including Jarkko Jaaskela and Tom Rosewall.

I'd like to thank the Economic Society of Victoria and the organisers of this event. It truly is an honour to be included in the list of presenters of the Stan Kelly Lecture. This lecture was established forty years ago by the former member of parliament and commentator Bert Kelly in the name of his father, Stan. Both men were great servants to the people of Australia and advocates of free trade and an open economy. I'm not old enough to be able to claim to have known either man, but as a teenager I was certainly aware of Bert's columns in my parents' copies of the Bulletin magazine. And, of course, the issues Bert championed in them - free trade and less regulation - were central to the policy conversation in the 1980s, when I was an undergraduate here at the University of Melbourne.

A different world

When Bert entered Federal Parliament in 1958, Australia was a very different place. The industrial structure was very different. Manufacturing accounted for around 25 per cent of output and 26 per cent of employment compared with 6 per cent and 7 per cent now. Living standards were lower. Real household disposable income per household was a little more than half the level it is now.1 Even that figure does not truly capture the difference in people's experience. In the late 1950s, the average household spent 20 per cent of its post-tax income on food consumed in the home, compared with 9 per cent now. And the basket of goods and services used to calculate real incomes did not then include overseas holidays, internet connections or the array of electronic goods that it does today.

Australia's economy was also organised very differently then. Almost all wages were set by a judicial process. High tariff and other barriers restricted manufactured imports. Agricultural production was protected and managed through marketing boards and other government agencies. The financial sector was highly regulated and restricted in the kinds of business it could do.

Because of this regulatory structure, by the time Bert retired from parliament in 1977, Australia was a poorly performing, inward-looking economy. Economic growth and living standards were lagging other industrialised economies. Inflation remained higher as well. Productivity growth seemed lacklustre and there was a general sense that the Australian economy was not 'world class'. Indeed, the 1987/88 Annual Report of the Department of Industry, Technology and Commerce was titled 'Towards World Class'. The supposition was clearly that we weren't there yet.

The Kellys' legacies

From their various positions, both of the Kellys opposed the system of 'protection all round'. Stan joined with other members of the Commonwealth Tariff Board in opposing high tariffs. Bert became an advocate for free trade and dismantling regulation, both in and outside parliament.

Father and son both opposed the high-tariff regime because it made the economy less efficient; it reduced Australians' living standards. But more than anything, they opposed the system's unfairness. Businesses and industries did well not because they produced a better product or provided the best customer service, but because they were better at persuading politicians and bureaucrats that they deserved special protections. As Gary Banks pointed out in a previous Stan Kelly Lecture, the system was designed to produce arbitrary 'preferments' (Banks 2013). Some firms and industries would be favoured, while others were ignored.

So 'protection all round' was far from a progressive system. It encouraged rent-seeking. The wage-setting system didn't just support a basic 'living wage'. For most of its existence it enforced lower pay rates on women and excluded them from many occupations.

The system also limited our thinking. By protecting Australian industry from imports, it created a mindset that local firms would never be able to compete. The idea that our industries could export abroad was barely considered.

Over time, the Australian economy was liberalised. This took decades. Some of the reforms, including the tariff cuts in the 1970s, might have been motivated by other concerns. But they had the same effect as if they'd been cut as a deliberate liberalisation measure: they spurred domestic firms to respond.

The floating of the exchange rate in 1983 was particularly important. For a commodity-exporting country like Australia, subject to global economic fluctuations, a floating exchange rate is the best absorber of external economic shocks ever invented. And so it was that in the 1980s, the floating exchange rate absorbed the shock of our economy's increasing openness. Over the two years to January 1987, the Australian dollar depreciated by around a third on a trade-weighted basis.

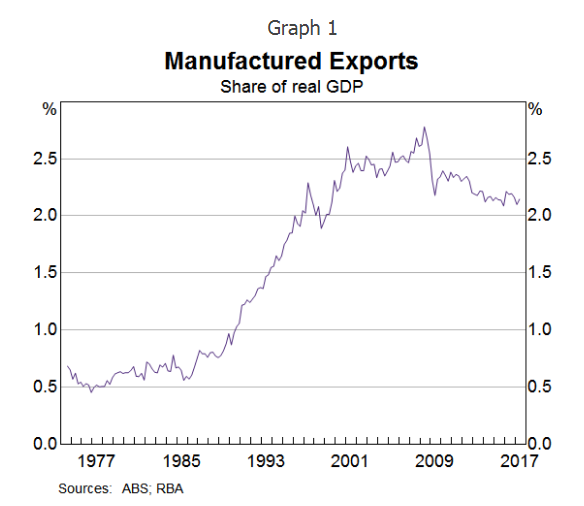

At the time, that depreciation was sobering. I remember our lecturers telling us economics students that it meant our living standards had declined. (It was also a response to that decline.) Some important policy responses were needed to avoid a burst of inflation; these policies also constrained real wages. But that depreciation made it easier for domestic firms to compete with imports and - perhaps surprisingly to some - become exporters. Manufactured exports roughly quadrupled their share of real GDP over the subsequent decade and a half (Graph 1).2 And despite the boom in resource exports and the gloomy rhetoric that often surrounds Australian manufacturing, that share hasn't fallen much since then.

Some former colleagues looked at this transition a few years after it happened and found what they called a 'beachhead effect'. There seems to be a hurdle to becoming an exporter, but once you start, you continue (Menzies and Heenan 1993). Another way of looking at this transition is that it was the inevitable result of the shift in relative prices implied by the depreciation of the exchange rate. But a third interpretation is that it was enabled by a psychological shift. In the era of 'protection all round', the presumption was that Australian industry couldn't compete with overseas suppliers. That was why it 'needed' tariff protection. If you see yourself as inherently uncompetitive, why would you even try to export? But once Australia started opening its economy more to the rest of the world, exporting started to seem possible. And once you start believing you can compete, you have a chance of being right.

Parallels with the current situation

The Australian economy of the 21st century is structured very differently than it was during Bert's career. But there are a number of parallels and some of the challenges we face would seem familiar to him.

Back then, Australia was said to ride on the sheep's back. Together, wool and wheat were close to half of Australia's goods exports in the 1960s. Agriculture accounted for more than 40 per cent of business investment. Indeed, almost all of that agricultural investment was 'cultivated biological products', which is mainly livestock but includes vineyards and orchards. But, even then, agricultural employment was only 11 per cent of the total. And the vast majority of Australians, then as now, lived in the biggest cities, far removed from agricultural activity.

In recent years, resource exports accounted for around half of Australian exports. That figure is likely to increase a little as new liquefied natural gas (LNG) capacity comes on line. During the recent resource investment boom, mining investment exceeded non-mining investment for a period. But, even if you added in workers in sectors such as construction and professional services who were doing work on mining projects, mining-related employment is just a fraction of the workforce. That was true even at the peak of the mining investment boom. So, again, the vast majority of Australians' economic lives are relatively unconnected to the biggest exporting sector.

The past decade or so also isn't the first time Australia has seen a surge and reversal in the terms of trade, either. The Korean War induced a boom-bust cycle in wool prices, a few years before Bert entered parliament. And just a few years after he left it, there was a surge in mineral commodity prices. This induced a boom in resource investment, though not as large or long-lived as the one we have just been through. Then, as recently, Australia needed to manage the consequences of that. Former treasury secretary John Stone tackled this issue when he gave this lecture in 1981 (Stone 1981).

Then, as now, there were concerns that the economy would suffer from 'Dutch Disease', where a higher exchange rate renders the manufacturing sector uncompetitive and industrial capacity atrophies. Often it wasn't appreciated that if much of the investment equipment is imported, the exchange rate doesn't appreciate as much. Yes, other sectors, including manufacturing, will find it harder to compete with imports when the exchange rate is high. But that isn't a permanent state of affairs. In any case, the international evidence is that the Dutch disease doesn't necessarily reduce long-term growth prospects. For that to have been true, the industries that get squeezed out would need to be somehow more important for productivity growth than those that survived. That isn't what the evidence suggests (Magud and Sosa 2010). What seems more important is the quality of a nation's institutions, and their ability to ensure that the benefits of the mineral endowment are not squandered through rent-seeking (van der Ploeg 2011).

Then, as now, there were concerns that our prosperity might be based on too narrow a foundation. Even around the turn of this century, I remember foreign investors telling me that Australia was an 'old economy'. We should stop digging things out of the ground, they said, and start building microchip factories. Of course, this would have meant stopping the export of commodities in order to start the export of different commodities. And considering the relative price movements of iron ore versus microchips since then, we are better off for not having taken that path.

So there are many similarities between the resources boom of the early 1980s and now. But there were also important differences. This time around, the role of foreign investment in funding that boom has been less controversial. The labour market has probably adapted to the shock more quickly, too. We see this in the interstate migration figures. Perhaps more importantly, the high wages on offer in the booming sector weren't automatically flowed through to the rest of the labour force through a centralised system. So the cost base of the economy didn't shift as much. And this time around, the Australian dollar has floated freely and done much of the work to adjust to the shock.

As some of my colleagues have pointed out previously, a floating exchange rate regime has several advantages in the face of a terms of trade and investment boom. As the exchange rate appreciated, the benefits of the income shock coming from the higher terms of trade were more evenly shared. Rather than the income boost going solely to the resource industry, lower import prices raised the real incomes of all Australians. If instead we'd had a fixed exchange rate, we would have had a balance of payments surplus. That would have represented a large monetary stimulus. And we know from the wool boom during the Korean War what the result of that would have been: significant inflation, and not much to show for it afterwards.

Growth in the aftermath of the mining investment boom

As the mining investment boom turned down, and became a drag on growth, the question was often asked: 'Where is the growth going to come from?' Commentators started speaking of a growth 'handover': if mining investment wasn't going to provide our growth, something else needed to. And for a while, particular non-mining sectors did seem to pick up, to become in turn the new 'engine of growth'.

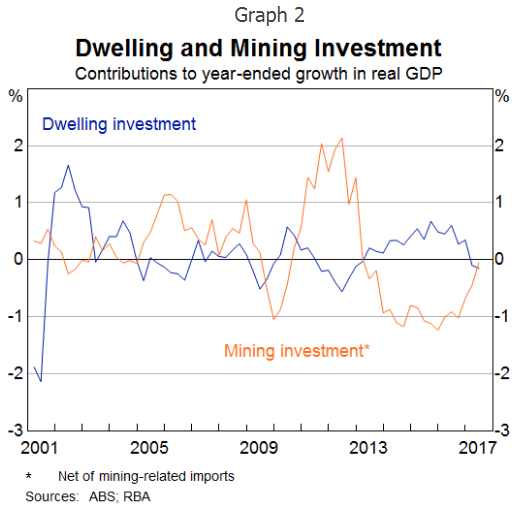

First to do so was residential construction. It added much less to growth than the mining investment boom did, at least directly (Graph 2). Even at its peak, it was only adding around ½ percentage point to annual GDP growth. Compare that with the mining investment boom, which added roughly 1-2 percentage points to growth in each of 2011 and 2012, for example, even after netting out the high import content in resource investment.

Residential building work remains at a high level - faster than would be needed to house our growing population - but it is no longer adding materially to growth. You could argue that there are important spillover effects from housing. People need to buy furniture and other goods to complete their new homes, after all. But it turns out not to add that much. Spending on furnishing and household equipment accounts for less than half the share of GDP that housing construction does, not all of it to furnish new homes. Housing construction contributed about 0.3 percentage points to annual GDP growth over recent years. So any spillover via furnishings must be even smaller. This sector is not where we will find an 'engine of growth' to pull us all along.

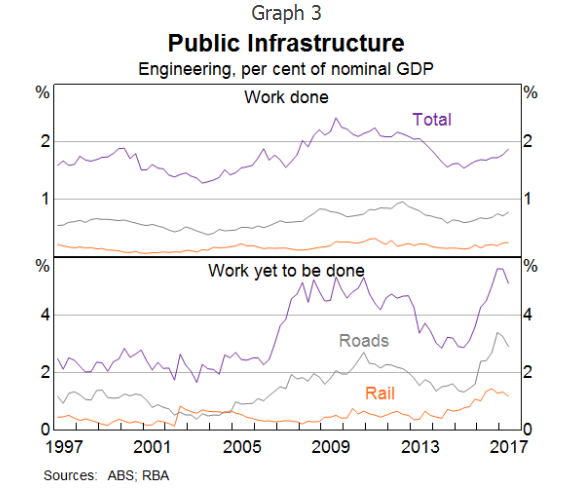

The newest so-called 'engine of growth' is public infrastructure. Like high-density residential construction, infrastructure projects serve as a good replacement for mining investment projects in a 'growth handover': the human skills needed for both types of work are very similar. And spillovers to the rest of the economy are probably even stronger than for housing.

It is more apparent in the large stock of announced projects than in current activity, but the program of public works in the pipeline is now much higher than usual (Graph 3). How much this will add to growth directly depends on how quickly these projects are completed. But there are also important indirect effects. Infrastructure work also supports activity in private firms, because they are doing much of the work on these projects on behalf of the public sector. And we are hearing from our contacts in industry that it is also spurring private businesses to invest in new equipment, to support that activity. Better public infrastructure is also thought to boost productivity in the economy more broadly. Transport infrastructure seems to be especially good at this. Compared with the previous upswing in infrastructure spending a decade ago, transport projects are a larger share this time around.

I observe several things about this 'handover' idea. First, all of the sectors identified as new 'engines' of growth produce long-lived stocks of things: mines, buildings, bridges and railways. You can produce above-average amounts of these things for a while, but you can end up with an excess you don't really need if the boom continues for too long. This is the problem with any kind of construction-related boom. The stock-flow dynamics really matter. None of these sectors should be thought of as sustaining growth indefinitely.

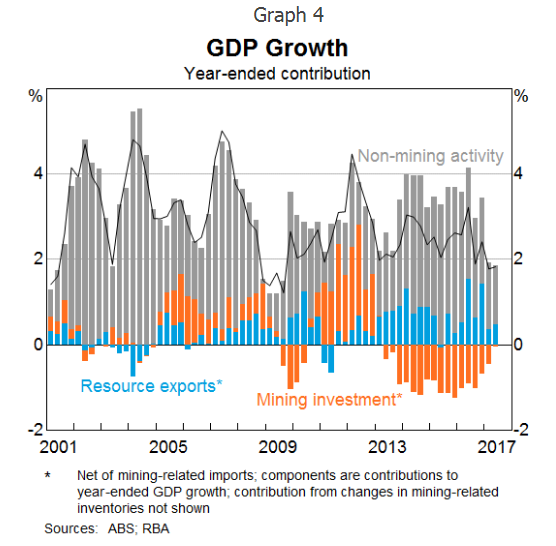

Second, in searching for a replacement for the mining investment boom, too often people forget that it gave way to a mining exports boom. That boom is now happening, and for LNG it still has a bit longer to run. We anticipate that resource exports will add about a cumulative 1.2 percentage points to GDP over the next two years. Resource exports now account for around half of Australia's export revenue, and that will remain broadly true even if commodity prices fall a bit from here.

Third, it was also often forgotten that the rest of the economy had been squeezed to make way for the mining investment boom (Graph 4). Sectors such as tourism and manufacturing were affected by the exchange rate appreciation. Since the beginning of 2014, though, the Australian dollar has on average been 18 per cent below the peaks it reached in 2013, on a trade-weighted basis. The squeeze naturally reversed itself when the investment boom ended. So part of the answer to the question 'where is the growth going to come from?' is 'all the industries that had been growing more slowly than usual during the boom'.

A high exchange rate can (and did) squeeze some firms so hard that they stop exporting altogether, or even go out of business. This can have lasting effects even once the exchange rate depreciates again. Maybe the loss of export market presence or longstanding supply networks creates some path dependence. This would be the reverse of the beachhead effect identified by Menzies and Heenan (1993). It would have to be a big effect, though, to offset the increase in overall productive capacity enabled by the investment boom.

There's nothing wrong with noting that some sectors pick up as others slow. But behind the idea that growth needed to 'handover' to something else, there also seems to be a presumption that the Australian economy needs a special something - an identifiable engine of growth - for reasonable growth to be possible at all. This view strikes me as being similar to the mindset that the Kellys opposed. The 'protection all round' mindset took as given that Australia had a cost base set so high that we could never compete internationally without government help. The 'engine of growth' mindset presumes that we need some sort of external trigger to grow, which for some reason cannot come from within.

The 'engine of growth' mindset also seems to divide industries into the worthy and the unworthy. Only 'good growth', we are told, is truly sustainable. And 'good growth', I can't help noticing, always seems to be defined as 'goods growth'. Services don't count. There's a hint of the eighteenth century physiocrats in this mindset, but with manufacturing and business investment taking the place of agriculture in the firmament of virtuous activities.3

Much of the recent growth in employment has been in household services such as health and education, which leads some to dismiss it as 'bad growth'. Are people presuming that it's all driven by the public sector and therefore somehow artificial? Or is it that they think jobs in service industries are all low-skill, low-wage jobs and therefore bad jobs? (University academics, teachers and medical professionals would presumably disagree with that idea.) Or is it just discomfort that growth is concentrated in industries where productivity is harder to measure? Or do people genuinely think that it's not really production if you can't drop it on your foot?

The literature in fact shows that growth in health and education can indeed be 'good growth' - sustainable growth. Both sectors contribute to stronger performance in other sectors. Better health outcomes are good for their own sake; they improve people's welfare. In addition, they improve productivity of individual workers and make it less likely that careers will be cut short (and retirement income will fall short) because of ill-health. Similarly, better education is not only good for its own sake - it builds human capital, the better skills we all need to be more productive.

To support growth and living standards in parts of the economy, it is important that the increased resourcing of and employment in the health and education sectors actually translate into better outcomes. This is an ongoing conversation in public policy, one I'm not qualified to add to. I will, however, note another connection to the Kelly legacy. The Commonwealth Tariff Board, on which Stan served for many years, morphed first into the Industries Assistance Commission, then the Industry Commission, and finally, the Productivity Commission.4 Over the past two decades of its existence in its current form, the Commission has become the key public-sector institution involved in developing policies to boost productivity. I note the Commission has recently published its five-year review, which contains many policy ideas for improving effectiveness and outcomes in the areas of health and education (Productivity Commission 2017).

Where will the growth really come from?

The preceding just shows that, over time, some industries grow faster than others. For a while, the mining industry was growing faster than the rest. Other industries take the lead at other times. But it doesn't really get at the underlying drivers of growth. We need to ask: where will the growth really come from, over the longer term?

In answering this question, it is hard to go past the 'three Ps' popularised by our colleagues at Treasury: population, participation and productivity. I'll go through each in turn.

Population

As the Governor noted in a speech a few years ago, Australia's population is growing faster than in almost any other OECD economy (Lowe 2014). That has remained true over the past couple of years. The rate of natural increase is higher than many other countries, but most of the difference is the large contribution from immigration.

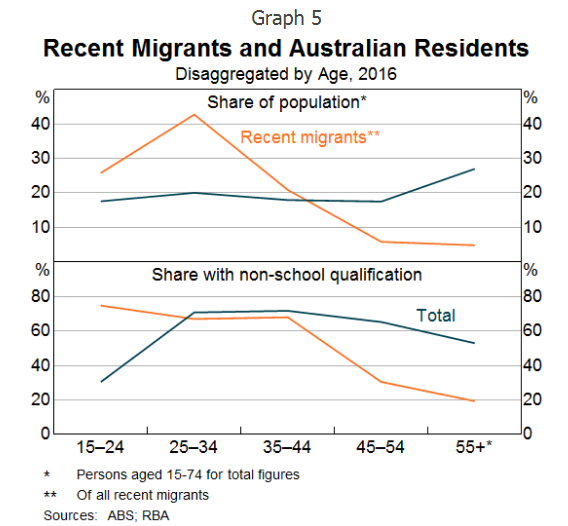

Of course, just adding more people and growing the economy to keep pace wouldn't boost our living standards.5 But there are two reasons why we should not assume that this is all that happens. Firstly, recent migrants have a different profile to the incumbent Australian population. They are generally younger, and the youngest age group are significantly more likely to have non-school qualifications (Graph 5). This is possibly because so many recent migrants initially arrive on student visas and then stay. In line with that, service exports in the form of education have grown rapidly over the past few decades.

Older migrants are on average less likely to have such a qualification than existing residents in the same age groups, but they are a small fraction of all migrants. The average education level of newly arrived Australians is actually higher than that of existing residents, precisely because they are younger. So Australia's migration program is structured in a way that, in principle at least, it can grow the economy while raising average living standards.

Secondly, increasing economic scale is not neutral. There is more to it than just getting bigger. This is the lesson of what is sometimes called New Economic Geography: scale economies arise from product differentiation (Fujita, Krugman and Venables 1999). Bigger, denser cities are more productive. Perhaps more importantly, larger population centres allow more variety in the goods and services produced. Fujita and Thisse (2002) quote Adam Smith making the same point (Smith 1776, p 17).

There are some sorts of industry, even of the lowest kinds, which can be carried on no where but in a great town. A porter, for example, can find employment and subsistence in no other place. A village is by much too narrow a sphere for him; even an ordinary market town is scarce large enough to afford him constant occupation.

So it is also with management consultants, medical specialists and a myriad of other occupations that can only be sustained in a large market.

Participation

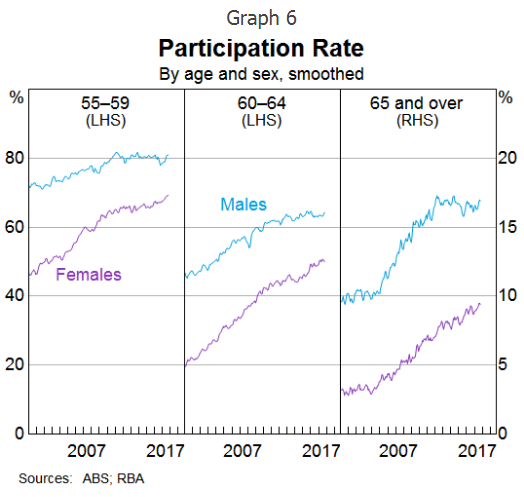

The second of the three Ps, participation, can and has been increasing average incomes and living standards. It is usually presumed that ageing of the population will reduce participation. In Australia at least, other forces have offset that tendency in recent years.

In our Statement on Monetary Policy, released last week, we noted that the participation rate has been rising recently. The increase has been concentrated amongst women and older workers. That is true of the pick-up over recent months. It is also true over a somewhat longer period, as shown in this graph (Graph 6). Older workers have increased their participation in the workforce as the trend to earlier retirement has abated. Mixed in with this is a cohort effect related to the increasing participation of women more generally. Each generation of women participates in the labour force at a greater rate than the previous generation of women did at the same age.

There is a connection here with the increase in health and education employment I mentioned earlier. Better healthcare outcomes means that fewer people retire early because of ill-health, so participation rises. More extensive childcare options make it easier for both parents to be in paid work. Given the usual presumptions in our society about who has primary responsibility for caring for children, this shift affects participation of women more than that of men. So it's no surprise that the participation rates of women aged 35-44 have also been rising strongly. And more flexible work arrangements tend to encourage participation by both female and older workers.

In the end, though, lifting participation is a once-off adjustment. Once someone enters the workforce, they can't enter it a second time without leaving first. Greater participation raises the level of living standards but it isn't an engine of ongoing growth. We must also remember that the objective is not that everyone must be in paid employment. Many people are outside the labour force for good reasons, for example because they are in full-time education, caring for children or other relatives, or doing volunteer work by choice.

Productivity and innovation

That leaves us with productivity, arguably the most important of three Ps, but unfortunately also the hardest to measure. It is also an area where distributions and firm-specific decisions really matter. Some recent international evidence shows that the firms at the global productivity frontier can be several times more productive than the average firm in their industry (Andrews, Criscuolo and Gal 2015).6 This research also finds that firms tend to adopt a new technology only after the leading firms in their own country have adopted it. That is, the national productivity frontier first has to catch up to the global frontier, by adapting the new technology to local conditions. So the average productivity of firms in an economy depends on three things.

- How quickly the leading firms in that country adopt the technology and match the productivity levels of the globally leading firms in that industry.

- How large the leading firms are in the national economy.

- How quickly the laggard firms can catch up, once the national leading firms have adopted a particular technology.

The findings of this research suggest that this last factor - the rate of technology adoption - has slowed down since the turn of the century.

The policy implications of these findings are subtle, and depend on whether you want to affect firms near the frontier, or the firms that are lagging far behind. For example, a more flexible labour market might make it easier for the leading firms to grow faster. Average productivity would rise because those leading firms account for a greater share of output. But then you would have an economy dominated by 'superstar firms' (Autor et al 2017). The implications of that are not necessarily benign. For a start, inequality could be greater. Median living standards might not rise.

The drivers of innovation, like the drivers of creativity more generally, are hard to pin down. But the literature does provide some pointers to them. First and perhaps most important is simply to grow: growth is more conducive to innovation than recession is. Recessions do not engender 'creative destruction'; they produce liquidations, which are destructive destruction (Caballero and Hammour 2017). Indeed, when labour is plentiful, there is not much incentive to invest in productivity-boosting technology. And when everyone's sales are weak, there is not much incentive to invest to try to increase them. There is nothing quite like a tight labour market to make firms think about how to do things more efficiently.

The pressures of strong sales or competition might spur innovation, but many other factors enable it. Infrastructure is a key enabler not only of productivity growth of existing firms, but whole new business opportunities. Often we think of communications infrastructure and the internet in this context. Transport infrastructure is at least as important, I would argue, which makes the current pipeline of public investment even more relevant to future growth outcomes. That's because online commerce still needs good physical logistics. Unless it's a purely digital product, something still needs to be delivered. Australia is a highly urbanised country, but it is also a highly suburbanised country. Improving urban transport infrastructure, as well as inter-urban transport infrastructure, could help boost productivity across a range of both traditional and new industries.

Also important is the political and regulatory environment. It would not surprise Stan and Bert Kelly that much of the literature finds that product market regulation and other devices protecting laggard firms tend to retard innovation. More generally, barriers to entry make it harder for new, potentially more innovative firms to break in.

It isn't all about the start-ups, though. A lot depends on the propensity of existing firms to adopt new technologies and business practices. We think that this is one of the reasons for the slow rate of growth in retail prices in Australia at present. In the face of increased competition, incumbent retailers are having to both compress margins and use technology to become more efficient. Our liaison contacts tell us that they are investing heavily in better inventory management and other cost-saving measures, often by using data analysis more extensively.

Adopting these innovations takes time, because firms have to become familiar with the new technologies and change their business practices to take advantage of them. It wouldn't be the first time that the computers - or perhaps this time, the machine learning algorithms - were visible everywhere except in the productivity statistics for just this reason.7

Adopting new technologies and business models also requires a willingness to change. Just as views to protection can change, so can society's attitudes to risk, innovation and, thus, entrepreneurship. We saw, after all, that Australia's economic culture could shift from being inward-looking to outward-looking over the course of a couple of decades.

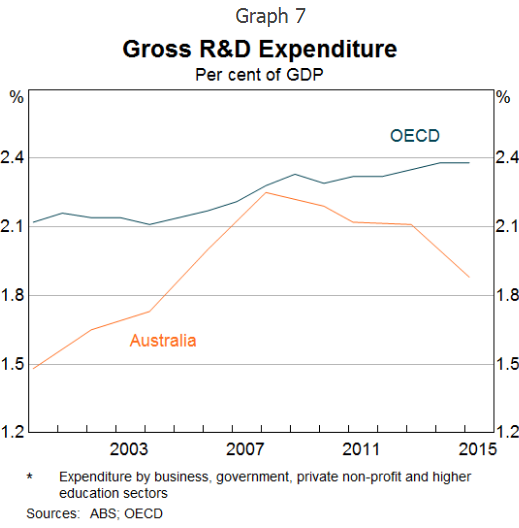

Australia is normally seen as being a relatively fast adopter of technology. But there are some aspects where we seem to lag. One is R&D expenditure (Graph 7). While this isn't greatly below the average of industrialised countries and many similar countries get by perfectly well doing much less, it has been declining in importance lately. Some other indicators also suggest that Australian firms have in recent years been less likely to adopt innovative technologies than their peers abroad. For example, while small firms are holding their own, large firms in Australia are less likely to use cloud computing services than large firms in many other countries.8 This wasn't always the case: a decade and a half ago, Australian firms were towards the front of the curve in adopting the e-commerce technologies that were new at the time (Macfarlane 2000). A lot depends on whether the workforce has the skills to use these new technologies, but at heart, technology adoption is a business decision.

Parting remarks

In conclusion, I think both Kellys would be pleased to see how the Australian economy evolved. The Australia of today is less inward-looking and more flexible in the face of the considerable shocks that can occur. Removing the tariff wall and the associated regulatory restrictions has enabled higher living standards and made the economy more resilient. As a nation, we are better off for that.

There are challenges for any small, open economy. Around the world, the policy conversation is turning to issues of inequality and inclusion. And rightly so: liberalisation and reform are not ends in themselves. The focus must be on the end goal, the welfare of the population. If a specific reform doesn't deliver that, it ought to be modified, whether through explicit safety nets or other means.

In the end, the Kellys were right. 'Protection all round' hurt more than it helped. And it left a legacy of disbelief in our own competitiveness. This is, I think, part of the reason why people search for 'engines of growth'. That older era left an ingrained doubt that Australia can become more prosperous without identifiable external triggers. I believe that it can, and that it will do so through continual innovation and productivity growth spurred by ongoing growth and competition.

So next time somebody asks you 'where's the growth going to come from?', you can answer: 'from all of us, trying new things, and gradually getting a bit better at what we do.' We don't need to wait for something external to make it happen.

Thank you for your time.

Bibliography

Andrews D, C Criscuolo and PN Gal (2015), 'Frontier Forms, technology diffusion and public policy: Micro evidence from OECD economies', OECD: The Future of Productivity: Main Background Papers.

Autor D, D Dorn, LF Katz, C Patterson and J Van Reenan (2017), 'The Fall of the Labor Share and the Rise of Superstar Firms', NBER Working Paper 23396.

Banks G (2013), 'Return of the Rent-Seeking Society?', Stan Kelly Lecture, Melbourne, 15 August. Available at .

Caballero RJ and ML Hammour (2017), 'The Cost of Recessions Revisited: A Reverse-Liquidationist View', Review of Economic Studies, 72(1), pp 313-341.

Fujita M and J-F Thisse (2002), Economics of Agglomeration, Cambridge University Press, Cambridge.

Fujita M, P Krugman and AJ Venables (1999), The Spatial Economy, The MIT Press, Cambridge, MA.

Hughes B (1980), Exit full employment, Angus & Robertson, London ; Sydney.

Lowe P (2014), 'Demographics, Productivity and Innovation', Speech to the Sydney Institute, Sydney, 12 March.

Macfarlane IJ (2000), 'Talk to World Economic Forum Asia Pacific Economic Summit', World Economic Forum Asia Pacific Economic Summit, Melbourne, 11 September.

Magud N and S Sosa (2010), 'When and Why Worry About Real Exchange Rate Appreciation? The Missing Link between Dutch Disease and Growth', IMF Working Paper Series WP/10/271.

Menzies G and G Heenan (1993), 'Explaining the Recent Performance of Australia's Manufactured Exports', RBA Research Discussion Paper No 9310.

Productivity Commission (2017), Shifting the Dial: 5 Year Productivity Review, Report No. 84, Canberra.

Quesnay F (1759), Tableau économique, Reprint, 3rd Edition, Macmillan, 1972, London.

Smith A (1776), An Inquiry into the Nature and Causes of the Wealth of Nations, Straham and Cadell.

Solow RM (1987), 'We'd Better Watch Out', New York Book Review, p 36.

Stone J (1981), 'Australia in a Competitive World: Some More Options', Stan Kelly Lecture, Melbourne, 16 November. Available at .

van der Ploeg F (2011), 'Natural Resources: Curse or Blessing?', Journal of Economic Literature, 49(2), pp 366-420.

1 These figures are actually for the 1959/60 financial year, the first year for which Australia has quarterly national accounts comparable to current data.

2 The share has fallen more noticeably since the peak if the calculation is expressed as current values of manufacturing exports as a share of nominal GDP, but this is affected by the cycle in the terms of trade.

3 The physiocrats believed that wealth was derived from agriculture. For example, Quesnay (1759) described how the economy functions, deriving wealth only from agriculture. See also Hughes (1980) for a discussion.

4 The Productivity Commission also replaced the Bureau of Industry Economics and the Economic Planning Advisory Commission. Its first chair, Gary Banks, delivered the Stan Kelly Lecture in 2013 (Banks 2013).

5 It would increase the living standards of migrants if they came from a country with lower average living standards than Australia's.

6 Unfortunately this study does not include Australia.

7 Apologies to Robert Solow. See Solow (1987).

8 This information comes from the OECD database on technology access and usage by businesses, .