A multi-sector assessment of the macroeconomic effects of tariffs

We draw insights from multi-sectoral trade and macroeconomic models to quantify the implications of higher tariffs for inflation and output. While tariffs lower output in most jurisdictions, their inflationary consequences are nuanced. Tariffs are inflationary for countries that impose them and typically disinflationary for imposing countries' largest trading partners. For other countries, the estimated effects are generally small, as an inflationary impulse from disruptions to global supply chains balances out the disinflationary effect of lower global growth. For some countries, lower output and materially higher inflation pose difficult trade-offs for monetary policy, which could worsen if an initial rise in inflation becomes embedded in higher inflationary expectations.1

JEL classification: E17, E52, F17

In April 2025, the United States announced sharply higher import tariffs. Subsequent months have seen repeated cycles of trade policy announcements, negotiations, adjustments and reversals. While the final extent of tariffs remains uncertain, they are likely to be materially higher in the coming years than they were previously, at least for trade between the United States and the rest of the world.

Higher tariffs will affect inflation and output and hence matter for monetary policy. In principle, for countries that levy them, tariffs should resemble a supply shock – raising prices and lowering domestic incomes and output. For countries on the receiving end, they should resemble a demand shock – reducing economic activity and inflation. The size of the effects will depend on the size of the tariff and the depth of the affected trading relationships. In practice, the consequences will be more complex, as they depend not only on tariffs themselves but also on how the tariffs affect global supply chains. They also depend on the ability and willingness of households and businesses to substitute away from goods subject to tariffs.

This article assesses the short-run implications of the increase in tariffs for monetary policy through the lens of two complementary multi-sector models.2

Key takeaways

- Higher import tariffs could lower global growth and disrupt supply chains. The estimated effects on output and inflation are largest for the United States and its major trading partners.

- To fully assess the macroeconomic impact of tariffs and their implications for aggregate supply and demand, it is critical to account for global supply chains and sectoral spillovers.

- Some central banks could face a difficult trade-off between stabilising output and maintaining price stability, which could worsen significantly if inflation expectations de-anchor.

The first – a global multi-sector trade model – allows us to assess how tariff changes affect output and prices, by sector and country, taking into account potential shifts in household spending patterns, changes in the structure of global production networks and rerouting of trade flows. While well suited for this task, the trade model assumes flexible prices. Because of this, it cannot assess how monetary policy shapes the macroeconomic impact of tariffs. We therefore use our second model – a multi-sector New Keynesian dynamic stochastic general equilibrium (DSGE) model – to map the sectoral output and price responses generated by the trade model onto sectoral supply and demand shocks, analyse how sectoral dynamics affect aggregate output and inflation trajectories, and explore alternative monetary policy responses to tariffs.3

Our sectoral approach provides a granular perspective on how the effects of tariffs propagate within and across countries, highlighting their impact on global value chains and inter-industry dynamics. The sectoral dimension of tariff changes matters for two reasons. First, a large share of international trade consists of intermediate goods that cross borders as part of intricate global value chains, and tariffs will induce substitution across countries. Second, tariff rates, which vary greatly between industries, trigger cost spillovers and substitution effects across sectors within countries. Assessing tariffs from a sectoral dimension is therefore crucial to understand their macroeconomic impact and transmission within and across economies.

Three key findings stand out in our analysis. First, the effects of tariffs are more complex than the simple characterisation of countries as those that impose tariffs and those that are subject to them would imply. Countries that impose tariffs are also hit by spillbacks from the global reduction in aggregate demand. Meanwhile, countries that do not impose tariffs may still experience adverse supply shocks, not least due to the realignment of global value chains. Because firms may find it hard to adjust their production networks, at least in the short run, such supply disruptions could be inflationary and in some cases may even overwhelm the disinflationary effect of lower aggregate demand.

Second, a large part of our estimated macroeconomic effect of tariffs reflects sectoral spillovers within countries. For example, changes in output or prices in industries subject to tariffs will in turn affect wages and input costs in other parts of the economy, even if those sectors' products are not traded internationally or subject to tariffs. For jurisdictions most affected by tariffs, including the United States, Canada and Mexico, 30–50% of the drop in output is due to services, even though services are not subject to tariff changes.

Third, while monetary policy cannot make up for losses in potential output that result from higher tariffs, it can smooth changes in demand and limit movements in inflation. For countries like Mexico, where tariffs primarily resemble an aggregate demand shock, the monetary policy prescription is reasonably straightforward, as central banks face little trade-off between stabilising the output gap and stabilising inflation.4 For jurisdictions where changes in tariffs resemble an adverse supply shock, central banks face a more difficult choice. They may, for example, opt to "look through" the increase in prices in order to limit the decline in output. However, particularly in countries where projected price increases are large and inflation has not returned to target since the post-Covid-19 inflation surge, such a strategy creates the risk that inflation expectations will de-anchor. This could lead to worse outcomes for both output and inflation than would have resulted had the central bank not adopted a look-through strategy.

In addition to the three qualitative findings mentioned above, we also quantify the effects of tariff changes on key economies. While these indicate the possible magnitudes of the effects across countries, we would caution against reading too much into the specific numerical results. They assume, for example, a specific combination of tariffs across countries and industries, which may be subject to change. Moreover, they rely on a number of further assumptions about features of the economic landscape, such as the willingness of consumers and businesses to substitute across products or the degree to which businesses will absorb tariffs through lower profit margins, which are inherently uncertain. While the economic mechanisms we highlight are insensitive to the modelling choices used in this paper, the actual impact of tariffs could well be larger or smaller than we estimate.

The first section of this article describes the key features of recent tariff announcements and discusses the rationale for using a sectoral perspective to assess their monetary policy implications. The second quantifies the short-run implications of tariffs using a multi-country, multi-sector model of global trade. In the third section, we use a calibrated multi-sector New Keynesian DSGE model to recover the underlying demand and supply shocks that explain the sectoral output and inflation outcomes in the trade model and assess the implications of alternative monetary policy strategies. We conclude with some final policy considerations.

Tariff announcements and the structure of global trade

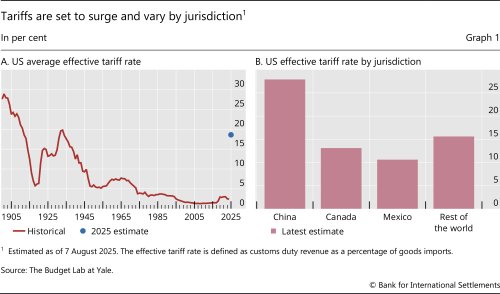

Recent US trade policy announcements represent a step change in the level of trade tariffs. Before the announcements, US tariffs had been low by historical standards (Graph 1.A). Notwithstanding a modest increase in the second half of the 2010s, the weighted average effective tariff rate was less than 3%. While the final extent of tariffs remains uncertain, it seems likely that US tariffs will ultimately settle at levels last seen in the 1930s.

Announced US tariff increases vary greatly across jurisdictions (Graph 1.B). As of the time of writing, most countries faced a tariff rate of 10–15%. There are some exceptions, however. Jurisdictions such as Brazil, China, Hong Kong SAR, India and Switzerland face much higher tariffs on many items. In contrast, many goods originating from Canada and Mexico that are covered by the United States-Mexico-Canada Agreement (USMCA) are exempt from tariffs.

US tariff increases also vary across items. Tariffs on aluminium and steel imports are now set at 50%, with few exceptions. Many motor vehicles and car parts face tariffs of 25%. In contrast, items such as petroleum, computer equipment, many pharmaceutical products and most services are currently excluded from tariffs.

Some jurisdictions have levied their own tariffs on US exports in response to US tariff announcements. For example, China has set tariffs of 10% on most imports from the United States, while Canada has imposed tariffs of 25% on imports of certain goods from the United States, including steel, aluminium products and car parts.

The macroeconomic effects of tariffs will be complex, for several reasons. One is the previously mentioned variation in tariff rates across items and countries. This creates an incentive for substitution, either by consumers – who may tilt their spending towards items that face lower tariffs – or businesses – which may shift production to jurisdictions that face lower tariffs in other markets. For countries that face relatively low US tariffs, substitution effects should cushion the fall in demand for their exports, although the gains to growth may be partly offset by higher imports from countries subject to higher US tariffs.

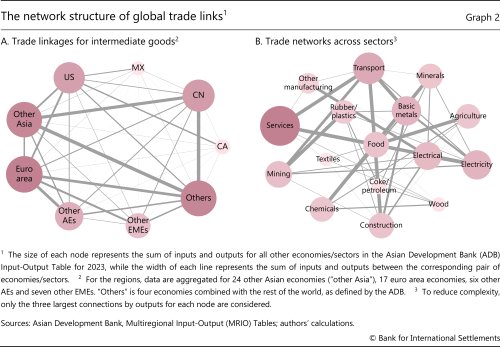

Trade in intermediate goods further complicates the impact of tariffs. Whether considered at the country or sectoral level, the global trading system represents a dense network of linkages that stretches well beyond the main trading partners of the United States (Graphs 2.A. and 2.B). Tariff-induced changes in bilateral trade flows could have disruptive upstream and downstream spillovers through production networks. Countries where demand falls due to the imposition of tariffs by key trading partners could nonetheless also face higher import prices on goods produced in supply chains that have been affected by tariffs.

The effects of tariffs will also be felt through shifts in global aggregate demand. Countries not subject to tariffs may nonetheless see exports decline if tariffs on their trading partners lower incomes, and hence spending, in those jurisdictions. The resulting contraction in economic activity will also be felt in sectors, such as services, that have not been subject to changes in tariffs.

When trying to quantify the macroeconomic implications of trade tariffs, it is therefore crucial to take a global perspective that considers cross-country demand spillovers, allows for potential substitution and disruption to supply chains, and accounts for sectoral differences in tariff rates and trade patterns. We turn to this in the next section.

The impact of tariffs on output and inflation – an initial assessment

We use a multi-sector global trade model, which we refer to as MS-Trade, to form an initial quantitative assessment of the impacts of tariffs on output and inflation.5 The model accounts for the direct effects of tariffs and second-round effects through changes in the structure of global value chains, domestic wages and other input costs, as well as in the composition of final demand across sectors and countries. Demand for each industry's output depends on its relative price, which in turn is determined by domestic and imported input costs, wages and any tariffs that goods may face in destination markets. The model can be used to assess the effect of changes in tariff rates on output and prices for each country and sector. We calibrate it to match the input-output structure of production and global trade across 16 sectors for 63 jurisdictions (see Box A for a description of the model).

We use the model to simulate the effects of announced tariffs as of 25 August 2025. The tariffs include differentiated US rates by country and sector, as well as retaliatory tariffs on US exports to China and Canada. We aim to assess the short-run effect of tariffs, ie over a time horizon relevant for central banks.6 Accordingly, while we allow agents in the model to alter their spending patterns in response to tariff-induced shifts in relative prices, we put more constraints on the degree of adjustment than we would if we sought to assess the long-run structural implications of tariffs. Specifically, when simulating the model, we assume that firms can adjust international trade along the intensive margin – meaning that they can choose to buy more or less from existing suppliers – but not along the extensive margin – meaning that they cannot tap entirely new sources of supply or start exporting to markets where they do not currently operate.7 We present all results as deviations from a counterfactual where tariffs remained at their end-2024 levels.

We show results for the world economy as a whole and for the jurisdictions that are most affected by the tariffs. These include the United States itself and its largest trading partners: Canada, China and Mexico. We also show results for Germany and Vietnam, which are among the most significant trading partners of the United States within the European Union and the Association of Southeast Asian Nations (ASEAN), as well as Brazil and India, two large economies subject to particularly high tariffs at the time of writing.8

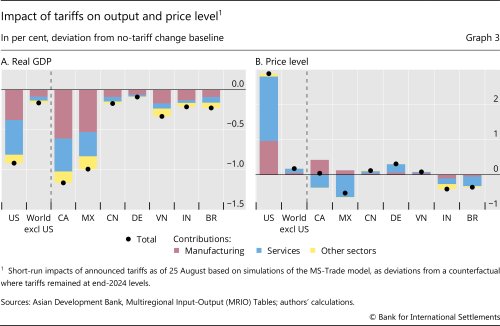

The impact of tariff changes on output and inflation varies across countries. The model's projections indicate that the effects will be felt strongly in the United States. Relative to a counterfactual with unchanged tariffs, our model suggests a significant drop in output and rise in the price level in the United States (Graphs 3.A and 3.B). These estimates of the short-run effects of tariffs are broadly within the range of other recent studies.9 Nonetheless, it should be emphasised that the projections do not factor in other recent developments that may lower inflation, as mentioned above. In particular, they do not account for the depressing effects of tariff uncertainty on aggregate demand or the reduction in oil prices since early 2025, and assume that firms do not accommodate tariffs through lower profit margins.

Output falls in most other jurisdictions as well, although the effects are material in only a few. Cross-country differences largely reflect the importance of trade with the United States (relative to the overall size of the economy) and the tariffs a country faces. For example, projected output declines are particularly large in Canada (1.2%) and Mexico (1%), for which the United States is by far the most important export destination.10 Economies in Asia with significant trade links to the United States are generally projected to experience somewhat smaller, but still noticeable, output declines. The estimated 0.3% output decline in Vietnam is among the largest. In Brazil and India, large economies subject to higher than average tariffs, output is projected to fall by a bit more than 0.2%. The hit to output is smaller in large economies where exports to the United States are less important relative to the size of the overall economy. For China and Germany, these are in the range of 0.1–0.2%.

The impact of trade tariffs on prices differs notably across countries as well. The cases of Mexico, Brazil and Canada are instructive. In Mexico, which experiences a sizeable output drop and for which the United States is the largest source of imports, prices fall by 0.5%. In Brazil, the price decline is only a bit smaller, at 0.4%, even though output is projected to decline by much less. In Canada, which displays the largest projected output drop, but which has also imposed retaliatory tariffs on the United States, the price level is projected to be essentially unchanged.

The variation in price changes across Mexico, Brazil and Canada reflects a mix of factors. First, in all three countries lower output is disinflationary, albeit to a lesser degree in Brazil – which has the smallest output decline – than in Canada or Mexico. Second, weighing against this disinflationary force, higher prices in the United States raise costs for firms that rely on US imports.11 This inflationary force transmits across countries through supply chain linkages, compounded by higher wages and prices.12 It is felt most strongly in countries that trade extensively with the United States, helping to explain the comparatively modest overall price decline (relative to output) in Mexico compared with Brazil. Third, retaliatory tariffs are a further inflationary force for countries that implement them. This explains why prices do not decline in Canada, despite the large ouput drop.

In most other economies, projected price changes are modest. Particularly in jurisdictions like China and Germany, whose integration into global supply chains is large relative to their bilateral trade links with the United States (Graph 2.A), the inflationary effect of higher intermediate input costs acts as a counterweight to the disinflationary effect of lower global aggregate demand, and can even offset it.

Spillovers across industries magnify the direct impact of tariff changes on aggregate outcomes. The contributions of the different sectors to changes in output and the price level illustrate this mechanism. The services sector, which is not subject to tariff changes, accounts for around half of the output drop in the United States and more than half of the increase in inflation.13 For economies like China, Germany, Brazil and Mexico, the contribution of services to price dynamics is also material.

The large contribution of services to overall price changes reflects three factors. First, many services are labour-intensive. Tariff-induced changes in aggregate economic conditions, which are likely to affect wages, will therefore also influence services prices. Second, some services (eg travel services) are traded and so can be affected by price changes abroad. Third, the services sector is large. Hence, even small moves in services prices can exert a large influence on the overall price level.

The size, and even direction, of the aggregate demand and intermediate input cost channels on services prices varies across countries. In Canada and Mexico, lower aggregate demand dominates the price impact on services. This contrasts with China, Germany and the United States, where higher intermediate input costs translate into higher services prices. These effects speak to the powerful – and at times countervailing – influence of shifts in aggregate demand and intermediate input costs in the transmission of tariff changes, and hence the value of assessing the implications of tariffs from a sectoral perspective.

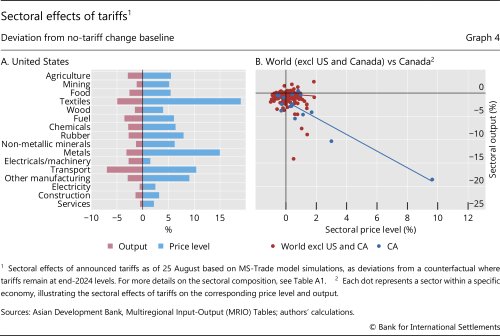

The output and price effects of higher tariffs vary greatly by industry. In the United States, output contracts in all industries. It falls most in the transport equipment and textile sectors, where US firms make extensive use of imported intermediate inputs.14 These sectors also see some of the largest price increases, of 10% and 19%, respectively, while in the metals industry prices rise by 15% (Graph 4.A). However, even in the services sector, which faces no additional tariffs, output still declines by around 0.5% and prices rise by 2.2%.

Outside the United States, these patterns are more nuanced. Those of Canada are unique (Graph 4.B, blue dots and line). Highly exposed to tariff increases due to its close trading relationship with the United States and having imposed retaliatory tariffs, our model suggests a severe drop in output and higher prices in several industries, albeit to a generally smaller extent than in the United States. Retaliatory tariffs play a key role, as their level significantly influences the extent of the increase in the price level. Elsewhere, there is a wide diversity of output and price outcomes (Graph 4.B, red dots and line). Both output and prices decline in many country/sector pairs (bottom left-hand quadrant), consistent with the intuition that tariffs by and large act as negative demand shocks for countries on the receiving end. However, in many country/sector pairs output and prices move in opposite directions (bottom right-hand and top left-hand quadrants), and in a few both output and prices even increase (top right-hand quadrant). This illustrates that the sectoral effects of tariffs are more complex than simple intuition would suggest, and motivates the use of our second model to shed light on these sectoral supply and demand interactions.

Further reading

Interpreting the transmission mechanism: supply, demand and production networks

We now turn to the mechanisms determining the output and price responses to tariff changes, which could inform the appropriate monetary policy response.15 To do so, we use our second model – the multi-sector New Keynesian DSGE model (BIS-MS; see Box B for a description). This model features the same 16-sector input-output structure as MS-Trade. Unlike that model, BIS-MS is a dynamic closed economy model featuring sticky prices. While unable to assess the effects of tariffs on global trade flows, BIS-MS is well equiped to analyse the implications of tariff changes for monetary policy.

We link the two models by calibrating BIS-MS to replicate the main results of the trade model from the previous section. Specifically, we calculate the sequence of supply and demand shocks in BIS-MS that allows it to exactly match the trade model's industry- and country-specific output and price responses after four quarters (see Box C for more explanation). The model's supply shocks can be interpreted as changes in imported goods prices resulting from global tariff changes. The demand shocks can be viewed as tariff-induced shifts in external demand. With these results in hand, we conduct two exercises.

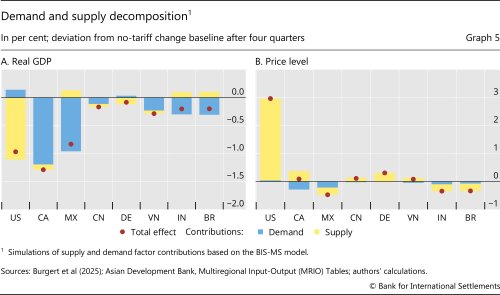

The first assesses the relative importance of supply and demand side influences in explaining the behaviour of sectoral output and prices. This reveals interesting country-specific patterns. As one might expect, for the United States, which has imposed tariffs on other countries, the model interprets the output and price movements primarily as cost-push shocks that lower aggregate supply (Graphs 5.A and 5.B).

For other countries, the drivers of output and prices are more nuanced. For most, negative demand shocks are a significant contributor to lower output. In fact, in economies like China and Vietnam, these shocks account for the bulk of the output decline, and in Mexico, India and Brazil for all of it. There are exceptions, however. In Canada, adverse supply shocks explain around 10% of the decline in output, reflecting retaliatory tariffs on imports from the United States.

The drivers of prices are different from those of output. While the negative aggregate demand shocks that lower output in most economies also weigh on prices, their influence is quantitatively small in most cases. One reason may be that BIS-MS is calibrated to a period in which the Phillips curve was flat in many economies, meaning that changes in economic activity have only a modest impact on prices. In contrast, shifts in aggregate supply are more important.

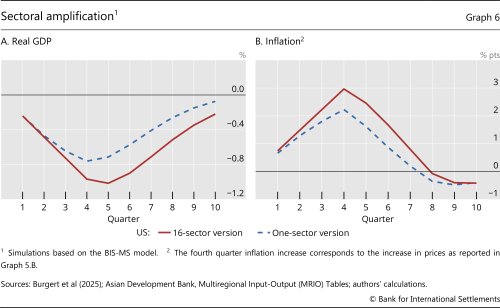

The second exercise illustrates the importance of production networks for understanding the transmission of tariffs. To do so, we set up an alternative version of the model that features only a single good and, hence, eliminates all sectoral interactions (henceforth, the one-sector model), meaning that the model does not account for any intersectoral production linkages. We then calculate the weighted average of the sectoral demand and supply shocks from the baseline 16-sector BIS-MS model and feed them into the one-sector model.

This exercise reveals that sectoral linkages play a substantial role in driving the aggregate results. For the United States, the trough in output in the one-sector model is only three quarters as deep as in the full model and substantially less persistent (Graphs 6.A and 6.B). Similarly, the rise in inflation is almost 1 percentage point lower. The difference for other countries is qualitatively similar.16

Policy implications

We now turn to the implications of tariffs for monetary policy.

A clear distinction exists between those economies where the overall impact of tariffs resembles an aggregate demand shock from those where it resembles an aggregate supply shock. In the former, where output and inflation move in the same direction, central banks face no distinct trade-off between stabilising economic activity and stabilising inflation, although they still face a choice about how quickly to seek to return these variables to target.

In jurisdictions where we project the effects of tariffs to resemble an aggregate supply shock, central banks, particularly those with a dual mandate to support domestic economic conditions as well as to ensure price stability, face a more complex task. In these economies, limiting the inflationary impact of tariffs risks worsening the output consequences, and vice versa.17

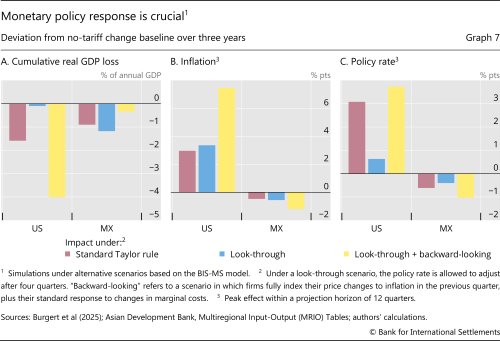

One way to illustrate the choices central banks face is to compare inflation and output outcomes across two scenarios: one where central banks follow a standard Taylor rule, which assumes that they respond to current levels of inflation and the output gap, versus an alternative scenario where they look through the effect of tariffs by holding their policy rates unchanged. Such a look-through strategy is a common policy prescription for central banks in the face of supply disturbances that are expected to be temporary.18 Conceptually, the introduction of tariffs that imply a "once-and-for-all" increase in the price level could fall into that category. Both scenarios consider the effects of tariffs in isolation, and do not take into account other economic developments that may influence the appropriate stance of monetary policy.

We find that for the United States, adopting a look-through strategy could potentially mitigate much of the short-run output loss that results from higher trade tariffs (Graphs 7.A and 7.B). Over the first three years after the introduction of higher tariffs, the projected cumulated output loss declines from 1.6% to 0.1% of annual GDP. However, this comes at the cost of a larger increase in inflation. In contrast, for Mexico, where the effect of tariffs resembles an aggregate demand shock, a look-through strategy leaves both output and inflation further away from target than would be the case if the central bank followed the model's standard Taylor rule.

A drawback of the look-through strategy is that higher inflation could have second-round effects from an upward shift in inflation expectations. The consequences of this could be substantial. For example, if we adjusted the model so that past inflation fed into expectations – what economists label backward-looking expectations – the projected increase in US inflation from tariffs would rise further (Graph 7.B).19

Large increases in inflation raise the risk that the look-through strategy could ultimately cause central banks to fall behind the curve. To then restore price stability, they may need to hike policy rates substantially (Graph 7.C). For the United States, if we assume that the look-through strategy were to be dropped after four quarters, the ultimate increase in the policy rate in our counterfactual simulation is larger than it would have been if the central bank had not pursued the look-through strategy. A delay in responding to higher inflation would come at a cost to economic activity.

Conclusion

This article has explored the implication of higher trade tariffs for monetary policy in the short run. Our analysis indicates that the impact of tariff changes for output and inflation will vary significantly across countries. In particular, it would have sizeable impacts mostly in the United States and its main trading partners – Canada and Mexico. We also show that accounting for the sectoral dimension of tariff changes is crucial for gauging their size and nature and, hence, for determining the appropriate monetary policy response.

For countries where the effects of tariffs resemble a supply shock, monetary policy faces a difficult trade-off. It cannot simultaneously stabilise inflation and the output gap. Counterfactual scenarios indicate that if inflation expectations remain well anchored, monetary policy may be able to offset much of the short-run output loss due to higher tariffs, at the cost of modestly higher inflation. However, if the increase in tariffs leads to inflation expectations becoming unmoored, the safest route (absent other disinflationary forces) for central banks is to set rates at a level that would achieve their inflation targets. Failing to do so may eventually require a much tighter monetary policy stance at the cost of a material loss of output.

Finally, one cannot expect monetary policy to undo any reductions in potential output that result from tariff changes, eg due to reduced ability to source goods from the lowest-cost producers. This speaks to the critical role of other policies – particularly structural reform policies – in helping economies adjust to the consequences of tariff changes. Over time, tariffs could lead to material changes in the shape of supply chains, both within and across economies. Even though these adjustments may mitigate some of the impact, there will be long-lasting effects. It will be important for central banks to understand these changes and their implications for growth, inflation and trade patterns going forward.

References

Bank of Canada (2025): "Evaluating the potential impact of US tariffs", Monetary Policy Report, January.

Baqaee, D and E Farhi (2022): "Supply and demand in disaggregated Keynesian economies with an application to the COVID-19 crisis", American Economic Review, vol 112, no 5, pp 1397–436.

Bergin, P and G Corsetti (2025): "Monetary stabilization of sectoral tariffs", NBER Working Paper, no 33845.

Bianchi, F, L Melosi and M Rottner (2021): "Hitting the elusive inflation target", Journal of Monetary Economics, vol 124, pp 107–22.

Boehm, C, A Levchenko and N Pandalai-Nayar (2023): "The long and short (run) of trade elasticities", American Economic Review, vol 113, no 4, pp 861–905.

Bonadio, B, Z Huo, A Levchenko and N Pandalai-Nayar (2021): "Global supply chains in the pandemic", Journal of International Economics, vol 133, pp 1–23.

Burgert, M, G Cornelli, B Erik, B Mojon, D Rees and M Rottner (2025): "The BIS multisector model: a multi-country environment for macroeconomic analysis", BIS Working Papers, forthcoming

Caldara, D, M Iacoviello, P Molligo, A Prestipino and A Raffo (2020): "The economic effects of trade policy uncertainty", Journal of Monetary Economics, vol 109, pp 38–59.

Caliendo, L and F Parro (2015): "Estimates of the trade and welfare effects of NAFTA", The Review of Economic Studies, vol 82, no 1, pp 1–44.

Dekle, R, J Eaton and S Kortum (2008): "Global rebalancing with gravity: measuring the burden of adjustment", IMF Staff Papers, vol 55, no 3, pp 511–40.

Eaton, J and S Kortum (2002): "Technology, geography, and trade", Econometrica, vol 70, no 5, pp 1741–79.

European Central Bank (ECB) (2025): "Eurosystem staff macroeconomic projections for the euro area", June.

Gnocato, N, C Montes-Galdon and G Stamato (2025): "Tariffs across the supply chain", ECB Working Paper Series, no 3081.

Hofmann, B, C Manea and B Mojon (2024): "Targeted Taylor rules: monetary policy responses to demand- and supply-driven inflation", BIS Quarterly Review, December, pp 19–35.

Kalemli-Özcan, Ş, C Soylu and M Yildirim (2025): "Global networks, monetary policy and trade", mimeo.

Kohlscheen, E, P Rungcharoenkitkul, D Xia and F Zampolli (2025): "Macroeconomic impact of tariffs and policy uncertainty", BIS Bulletin, no 110.

Mankiw, N and R Reis (2002): "Sticky information versus sticky prices: a proposal to replace the New Keynesian Phillips curve", The Quarterly Journal of Economics, vol 117, no 4, pp 1295–328.

Monacelli, T (2025): "Tariffs and monetary policy", mimeo.

Nelson, E (2025): "A look back at 'look through'", Finance and Economics Discussion Series, no 2025-037.

Paulson, C, A Poduri, A Singh and M Ulate (2025): "The economic implications of tariff increases", FRBSF Economic Letter, no 2025-17.

Poilly, C and F Tripier (2025): "Regional trade policy uncertainty", Journal of International Economics, vol 155, pp 104–34.

Rubbo, E (2023): "Networks, Phillips curves, and monetary policy", Econometrica, vol 91, no 4, pp 1417–55.

The Budget Lab (2025): "State of US tariffs: August 7, 2025", https://budgetlab.yale.edu/research/state-us-tariffs-august-7-2025.

Werning, I, G Lorenzoni and V Guerrieri (2025): "Tariffs as cost-push shocks: implications for optimal monetary policy", NBER Working Papers, no 33772.

Footnotes

1 The views expressed in this publication are those of the authors and not necessarily those of the BIS or its member central banks. We thank Andrew Li for superb research assistance. Matthias Burgert contributed to this article while he was on secondment at the BIS. For helpful comments, we are also grateful to Marco Del Negro, Gaston Gelos, Marco Lombardi, Phurichai Rungcharoenkitkul, Damiano Sandri, Andreas Schrimpf, Hyun Song Shin, Frank Smets, Tom Rosewall, Phil Wooldridge and James Yetman. All remaining errors are our own.

2 Our analysis focuses exclusively on the direct effects of tariffs. We do not assess the indirect effects arising from uncertainty about the size and scope of tariffs, shifts in household and business sentiment or pre-emptive stockpiling by firms in anticipation of higher future tariffs. Numerous studies, including Caldara et al (2020), Kohlscheen et al (2025), Poilly and Tripier (2025) and ECB (2025) conclude that higher trade policy uncertainty will weigh on economic activity. Likewise, we do not model the effects of shifts in investor perceptions of sovereign risk or of other major determinants of trade such as movements in commodity prices or persistent excess supply capacity in several large economies.

3 Several recent papers (eg Bergin and Corsetti (2025), Monacelli (2025) and Werning et al (2025)) have explored the implications of tariffs for optimal monetary policy. Kalemli-Özcan et al (2025) quantify the effect of the 2025 tariff changes for a single monetary policy rule. Our article is the first analysis that we are aware of that considers the implications of alternative monetary policy strategies at the country level.

4 Note that even if the output gap is zero, actual output may still be lower than it would have been in the absence of tariffs if potential output declines.

5 The model is based on Caliendo and Parro (2015).

6 We interpret this as corresponding to a one-year horizon in our simulations. That said, delays in tariff implementation, pre-emptive stockpiling in anticipation of tariffs or delays in price adjustment by firms due to uncertainty about the final level of tariffs, among other factors, all mean that these effects may play out over a longer horizon than the one we assume in this article.

7 Our interpretation of a scenario in which firms cannot adjust along the extensive margin as representing the short-run effects of a trade policy change follows Dekle et al (2008).

8 The online appendix includes the tariff assumptions, as well as output and inflation projections for all 63 jurisdictions.

9 For instance, The Budget Lab (2025) projects a 1.1% decline in GDP, relative to a no-tariff baseline, by mid-2026 and a 1.8% rise in the price level in the short run.

10 Our finding of a significant decline in economic output in Canada is consistent with projections from the Bank of Canada (2025), which report a decline in GDP growth of 2.5 percentage points in a scenario that assumes that the United States levies 25% tariffs on all goods imports and that Canada imposes retaliatory tariffs in response.

11 Although higher prices lower demand for US exports, the effect of this channel is smaller in our model than it would be if we allowed firms to adjust on the external margin and source products from jurisdictions with which they do not currently trade.

12 In related analysis, Gnocato et al (2025) conclude that tariffs levied on intermediate goods are more inflationary than those levied on final goods because tariffs on intermediate goods amplify cost pressures through production linkages.

13 Paulson et al (2025) also find that the services sector contributes substantially to the decline in output.

14 If we simulate the long-run effects of tariffs by allowing firms to adjust along the extensive margin (ie by accessing inputs from previously untapped markets), output in the US textile industry expands by 5%, while that in the transport industry declines by 4%, significantly less than the 7% drop observed in the short run. The consequences of these gains for aggregate US output, which still contracts by 0.7% relative to a no-tariff baseline, are modest.

15 While it is possible with MS-Trade to decompose output and price responses into the contributions of changes in tariffs, wages and intermediate input costs within and across sectors, one cannot use the model to separately identify shifts in sectoral or aggregate demand and supply.

16 In a similar vein, Kalemli-Özcan et al (2025) highlight that overlooking a multi-sector perspective risks underestimating the effects of tariffs on GDP.

17 Werning et al (2025) argue that in response to a tariff shock that transmits as a supply shock, the optimal monetary policy involves partial accommodation at the cost of higher inflation.

18 Hofmann et al (2024) present evidence that central banks respond more strongly to inflation that arises from changes in aggregate demand than they do when inflation is supply-driven. Nelson (2025) reviews historical episodes where central banks have looked through perceived temporary supply shocks and their link to well anchored inflation expectations.

19 One reason price- and wage-setting might be backward-looking is that it may be costly for households and firms to acquire information about the economic landscape (Mankiw and Reis (2022)). Hard to observe when inflation is broadly stable, such behaviour could become more apparent after significant economic disturbances, such as those resulting from large tariff changes.