Leverage and liquidity backstops: cues from pension funds and gilt market disruptions

Box extracted from Overview chapter "Markets swayed by inflation and growth prospects"

The market for UK sovereign bonds (gilts) experienced significant turmoil in late September. A sharp rise in yields, set off by the then announced change in the UK fiscal stance, was amplified by forced selling due to rapid deleveraging by investment vehicles used by pension funds. This box reviews the dynamics that led to the disruptions and highlights factors that could set off similar episodes in other markets and jurisdictions.

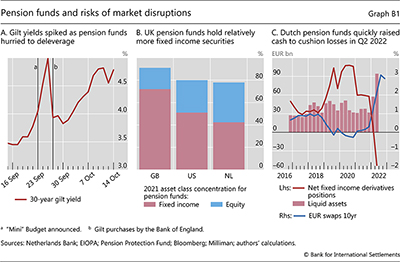

Liquidity in the gilt market started to worsen on 22 September 2022, when the Bank of England announced a 50 basis point rate hike, and deteriorated rapidly the following day (Graph B1.A). A surge in yields was precipitated by plans for an expansionary fiscal programme featuring tax cuts and energy subsidies. In addition, the gilt market witnessed unusually large trading volumes, a sharp widening of bid-ask spreads and a significant depreciation of sterling. Markets returned to normal only when the Bank of England committed to purchase large amounts of long-dated gilts on 28 September. To encourage timely deleveraging, the commitment was for a limited period.

Liability-driven investment (LDI) funds played an important role in the late September events. These legally separate investment vehicles help defined benefit pension funds hedge long-lived liabilities towards future retirees. A hedging strategy could in principle simply entail purchasing long-term sovereign bonds, similar to asset-liability duration matching by insurance companies. But, over the years, a shortage of such physical bonds led UK LDIs to obtain the desired asset side duration via leverage, which increases the sensitivity of asset returns to long-term interest rates. LDIs had levered up by funding bond holdings with repurchase agreements (repos) or, to a smaller extent, by partial collateralisation of interest rate swaps.

But, over the years, a shortage of such physical bonds led UK LDIs to obtain the desired asset side duration via leverage, which increases the sensitivity of asset returns to long-term interest rates. LDIs had levered up by funding bond holdings with repurchase agreements (repos) or, to a smaller extent, by partial collateralisation of interest rate swaps.

As gilt yields rose rapidly in September, LDI funds came under severe pressure, in contrast to pension funds themselves. The yields' rise generated losses for LDIs' leveraged positions and triggered calls for additional collateral. To meet these calls, LDIs needed cash infusions, which pension funds failed to provide promptly enough. The infusions were particularly slow to come for "pooled LDIs", which manage assets on behalf of multiple pension funds. In this case, individual pension funds had less incentive to step in, as the benefits would have been shared by all participants but the costs borne privately. As their solvency positions worsened, LDI funds had to deleverage by selling gilts, putting further upward pressure on yields and setting off a full-fledged spiral. These yield moves might have also been amplified by other intermediaries attempting to maintain matched duration across assets and liabilities. From a system-wide perspective, the cause of market dysfunction was predominantly a liquidity problem. Pension funds' overall net worth actually improved with the higher interest rates: given incomplete hedging, the decline in the present value of marked-to-market liabilities more than offset the corresponding asset losses.

These yield moves might have also been amplified by other intermediaries attempting to maintain matched duration across assets and liabilities. From a system-wide perspective, the cause of market dysfunction was predominantly a liquidity problem. Pension funds' overall net worth actually improved with the higher interest rates: given incomplete hedging, the decline in the present value of marked-to-market liabilities more than offset the corresponding asset losses.

In principle, the mechanism that led to the UK turmoil could be at work in other jurisdictions. Key determinants of potential disruptions are: (i) leverage, which raises the risk of forced sales to prevent a default; (ii) lack of portfolio diversification, which forces funds to sell similar assets; (iii) small market size for the assets being sold, which raises the price impact of forced sales; and (iv) reliance on pooled LDI funds, which are slow to raise liquidity.

On the basis of these criteria, other large defined benefit pension systems, notably in the Netherlands and the United States, appear less vulnerable to the risk of fire sales than those in the United Kingdom. To begin with, US pension funds reportedly seldom use leverage, in part because the shorter duration of their liabilities limits their need to hedge with long-duration investments. Likewise, Dutch pension funds rely less on leverage than their UK counterparts, as they only hedge less than 60% of their interest rate risks on average.

Likewise, Dutch pension funds rely less on leverage than their UK counterparts, as they only hedge less than 60% of their interest rate risks on average. They also often use over-the-counter derivatives for hedging, with flexibility to post margins with certain securities rather than cash. As for diversification, portfolios of US and Dutch pension funds are less concentrated in fixed income instruments than those in the United Kingdom (Graph B1.B).

They also often use over-the-counter derivatives for hedging, with flexibility to post margins with certain securities rather than cash. As for diversification, portfolios of US and Dutch pension funds are less concentrated in fixed income instruments than those in the United Kingdom (Graph B1.B). In addition, compared with the United Kingdom, the sovereign bond holdings of US and Dutch pension funds represent a smaller share of the total outstanding amounts of US Treasury and euro area sovereign debt, respectively. Lastly, US and Dutch pension funds rely less on pooled LDI funds and can readily use own fund-wide cash and liquid assets when the value of leveraged positions fluctuates. Indeed, as interest rates rose sharply in the second quarter of 2022, Dutch pension funds were able to quickly raise liquidity to cushion against the falling value of interest rate derivatives positions (Graph B1.C).

In addition, compared with the United Kingdom, the sovereign bond holdings of US and Dutch pension funds represent a smaller share of the total outstanding amounts of US Treasury and euro area sovereign debt, respectively. Lastly, US and Dutch pension funds rely less on pooled LDI funds and can readily use own fund-wide cash and liquid assets when the value of leveraged positions fluctuates. Indeed, as interest rates rose sharply in the second quarter of 2022, Dutch pension funds were able to quickly raise liquidity to cushion against the falling value of interest rate derivatives positions (Graph B1.C).

The stress episode in the gilt market holds broad lessons for non-bank financial intermediaries (NBFIs). Financial stability risks from high leverage and inadequate market liquidity are not confined to the pension fund sector. Indeed, long periods of low interest rates have incentivised a reach for yield and leverage build-up by financial institutions across the spectrum, including more innovative forms of securitisation, such as those of private equity funds. With rapid increases in interest rates and receding liquidity in core markets, simultaneous deleveraging can generate liquidity demand pressure, which could lead to market dysfunction. In addition, strategies that involve duration matching could create similar pressures, eg when a sharp rise in interest rates shortens liability duration, and prompts asset sales in a falling market. When these risks materialise and the attendant economic costs are substantial, there will be pressure on central banks to provide backstops – as market-makers of last resort. While justified, this can contrast with the monetary policy stance and encourage risk-taking in the longer run.

Financial stability risks from high leverage and inadequate market liquidity are not confined to the pension fund sector. Indeed, long periods of low interest rates have incentivised a reach for yield and leverage build-up by financial institutions across the spectrum, including more innovative forms of securitisation, such as those of private equity funds. With rapid increases in interest rates and receding liquidity in core markets, simultaneous deleveraging can generate liquidity demand pressure, which could lead to market dysfunction. In addition, strategies that involve duration matching could create similar pressures, eg when a sharp rise in interest rates shortens liability duration, and prompts asset sales in a falling market. When these risks materialise and the attendant economic costs are substantial, there will be pressure on central banks to provide backstops – as market-makers of last resort. While justified, this can contrast with the monetary policy stance and encourage risk-taking in the longer run.  Such dilemmas highlight the urgency of implementing systemically oriented regulation that addresses structural vulnerabilities in the NBFI sector.

Such dilemmas highlight the urgency of implementing systemically oriented regulation that addresses structural vulnerabilities in the NBFI sector.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  D Domanski, H S Shin and V Sushko, "The hunt for duration: not waving but drowning", IMF Economic Review, March 2017.

D Domanski, H S Shin and V Sushko, "The hunt for duration: not waving but drowning", IMF Economic Review, March 2017.  Bank of England, "Letter to the Chair of the Treasury Committee, House of Commons", 5 October 2022.

Bank of England, "Letter to the Chair of the Treasury Committee, House of Commons", 5 October 2022.  R Ratkowski, "Four structural differences to know about the UK and US LDI markets", NISA Perspectives, 20 October 2022.

R Ratkowski, "Four structural differences to know about the UK and US LDI markets", NISA Perspectives, 20 October 2022.  Netherlands Bank, individual pension fund statistics.

Netherlands Bank, individual pension fund statistics.  JPMorgan, "Flows & liquidity", 20 October 2022.

JPMorgan, "Flows & liquidity", 20 October 2022.  S Aramonte, A Schrimpf and H S Shin, "Non-bank financial intermediaries and financial stability", BIS Working Papers, no 972.

S Aramonte, A Schrimpf and H S Shin, "Non-bank financial intermediaries and financial stability", BIS Working Papers, no 972.  Markets Committee, "Market dysfunction and central bank tools", May 2022.

Markets Committee, "Market dysfunction and central bank tools", May 2022.  A Carstens, "Non-bank financial sector: systemic regulation needed", BIS Quarterly Review, December 2021, pp 1–6.

A Carstens, "Non-bank financial sector: systemic regulation needed", BIS Quarterly Review, December 2021, pp 1–6.