Growing uncertainty about terminal rates

Box extracted from Overview chapter "Investor optimism prevails over uncertainty"

With inflation on track towards targets and global economic activity remaining strong, central banks began easing the policy stance earlier this year. At the same time, the uncertainty over the level at which policy rates will eventually settle has been growing. This box documents how disagreement over "terminal rates" has recently evolved, based on the views of policymakers and professional forecasters.

Market participants have held a wide range of views about the short- to medium-term monetary policy outlook since 2021. At first, as central banks embarked on policy rate hikes, participants wondered how much tightening would be necessary to rein in inflation. Subsequently, as inflation started declining steadily, market commentary revolved around the question of how long rates would be kept high to ensure plain sailing to targets. More recently, as the easing phase began, the debate in markets has shifted towards terminal rates.

At first, as central banks embarked on policy rate hikes, participants wondered how much tightening would be necessary to rein in inflation. Subsequently, as inflation started declining steadily, market commentary revolved around the question of how long rates would be kept high to ensure plain sailing to targets. More recently, as the easing phase began, the debate in markets has shifted towards terminal rates.

The terminal rate can be viewed as the level of the policy rate that is consistent with inflation at target and economic activity at potential. As such, it is simply the nominal equivalent of the so-called natural rate of interest, or r*. In this sense, steering policy towards the terminal rate means aiming for a neutral policy stance, ie one that is neither tight nor loose. Similarly to r*, the terminal rate cannot be observed directly and must be inferred from the dynamic interplay of the variables that help define it: policy rates, inflation and economic activity.

In this sense, steering policy towards the terminal rate means aiming for a neutral policy stance, ie one that is neither tight nor loose. Similarly to r*, the terminal rate cannot be observed directly and must be inferred from the dynamic interplay of the variables that help define it: policy rates, inflation and economic activity.

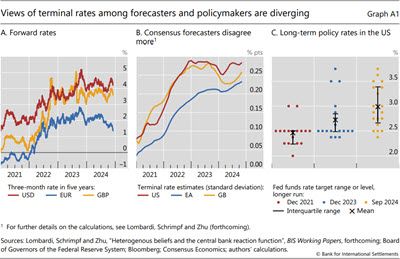

The global economy's apparent resilience despite the sharp policy tightening has led to upward revisions in proxies for terminal rates. Even with the caveat that they also reflect term premia, forward rates give a broad sense of bond market participants' view of how future short rates will evolve. A reasonable proxy for the terminal rate is the short-term rate expected to prevail five years ahead. Over the past few months, such short-term forward rates rose steadily, back to the levels of late 2023 (Graph A1.A). This has been hinting at a shallower easing trajectory and at an overall higher level of rates at the end of the loosening phase.

In parallel with an upward shift in expectations of terminal rates, the uncertainty surrounding them also increased. One way to gauge this is to consider professional forecasters' views on the policy stance across different jurisdictions. Professional forecasters in surveys are typically not directly asked about their views on policy rates in the long run, but one can use their expectations on interest rates, inflation and output to gauge their perceptions of the monetary policy rule, including the perceived level of neutral nominal rates. This can be done by stripping their short-run monetary policy expectations from the component that they ascribe to the cyclical position of the economy, ie their short-run expectations on inflation and output. On this basis, the estimated standard deviation of professional forecasters' perceived terminal rates rose across different jurisdictions from 2021 to 2022 in tandem with inflation. It then started declining somewhat as inflation receded, but has picked up again since mid-2024 in the euro area, the United Kingdom and the United States, even with inflation well on track towards targets (Graph A1.B).

On this basis, the estimated standard deviation of professional forecasters' perceived terminal rates rose across different jurisdictions from 2021 to 2022 in tandem with inflation. It then started declining somewhat as inflation receded, but has picked up again since mid-2024 in the euro area, the United Kingdom and the United States, even with inflation well on track towards targets (Graph A1.B).

The growing divergence of professional forecasters' views on terminal rates reflects uncertainty about a variety of factors. As argued above, one is the somewhat surprising resilience of economic activity to higher rates. Another relates to the outlook of inflation and to the central banks' expected response to possible future over- or undershooting of targets. But disagreement can also reflect higher uncertainty about the speed and strength of the transmission of monetary policy to economic activity.

The growing uncertainty among professional forecasters also echoes policymakers' own diverging views on terminal rates. This is evident in the United States, where the future policy rate forecasts of Federal Open Market Committee members are regularly disclosed through the Fed dot plot: members' views of the level of policy rates in the long term are a reasonable proxy for expected terminal rates. The upward revisions in those rates that took place as the economy repeatedly surprised on the upside coincided with a growing dispersion. At the end of 2023, expected terminal rates were still mostly clustered around 2.5%, as they had been two years earlier. By September 2024, the range had become substantially wider (Graph A1.C).

The growing divergence in views on terminal rates among both policymakers and professional forecasters underscores the challenges central banks face in navigating the current economic waters. Given the associated uncertainties, it also highlights the importance of relying on robust monetary policy frameworks.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  See M Aquilina, M Lombardi and S Zhu, "The return of monetary policy uncertainty", BIS Quarterly Review, March 2024.

See M Aquilina, M Lombardi and S Zhu, "The return of monetary policy uncertainty", BIS Quarterly Review, March 2024.  For an introductory discussion, see G Benigno, B Hofmann, G Nuño and D Sandri, "Quo vadis, r*? The natural rate of interest after the pandemic", BIS Quarterly Review, March 2024.

For an introductory discussion, see G Benigno, B Hofmann, G Nuño and D Sandri, "Quo vadis, r*? The natural rate of interest after the pandemic", BIS Quarterly Review, March 2024.  For further details, see M Lombardi, A Schrimpf and S Zhu, "Heterogeneous beliefs and the central bank reaction function", BIS Working Papers, forthcoming.

For further details, see M Lombardi, A Schrimpf and S Zhu, "Heterogeneous beliefs and the central bank reaction function", BIS Working Papers, forthcoming.  For an overview of the issues, see BIS, "Monetary policy in the 21st century: lessons learned and challenges ahead", Annual Economic Report 2024, Chapter II, 2024.

For an overview of the issues, see BIS, "Monetary policy in the 21st century: lessons learned and challenges ahead", Annual Economic Report 2024, Chapter II, 2024.