US spillovers amid macroeconomic divergence

Box extracted from Overview chapter "Markets caught in cross-currents"

Core bond yields in advanced economies (AEs) moved up in tandem in the last few months, despite increased macroeconomic divergence. Since the start of the ongoing monetary policy cycle in early 2022, the US economy has been widely outperforming most of its AE peers, in terms of both realised growth and outlook. Under those conditions, interest rates would typically be expected to decouple, with US rates exhibiting more upward momentum than those of other AEs. Instead, US yields have been setting the tone for global yields, pulling up other AE yields, particularly in the second half of 2024. This box quantifies the extent of US rate spillovers to other AE rates and explores some of the potential drivers.

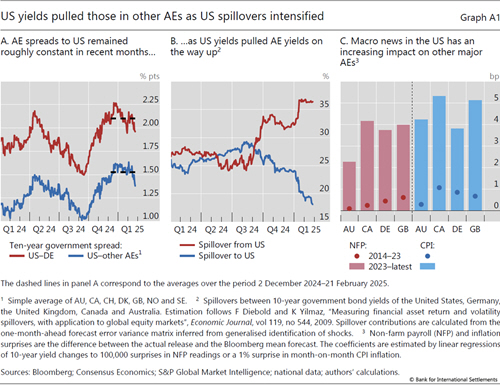

Long-term rates in major economies have been moving in lockstep in recent months, particularly since the fourth quarter of 2024. For instance, the spread between 10-year US Treasury notes and German bunds has fluctuated around 210 basis points since last October, which contrasted with a period of pronounced swings earlier in 2024 (Graph A1.A, red line). The picture for other AEs is broadly similar (blue line). Remarkably, growth in most AEs has generally trailed that of the US economy for most of the post-pandemic period, and uneven dynamism continued in the second half of 2024. Surveys indicate that economic forecasters do not expect AEs' growth to catch up with that of the United States in the near future.

The parallel upward shift in AE bond yields has been spearheaded by spillovers from US bond markets. The surge in US interest rates in the second half of 2024 has exerted a gravitational pull on the yields of other major economies. For instance, around a third of the variance of unexpected changes in the 10-year yields of Germany and the United Kingdom can be attributed to unexpected changes in US 10-year yields (Graph A1.B, red line).

The magnitude of the spillovers intensified quickly in the second half of 2024 and spiked at the beginning of 2025 as long-term rates in the US continued their upward march. In contrast, the spillovers from other major economies' yields to US rates receded gradually in 2024 and plummeted in the new year (blue line). In summary, US Treasuries have had much larger effects on AE bond markets than the other way around.

The larger spillovers from US bond markets seem related to the increasing impact of macroeconomic developments in the United States on bond yields of other major economies. Macroeconomic surprises in US economic data, ie the difference between actual release and consensus forecasts, are inducing larger market responses abroad. For instance, US labour market news during 2023–24 had an effect (Graph A1.C, red bars) about four times larger than the one typically observed in the previous decade (red dots). A similar pattern also holds for US inflation surprises (blue bars and dots), which had very little to no impact on AE yields before 2023 but have become very important since then as a driver of core bond yields.

This latest phase of highly synchronised increases in AE yields highlights the global influence of US yields. Several factors can be underlying these moves. First, adjustments in interest rates by the Federal Reserve have significant spillover effects on global financial markets by shaping investor expectations and sentiment globally. Second, spillovers could stem from international portfolio flows as global investors rebalance their portfolio and transmit shocks of US yields to other AEs.

Second, spillovers could stem from international portfolio flows as global investors rebalance their portfolio and transmit shocks of US yields to other AEs. US bond yields' disproportionate influence on other AEs, with limited reciprocal effects, further supports the notion of asymmetric spillovers and underscores the dominant role of the United States in global financial markets.

US bond yields' disproportionate influence on other AEs, with limited reciprocal effects, further supports the notion of asymmetric spillovers and underscores the dominant role of the United States in global financial markets.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  M Ehrmann and M Fratzscher, "Equal size, equal role? Interest rate interdependence between the euro area and the United States", The Economic Journal, vol 115, no 506, 2005, pp 928–48.

M Ehrmann and M Fratzscher, "Equal size, equal role? Interest rate interdependence between the euro area and the United States", The Economic Journal, vol 115, no 506, 2005, pp 928–48.  K Forbes and R Rigobon, "No contagion, only interdependence: Measuring stock market comovements", The Journal of Finance, vol 57, no 5, 2002, pp 2223–61.

K Forbes and R Rigobon, "No contagion, only interdependence: Measuring stock market comovements", The Journal of Finance, vol 57, no 5, 2002, pp 2223–61.  H Rey, "Dilemma not trilemma: The global financial cycle and monetary policy independence", NBER Working Papers, no 21162, 2015.

H Rey, "Dilemma not trilemma: The global financial cycle and monetary policy independence", NBER Working Papers, no 21162, 2015.