Murat Çetinkaya: Recent economic and financial developments in Turkey

Speech by Mr Murat Çetinkaya, Governor of the Central Bank of the Republic of Türkiye, at the press conference for the presentation of the Oktober 2016 Inflation Report, Istanbul, 27 October 2016.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Distinguished Guests,

Welcome to the briefing held to convey the key messages of the October 2016 Inflation Report.

The report typically summarizes the economic outlook underlying monetary policy decisions, shares our evaluations on macroeconomic developments and presents our medium-term inflation forecasts, which were revised in view of the developments in the last quarter, along with our monetary policy stance. Furthermore, I would like to talk about some of our evaluations on the recent steps taken by our Bank.

In addition to the main text, the Report includes eight boxes, which entail analyses on current and interesting topics. These boxes evaluate the dynamics of inflation over the last decade; discuss how developments in the tourism industry affected food inflation and key macroeconomic aggregates; and look into Turkey's export gains in the EU market on the competitiveness front. In addition, the Report also includes boxes that analyze the effect of agricultural banking on agricultural productivity; give a brief account of motivations for FX collateral deposits and then elaborate on their effects on currency swap markets; scrutinize recent loan developments through various indicators for loan supply and demand; and summarize the general framework and key features of the recent incentive systems introduced in Turkey. The titles of the boxes are shown on the slide. Each of these boxes shed light on important and current issues pertaining to the Turkish economy. I strongly recommend that you read these boxes, which will soon be published on our website.

Esteemed Guests,

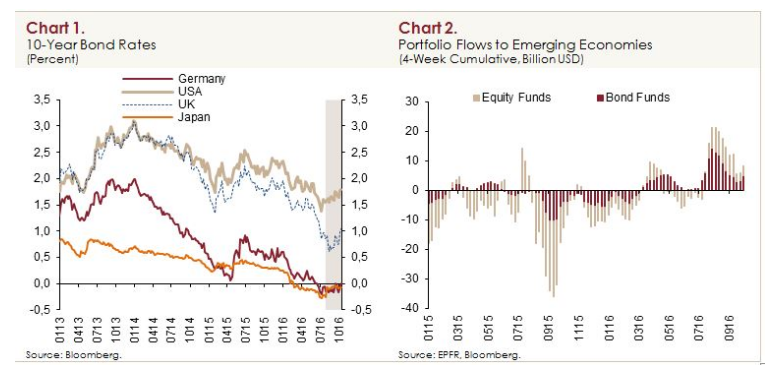

I would like to commence my speech by reviewing the global economic outlook, given its ongoing influence on our policies. As you all know, monetary policy developments in advanced economies were the major factor feeding into volatility in global markets in the third quarter of 2016. In this period, major central banks opted for more monetary easing, yet growing expectations of a possible Fed rate hike and uncertainties surrounding monetary policies of other advanced market central banks stopped the ongoing decline in bond yields (Chart 1). Thus, after a marked upsurge following the previous reporting period, portfolio flows into emerging economies have recently started to slow down again (Chart 2).

In addition to the volatility in global markets, both geopolitical developments and decisions of credit rating agencies caused domestic financial markets to fluctuate over the third quarter of 2016. In this period, Turkey attracted less portfolio flows than other emerging economies, while the Turkish lira depreciated against the US dollar and the country's risk premium inched up.

Overall financial conditions were supported by reduced tightness in monetary conditions, thanks to our policy actions, and macroprudential measures. The gradual fall in the marginal funding rate has partially passed through to loan and deposit rates while consumer loans have edged up in recent months. Consumer inflation was in line with the forecasts of the July Inflation Report in the third quarter of 2016, with core goods and unprocessed food pulling underlying inflation down. Domestic demand was subdued in the third quarter but leading indicators signal that economic activity will pick up by the fourth quarter of the year. Moreover, despite downside risks to external demand due to geopolitical tensions, the external trade balance continues to improve amid increasing EU demand. On the other hand, developments regarding tourism revenues cause a slight widening in the current account deficit.

1. Monetary policy and monetary conditions

Esteemed Guests,

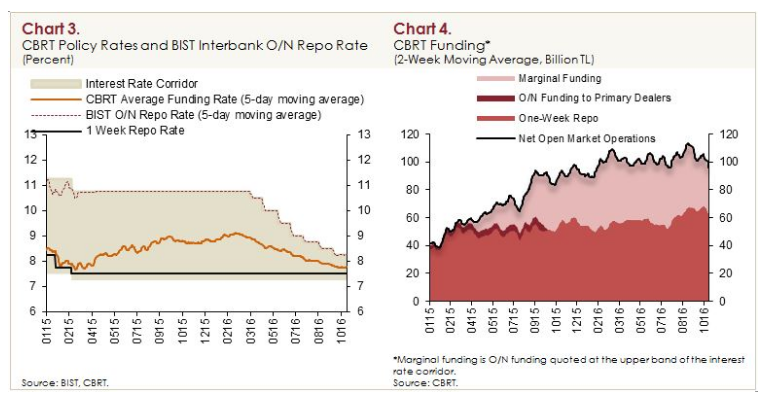

We continued with monetary policy simplification in the third quarter on the back of improved core inflation indicators, the favorable course of the global risk appetite and the effective use of monetary policy tools. Accordingly, we lowered the marginal funding rate to 8.25 percent by three consecutive 25 basis point reductions in July, August and September. On the other hand, in October, we left the policy rates unchanged in view of less tight financial conditions and spillovers of other cost factors to the inflation outlook. Hence, we kept the marginal funding rate, one-week repo auction rate and the overnight borrowing rate constant at 8.25, 7.5 and 7.25 percent, respectively (Chart 3). As you all know, with simplification, we aim to provide funding via a single rate, which will bring short-term market rates closer to the funding rate. The simplification will contribute to the effectiveness of the transmission mechanism by enabling a more reliable assessment of the monetary policy stance. In this context, we mostly achieved our targeted gains. We are planning to finalize the monetary policy simplification within a reasonable schedule. I also would like to add that the direction and timing of the next step towards simplification will depend on the developments affecting the inflation outlook and financial stability.

As CBRT, our main funding has continued to be provided via one-week repo auctions, while the share of our marginal funding decreased (Chart 4). Our weighted average funding rate dropped to around 7.8 percent in October. Interbank overnight repo rates remained on the decline in line with the reductions in the upper band of the interest rate corridor. I would like to underline that our monetary policy stance will continue to depend on the inflation outlook in the upcoming period. As CBRT, we will maintain our cautious monetary policy stance by taking into account the developments regarding inflation expectations, the pricing behavior and other factors affecting inflation.

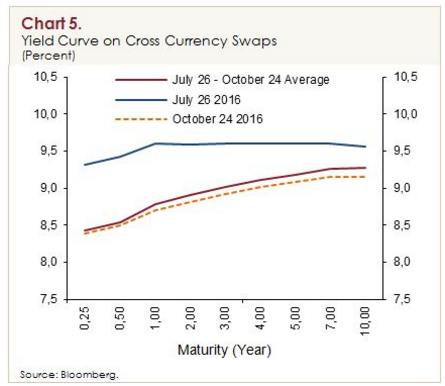

Amid continued expectations for a prolonged low interest rate environment across advanced economies as well as the favorable course of domestic macroeconomic indicators and monetary policy simplification, the yield curve shifted downwards in all maturities from the previous reporting period, as shown on the slide (Chart 5). The fall was more pronounced in short-term interest rates due to the decline in our funding rate.

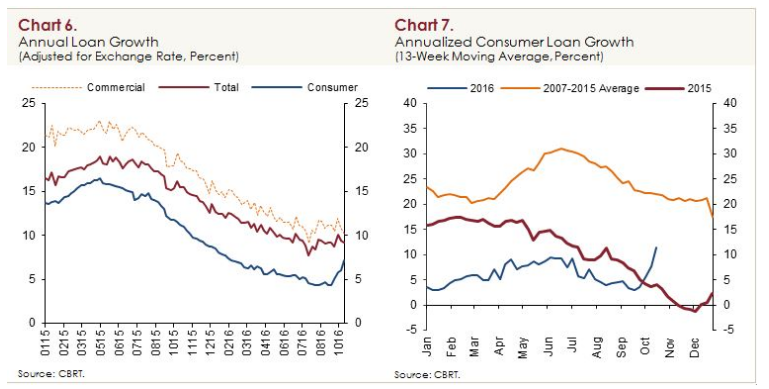

The slide in the annual growth rate of loans extended to the non-financial sector came to a halt in the third quarter of 2016 owing to reduced tightness in monetary conditions, macroprudential measures that support the financial system and government incentives (Chart 6). Commercial loans continued to grow faster than consumer loans in this period as well. Although the gradual fall in our marginal funding rate partially passed through to loan and deposit rates, loan standards remained partially tight in the third quarter. However, I would like to state that consumer loans have recently rebounded on the back of the favorable effect of our liquidity policies on banks' domestic funding conditions and emerging effects of macroprudential policies (Chart 7).

2. Macroeconomic developments and main assumptions

Estemeed Guests,

Now, I will talk about the macroeconomic outlook and our assumptions on which our forecasts are based. First, I will summarize the recent inflation developments. Then, I will continue with the domestic and external demand outlook upon which we based our projections.

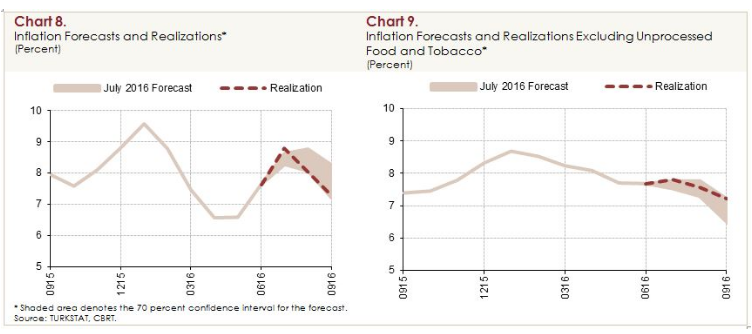

Consumer inflation ended the third quarter at 7.28 percent, remaining consistent with the lower bound of the July Inflation Report forecast (Chart 8). The fall in inflation was mostly driven by prices of core goods and unprocessed food, whereas annual inflation in tobacco and energy was up. Thus, inflation excluding unprocessed food and tobacco posted a smaller decline, according closely with the upper bound of the July Inflation Report forecast (Chart 9). The inflation outlook remained benign amid waning cumulative exchange rate effects, weakening demand conditions and modest import prices. Cost pressures driven by producer prices remained subdued in this period. On the other hand, rising tobacco prices and adjustments in fuel taxes hampered the improvement in inflation. Therefore, consumer inflation fluctuated while annual core inflation remained on a downward track through the third quarter.

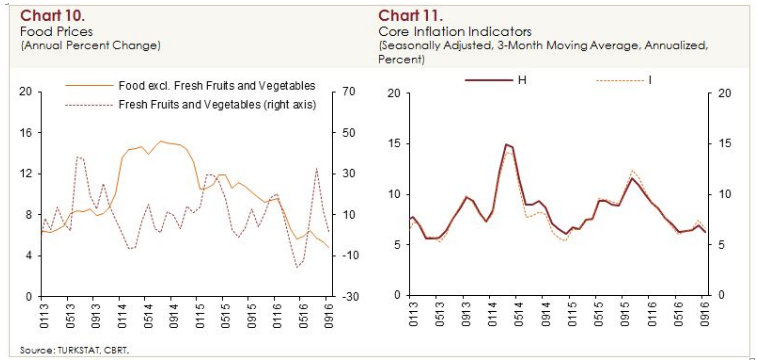

After a slight increase in the previous quarter, annual food inflation recorded a sharp drop in the third quarter, standing far below the path projected in the July Inflation Report. The slowing food inflation was mostly attributed to the waning tourism demand, the contraction in exports to Russia and the measures placed on red meat. Food inflation excluding fresh fruits and vegetables fell to a five-year low of 4.78 percent in September (Chart 10). Meanwhile, despite the sluggish economic activity and the slowing food inflation, services inflation remained high mostly due to rising real unit labor costs and rent.

The underlying core goods inflation slowed down in the third quarter as a result of moderate exchange rates and weakening domestic demand. On the other hand, the underlying services inflation increased. Accordingly, the underlying core inflation indicators remained largely flat compared to the previous quarter (Chart 11). Meanwhile, the tendency to increase prices was down quarter-on-quarter as implied by the diffusion indices for core indicators, while our alternative core inflation indicators posted a more solid decline. In conclusion, considering all indicators capturing the underlying trend and the pricing behavior, I would like to say that underlying inflation continued to improve in the third quarter.

Esteemed Guests,

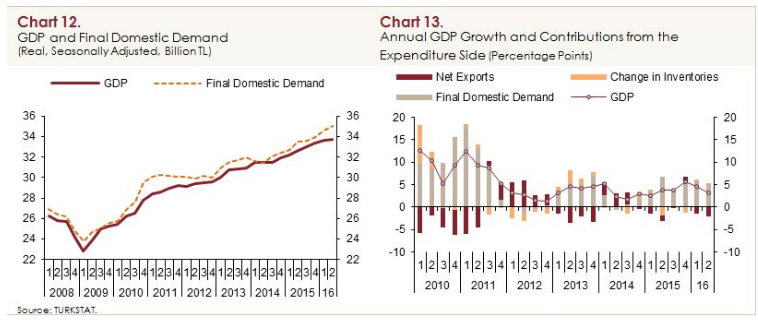

Economic activity slowed in the second quarter as we predicted in the July Inflation Report. The GDP grew by 0.3 and 3.1 percent in quarter-on-quarter and year-on-year terms, respectively (Chart 12). We observe that the main driver of annual growth was final domestic demand, whereas net exports provided more negative contribution to growth due to the tourism slump (Chart 13). The contribution of final domestic demand to growth has been through both public and private consumer spending, while investments remain subdued. Public spending provided a large (1.7 points) contribution to growth as in the first quarter. On the other hand, value added gains were limited in industrial and services sectors with strong linkages to tourism.

Indicators for the third quarter of 2016 point to further deceleration in economic activity. In addition to the deepening tourism slump, the mid-July domestic turbulence and working day losses due to religious holidays dampened production activities. Therefore, although the sharp drop in July's industrial production was offset by a rapid recovery in August, we expect production to fall below the second-quarter level in the third quarter. Yet, I would like to remind you that working day losses caused by the holiday in September will make it difficult to track the underlying trend in production as in July. Despite weaker domestic demand, growing EU demand continued to bolster Turkey's exports in the third quarter. Turkey's market shifting flexibility continues to cushion exports against the negative effects of geopolitical tensions on external demand.

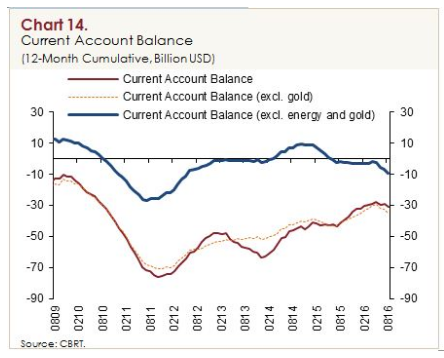

We expect domestic demand and economic activity to recover starting from the last quarter of 2016. Thanks to more accommodative monetary conditions and other measures, the recovery in consumer loans in recent months support our projections of improvement in the last quarter. Against this background, we envisage that the economic growth will be mild in 2016, which is marked by consecutive adverse shocks. In view of waning uncertainties in the upcoming period, we assess that producer and consumer confidence will be re-built, demand-stimulating policies will support consumption expenditures and negative contribution of net exports will fall, which will all contribute to economic recovery. In addition to the partial improvement both in tourism revenues and exports to Russia in the normalization process, we envisage that the recently released incentive packages will contribute to growth next year. On the other hand, uncertainties regarding the pace of global growth and monetary policies of advanced economies as well as the course of capital flows and geopolitical developments pose a downside risk to growth. Moreover, the persistent contraction in the tourism sector and the gradual decline in the favorable effects of commodity prices are likely to cause some increase in the current account deficit in the short term (Chart 14).

Esteemed Guests,

As you all know, food, energy and import prices also play a great role in inflation forecasts. Therefore, before moving on to forecasts, I will briefly talk about our assumptions regarding these variables.

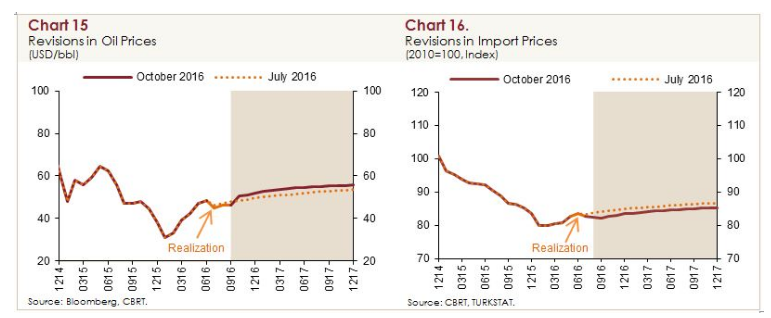

We revised our assumptions for crude oil prices for the upcoming period upwards compared to the July Inflation Report, while our assumptions for USD-denominated import prices saw some downward revision (Charts 15 and 16). As depicted on the slide, in terms of annual averages, we kept our oil price assumption constant at 44 USD for 2016, and increased it to 54 USD for 2017.

On the food front, food inflation remained far below the level envisaged in the July Inflation Report due to unprocessed food inflation in the third quarter of 2016. Taking account of the current trend of unprocessed food inflation as well as the decrease in the demand for food stemming from the fall in tourism revenues, food inflation, which we assumed to be 8 percent by end-2016 in the July Inflation Report, was revised downwards to 6 percent. Due to the ongoing weakness in food demand owing to the tourism sector that will persist in 2017 coupled with the measures taken by the Food and Agricultural Products Markets Monitoring and Evaluation Committee (the Food Committee), we expect food inflation to be lower than its historical average in 2017 as well. Accordingly, we revised our assumption for food inflation downwards from 8 percent to 7 percent for end-2017.

Our medium-term forecasts are based on an outlook that adjustments to taxes and administered prices will be consistent with the inflation target and automatic pricing mechanisms. For medium-term fiscal policy stance, we use the MTP projections covering the 2017-2019 period.

3. Inflation and the monetary policy outlook

Esteemed Guests,

Now, I would like to present our inflation and output gap forecasts based on the outlook I have described so far.

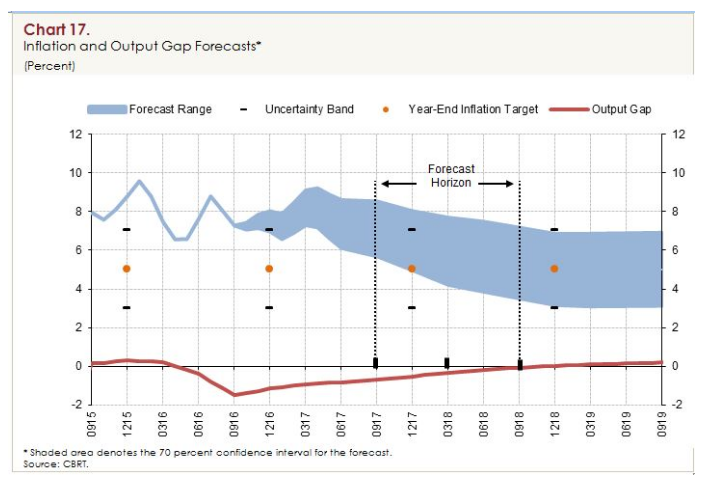

Given a cautious policy stance that focuses on bringing inflation down, we estimate inflation to approach gradually to the 5-percent target. Inflation is likely to be 7.5 percent in 2016, falling to 6.5 percent in 2017 and stabilizing around 5 percent in 2018. Accordingly, we expect inflation to be, with 70 percent probability, between 7 percent and 8 percent (with a mid-point of 7.5 percent) at end-2016 and between 5 percent and 8 percent (with a mid-point of 6.5 percent) at end-2017 (Chart 17).

The Turkish lira fluctuated following the July Inflation Report, while oil prices increased. We revised our assumptions for TL-denominated import prices upwards for the upcoming period compared to the previous reporting period. On the other hand, we envisage that the latest domestic developments will curb domestic demand particularly in the short term. Accordingly, we revised our output gap forecasts downwards. The year-end consumer inflation forecast for 2016 remained unchanged as downside effects and upside effects on inflation cancelled each other out. On the other hand, end-2017 consumer inflation forecast was revised upwards by 0.5 points as the upside effects driven by import prices outweighed the effects of the downward revision in the output gap and food inflation.

In addition to these forecasts, we summarize a variety of risk assessments regarding the overall macroeconomic outlook and the monetary policy in the Risks and Monetary Policy section of the Inflation Report. You can refer to the Report for details.

Esteemed Guests,

In the final part of my speech, I also would like to share some information on structural developments I mentioned in the previous Inflation Report briefings.

Previously, I have emphasized that long-lasting price stability would only be achieved through cooperation among institutions. Moreover, I underlined the role of structural factors in the higher-than-targeted inflation realization and price volatility in certain products. We continue to take actions in this regard.

Last month, secretarial affairs of the Food Committee were entrusted to the Central Bank of the Republic of Turkey. From now on, the Committee will be headed by the Deputy Prime Minister and measures regarding food prices will be evaluated efficiently. The committee held its first meeting under the new setup and commenced work. The key agenda items of the Food Committee include establishing an early warning system to facilitate close monitoring of supply and demand developments in food products and taking timely actions; enforcing foreign trade mechanisms when necessary also taking account of the sectoral balances; introducing arrangements to improve competition conditions in the wholesale and retail food market; taking logistic measures to diminish losses and developing efficient agricultural financing models.

Actions taken by the Food Committee set an invaluable precedent for the joint effort of institutions to achieve long-lasting price stability in Turkey. However, I would also like to underline that food is only one of the structural factors that slow down the disinflation process. We will soon announce our work on other structural issues that cause persistence in inflation.

Esteemed Guests,

While concluding my remarks, I would like to thank all my colleagues who contributed to the Report, primarily those at the Research and Monetary Policy Department as well as the members of the Monetary Policy Committee. I also thank every one of you for your participation and patience.