Claudia Buch: How can we protect economies from financial crises?

Statement by Prof Claudia Buch, Deputy President of the Deutsche Bundesbank, for a panel debate at the Rencontres Economiques d'Aix-en-Provence "In search of new forms of prosperity", Aix-en-Provence, 8 July 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

These remarks have been prepared for a panel debate at the Rencontres Economiques d'Aix-en-Provence, July 7-9, 2017, Session 19. I would like to thank Steffen Günther, Marcus John, Katharina Knoll, Sophia List, Frieder Mokinski, Jens Reich, Marc Rennert, Christoph Weißermel, and Melanie Wulff for their most helpful contributions to an earlier draft. Any errors are my own.

Financial crises are costly - output and financial wealth are lost, unemployment increases, and social gaps widen. The costs may be prolonged, and they may become chronic. The global financial crisis that began ten years ago with the liquidity squeeze on global financial markets in August 2007 is still casting long shadows.

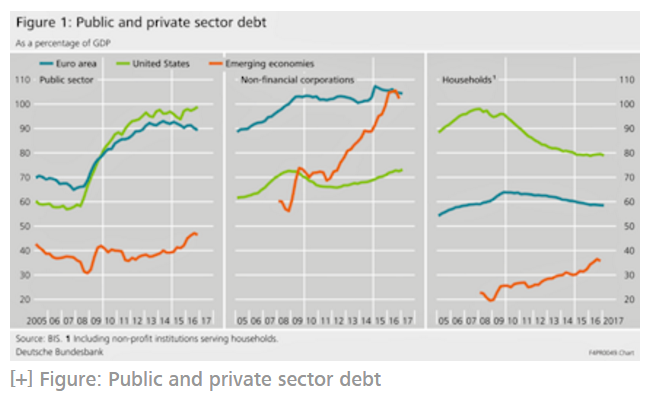

Global debt levels remain elevated. Debt levels of the non-financial sector relative to GDP stood at 220% by the end of 2016 compared with 179% a decade earlier (BIS 2017).1 In the aftermath of the financial crisis, risks were shifted from the private to the public sector (Figure 1). In the euro area, government debt due to the support for financial institutions went up by €488 billion, or 4.5% of GDP, between 2007 and 2016 (Eurostat2017a). Today, in the euro area, government debt relative to GDPis about 24 percentage points higher than it was prior to the crisis (Eurostat 2017b).

The global financial crisis has had a significant impact on economic growth and unemployment. The estimated median loss varies between 4% and 9 % (Ball 2014, Mourougane 2017, Ollivaud and Turner 2014). Such output losses have also had social consequences. In the euro area, the unemployment rate went up from 9.2% in 2005 to 11.2% in 2015 (Eurostat 2017c).

Answering the question of how economies can be protected from financial crisis is thus a key challenge for policymakers. Complete "protection" against fluctuations on financial markets is not possible and would impair critical functions of markets in terms of the allocation of resources. But reducing excessive risk-taking, making crises less likely and reducing their costs should be the ambition of policymakers. In this note, I want to highlight three elements of a strategy for making future progress.

First, agreed financial sector reforms need to be implemented. Enhancing the resilience of the financial system and improving buffers against unexpected shocks has been a key goal of post-crisis financial sector reforms. High levels of debt can increase the fragility of finance, make financial crisis more likely, and be an impediment to growth. In response to the global financial crisis, governments have thus set out to tackle the underlying causes of the kind of financial distress that can seriously harm the economy. Regulations have been amended in order to strengthen the financial system's capacity to buffer shocks and to promote strong, sustainable, balanced, and inclusive growth.

Second, complementary reforms can make the reform agenda fully effective. In Europe, the Capital Markets Union is such a complementary project. Implementing the Capital Markets Union can represent a major step forward towards achieving a more resilient financial system and putting in place improved mechanisms of cross-border risk sharing in Europe.

Third, effects of post-crisis reforms need to be evaluated. Full implementation of post-crisis financial sector reforms should be followed by a structured evaluation of the effects of reforms. A structured evaluation is needed in order to assess the impact and the effectiveness of the reforms implemented and to study potential unintended consequences.

1. What are the drivers and costs of financial crises?

Financial crises have been a recurrent theme in economic history. Reinhart and Rogoff (2008b) have put together a large historical database covering eight centuries and 66 countries in Africa, Asia, Europe, Latin America, North America, and Oceania. These countries represent about 90% of world GDP. The database comprises information on a large set of economic indicators as well as indicators of crisis episodes (0/1 indicators), including external and domestic defaults, banking crises, currency crashes, and inflation outbursts. Analysing these data, the authors conclude:

"Capital flow/default cycles have been around since at least 1800 - if not before. Technology has changed, the height of humans has changed, and fashions have changed. Yet the ability of governments and investors to delude themselves, giving rise to periodic bouts of euphoria that usually end in tears, seems to have remained a constant" (Reinhardt and Rogoff 2008b, p. 53).

While fluctuations on financial markets are part of regular market processes, making crises less likely and less costly should be a key goal of economic policy. After the crisis, macroprudential policy has thus become established as a new policy area. A stable financial system fulfils its core macroeconomic functions smoothly and at all times. These functions include the efficient allocation of financial resources, the provision of risk-sharing mechanisms, and the provision of an efficient and secure financial infrastructure, including the payments system.

Yet, financial stability can be threatened if the distress of one institution or a group of financial institutions can "infect" the entire system. Channels of infection can be direct contagion through financial linkages or indirect contagion through asymmetries of information, panics, or fire sales. Through such channels, decisions by individual market participants can have external effects on the functioning of the financial system. Such "externalities" are all the greater, depending on how pronounced the risk-taking incentives are, how high the leverage of individual market participants is, how large the institutions are ("too big to fail"), how connected they are ("too connected to fail"), and how high common exposures to similar risks are ("too many to fail"). The real economy can be affected through a credit crunch when banks are forced to reduce their lending activities in response to the crisis (Brunnermeier 2009, Brunnermeier and Oehmke 2013).

One key factor that affects the stability of the financial system is the structure of finance (Bernanke, Gertler andGilchrist 1996; Gambacorta, Yang, and Tsatsaronis 2014). The larger the share of debt finance is, the larger the "financial accelerator" effects can be - seemingly small shocks can then have large and systemic implications. Economic fluctuations may become magnified and threaten the stability of the entire financial system. The channel of transmission between debt and output fluctuations can run through consumption or investment (Cecchetti, Mohanty, and Zampolli 2011, Sutherland and Hoeller 2012):

- High levels of household debt can affect the stability of the real economy through the adjustment of consumption. Evidence for the United States shows that, during the crisis, households with high levels of real estate debt cut down consumption in response to shocks to asset prices, thus amplifying the cycle (King 1994; Mian and Sufi 2014, Jordà, Schularick and Taylor 2015; Mian, Sufi and Verner forthcoming). Similar effects have been documented for other countries: The loss in consumption during the financial crisis was particularly severe in economies that experienced a large run-up of household debt prior to the crisis. And these same countries experienced the fastest increases in house prices in the pre-crisis period (Glick and Lansing 2010, Leigh et al. 2012).

- High levels of debt may also impair the ability of firms to smooth employment and investment when an adverse shock hits. High leverage has, for example, been shown to have negative effects on the performance of firms as a consequence of industry downturns (González 2013).

- High levels of public sector debt can be destabilising. Strained government finances may, for example, weaken the ability to ensure financial stability (Das et al. 2010, Davies and Ng 2011). Furthermore, high levels of public sector debt may amplify under some conditions the effects of cyclical shocks due to raising sovereign risk (Corsetti et al. 2013).

- Given the importance of the banking sector for the allocation of resources across all sectors of the economy, excessive leverage in the financial sector can be particularly harmful for the real economy. An insufficiently capitalised financial sector or banking system is thus a threat to financial stability. Adverse shocks can then set in motion a downward spiral of asset valuations and prices that ultimately threatens the solvency of financial institutions.

The destabilising effects of debt arise from its contractual features. Standard debt contracts are insensitive to the borrower's situation. An adjustment to idiosyncratic shocks can occur only through new lending or through haircuts on existing loans after risks have materialised. In contrast, the value of equity adjusts if the borrower's situation changes. In this sense, equity provides an ex ante risk-sharing mechanism. In other words, equity as a claim on real assets has stabilising features compared with debt as a claim on nominal assets.

Empirical studies do indeed show that excessive private (and public) sector indebtedness, asset price misalignments, international linkages of banks, and high external imbalances are drivers of financial crisis (Borio and Drehmann 2009). Furthermore, banking crises have often been preceded by real estate price booms (Reinhart and Rogoff 2008a, 2008b). This was the case in the 2008 global financial crisis, but it is also true of earlier crises in the 1970s to 1990s in, for example, Spain, Sweden, Norway, and Finland. Asset price booms are particularly harmful if they are debt-financed (Jordà, Schularick and Taylor 2015). Consequently, measures of private sector indebtedness, such as credit relative to GDP, have been identified as predictors of banking crises (Detken et al. 2014, Drehmann and Juselius 2014, Laeven and Valencia 2012). Moreover, asset price booms may be fuelled by increasing capital inflows from abroad with the potential for severe negative consequences when these capital flows stop (Kaminsky and Reinhart 1999).

2. Financial sector reforms - where do we stand?

In response to the crisis, the G20 countries have agreed on a large set of financial sector reforms with four core areas:

- building resilient financial institutions

- ending too-big-to-fail

- making derivatives markets safer, and

- transforming shadow banking into resilient market-based finance.

Progress in the implementation of reforms has been steady but uneven across the core areas of reforms. Several reforms of the Basel III package still need to be fully implemented, more work is required to improve the framework for the resolution of global systemically important banks, implementation of over-the-counter derivative reforms has progressed relatively far, and the implementation of reforms in the regulation and oversight of shadow banks is still at an early stage (Financial Stability Board 2016).

2.1 From implementation to evaluation

Many of the reforms have ventured into uncharted territory. Assessing the effects of financial sector reforms in a structured way is thus crucial. Evaluation of reforms needs to take into account how the macroeconomic environment has changed, what the short- and the long-term effects of reforms are, and how reform effects differ across countries.

One key challenge for evaluation is that many of the costs of financial reforms borne by financial participants - such as enhanced reporting costs - tend to be felt immediately and are often observable. The benefits to broader society, in contrast, can be reaped only over the longer term and are difficult to quantify: What is the probability that financial crises will occur in the future? And how devastating would their effects be? Addressing such questions, let alone providing quantitative answers to them, poses a number of challenges. Also, resources that are needed for policy evaluation. Evaluations require good data and the labour input of skilled individuals to perform them.

Facing up to such challenges is unavoidable if the effects of reforms are to be understood. A structured evaluation process is critical to managing them. Policy evaluation means being transparent about what policy was intended to do in the first place and what it has achieved.

Policy evaluations follow procedures that have many similarities with drug tests in medical science. "What are the effects of regulations on the stability of the financial system?" is like asking "How does this drug affect the patient's health?" In either case, the purpose of the question is to find out whether the treatment cures the disease - or merely alleviates the symptoms. Besides this, potential side effects can be revealed. A structured evaluation framework allows disentangling the many different factors that may have affected the "patient".

Good evaluations provide answers to three questions:

Did the reform "cause" an outcome? Much has changed since the crisis: the competitive environment in which banks find themselves has changed, economic recovery has been slow, and other policies areas such as monetary policy have responded as well. Thus, even in the absence of regulatory reforms, banks would be in a different situation now than before the crisis.

Have the reforms had similar effects across markets or jurisdictions? Lessons learned from one market or country may not apply to another. In some countries, (non-financial) firms finance the bulk of their investments through capital and debt markets, in others, they rely more heavily on bank credit. Legal and institutional settings differ across countries. Such differences need to be taken into account.

Have the reforms achieved their overall objectives? Ultimately, one needs to look at the benefits of reforms to society as a whole. Disentangling the costs and benefits of regulation is the crucial point of any evaluation. Financial reforms generate direct compliance costs for market participants, such as the costs of reporting requirements, and these costs tend to be recognised immediately. The benefits of a more stable and resilient financial system, by contrast, can be reaped only over the longer term and are more difficult to quantify.

Direct costs of compliance need to be distinguished from the costs of crises that are borne by market participants. The bailout of banks during the crisis shifted private costs to taxpayers and raised levels of public debt worldwide. Reforms thus seek to realign incentives by withdrawing implicit public guarantees. As a result, risk taking on the part of banks may decline, allocation of credit may change, and costs of debt may increase, because creditors cannot rely on bailouts and thus demand higher risk premia. Profits in the financial sector may decline as a consequence of reforms.

Taken together, costs are shifted from the public sector to the (private) financial sector. One example from environmental policy may serve to illustrate the point. A Pigovian tax on chemical producers that pollute a river internalises the externalities of polluting the river by aligning private and social costs, thereby realigning the incentives to pollute. The direct result of this policy is lower production of chemicals, as pollution of the river is now part of the private sector's costs, and lower sectoral profits. However, these are not the costs of the reform, but rather the intended consequence.

Fortunately, a robust, evidence-based policy evaluation process does not have to be designed from scratch. Many jurisdictions already have explicit frameworks for the evaluation of financial sector policies (Financial Stability Board 2017, Annex A). In many policy areas, structured evaluations are routinely applied. Labour market reforms are being evaluated in many countries, educational programmes are often implemented only following a testing phase, and policy evaluations are commonly applied in the area of development policies. There has been a profound improvement in economic analysis, and this forms part of the infrastructure needed to perform evaluations. Policy evaluation can thus rely on a rich infrastructure of data, methodologies, and - not least - skilled personnel.

Because regulatory reforms have a global dimension, it is important to speak a common language when looking at the effects of reforms. Setting standards, learning from good practices, and international coordination are thus vitally important. The Financial Stability Board has developed a framework for the post-implementation evaluation of the effects of the Group of 20 (G20) financial regulatory reforms (Financial Stability Board 2017).

2.2 The role of the Capital Markets Union

Complementary reforms can further strengthen the international reform agenda. The European Capital Markets Union provides an opportunity to deepen financial market integration and to enhance the resilience of the European financial system (European Commission 2015, 2017; Deutsche Bundesbank 2015a). Cross-border debt flows tend to be more stable than equity flows and in particular foreign direct investment. Well developed and integrated capital markets can thus facilitate risk sharing among investors, with the accompanying potential for generating welfare gains. In integrated markets, local risks can be shared among investors from different regions. Similarly, individual investors can protect themselves against local income shocks by diversifying their investments across borders. Increased reliance on equity finance would be particularly beneficial in the European Monetary Union, where exchange rates cannot adjust to cope with regional macroeconomic shocks and where cross-border fiscal risk-sharing mechanisms are limited.

Cross-border risk sharing, however, is constrained if the integration of capital markets is tilted towards debt finance. In fact, private sector mechanisms for cross-border risk-sharing remain underdeveloped in Europe (European Central Bank 2017). The development and integration of European equity markets can thus play a vital role in strengthening cross-border risk sharing in Europe and should remain a goal of the Capital Markets Union. Despite the freedom of mobility of cross-border capital flows in Europe, many implicit barriers to the cross-border movement of equity capital and the development of equity markets remain in place. Examples include the development and integration of European venture capital markets and the removal of tax incentives that favour debt over equity financing (Deutsche Bundesbank 2015b). One major achievement of the Capital Markets Union could thus be the removal of impediments to efficient, non-distorted cross-border capital flows.

3. References

- Ball, L. (2014): "Long-term damage from the Great Recession in OECD countries", European Journal of Economics and Economic Policies, 11 (2), pp. 149-160.

- Bank for International Settlements - Statistics (2017): "Time series for total credit to the non-financial sector (core debt), all reporting economies", accessed on 03.07.2017, http://stats.bis.org/statx/srs/table/f1.1. Basel.

- Bernanke, B., Gertler, M., Gilchrist, S. (1996): "The Financial Accelerator and the Flight to Quality", Review of Economics and Statistics, 78 (1), pp. 1-15.

- Borio, C. E. V., Drehmann, M. (2009): "Assessing the Risk of Banking Crises - Revisited", BIS Quarterly Review, March, pp.29-46. Basel.

- Brunnermeier, M. K. (2009): "Deciphering the Liquidity and Credit Crunch 2007-2008", Journal of Economic Perspectives, 23 (1), pp. 77-100.

- Brunnermeier, M. K. and Oehmke, M. (2013): "Bubbles, Financial Crises, and Systemic Risk", Handbook of the Economics of Finance, Chapter 18, pp. 1221-1288.

- Cecchetti, S. G., Mohanty, M. S., Zampolli, F. (2011): "The Real Effects of Debt", BIS Working Paper, No. 352. Basel.

- Corsetti, G., Kuester, K., Meier, A., Muller, G. J. (2013): "Sovereign Risk, Fiscal Policy, and Macroeconomic Stability", Economic Journal, 123 (566), pp. 99-132.

- Das, U. S., Papapioannou, M., Pedras, G., Ahmed, F., and Surti, J. (2010): "Managing Public Debt and Its Financial Stability Implications", IMF Working Paper, WP/10/280. Washington DC.

- Davies, M. and Ng, T. (2011): "The rise of sovereign credit risk: implications for financial stability", BIS Quarterly Review, September, pp. 59-70. Basel.

- Detken, C., Weeken, O., Alessi, L., Bonfim, D., Boucinha, M. M., Frontczak, S., Giordana, G., Giese, J., Jahn, N., Kakes, J., Klaus, B., Lang, J. H., Puzanova, N., and Welz, P. (2014): "Operationalising the countercyclical capital buffer: indicator selection, threshold identification and calibration options", ESRBOccasional Paper, 5. Frankfurt a.M.

- Deutsche Bundesbank (2015a): "Capital markets union - financial stability and risk sharing", Financial Stability Review 2015, pp. 85-94.

- Deutsche Bundesbank (2015b): "Deutsche Bundesbank's reply to the European Commis-sion's Green Paper 'Building a Capital Markets Union'". Frankfurt a.M.

- Drehmann, M., and Juselius, M. (2014): "Evaluating Early Warning Indicators of Banking Crises: Satisfying Policy Requirements", International Journal of Forecasting, 30 (3), pp.759-780.

- European Central Bank (2016): "Report on financial structures", October. Frankfurt a.M.

- European Central Bank (2017): "Financial integration in Europe". Frankfurt a.M.

- European Commission (2015): "Action plan on building a capital markets union", accessed on 04.07.2017, https://ec.europa.eu/info/publications/action-plan-building-capital-markets-union_en. Brussels.

- European Commission (2017): "Mid-term review of the capital markets union action plan", assessed on 04.07.2017, https://ec.europa.eu/info/publications/mid-term-review-capital-markets-union-action-plan_en. Brussels.

- Eurostat (2017a): "Eurostat Supplementary Table for Reporting Government Interventions to Support Financial Institutions - Background note (April 2017)", accessed on 27.06.2017, http://ec.europa.eu/eurostat/documents/1015035/2022710/Background-note-on-gov-interventions-APR-2017-final.pdf. Luxembourg.

- Eurostat (2017b): "Time series for general government gross debt (annual data)", accessed on 27.06.2017, http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=teina225&lang=en. Luxembourg.

- Eurostat (2017c): "Unemployment by sex (total) and age (total) - monthly average, EA19 - Euro area (19 countries)", accessed on 04.07.2017, http://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do. Luxembourg.

- Financial Stability Board (2016): "Implementation and Effects of the G20 Financial Regulatory Reforms 31 August 2016 2nd Annual Report", accessed on 04.07.2017, http://www.fsb.org/wp-content/uploads/Report-on-implementation-and-effects-of-reforms.pdf. Basel.

- Financial Stability Board (2017): "Framework for Post-Implementation Evaluation of the Effects of the G20 Financial Regulatory Reforms", assessed on 03.07.2017, http://www.fsb.org/wp-content/uploads/P030717-4.pdf. Basel.

- Gambacorta, L., Yang, J., Tsatsaronis, K. (2014): "Financial Structure and Growth", BIS Quarterly Review, March, pp. 21-35. Basel.

- Glick, R., Lansing, K.J. (2010): "Global Household Leverage, House Prices, and Consumption", FRBSF Economic Letter, January. San Francisco CA.

- González, V. M. (2013): "Leverage and corporate performance: International evidence", International Review of Economics & Finance, 25, pp. 169-184.

- Group of 20 (2017): "Communiqué of the G20 Finance Ministers and Central Bank Governors Meeting in Baden-Baden, Germany, 17-18 March 2017", accessed on 04.07.2017, http://www.bundesfinanzministerium.de/Content/EN/Standardartikel/Topics/Featured/G20/g20-communique.pdf?__blob=publicationFile&v=3.

- International Monetary Fund (2016): "Debt: Use it Wisely", Fiscal Monitor - World Economic and Financial Surveys, October. Washington DC

- Jordà, O., Schularick, M., Taylor, A. (2015): "Leveraged Bubbles", Journal of Monetary Economics, 76, pp. 1-20.

- Kaminsky, G. L., and Reinhart, C. M. (1999): "The Twin Crises: the Causes of Banking and Balance-of-Payments Problems", American Economic Review, 89 (3), pp. 473-500.

- King, M. (1994): "Debt Deflation: Theory and Evidence", European Economic Review, 38, pp. 419-445.

- Laeven, L., and F. Valencia, F. (2012): "Systemic Banking Crises Database: An Update", IMF Working Paper, No. 12/163. Washington DC.

- Leigh, D., Ignaz, D., Simon, J., Topalova, P. (2012): "Dealing with Household Debt", World Economic Outlook: Growth Resuming, Dangers Remain, Washington DC: International Monetary Fund, pp. 89-124.

- Mian, A., Sufi, A. (2014): House of Debt, Chicago: Chicago University Press.

- Mian, A., Sufi, A., Verner, E. (forthcoming): "Household Debt and Business Cycles Worldwide", Quarterly Journal of Economics.

- Mourougane, A. (2017): "Crisis, potential output and hysteresis", International Economics, 149, pp. 1-14.

- Ollivaud, P., Turner, D. (2014): "The Effect of the Global Financial Crisis on OECD Potential Output", OECD Economics Department Working Papers, No. 1166, Paris.

- Reinhart, C. M., and K. S. Rogoff, K. S. (2008a): "Is the 2007 USSub-Prime Financial Crisis so Different? An International Historical Comparison", American Economic Review, 98 (2), pp.339-344.

- Reinhart, C. M., Rogoff, K. S. (2008b): "This Time is Different: A Panoramic View of Eight Centuries of Financial Crises", NBERWorking Paper, No. 13882. Cambridge MA.

- Sutherland, D., Hoeller, P. (2012): "Debt and Macroeconomic Stability: An Overview of the Literature and Some Empirics", OECD Economics Department Working Paper, No. 1006. Paris.

1 Aggregates cover G20 and other major economies and are based on a conversion to US dollars at purchasing power exchange rates.