Philip Lowe: Household debt, housing prices and resilience

Speech by Mr Philip Lowe, Governor of the Reserve Bank of Australia, at the Economic Society of Australia (QLD) Business Lunch, Brisbane, 4 May 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

I would like to thank Gianni La Cava, Andre Liew and Fiona Price for assistance in the preparation of this talk.

Thank you for the invitation to address the Queensland branch of the Economic Society of Australia. It is a pleasure to be in Brisbane again today.

This afternoon I would like to talk about household debt and housing prices.

This is a familiar topic and one that has attracted a lot of attention over recent times. It is understandable why this is so. The cost of housing and how we finance it matters to us all. We all need somewhere to live and for many people, their home is their largest single asset. Real estate is also the major form of collateral for bank lending. The levels of debt and housing prices also affect the resilience of our economy to future shocks. Beyond these economic effects, high levels of debt and housing prices have broader effects on the communities in which we live. The high cost of housing is a real issue for many Australians and can have serious side-effects. High levels of debt and high housing costs can also reinforce the existing distribution of wealth in our society, making social and geographic mobility more difficult. So it is understandable why Australians are so interested in these issues.

At the Reserve Bank, we too have been focused on these issues in the context of our monetary policy and financial stability responsibilities. Our work has been in three broad areas. First, understanding the aggregate trends and their causes. Second, understanding how debt is distributed across the community. And third, understanding how the level of debt and housing prices affect the way the economy operates and its resilience to future shocks.

This afternoon, I would like to make some observations in each of these three areas.

Aggregate trends

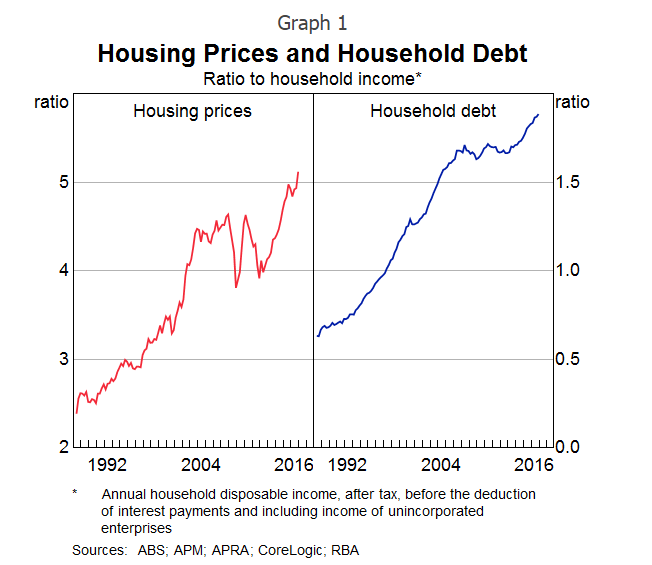

This first chart provides a good summary of the aggregate picture (Graph 1). It shows the ratios of nationwide housing prices and household debt to household income. Housing prices and debt both rose a lot from the mid 1990s to the early 2000s. The ratios then moved sideways for the better part of a decade - in some years they were up and in others they were down. Then, in the past few years, these ratios have been rising again.1 Both are now at record highs.

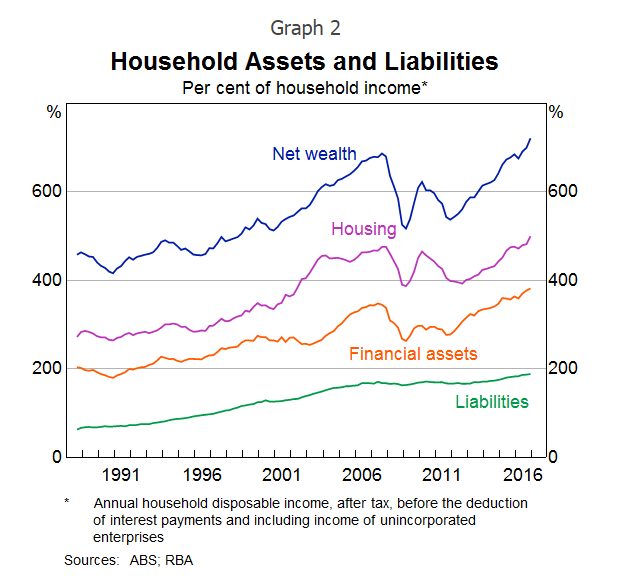

Although the debt-to-income ratio has increased over recent times, the ratio of debt to the value of the housing stock has not risen. This reflects the large increase in housing prices and the growth in the number of homes. Over recent times, there has also been a substantial increase in the value of households' financial assets, with the result that the ratio of household wealth to income is at a record high (Graph 2). So both the value of our assets and the value of our liabilities have increased relative to our incomes.

Turning now to why the ratios of housing prices and debt to income have risen over time.2 A central factor is that financial liberalisation and the lower nominal interest rates that came with the lower inflation of the 1990s increased people's ability to borrow. These developments meant that Australians could take out larger and more flexible loans. By and large, we took advantage of this new ability, as we sought to buy the housing we desired.

We could, of course, have used the benefit of lower nominal interest rates in the 1990s and the increased ability to borrow for other purposes. But instead we chose to borrow more for housing and this pushed up the average price of housing given the constraints on the supply side. The supply of well-located housing and land in our cities has been constrained by a combination of zoning issues, geography and inadequate transport. Another related factor was that our population was growing at a reasonable pace. Adding to the picture, Australians consume more land per dwelling than is possible in many other countries, although this is changing, and many of us have chosen to live in a few large coastal cities.3 Increased ability to borrow, more demand and constrained supply meant higher prices.

So we saw marked increases in the ratios of housing prices and debt to household incomes up until the early 2000s. At the time, there was much discussion as to whether these higher ratios were sustainable. As things turned out, the higher ratios have been sustained for quite a while. This largely reflects the choices we have made as a society regarding where and how we live (and how much at least some of us are prepared to spend to do so), urban planning and transport, and the nature of our financial system. It is these choices that have underpinned the high level of housing prices. So the changes that we have seen in these ratios are largely structural.

Recently, the ratios of housing prices and debt to household income have been increasing again. Lower interest rates both in real and nominal terms - this time, largely reflecting global developments - have again played some role. But there have also been other important factors at work over recent times.

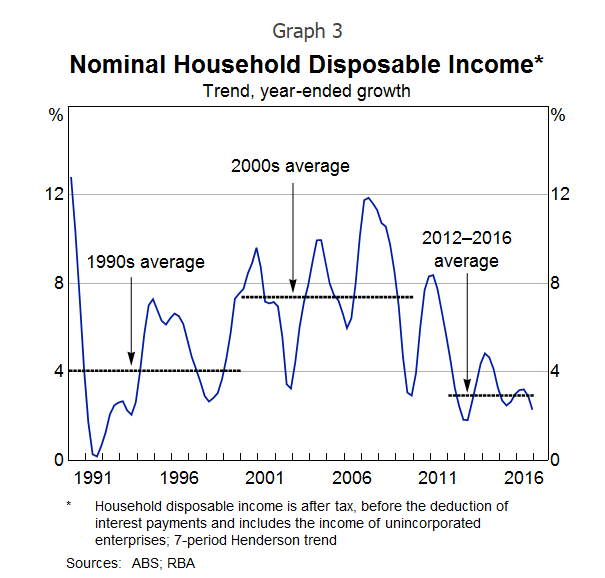

One of these is the slow growth in household income. During the 2000s, aggregate household income increased at an average rate of over 7 per cent (Graph 3). In contrast, over the past four years growth has averaged less than half of this, at about 3 per cent. Slower growth in incomes will push up the debt-to-income ratio unless growth in debt also slows. This partly explains what has happened over recent years.

A second factor is that some of our cities have become major global cities. Reflecting this, in some markets there has been strong demand by overseas investors.

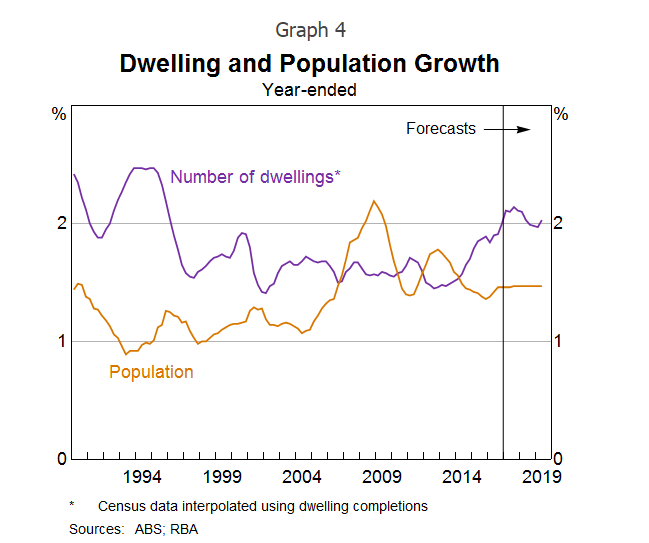

A third factor has been stronger population growth. Population growth picked up during the mining investment boom and, although it subsequently slowed, it is still around ½ percentage point faster than it was before the boom (Graph 4). For some time the rate of home-building did not respond to the faster population growth; indeed, the response took the better part of a decade. The rate of home-building has now responded and we are currently adding to the housing stock at a rate not seen for more than two decades. Over time, this will make a difference.

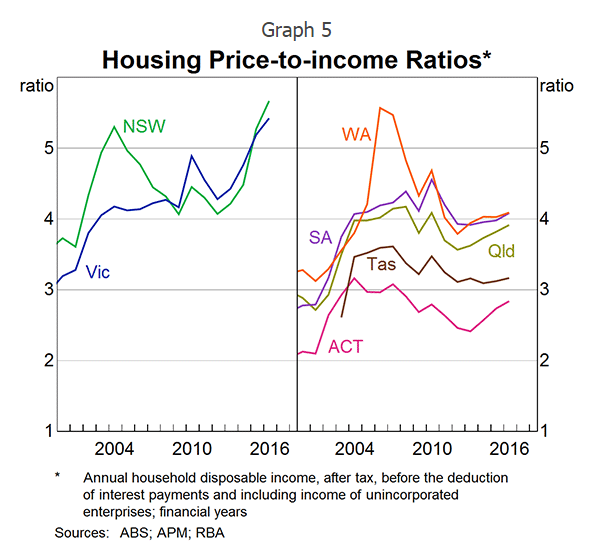

It is Melbourne and Sydney where population growth has been the fastest over recent times. Not surprisingly, it is these two cities where the price gains have been largest, and these price gains have helped induce more supply. Indeed, Victoria and New South Wales account for all of the recent upward movement in the national housing price-to-income ratio (Graph 5). In the other states, the ratio of housing prices to income is below previous peaks. So there is not a single story across the country. This is despite us having a common monetary policy for the country as a whole. Factors other than the level of interest rates are clearly at work.

In summary then, the supply-demand dynamics have been pushing aggregate housing prices in our largest cities higher relative to our incomes. With interest rates as low as they have been, and prices rising, many people have found it attractive to borrow money to invest in an asset whose price is increasing. The result has been strong growth in borrowing by investors, with investors accounting for 30 to 40 per cent of new loans.

This borrowing is not the underlying cause of the higher housing prices. But the borrowing has added to the upward pressure on prices caused by the underlying supply-demand dynamics. It has acted as a financial amplifier in some cities, adding to the already upward pressure on prices. The borrowing by investors is also obviously contributing to the rise in the aggregate debt-to-income ratio. Just like in the early 2000s, there is again a discussion as to whether these increases will continue and whether they are sustainable.

The distribution of debt

I would now like to turn to the distribution of housing debt across households. This is important, as it is not the 'average' household that gets into trouble. At the Reserve Bank we have devoted considerable resources to understanding this distribution. One important source of household-level information is the survey of Household Income and Labour Dynamics in Australia (HILDA).

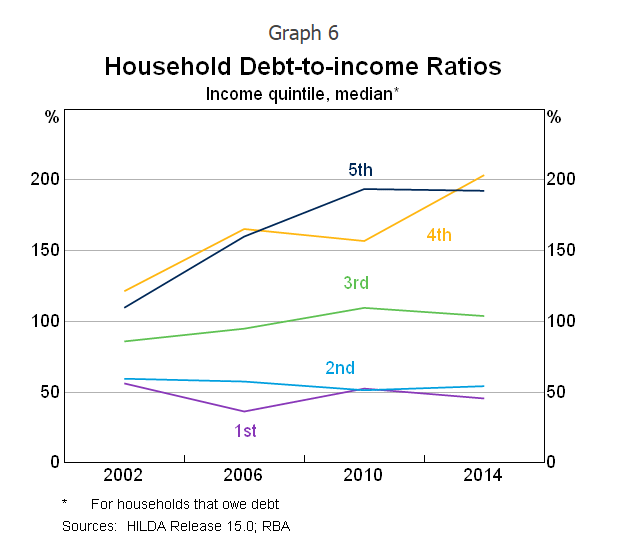

If we look across the income distribution, it is clear that the rise in the debt-to-income ratio has been most pronounced for higher-income households (Graph 6). This is different from what occurred in the United States in the run-up to the subprime crisis, when many lower-income households borrowed a lot of money.

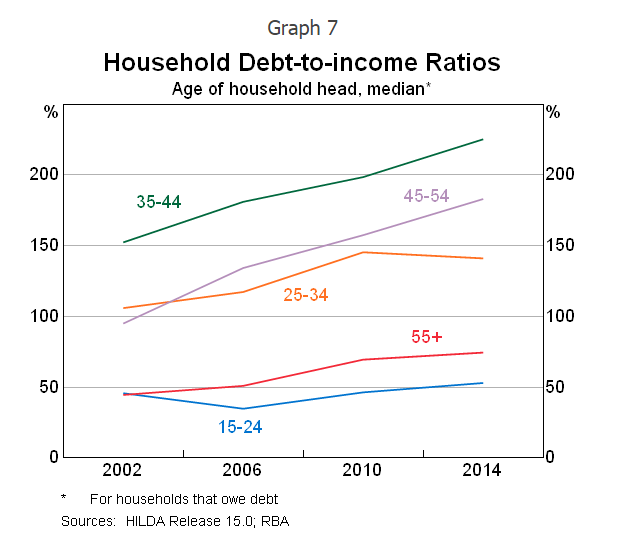

It is also possible to look at how the debt-to-income ratio has changed across the age distribution. This ratio has risen for households of all ages, except the very youngest, who tend to have low levels of debt (Graph 7). Borrowers of all ages have taken out larger mortgages relative to their incomes and they are taking longer to pay them off. Older households are also more likely than before to have an investment property with a mortgage and it has become more common to have a mortgage at the time of retirement.

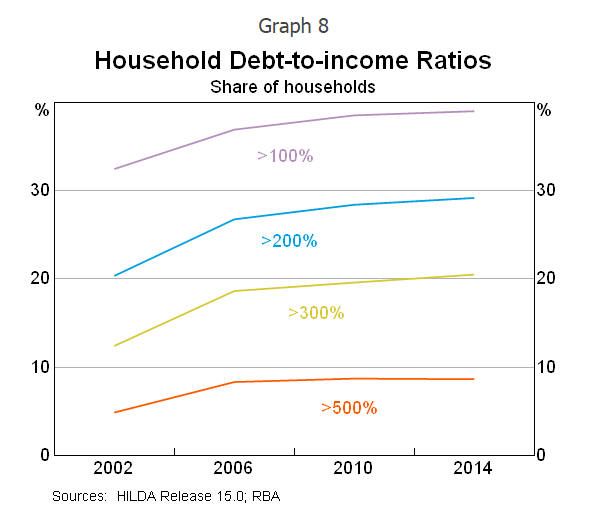

We also look at the share of households with a debt-to-income ratio above specific thresholds. In 2002, around 12 per cent of households had debt that was over three times their income (Graph 8). By 2014, this figure had increased to 20 per cent of households. There has also been an increase, although not as pronounced, in the share of households with even higher debt-to-income ratios.

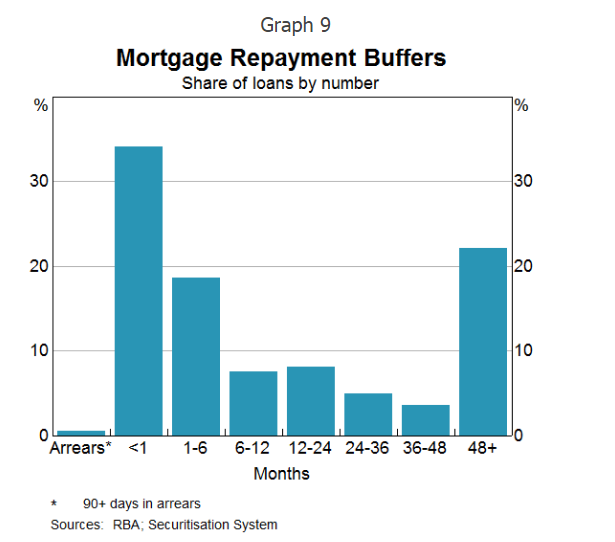

Another dataset that provides insight into distributional issues is one maintained by the Reserve Bank on loans that have been securitised.4 This indicates that around two-thirds of housing borrowers are at least one month ahead of their scheduled repayments and half of borrowers are six months or more ahead (Graph 9). This is good news. But a substantial number of borrowers have only small buffers if things go wrong.

At the overall level, though, nationwide indicators of household financial stress remain contained. This is not surprising with many borrowers materially ahead on their mortgage repayments, interest rates being low and the unemployment rate being broadly steady over recent years. At the same time, though, the household-level data show that there has been a fairly broad-based increase in indebtedness across the population and the number of highly indebted households has increased.

Impact on economy and policy considerations

I would now like to turn to the third element of our work: the implications of all this for the way the economy operates and its resilience.

It is now commonplace to say that housing prices and debt levels matter because of financial stability. What people typically have in mind is that a severe correction in property prices when balance sheets are highly leveraged could make for instability in the banking system, damaging the economy. So the traditional financial stability concern is that the banks get in trouble and this causes trouble for the overall economy.

This is not what lies behind the Reserve Bank's recent focus on household debt and housing prices in Australia. The Australian banks are resilient and they are soundly capitalised. A significant correction in the property market would, no doubt, affect their profitability. But the stress tests that have been done under APRA's eye confirm that the banks are resilient to large movements in the price of residential property.

Instead, the issue we have focused on is the possibility of future sharp cuts in household spending because of stretched balance sheets. Given the high levels of debt and housing prices, relative to incomes, it is likely that some households respond to a future shock to income or housing prices by deciding that they have borrowed too much. This could prompt a sharp contraction in their spending, as they try to get their balance sheets back into better shape. An otherwise manageable downturn could be turned into something more serious. So the financial stability question is: to what extent does the higher level of household debt make us less resilient to future shocks?

Answering this question with precision is difficult. History does not provide a particularly good guide, given that housing prices and debt relative to income are at levels that we have not seen before, and the distribution of debt across the population is changing.

Given this, one of the research priorities at the Reserve Bank has been to use individual household data to understand better how the level of indebtedness affects household spending. The results indicate that the higher is indebtedness, the greater is the sensitivity of spending to shocks to income.5 This is regardless of whether we measure indebtedness by the debt-to-income ratio or the share of income spent on servicing the debt. If this result were to translate to the aggregate level, it would mean that higher levels of debt increase the sensitivity of future consumer spending to certain shocks.6

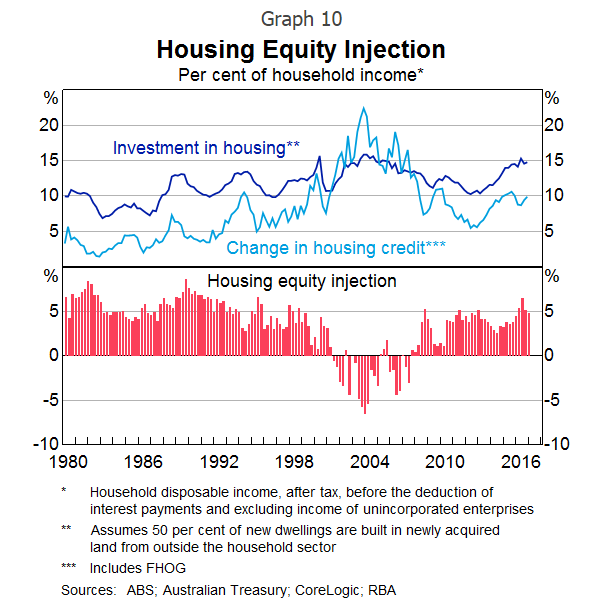

The higher debt levels also appear to have affected how higher housing prices influence household spending. For some years, households used the increasing equity in their homes to finance extra spending. Today, the reaction seems different. This is evident in the estimates of housing equity injection (Graph 10). In earlier periods of rising housing prices, the household sector was withdrawing equity from their housing to finance spending. Today, households are much less inclined to do this. Many of us feel that we have enough debt and don't want to increase consumption using borrowed money. Many also worry about the impact of higher housing prices on the future cost of housing for their children. As I have spoken about previously, higher housing prices are a two-edged sword.7 They deliver capital gains for the current owners, but increase the cost of future housing services, including for our children.

This change in attitude is also affecting how spending responds to lower interest rates. With less appetite to incur more debt for current consumption, this part of the monetary transmission mechanism looks to be weaker than it once was. There is, however, likely to be an asymmetry here. When the interest rate cycle turns and rates begin to rise, the higher debt levels are likely to make spending more responsive to interest rates than was the case in the past. This is something that we will need to take into account.

In terms of resilience, my overall assessment is that the recent increase in household debt relative to our incomes has made the economy less resilient to future shocks. Given this assessment, the Reserve Bank has strongly supported the prudential measures undertaken by APRA. Double-digit growth in debt owed by investors at a time of weak income growth cannot be strengthening the resilience of our economy. Nor can a high concentration of interest-only loans.

I want to point out that APRA's measures are not targeted at high housing prices.8 The international evidence is that these types of measures cannot sustainably address pressures on housing prices originating from the underlying supply-demand balance. But they can provide some breathing space while the underlying issues are addressed. In doing so, they can help lessen the financial amplification of the cycle that I spoke about before. Reducing this amplification while a better balance is established between supply and demand in the housing market can help with the resilience of our economy.

There are some reasons to expect that a better balance between supply and demand will be established over time.

One is the increased rate of home-building. As we are seeing here in Brisbane and some parts of Melbourne, increased supply does affect prices. This increase in supply is also affecting rents, which are increasing very slowly in most markets.

A second reason is the increased investment in some cities, including in Sydney, on transport. Over time, this will increase the supply of well-located residential land, and this will help as well.

And a third reason is that at some point, interest rates in Australia will increase. To be clear, this is not a signal about the near-term outlook for interest rates in Australia but rather a reminder that over time we could expect interest rates to rise, not least because of global developments. Over recent years, the low interest rates in Australia have helped the economy adjust to the winding down of the mining investment boom. They have helped support employment and demand through a significant adjustment in the Australian economy. We should not, though, expect interest rates always to be this low.

It remains to be seen how the various influences on housing prices play out. Other policies, including tax and zoning policies, also have an effect. But increased supply and better transport could be expected to help address the ongoing rises in housing prices relative to incomes. These changes and some normalisation of interest rates over time might also reduce the incentive to borrow to invest in an asset whose price is rising strongly. To the extent that, over time, a better balance is established, we will be better off not incurring too much debt, and having housing prices go too high, while this is occurring.

I want to make it clear that the Reserve Bank does not have a target for the debt-to-income ratio or the ratio of nationwide housing prices to income.

As I spoke about earlier, there are good reasons why these ratios move over time. My judgement, though, is that, in the current environment, the resilience of our economy would be enhanced by an extended period in which housing prices and debt outstanding increased no faster than our incomes. Again, this is not a target or a policy objective of the Reserve Bank, but rather a general observation about how we build resilience.

Many of you will be aware that these issues have figured in the deliberations of the Reserve Bank Board for some time. This is entirely consistent with our flexible medium-term inflation targeting framework. With a medium-term target, it is appropriate that we pay attention to the resilience of our economy to future shocks. In the current environment of low income growth, faster growth in household debt is unlikely to help that resilience.

We have also been watching the labour market closely. The unemployment rate has moved up a little over recent months and wage growth remains subdued. Encouragingly, employment growth has been a bit stronger of late and the forward-looking indicators suggest ongoing growth in employment. We will want to see a continuation of these trends if the overall growth in the economy is to pick up as we expect. Stronger growth in incomes would of course also help people deal with the high levels of debt and housing prices. Overall, our latest forecast is for economic growth to pick up gradually and average around 3 per cent or so over the next few years.

To conclude, I hope these remarks help provide some insight into the Reserve Bank's thinking about housing prices and household debt. As household balance sheets have changed, so too has the way that the economy works. Both from an individual and an economy-wide perspective, we need to pay attention to how the higher level of debt affects our resilience to future shocks.

Thank you. I look forward to your questions.

1 When balances in offset accounts are taken into account, the recent rise in household debt is less pronounced, although the household debt-to-income ratio has still risen to a record high.

2 For RBA analysis of this issue see Kohler M and M van der Merwe (2015), 'Long-run Trends in Housing Price Growth', RBA Bulletin, September, pp 21-30 and RBA (2003) 'Household Debt: What the Data Show', RBA Bulletin, March, pp 1-11.

3 See RBA (2015), 'Submission to the Inquiry into Home Ownership', Submission to the House of Representatives Standing Committee on Economics Inquiry into Home Ownership, 25 June, and RBA (2014), 'Submission to the Inquiry into Affordable Housing', Submission to the Senate Economics References Committee Inquiry into Affordable Housing, 14 February.

4 These data, which go down to the level of the individual (anonymised) underlying loans, are collected by the Reserve Bank and assist in managing our exposures to asset-backed securities accepted in market operations. These data cover around one-quarter of the value of outstanding housing loans.

5 See La Cava G, H Hughson and G Kaplan (2016) 'The Household Cash Flow Channel of Monetary Policy', RBA Research Discussion Paper No 2016-12.

6 It is, however, worth pointing out that, at least to date, aggregate consumption has not been more volatile following the earlier increase in the debt-to-income ratio.

7 Lowe, P (2015) 'National Wealth, Land Values and Monetary Policy', Address to the 54th Shann Memorial Lecture, Perth, 12 August 2015.

8 See Byres W (2017) 'Prudential Perspectives on the Property Market', available at <http://www.apra.gov.au/Speeches/Documents/Prudential prespectives on the property market - 28 April 2017.pdf>, Remarks at CEDA's 2017 NSW Property Market Outlook, Sydney, 28 April.