Markets' increasing response to labour market conditions in the United States

Box extracted from Overview chapter "Carry off, carry on"

Macroeconomic news triggers the repricing of financial assets, partly due to revised expectations of monetary policy. The extent to which asset prices respond to macroeconomic news depends on the perceived importance of the economic variable for central banks' monetary policy decisions.

This box examines the influence of two key economic indicators in the United States – non-farm payrolls and core consumer price index (CPI) inflation – on the yield of US Treasury bonds with two years to maturity (a yield curve segment that is fairly sensitive to shifts in policy expectations). We find that macroeconomic news has had a growing impact on asset prices in recent years, indicating that the Federal Reserve is becoming more data dependent. This was already the case amid the post-pandemic inflation surge, when inflation-related news came into the spotlight. In the more recent period, financial markets have shown an increasing sensitivity to labour market news.

This box examines the influence of two key economic indicators in the United States – non-farm payrolls and core consumer price index (CPI) inflation – on the yield of US Treasury bonds with two years to maturity (a yield curve segment that is fairly sensitive to shifts in policy expectations). We find that macroeconomic news has had a growing impact on asset prices in recent years, indicating that the Federal Reserve is becoming more data dependent. This was already the case amid the post-pandemic inflation surge, when inflation-related news came into the spotlight. In the more recent period, financial markets have shown an increasing sensitivity to labour market news.

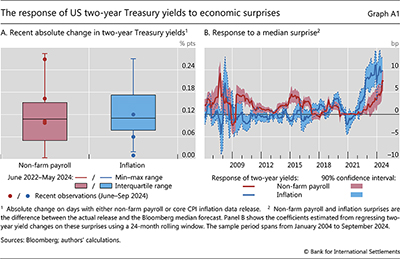

Recent labour market news has elicited large responses in asset prices despite the moderate size of the economic surprise. For instance, on 2 August, when the July non-farm payroll report was released, the two-year US Treasury yield declined by 26 basis points, representing a more than four standard deviation change for that month. More broadly, during the latest three job report release days, the absolute change in the two-year US Treasury yield was close to, or higher than, the median observed in the past two years (Graph A1.A, red dots). Meanwhile, the size of the data surprise, defined as the difference between the actual data and the median forecast by analysts polled by Bloomberg, was only close to or below the median.

The substantial movements in the two-year yield on recent job release days align with a trend of rising sensitivity of asset prices to labour market news. To illustrate this, we estimate the time-varying sensitivity of the two-year yield to the non-farm payroll surprise using rolling regressions with 24 months of data. Specifically, we employ a weighted least squares regression approach with higher weights assigned to more recent observations. Our estimates reveal that this sensitivity has been rapidly increasing since 2023 (Graph A1.B, red line). In fact, the magnitude of the latest estimate is near its two-decade peak.

Our estimates reveal that this sensitivity has been rapidly increasing since 2023 (Graph A1.B, red line). In fact, the magnitude of the latest estimate is near its two-decade peak.

The two-year yield has also exhibited high sensitivity to inflation surprises (Graph A1.B, blue line). Amid heightened inflation pressures, the sensitivity of two-year Treasury yields to core CPI inflation surprises surged during 2022. As inflation decelerated from post-pandemic peaks, the increase became more gradual and has currently plateaued at an elevated level. And as the magnitude of inflation surprises has diminished, the corresponding changes in the two-year yield have been limited in recent months (Graph A1.A, blue dots).

And as the magnitude of inflation surprises has diminished, the corresponding changes in the two-year yield have been limited in recent months (Graph A1.A, blue dots).

What explains the increasing importance of labour market surprises in recent months? The jury is still out. One possibility is that, with inflation seemingly on track towards the target, markets anticipate that the Federal Reserve will place a greater emphasis on labour market news when making policy decisions. Indeed, in a recent assessment of the economic outlook, the Federal Market Open Committee chair acknowledged diminishing upside risks to inflation and highlighted increasing downside risks to employment. Communication of this type could prompt market participants to update their perceptions about the central bank's reaction function and place more weight on employment conditions. The perceived evolution in the monetary policy reaction function could be an important driver of the increasing sensitivity of asset prices to labour market news.

Communication of this type could prompt market participants to update their perceptions about the central bank's reaction function and place more weight on employment conditions. The perceived evolution in the monetary policy reaction function could be an important driver of the increasing sensitivity of asset prices to labour market news.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  See, for example, J Faust, J Rogers, S-Y Wang and J Wright, "The high-frequency response of exchange rates and interest rates to macroeconomic announcements", Journal of Monetary Economics, vol 54, no 4, May 2007, pp 1051–68.

See, for example, J Faust, J Rogers, S-Y Wang and J Wright, "The high-frequency response of exchange rates and interest rates to macroeconomic announcements", Journal of Monetary Economics, vol 54, no 4, May 2007, pp 1051–68.  We weight observations with an exponential decay function, with 0.85 being the decay constant.

We weight observations with an exponential decay function, with 0.85 being the decay constant.  Labour market news has been found to be the most important data release in terms of influencing asset prices and trading activity. See M Fleming and E Remolona, "What moves the bond market?", Economic Policy Review, vol 3, no 4, December 1997, pp 31–50.

Labour market news has been found to be the most important data release in terms of influencing asset prices and trading activity. See M Fleming and E Remolona, "What moves the bond market?", Economic Policy Review, vol 3, no 4, December 1997, pp 31–50.  Also documented in Z Arnaut and M Bauer, "Monetary policy and financial conditions", FRBSF Economic Letter, no 07, 4 March 2024.

Also documented in Z Arnaut and M Bauer, "Monetary policy and financial conditions", FRBSF Economic Letter, no 07, 4 March 2024.  See J Powell, "Review and outlook", speech at the Federal Reserve Bank of Kansas City Jackson Hole Economic Symposium: Reassessing the Effectiveness and Transmission of Monetary Policy, 23 August 2024.

See J Powell, "Review and outlook", speech at the Federal Reserve Bank of Kansas City Jackson Hole Economic Symposium: Reassessing the Effectiveness and Transmission of Monetary Policy, 23 August 2024.  See M Bauer, C Pflueger and A Sunderam, "Perceptions about monetary policy", Federal Reserve Bank of San Francisco Working Papers, no 31, 2023.

See M Bauer, C Pflueger and A Sunderam, "Perceptions about monetary policy", Federal Reserve Bank of San Francisco Working Papers, no 31, 2023.