Why have European stocks recently outperformed their US peers?

Box extracted from Overview chapter "Markets caught in cross-currents"

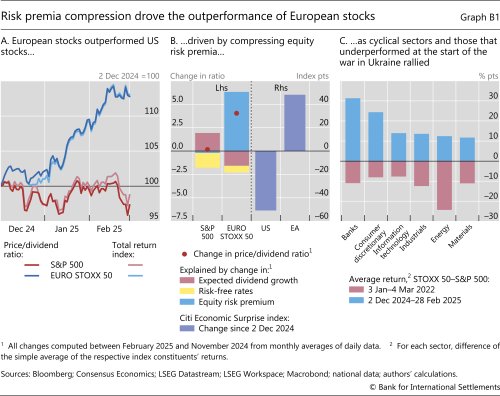

European stock markets outperformed their US peers, and most other global markets, in the new year. Despite the broad economic challenges faced by the region, including a tepid earnings outlook, high energy prices and the threat of tariffs, the EURO STOXX 50 index outstripped the S&P 500 by about 15 percentage points since early December (Graph B1.A). Other European indices in the United Kingdom and elsewhere also garnered strong gains. As a result, key valuation metrics in European equities, such as the price/dividend ratio, also improved by a similar margin versus the United States. In this box, we explore the drivers of this European outperformance and find that risk premium compression – investors' more benign sentiment regarding European stocks – has been the main driving force.

To understand the outperformance of European indices, it is useful to study the components of the price/dividend ratio. Conceptually, the index price itself should be equal to the discounted value of future expected dividends. As a result, changes in the price/dividend ratio can be decomposed into three main parts, which reflect discount rates or cash flows: (i) changes in risk-free rates; (ii) changes in equity risk premia; and (iii) changes in expected dividend growth. A rise in the first two components reduces the price/dividend ratio as higher risk-free rates or risk premia cause future cash flows to be discounted more heavily. In contrast, a rise in the third component increases the price/dividend ratio as it signals higher future dividends (ie cash flows).

Conceptually, the index price itself should be equal to the discounted value of future expected dividends. As a result, changes in the price/dividend ratio can be decomposed into three main parts, which reflect discount rates or cash flows: (i) changes in risk-free rates; (ii) changes in equity risk premia; and (iii) changes in expected dividend growth. A rise in the first two components reduces the price/dividend ratio as higher risk-free rates or risk premia cause future cash flows to be discounted more heavily. In contrast, a rise in the third component increases the price/dividend ratio as it signals higher future dividends (ie cash flows).

A decomposition along the lines just discussed reveals that risk premium compression has been the main force driving the recent outperformance in European stocks. During the review period, the price/dividend ratio for US stocks remained unchanged on average, while that of European stocks increased significantly (Graph B1.B, red dots). The rise in long-term rates put downward pressure on the price/dividend ratio in both the United States and Europe (yellow bars). An additional negative factor for European valuations was deteriorating expected dividend growth (red bars) in contrast to the improving figures for their US peers. On balance, the dominant factor that pulled up European stock market valuations despite the two countervailing headwinds was the large compression of the risk premia on European equities (blue bars).

On balance, the dominant factor that pulled up European stock market valuations despite the two countervailing headwinds was the large compression of the risk premia on European equities (blue bars).

Lower equity risk premia imply that investors demand less compensation for holding European stocks, increasing valuations. Several factors may underlie this more positive sentiment shift towards European stocks. First, high-frequency economic indicators have improved for Europe in recent months, in contrast to the United States (Graph B1.B, purple bars). Second, looser monetary policy in the short and medium term may shield some of these firms from threats like tariffs, not least by helping to keep exchange rates steady at current parities. Finally, the prospects of a more stable political situation in core European markets and perhaps even the potential easing of geopolitical conflicts in the region may have contributed to a general improvement in investors' sentiment towards European assets.

Consistent with improving sentiment and risk-taking in anticipation of an easing of geopolitical conflicts, most of the recent outperformance of European markets was driven by cyclical sectors. These sectors, such as consumer discretionary, banks and information technology, saw significant gains compared with their US counterparts during the review period (Graph B1.C, blue bars). Moreover, European sectors that could benefit from a sooner end to the war in Ukraine, via lower energy costs – such as energy, industrials and materials – also outperformed their US peers. These same sectors significantly underperformed during the period of rapid heightening of geopolitical uncertainty that surrounded Russia's invasion of Ukraine in February 2022 (red bars). Hence, the recent shift could at least partly reflect more positive sentiment and optimism about economic stability and growth in Europe in a context of de-escalating geopolitical tensions.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  The dividend yield decomposition is based on the analysis of J Campbell and R Shiller, "The dividend-price ratio and expectations of future dividends and discount factors", The Review of Financial Studies, vol 1, no 3, 1988, pp 195–228.

The dividend yield decomposition is based on the analysis of J Campbell and R Shiller, "The dividend-price ratio and expectations of future dividends and discount factors", The Review of Financial Studies, vol 1, no 3, 1988, pp 195–228.  Seminal papers in the large body of academic research on this matter are M Miller and F Modigliani, "Dividend policy, growth and the valuation of shares", Journal of Business, vol 34, no 4, 1961, pp 411–33; and T Marsh and R Merton (1987), "Dividend behavior for the aggregate stock market", Journal of Business, vol 60, 1987, pp 1–40.

Seminal papers in the large body of academic research on this matter are M Miller and F Modigliani, "Dividend policy, growth and the valuation of shares", Journal of Business, vol 34, no 4, 1961, pp 411–33; and T Marsh and R Merton (1987), "Dividend behavior for the aggregate stock market", Journal of Business, vol 60, 1987, pp 1–40.  In this application, we rely on dividend futures for both indices, which are available for the first five fiscal years. For the remaining horizon, we assume that dividends grow in line with long-term analyst expectations of earnings for each market, which implies a constant payout rate of dividends out of earnings.

In this application, we rely on dividend futures for both indices, which are available for the first five fiscal years. For the remaining horizon, we assume that dividends grow in line with long-term analyst expectations of earnings for each market, which implies a constant payout rate of dividends out of earnings.