Graeme Wheeler: Some thoughts on the balance of risks around the Reserve Bank's monetary policy setting

Speech by Mr Graeme Wheeler, Governor of the Reserve Bank of New Zealand, to Craigs Investment Partners' Investor Day, Auckland, 2 March 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Introduction

Thank you for inviting me to join you today. It's a pleasure to exchange views on the challenges facing the Reserve Bank (Bank) and investors in interpreting policy signals and political and market developments. In particular, I will focus on what we consider to be the main risks around the interest rate projections in the February 2017 Monetary Policy Statement (MPS).

New Zealand is one of the few countries where the central bank publishes interest rate projections in its MPS. These projections represent the Bank's central view of the policy path needed to return inflation to the 2 percent mid-point of the target range specified in the Policy Targets Agreement (PTA).

Such projections are highly conditional and based on a range of assumptions - many of which lie beyond the Bank's control. Such factors include: the outlook for global growth, inflation and commodity prices; movements in exchange rates and long term interest rates; the scale of migration flows; and the government's spending and tax policies.

These key assumptions, and other factors that affect the economy's output gap (or the extent to which there are capacity constraints, and therefore inflation pressures in the economy) are extensively debated in-house prior to finalising the MPS.

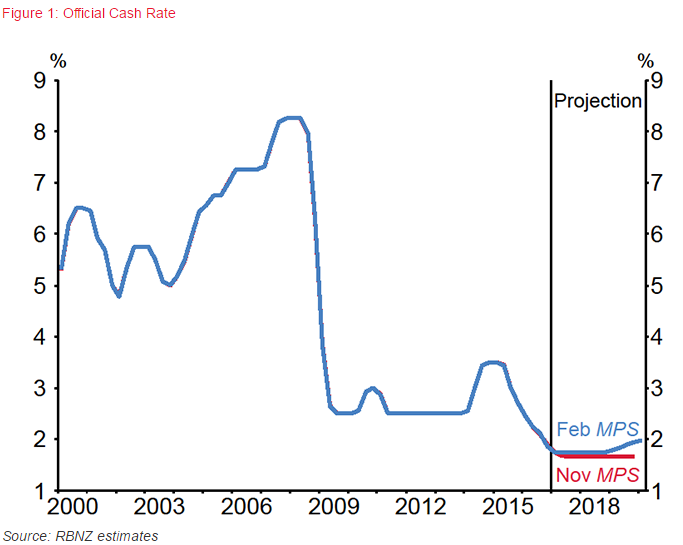

The OCR track contained in the February 2017 MPS

The Official Cash Rate (OCR) projections in the November 2016 MPS contained a slight easing bias, building in a 20 percent probability of a further 25 basis-point interest rate cut. This easing bias was replaced with a neutral bias in the February 2017 MPS, which shows an unchanged OCR until mid-2019. This suggests that if the economy were to develop along the lines of the Bank's economic projections, the current OCR would be sufficient to return annual consumer price inflation to around 2 percent. (The track incorporated a 25 basis point increase in the OCR in late 2019. As the economy would then be entering its 11th year of expansion, the usual maturation processes in a business cycle suggest it would be reasonable to expect an eventual rise in the policy rate as capacity pressures become more broad based.)

The risks around future OCR movements are considered to be equally weighted. In effect, there is an equal probability that the next OCR adjustment could be up or down. We consider the balance of risks for the global outlook to be downside. For the domestic economy, there is some potential upside for output growth if migration and commodity prices turn out to be stronger than forecast, but the risks around inflation look balanced.

Of course, small open economies such as New Zealand are hit by multiple shocks that may be political, economic or financial policy-related, or linked to natural or other disasters. The Bank reviews the implications of these events for the PTA and the OCR and summarises its conclusions every six weeks in OCR statements and the quarterly MPS.

Policymakers confront large shocks that are difficult to predict. For example, we saw how financial markets and policy makers did not anticipate the 1997 Asian Financial Crisis, the 2008 Global Financial Crisis, the outcome of the United Kingdom European Union membership referendum, or the recent US Presidential election.

Nevertheless, policy makers need to think carefully about risk and uncertainty and the 'what if' consequences of possible developments. Like many central banks, the Bank uses scenario analysis to model the possible economic impacts of specific shocks of a given magnitude. Several scenarios have been included in MPSs over the past few years - the February 2017 MPS included scenarios showing a sharp rise in commodity prices and softer growth in private consumption.

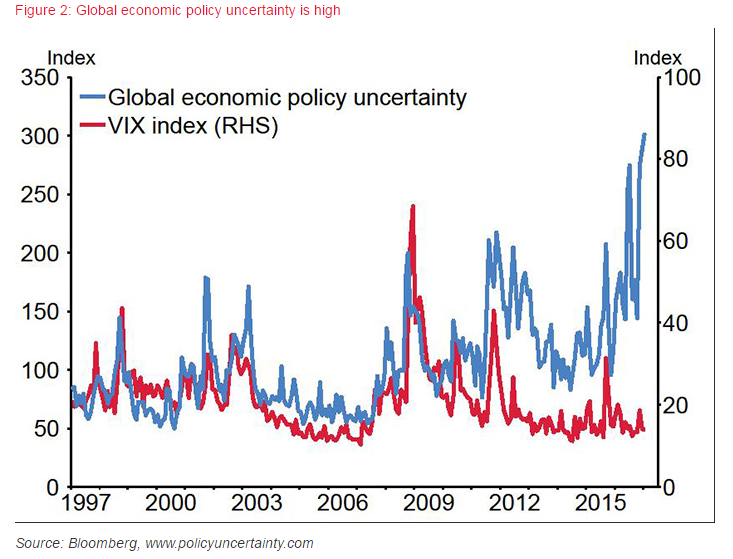

Considering the implications of possible shocks becomes even more important when levels of uncertainty are particularly high, which is currently the case1 (even though measures of equity market volatility remain low2).

Risks surrounding New Zealand's economic expansion

New Zealand's current economic expansion is entering its eighth year of what the OECD describe as a strong broad-based expansion. In the absence of major shocks, prospects look reasonable for continued strong growth over the next two years driven by accommodative monetary policy, construction spending, and net inward migration. If these prospects are realised, the current expansion would be New Zealand's longest in over 50 years.

Table 1 compares the latest summary macro-economic indicators with the 30 year average.

Table 1: Summary macro-economic indicators

|

Year to December 2016 |

30 Year Average |

|

|

GDP growth (%) |

3.5** |

2.5 |

|

CPI Inflation (%) |

1.3 |

2.1* |

|

Employment growth (%)*** |

3.2 |

1.7 |

|

Unemployment rate (%) |

5.2 |

6.2 |

|

Current account balance (% GDP) |

-2.7** |

-3.7 |

*CPI Inflation is a post-1991 average, reflecting the inflation targeting period.

** RBNZ estimate

*** Based on filled jobs in the Quarterly Employment Survey

Source: Statistics New Zealand, RBNZ

Expansions in small open advanced economies generally come to an end due to one or more factors:

- Global economic growth weakens or slows in major trading partners and affects the terms of trade and export growth. This might be triggered by a sharp rise in oil prices or a financial crisis.

- A major domestic policy correction is needed to address a deteriorating fiscal or current account deficit.

- Long-term interest rates rise significantly in response to offshore movements triggered by higher inflation expectations, and/or increased risk premia in major economies. Alternatively, domestic short-term rates may need to rise sharply to moderate inflation pressures associated with growing supply and demand imbalances.

At this stage the Bank's policy analysis does not suggest the need to adjust monetary policy in response to fiscal imbalances, external indebtedness or domestic inflationary pressures. In addition, New Zealand's financial system remains sound and continues to operate effectively.

i) domestic risks

The strength of the expansion will be affected by changes in households' desire to save, the scale of net immigration, and shifts in expectations about future inflation. Our forecasts do not incorporate any significant change in the household saving rate, but assume a reduced flow of net immigration that remains high by historical standards. Measures of long-term inflation expectations continue to be well-anchored at 2 percent.

The possibility of worsening imbalances in the housing market remains a major risk with continued low interest rates and strong migration, and rising construction cost inflation reflecting increasing resource pressures. There are upside risks in respect of our migration projections. Although departures remain low, arrivals have continued to increase with arrivals by migrants on work visas being particularly strong in recent months.

New Zealand house price indicators (such as the growth in real house prices, house price-to-income ratios and house price-to-rent ratios) are very high internationally and historically. At a time of heightened uncertainty, households are particularly vulnerable to a correction in house prices given the large rise in household debt since 1990. Household debt is now equivalent to around 165 percent of household disposable income, up from 100 percent in 2000 and 60 percent in 1990.

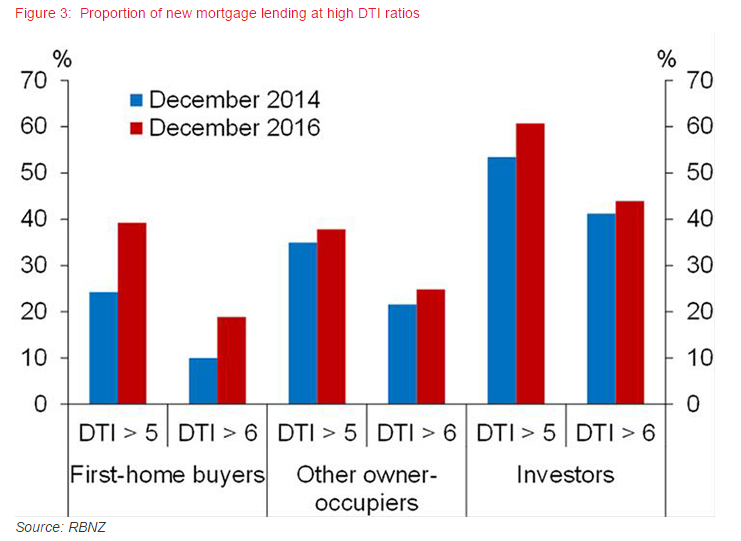

Households are also exposed to a normalisation in mortgage rates given the short interest rate duration of the mortgage market (with 89 percent of mortgage loans re-pricing within two years). In addition, the share of lending at debt-to-income ratios of over 5 and 6 has increased steadily for all borrower groups since September 2014.

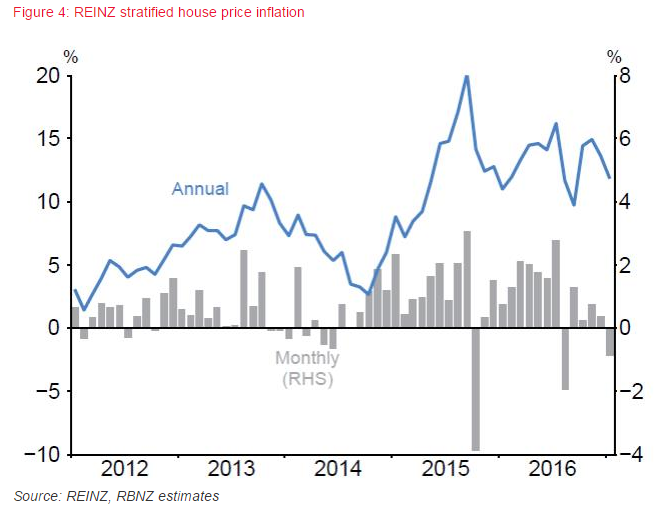

Fortunately, house price inflation has moderated substantially in recent months in response to increased housing supply, rising mortgage rates, the tighter lending criteria adopted by banks, and the impact of loan-to-value restrictions. Nationwide house prices have been broadly unchanged over the past six months, compared to a 12 percent increase in the six months prior. It's too early to say whether this moderation will continue, but future developments in respect of housing market imbalances and debt servicing costs are likely to be important influences on household spending and the level of aggregate demand in the economy.

Another risk is that the exchange rate remains higher than projected in the MPS, suppressing tradables inflation and net exports. As we indicated in the MPS, whether monetary easing would be required to offset this would depend on the factors driving the exchange rate (e.g. weaker global growth, higher commodity prices) and how domestic capacity pressures were changing.

ii) external risks

Developments in the global economy often have major impacts on small open economies through channels such as trade flows, commodity prices, exchange rates, capital movements and funding costs. There have been four troughs in global economic activity over the past 50 years - 1975, 1982, 1991, and 2009 - where we saw declines in world real GDP per capita.3 Three of these troughs were linked to oil price increases and the policy responses to them (1975, 1982, and 1991). The other was caused by the Global Financial Crisis (2009).

Several sources of uncertainty currently exist in the global economy including:

- The outlook for growth in Europe and the extent to which consumer and business confidence might be affected by issues such as Brexit negotiations, migration, upcoming elections in large European countries, the Greek debt negotiations and concerns regarding the vulnerability of some European banks.

- The extent to which the US Administration follows through with its 'America first" policy platform and adopts trade protectionist measures. Uncertainty also exists around the degree of fiscal stimulus likely to be adopted and its composition (e.g. through reductions in corporate tax rates, including border tax adjustments, and increases in infrastructure spending).

- The outlook for medium-term growth in China given the very rapid build-up in corporate (mainly SOE) debt since 2008, and the rising level of bad debts in the shadow banking sector. Uncertainty also exists around the pace at which the comprehensive economic reforms identified in the 3rd Plenum will be implemented.

Sources of uncertainty elsewhere include the Middle East, Russia, North Korea, and Brazil, but unless developments in these countries trigger commodity or security-related risks, such events are less likely to have major global economic and financial impacts.

To what extent could developments in the US, Europe and China affect New Zealand's economy? Many of the risks in these regions are well known, and already reflected in relative prices such as interest rates, exchange rates and commodity prices. It is new information, either through additional data or greater clarity about policy intent, that leads to reassessments of judgements around economic impacts and transmission effects.

a) Brexit

The financial market turbulence immediately following the Brexit vote appears to have largely settled down, and the UK economy has performed better than expected since this vote. Clearly, however, much uncertainty lies ahead as the actual Brexit negotiations get underway and as we wait to observe the overall tone, shape and outcomes of these discussions. Although the EU and UK are important trading partners of each other, and have much to gain through trade, there is always a risk that political considerations predominate and lead to more restrictive longer-term trading arrangements.

The combined EU and UK economies absorb around 14 percent of our goods exports and 23 percent of our service exports. If negotiations appear to head to an impasse or unfavourable outcomes, financial market pressures could spread into global markets and affect our external funding costs, equity markets and exchange rate. Greater uncertainty, along with higher funding costs, could reduce investment intentions with longer-run implications for domestic output and productivity.

b) Slowdown in China

A significant slowdown in economic growth in China would directly impact New Zealand (through trade volumes, investment, commodity prices, tourism etc.) and indirectly through reduced growth prospects in our regional trading partners - China, Australia and the rest of Asia account for around three quarters of our trade. China accounts for around 15 percent of world output (at current market exchange rates) and is New Zealand's largest trading partner for exports and imports of goods. IMF estimates suggest that an investment-driven, one percentage point drop in China's output growth would reduce G20 growth by ¼ percentage point.4

However, while there are important issues around the build-up of debt, house price inflation, capital outflows, and the slow speed of reform in the SOE sector, the consensus international forecasts are that the Chinese economy will avoid any material slowdown and grow by around 6¼ percent pa over the next two years.

New Zealand would be partly protected from any mild slowdown in China as some of our main exports (e.g. dairy products, meat, and tourism) are supported by China's move towards more consumption-led growth. But demand for these and other exports would weaken in the case of a more severe slowdown, especially if combined with financial disruption.

c) Risks emanating from the United States

Currently, the greatest source of uncertainty that could have important impacts on our economy relate to fiscal expansion (on the upside) and an increase in trade protectionism (on the downside) in the United States.

i) Increase in trade protection

In the run up to the US election, Donald Trump labelled China a 'currency manipulator' (a view not shared by the IMF) and suggested that tariffs of 45 percent should be imposed on China, and tariffs also be levied on imports from Mexico. House Republicans continue to push hard on their corporate tax plan that involves border tax adjustments that would redefine the taxable base for corporate income. It would disallow deduction of import costs and exempt export revenues. The White House has indicated it will publish its tax proposals in early March.

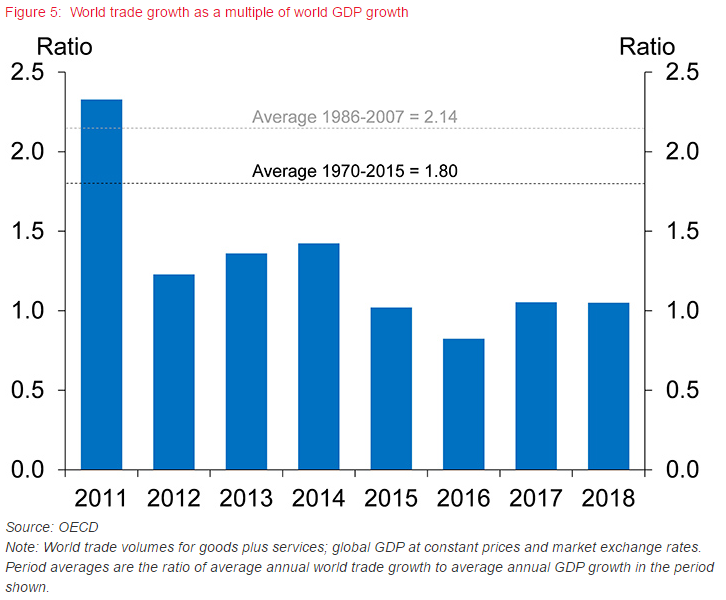

Such calls for protectionism are contrary to the global trend in trade liberalisation over recent decades. They also come at a time when the growth in merchandise trade volumes over the past five years is the weakest since the early 1980s and new trade-restrictive measures by G20 countries are at their highest level since the GFC.5

There is much uncertainty around the objectives of trade policy under the new US Administration, and the specific policy instruments that will be used in pursuit of these goals. However some lines seem clear. The US Administration withdrew from the Trans Pacific Partnership, the negotiations around the Transatlantic Trade and Investment Partnership between the EU and US are in jeopardy, and the Administration has signaled it wants to renegotiate the North America Free Trade Agreement.

Higher tariffs would raise prices for US consumers, could require a more accelerated tightening in monetary policy by the Federal Reserve, and could be expected to put upward pressure on the US dollar exchange rate. Furthermore, US tariffs would invite retaliatory actions by other countries. This would raise prices to consumers, and distort global supply chains as producers in the US and elsewhere change sources of supply and product destination.

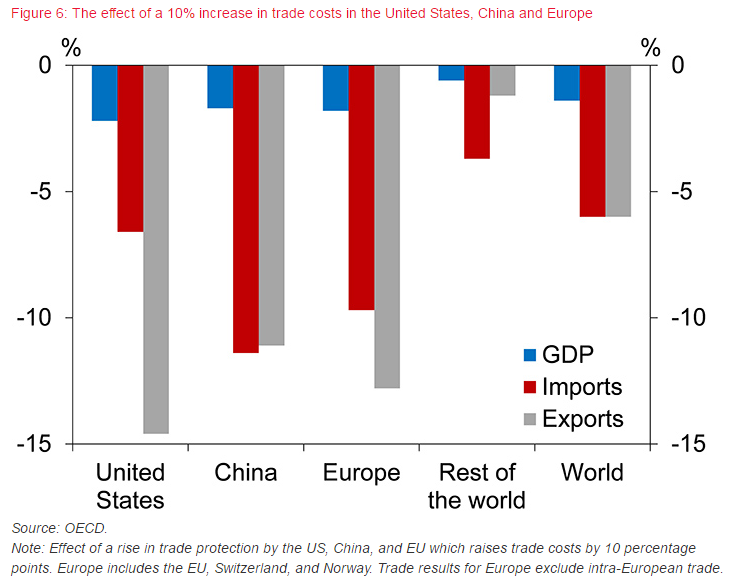

Increased protectionist measures would represent a negative global supply shock. Recent simulations conducted by the OECD estimate the potential impact of a general 10 percentage point increase in trade costs imposed by the major trading economies - the US, Europe, and China.6 Such an increase could have a major impact, especially on the countries introducing these restrictions: their GDP could fall by 2 to 3 percent; imports by 5 to 10 percent; and exports by 10 to 15 percent, with the US the worst affected. And the rest of the world would suffer too from falling GDP, imports, and exports.

New Zealand would not fare well in such circumstances. Even if our exports of goods and services to the US-currently over $8 billion - were not directly subject to higher tariffs, we would be hard hit by a downturn in the global economy, including among our main trading partners, in response to the direct and indirect impact of protectionist measures. We would experience lower global demand and weaker commodity prices. Our exporters would also experience efficiency losses and increased costs if they faced disruptions to established supply chains. We would also experience spillovers as foreign producers' diverted trade in response to tariffs and more general trading conditions.

World financial conditions would also change as heightened uncertainty and a rise in global risk aversion would likely lead to higher external funding costs even as global growth slows. In such a situation portfolio flows may shift to larger more liquid financial markets and our exchange rate could fall, placing upward pressure on domestic prices and eroding real incomes.

ii) Fiscal expansion in the US

As with the protectionist sentiment, it is too soon to be specific about the nature and size of fiscal stimulus in the US. However, the possibility of a significant US fiscal stimulus represents an upside risk for New Zealand. A significant stimulus would boost economic demand in the US and spillover to other countries. New Zealand would benefit through higher commodity prices and increased exports to the US and to our other trading partners experiencing higher growth as a result of the US stimulus.

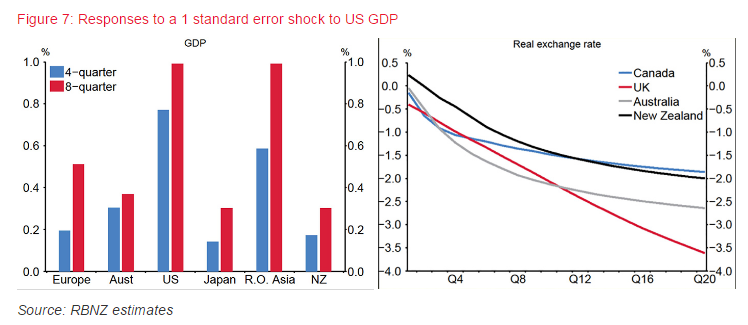

Modelling within the Bank suggests that a fiscal expansion that boosts US GDP by 1 percent would increase New Zealand's GDP by around 0.3 percent after 18 months. This increase in GDP results from higher commodity prices and expanded trade with the US and other regions benefiting from the US stimulus.

In the absence of offsetting changes, the Federal Reserve would likely need to tighten monetary policy more quickly than currently expected and the expectation and implementation of increases in the Fed Funds rate would put upward pressure on the US exchange rate. US long term interest rates would be expected to rise given the increased Government debt issuance.

In New Zealand, our long-term interest rates would be expected to increase and flow into higher mortgage rates, but the tightening in monetary conditions might be offset by some weakening in the NZ dollar exchange rate.

Conclusion

The Reserve Bank's economic projections in the February 2017 Monetary Policy Statement, which are based on several assumptions, suggest that the economy could grow by around 3½ percent pa over the next two years. Headline consumer price inflation is expected to return to the mid-point of the target band gradually, reflecting the strength of the economy, and despite persistent negative tradables inflation.

The official cash rate projections contained a neutral bias with an unchanged OCR until mid-2019. This means that if the economy were to develop in line with the Bank's economic projections, the OCR would remain at its current level over the next two years. However, small open economies such as New Zealand are hit by multiple shocks and the Bank assesses whether these, or a combination of them, warrants a change in monetary policy.

While the outlook for global growth has improved over the past 6 months due to rising commodity prices and stronger business and consumer sentiment, several major sources of uncertainty exist in Europe, China and the United States. The balance of risk in the global economy is on the downside.

Many of the risks in these regions are well known, and already reflected in relative prices such as interest rates, exchange rates and commodity prices. The greatest source of uncertainty relates to the US Administration policies in respect to its 'America first' policy platform. Although a substantial US fiscal stimulus could be positive for growth in the global economy, the prospect of a marked increase in protectionism - coming at a time when global trade is growing slowly and trade disputes are increasing - would have sizeable impacts on the global economy.

Domestically, there are several uncertainties around the economy including the future path for commodity prices, the exchange rate, migration, the housing market, and household saving. The greatest source of uncertainty currently lies around the housing market and the possibility that imbalances in the housing market might deteriorate. Fortunately, house price inflation has moderated substantially in recent months, but it's too early to say whether this moderation will continue.

We remain comfortable with our economic projections. Given the external and domestic risks in respect of output and inflation, we consider the risks evenly balanced in respect of the OCR.

1 The Global Economic Policy Uncertainty Index is a GDP-weighted average of national EPU indices for 15 countries that account for around three-quarters of global output at current prices. Each country's EPU index is constructed from an algorithm that searches newspapers for words related to uncertainty in an economic or policy context. The VIX is an index of S and P 500 options.

2 One possible reason why the VIX is muted despite rising uncertainty is that stocks are moving in different directions following recent US policy signals, supressing realised correlation and index volatility. However the Chicago Board of Options Exchange Skew Index, which measures the price of buying protection against dramatic moves in the S and P 500, indicates that investors appear to be concerned about tail risks.

3 IMF, April 2009, World Economic Outlook, Box 1.1 Global Business Cycles

4 IMF, April 2016, World Economic Outlook and 2016 China Article IV consultation report

5 WTO Report on G20 Trade Measures (mid-October 2015 to mid-May 2016)

6 OECD, November 2016 Economic Outlook