The correlation of equity and bond returns

Box extracted from Overview chapter "Markets adjust to 'higher-for-longer"

Amid a generalised increase in the volatility in fixed income markets and in sync with the inflation surge, the correlation between equity and bond returns has turned from negative to increasingly positive. A departure from the negative correlation between equity and bond returns, the typical configuration for the past two decades, weakens the diversification in the classical long-only asset allocation strategies of pension and investment funds. Specifically, it undermines the role of bonds as a hedge for the portfolio's equity portion. This box documents the recent persistence of positive correlations and explains it with reference to the inflation environment and the attendant uncertainty.

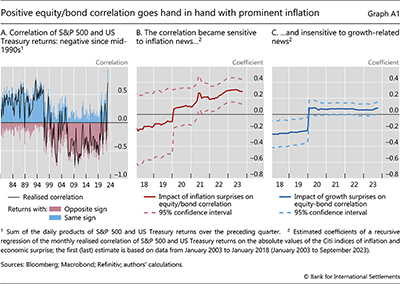

The correlation between US equity and government bond returns switched sign in mid-2021. Since then, the monthly realised correlation of the daily returns has become positive (Graph A1.A). One has to go back to the 1980s and the early 1990s to find a prolonged period with positive correlations.

The inflation environment plays a key role in shaping the correlation of equity and bond returns through the expected response of monetary policy to news. At times of low and stable inflation, market participants typically put more emphasis on growth-related news when forming expectations of monetary policy

At times of low and stable inflation, market participants typically put more emphasis on growth-related news when forming expectations of monetary policy Growth surprising on the downside, for example, would depress equity prices due to lower expected earnings. Such a surprise would also raise expectations of a monetary policy easing, so that bond prices would be boosted by lower discount rates. Thus, in a low-inflation environment, a negative correlation between equity and bond returns prevails. By contrast, at times of high and volatile inflation, it is the inflation outlook that takes centre stage in shaping the expected path of monetary policy rates. Positive inflation surprises, for example, depress the price of outstanding bonds, since their principal and coupons are expressed in nominal terms. Positive inflation surprises also raise expectations of rate hikes and give central banks less scope to cut interest rates if growth falters. This depresses future earnings and equity prices. In such an environment, the correlation between equity and bond returns would thus be positive.

Growth surprising on the downside, for example, would depress equity prices due to lower expected earnings. Such a surprise would also raise expectations of a monetary policy easing, so that bond prices would be boosted by lower discount rates. Thus, in a low-inflation environment, a negative correlation between equity and bond returns prevails. By contrast, at times of high and volatile inflation, it is the inflation outlook that takes centre stage in shaping the expected path of monetary policy rates. Positive inflation surprises, for example, depress the price of outstanding bonds, since their principal and coupons are expressed in nominal terms. Positive inflation surprises also raise expectations of rate hikes and give central banks less scope to cut interest rates if growth falters. This depresses future earnings and equity prices. In such an environment, the correlation between equity and bond returns would thus be positive.

Empirical evidence confirms that the inflation environment affects the correlation of equity and bond returns. The coefficient on inflation surprises turned positive and statistically significant in mid-2021 (Graph A1.B). By contrast, the coefficient on growth news, while significant and negative in the period prior to mid-2021, has become statistically insignificant more recently (Graph A1.C).

A positive correlation between equity and bond returns can partly explain the increase in bond yields observed over the past months. The hallmark portfolio structure of passive investors includes government bonds as a hedge against the swings of riskier assets such as equities. However, if returns on bonds and equities are positively correlated, the former will no longer work as a hedge, and investors will require a higher term premium – ie compensation for undiversified risk in government bonds. Hence, the switch in the sign of correlations between equity and bond returns has contributed to the recent increase in bond yields by pushing up the term premium.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  The shift from a positive to a negative correlation in the late 1990s has been widely documented and researched. More specifically, it has been associated with phases of monetary tightening at times of low inflation (see for example L Beale and F Van Holle, "Stock-bond correlations, macroeconomic regimes and monetary policy", SSRN Working Paper, October 2017), or more broadly to a change in the relationship between monetary policy and the business cycle (see J Campbell, C Pflueger and L Viceira, "Macroeconomic drivers of bond and equity risks", Journal of Political Economy, vol 128, no 8, August 2020).

The shift from a positive to a negative correlation in the late 1990s has been widely documented and researched. More specifically, it has been associated with phases of monetary tightening at times of low inflation (see for example L Beale and F Van Holle, "Stock-bond correlations, macroeconomic regimes and monetary policy", SSRN Working Paper, October 2017), or more broadly to a change in the relationship between monetary policy and the business cycle (see J Campbell, C Pflueger and L Viceira, "Macroeconomic drivers of bond and equity risks", Journal of Political Economy, vol 128, no 8, August 2020).  See also A Cieslak and A Schrimpf, "Non-monetary news in central bank communication", Journal of International Economics, vol 118, May 2019.

See also A Cieslak and A Schrimpf, "Non-monetary news in central bank communication", Journal of International Economics, vol 118, May 2019.  In a low-inflation environment, as inflation fluctuations around target are typically small and short-lived, they do not necessarily elicit a monetary policy response. In fact, inflation may be driven largely by relative price changes, which monetary policy could safely overlook; see C Borio, M Lombardi, E Zakrajšek and J Yetman, "The two-regime view of inflation", BIS Papers, no 133, March 2023.

In a low-inflation environment, as inflation fluctuations around target are typically small and short-lived, they do not necessarily elicit a monetary policy response. In fact, inflation may be driven largely by relative price changes, which monetary policy could safely overlook; see C Borio, M Lombardi, E Zakrajšek and J Yetman, "The two-regime view of inflation", BIS Papers, no 133, March 2023.  The same point was made, in the context of low inflation, by R Clarida, "Monetary policy, price stability and equilibrium bond yields: success and consequences", speech at the High-level conference on global risk, uncertainty and volatility, Zurich, November 2019.

The same point was made, in the context of low inflation, by R Clarida, "Monetary policy, price stability and equilibrium bond yields: success and consequences", speech at the High-level conference on global risk, uncertainty and volatility, Zurich, November 2019.