Philip R Lane: Tracker mortgage related issues, motor insurance market reform, and Brexit

Introductory statement by Mr Philip R Lane, Governor of the Central Bank of Ireland, at the Joint Committee on Finance, Public Expenditure and Reform, and Taoiseach, Dublin, 19 October 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Chairman, Committee members, I welcome the opportunity to appear before you today. In my introductory statement, I will focus on how our mission to safeguard stability and protect consumers is demonstrated through our work on: the Tracker Mortgage Examination; Brexit; the banking sector; the insurance sector; and the macroprudential mortgage measures.

I am joined by: Sharon Donnery, the Deputy Governor for Central Banking; Ed Sibley, the Deputy Governor for Prudential Regulation; and Derville Rowland, the Director General for Financial Conduct. Ed and Derville were appointed to these positions in recent weeks following the reorganisation of the Bank's financial regulation functions into prudential regulation and financial conduct pillars.

Ed is now responsible for the supervision of credit institutions, banks and credit unions, insurers and the asset management industry. He represents the Central Bank at the Supervisory Board of the European Central Bank under the Single Supervisory Mechanism (SSM) and the Boards of the European Banking Authority (EBA) and the European Insurance and Occupational Pensions Authority (EIOPA). Overseeing the financial conduct pillar, Derville is responsible for the financial conduct of firms in relation to their customers and clients. This encompasses consumer protection, securities and markets supervision and enforcement. Derville is a member of the Board of Supervisors of the European Securities and Markets Authority (ESMA).

This reorganisation of our financial regulation structures is in response to the expansion of our mandate in recent years and the evolution of the European System of Financial Supervision (ESFS), including the centralisation of prudential supervision of systemically-important banks under the SSM of the ECB. It also implements a dual regulatory approach that ensures the Central Bank is set up to deliver its mandate in relation to both prudential regulation and financial conduct regulation.

***

The Central Bank and Consumer Protection

The Central Bank's vision is for a well-functioning, well-managed and well-regulated financial services system that safeguards stability and protects consumers. This can be best delivered by a strong culture of compliance, with firms and individuals within firms acting in the best interests of customers. However, this needs to be reinforced by comprehensive and enforceable legislation, intrusive risk-based supervision, a credible threat of enforcement and powers of redress when consumers have suffered detriment.

As harshly illustrated by the financial crisis, a fundamental protection for consumers lies in ensuring that the financial system is stable and that individual financial firms are subject to prudential regulations that require firms to be sound and solvent - that is, to maintain substantial capital and liquidity buffers to guard against risks. Our oversight of the system includes the authorisation of firms, a fitness and probity regime and other governance-related requirements. It also includes a regime to manage the resolution or closure of firms in the event of failure. Finally, our macroprudential measures seek to build resilience across the financial system. For instance, our macroprudential mortgage measures set limits on mortgage loans to guard against over-lending and over-borrowing.

The Central Bank works with other state bodies - including the Competition and Consumer Protection Commission (CCPC) and the Financial Services Ombudsman (FSO) - to form the national consumer protection framework, and participates actively in European and international bodies that also work to safeguard the interests of consumers.

Our role as the national resolution authority also contributes to both our stability and consumer protection mandates. The Central Bank is responsible for the orderly resolution of failing credit institutions, credit unions and certain investment firms. In that respect, members will be aware of the recent appointment of provisional liquidators to Charleville Credit Union. We took this action to protect the savings of members, which are underpinned by the Deposit Guarantee Scheme. The Central Bank is conscious that there is a demand for the services of a credit union in the local area and is committed to ensuring credit union services are available in the community.

The Tracker Examination

I will now turn to the Tracker Examination.

This Examination is focused on ensuring that lenders provide fair outcomes for all borrowers damaged by unacceptable failings in the handling of tracker mortgages, which has caused considerable suffering for many of those affected.

It is clear that all lenders did not sufficiently recognise or address the scale of those unacceptable failings until Central Bank intervention. We have had to repeatedly challenge certain lenders and push to the limits of our powers in order to drive them to identify and remedy affected customers in an appropriate manner.

This is a principal reason why the Examination has required significant time to progress. If certain lenders had conducted their reviews in line with the requirements of the Framework and offered better initial proposals in respect of redress and compensation, the Examination would be at a more advanced stage.

We recognise the hurt and damage the actions of lenders have caused for many borrowers. This is evident in the calls we receive to our helpline and the powerful testimony from the individual borrowers that appeared before this Committee last week. As I will outline, we are pushing the limits of our powers to ensure affected customers are remedied appropriately.

The Examination is the largest, most complex and significant conduct review that we have undertaken to date in the context of our consumer protection mandate. Unusually for a live supervisory investigation, we publish regular updates on the Examination as our work progresses, precisely because we realise affected customers need information. Earlier this week, we published the latest such update, which was provided to the Committee.

We have also set out principles for lenders to pay appropriate redress and compensation to affected customers, commensurate with the consumer detriment. Among other important aspects, the principles provide for an up-front payment to enable borrowers to take independent advice regarding the redress and compensation offers made to them. The appeals process ensures that customers have the option to challenge any aspect of the redress and compensation. Customers can accept the redress and compensation offered and still make an appeal, since their offer cannot be reduced by virtue of lodging such an appeal. In addition, customers have the option of bringing a complaint to the FSO or initiating court proceedings.

The Examination is being conducted in phases. Phase 2 required lenders to conduct a review of their mortgage loan books, identify affected customers, as well as those deemed to have been in-scope but not impacted, and submit a report of their findings. All relevant lenders have provided Phase 2 Reports to the Central Bank.

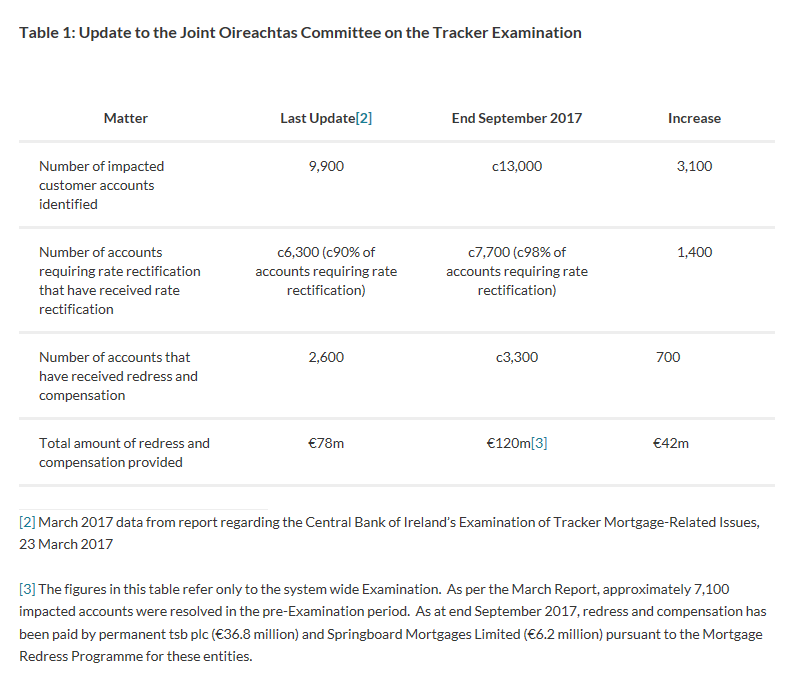

As our latest update shows, by the end of September, lenders had identified approximately 13,000 affected accounts. Approximately 60 percent of these cases arise as a result of customers not receiving a tracker product, and the balance relates to customers not receiving the correct tracker margin. As of end-September, lenders have rectified the interest rates applied to approximately 7,700 affected accounts. This represents 98 percent of customers identified by lenders as requiring rate rectification.

Lenders are required to categorise affected customers by reference to the type and level of detriment suffered. The types of loss identified range from overcharging as a result of the application of incorrect interest rates up to loss of ownership of mortgaged properties. Where home or property loss has occurred, a lender is further required to conduct a causation analysis to determine whether loss of ownership resulted from its failings.

To date, lenders have reported that as a result of their failings, loss of ownership has occurred in respect of 23 homes and 79 buy to let properties. As these analyses by lenders continue, we anticipate that more such cases of home and property loss will be identified.

Similarly, as the overall reviews by lenders are subject to ongoing assurance work and challenge by the Central Bank, it is possible that more accounts may be identified as the Examination progresses. We will publish a further update in early 2018.

Our assurance work involves challenging the findings of the reviews by each lender through on-site inspections, reviewing materials and meeting with the directors of these banks. We also receive information from customers which has informed our approach and focus in particular institutions.

While assurance work is ongoing in a number of lenders, the Central Bank is concerned from the assurance work completed to date that two lenders may have failed to identify populations of impacted customers or failed to recognise that certain groups of their customers have been affected by their failures. We are of the view that some of these customers have in fact been affected and, accordingly, are entitled to redress and compensation. We have challenged the two lenders on these issues and they will report back to us by end-October.

As the Central Bank progresses this work, other lenders will be similarly challenged. Where we believe there are customers who may have been wrongly excluded by lenders, we will require the lenders to inform these customers of their decision and customers' recourse options, using statutory powers as appropriate.

The Framework has been designed so that the phases of the Examination can run concurrently within a lender and at different times across lenders, meaning that Phases 3 and 4 (the calculation and payment, respectively, of redress and compensation) can commence while assurance work continues.

Tracker Redress and Compensation

While the Central Bank does not have the statutory power to compel lenders to implement redress and compensation in respect of failures that occurred prior to 1 August 2013, we have made our expectations very clear to lenders and published "Principles for Redress" so that people are aware of what is expected of their lender.

However, initial proposals from certain lenders fell materially short of the Central Bank's expectations. Examples of material deficiencies included:

- Failing to offer compensation for certain impacted cohorts of customers;

- Unacceptably low offers of compensation;

- Unacceptably low payments for independent advice; and

- Failing to acknowledge certain types of detriment sustained by customers, for compensation purposes, including customers that switched lenders as a result of being on the incorrect interest rate.

As a result of our repeated challenges, lenders have significantly improved their redress and compensation proposals and their appeals processes.

To end September 2017, €120 million has been paid in redress and compensation under the Examination. This is in addition to redress and compensation provided by permanent tsb plc (€36.8 million) and Springboard Mortgages Limited (€6.2 million) pursuant to their Mortgage Redress Programme (MRP) which was required by the Central Bank and which predated the Examination.

We expect all relevant lenders to have commenced redress and compensation by the end of 2017. In the meantime, our work continues. We are also liaising with other state agencies, including the CCPC, the FSO, and an Garda Síochána.

Finally, we have two enforcement cases open, two more are in train, and I expect more to follow. We will continue to provide updates to the public on our Examination and enforcement actions as this work continues.

***

Macroeconomic Outlook

I will now turn to some of the other matters you wish to discuss with us today, beginning with the overall economic outlook.

The Irish economy continues to expand at a solid pace with underlying growth in a range of 4 to 5 percent supported by strong activity in the domestic economy and a pronounced pick-up in external markets, particularly in the Euro area.

Broad-based growth in employment has underpinned the recovery, which has helped incomes recover and supported solid growth in consumer spending, while domestic investment has also gained traction.

Looking ahead, the outlook is favourable, although external uncertainty persists. In terms of the downside risks, Ireland is especially exposed as a small, highly open economy to international shocks. In addition, the legacy of high public and private debt means that Ireland is vulnerable to shifts in funding conditions. Disorderly versions of Brexit and changes to global trading conditions would disproportionately affect Ireland relative to other European economies.

From a macroeconomic perspective, the weaker Sterling exchange rate has affected the consumer price level in Ireland, reflecting the heavy concentration of UK-sourced goods in the goods component of the Irish consumption basket. Since the Brexit vote, the value of the euro has risen by almost 17 per cent against Sterling, and Sterling weakness has mapped into a substantial downward shift in the prices of consumer goods in Ireland.

While Sterling depreciation also adversely affects the earnings of exporters to the UK, export volumes to the UK remain robust, including for the food sector.

Brexit: Regulated Firms

Ensuring that all firms with UK exposures are planning effectively for Brexit risk remains a key continuing focus for the Central Bank. In this regard, it is important to note that we are now just 18 months away from the end of the Article 50 period. We expect regulated financial firms with UK-related business to have well-developed plans in place for dealing with all possible outcomes, including the risks of a hard Brexit. This should include a clear focus on any implications for their customers and clients.

The relocation of the EU activities of UK-based firms continues to be a focus for the Central Bank and we are committed to providing transparent, consistent and predictable regulatory decisions. The importance of European regulatory convergence in handling Brexit means that the Central Bank has been proactively engaged in the work of the European authorities via the European System of Financial Supervision. The ECB, ESMA, EIOPA and the EBA have all issued important guidance or opinions. This is consistent with our overall approach of operating in line with, and influencing, European standards.

As I have said before, the Brexit-driven relocation decisions of firms should not be driven by regulatory differences but by non-regulatory factors which differ across the various candidate locations.

Update on the Banking Sector

In relation to the banking sector, we observe no Brexit-related deterioration in asset quality among the Irish retail banks now prudentially supervised by the SSM of the ECB. These institutions have made satisfactory progress with respect to assessing their exposures and have implemented processes within their frameworks to ensure that Brexit-related risks are factored into assessments and inform decisions.

A well-functioning banking system is important to ensure it can support the economy, consumers and businesses. The continuing growth of the economy has provided a positive operating environment for the Irish retail banking sector, a prerequisite for competitive and effective banking services. Broadly, the recovery in the sector is continuing as banks continue to repair their balance sheets. The sustainability of bank business models, however, remains the main strategic risk for some institutions and a focus of supervisory work. Balance sheets continued to decline during the first half of 2017 and cost challenges remain a significant concern for bank operating models. Yields on the bonds issued by Irish banks have declined but remain at elevated levels compared with EU peers.

At end-June 2017, the non-performing loans (NPLs) of Irish retail banks stood at €35.8 billion, equivalent to an NPL ratio of 16.1 percent. NPLs, however, have declined for fourteen consecutive quarters, representing a 58 percent reduction from the Q4 2013 peak, or a decrease of €50 billion in gross exposures. Looking ahead, more NPL reductions are expected through further restructuring, recoveries, and loan portfolio disposals.

From a policy perspective, the recently published SSM public consultation for the minimum level of prudential provisions for NPLs is an example of the European-wide action in this critical area. Put simply, where new NPLs arise in the future, banks will have to provision fully for them over a set period, subject to a comply-or-explain mechanism.

NPLs cause considerable distress for borrowers but also require strategies from banks to manage these with their borrowers. Our focus remains the execution of an effective and sustainable NPL reduction strategy for each bank that ensures fair treatment of consumers and SME borrowers. The Code of Conduct for Mortgage Arrears (CCMA) sets out how lenders must treat borrowers in (or facing) mortgage arrears, with the objective at all times of providing sustainable solutions that assist the borrower to meet mortgage obligations.

The number of mortgage accounts for principal dwelling houses (PDH) in arrears fell further in the second quarter of 2017, the sixteenth consecutive quarter of decline. The number of PDH mortgage accounts classified as restructured at end-June was 120,398. Of these restructured accounts, 87 per cent were deemed to be meeting the terms of their current restructure arrangement. Similarly, regulations on SME lending have been strengthened to provide greater protections to firms in financial difficulties.

Concerns have arisen about sales of loans to international funds and non-banking entities. It is important to recognise that the CCMA applies to the entities which service the loans, so when loans are sold from a bank to a non-bank financial institution, the protection of the CCMA still applies. This also means that a borrower who has an individual complaint can access the FSO and that the Central Bank has oversight of the conduct of these firms in relation to distressed mortgage holders.

Turning to interest rates charged, for outstanding Primary Dwelling Home (PDH) loans, the average interest rates on variable rate (aggregating across standard and LTV-adjusted variable rates) and tracker loans were 3.78 percent and 1.04 percent respectively in Q2 2017. These rates were 13 points lower and 3 basis points higher respectively compared with one year earlier. The average standard or LTV variable rate for new PDH lending stood at 3.34 percent in Q2 2017, while the average rate on fixed rate loans of 1 to 3 years stood at 3.24 percent. These rates were 23 and 30 basis points lower respectively from one year earlier. First time buyers (FTBs) continue to account for roughly half of all approvals and drawdowns.

Within those averages, there is evidence that competition amongst domestic banks in the mortgage market is increasing. Certain lenders are now providing interest rates below 3 percent under particular terms and conditions, such as qualifying loan-to-value ratio. To further assist consumers, the Central Bank has published a consultation proposing additional measures to facilitate mortgage switching. The consultation period is open until 1 November.

***

Insurance Sector

Turning to insurance, the Central Bank also has a dual mandate regarding the insurance industry. It is responsible for the prudential supervision of Irish authorised insurance undertakings; and for the supervision of conduct of business for all insurers operating in Ireland, including those doing so on the basis of an authorisation in another EU Member State. Both aspects of our mandate are fundamental to the protection of consumers.

Prudential supervision seeks to ensure that insurance undertakings remain solvent and are able to pay claims as they fall due. The solvency requirements that insurers must meet in order to ensure they can meet their obligations to policyholders are enshrined in the EU regulatory framework for insurance, the Solvency II Directive. Where insurance undertakings are subsidiaries of an EU or international group, prudential supervision is carried out where the subsidiary is located with co-operation through colleges of supervisors each chaired by the supervisory authority of the group. Where an insurer authorised in another Member State operates in Ireland through a branch or under the freedom to provide services provisions, commonly referred to as "passporting", prudential supervision is the responsibility of the supervisory authority of the Member State which authorised the insurer. However, where an insurer offers its products to Irish consumers, it is subject to the consumer protection regulatory framework in Ireland

Cost of Insurance

Recognising that there are many factors influencing the price and availability of insurance, the Department of Finance is leading a wide-ranging "Insurance Policy Review", the first phase of which concluded with a report which issued in January this year. This report complements the Finance Committee's own report on the issue.

The Central Bank is a member of the Cost of Insurance Working Group, which is carrying out this ongoing review. Concerning the recommendations on the cost of motor insurance, we are currently working to implement the recommendations that fall within our remit. Legislation is being prepared to establish a National Claims Information Database to be run by the Central Bank. We are assisting the Department of Finance in its development of this legislation. We will also be issuing a public consultation shortly on the extension of notice periods and information which must be provided by insurers to policy holders regarding renewal of policies. We remain committed to implementing the recommendations in the Report, working with stakeholders in keeping with our mandate.

It should be noted that in the area of the pricing of insurance, the Central Bank, in common with other EU supervisors, does not have a role in setting or capping premiums or renewal rates and is prohibited from doing so by EU law, specifically Article 181 of the Solvency II Directive.

***

Macroprudential Measures

Finally, the Central Bank's role as Ireland's national macroprudential authority provides a further example of where our financial stability, prudential and consumer protection mandates intersect. Macroprudential policies are directed at limiting systemic financial risks, both through additional capital buffers for banks and borrower-based measures.

We view our mortgage measures that put ceilings on loan-to-income (LTI) and loan-to-value (LTV) ratios as essential to enhance the resilience of both borrowers and banks. The LTI rule is intended to ensure that mortgage debt is not too high relative to a household's income level, reducing the risks associated with excessive debt burdens. The LTV rule provides a buffer in the event of a future downturn in house prices.

Our commitment to an annual review process ensures that a rigorous evaluation of the mortgage measures is conducted each year. Our review is under way and the outcome will be published in November.

Conclusion

In closing, let me assure the Committee that the Central Bank is fully committed to all elements of our mandate as legislated for by the Oireachtas.

In relation to those who are affected by the tracker mortgage issue, we continue to work to the limits of our powers and with other agencies to ensure that lenders treat their customers fairly in resolving these issues and all avenues for redress and compensation are utilised.

We welcome your questions.