Liquidity risk in MBS markets

Box extracted from Overview chapter "Markets swayed by inflation and growth prospects"

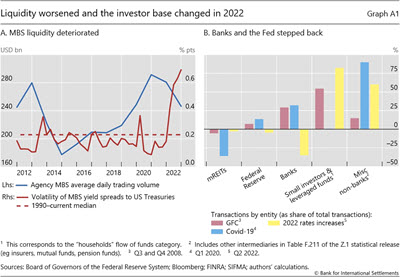

There are emerging signs of fragility in the markets for agency mortgage-backed securities (MBS). As MBS trading volumes declined in 2022, their yield spreads over US Treasuries became unusually volatile compared with those over the past 35 years (Graph A1.A). By examining transaction patterns across key intermediaries in the $10 trillion MBS market, this box discusses the risk of liquidity disruptions.

MBS demand from banks and the central bank proved an important stabilising force in two major stress episodes prior to 2022. During the Great Financial Crisis (GFC) and early in the Covid-19 pandemic, banks purchased large volumes of MBS, amounting to about 30% of transactions in each instance. The Federal Reserve was also an active buyer to support market functioning, absorbing roughly 10% in both cases (Graph A1.B). In contrast, other MBS investors were less reliable sources of demand. In particular, small investors and leveraged funds purchased significant amounts during the GFC but little in the midst of the Covid-19 crisis.

In contrast, other MBS investors were less reliable sources of demand. In particular, small investors and leveraged funds purchased significant amounts during the GFC but little in the midst of the Covid-19 crisis.

A shift in the composition of MBS buyers in 2022 could be a sign that the market has become more prone to bouts of volatility. Small investors and leveraged funds have become the main buyers, and they have been traditionally less forthcoming than banks in providing liquidity in times of stress. At the same time, monetary policy priorities may make it challenging for the Federal Reserve to backstop the MBS market, should the need arise. In this environment, surges in selling pressure could be particularly disruptive.

Among key market participants, closed-end funds known as mortgage real estate investment trusts (mREITs) are relatively prone to selling rapidly in times of stress. Large amounts of debt – often in the form of short-term repos – allow mREITs to pay out double-digit yields, even if they mostly invest in low-risk securities. High leverage and maturity mismatches imply that mREITs can be an important source of fire sales, even though they hold a small share of MBS outstanding (between 1.5% and 5% over the past 10 years). ,

, In fact, early in the Covid-19 pandemic, mREITs were behind a substantial fraction of overall MBS sales. In this instance, purchases by banks and the Federal Reserve provided the backstop, just as they did during the GFC.

In fact, early in the Covid-19 pandemic, mREITs were behind a substantial fraction of overall MBS sales. In this instance, purchases by banks and the Federal Reserve provided the backstop, just as they did during the GFC.

With a history of high liquidity demand in times of stress, mREITs remain a potential source of market dysfunction, especially if banks and the central bank continue to pull back.

Liquidity disruptions in the MBS market could have material systemic implications. First of all, MBS play a crucial role in facilitating credit to the US real estate sector. In addition, since MBS are near substitutes for US Treasuries, liquidity strains could reverberate more broadly in financial markets. The role of leverage and maturity mismatches in shaping fire sale risk in MBS markets, together with potential wide-ranging ramifications, is a reminder of the policy challenges in containing risk in non-bank financial intermediation.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  A Fuster, D Lucca, J Vickery, "Mortgage-backed securities", Federal Bank of New York Staff Reports, no 1001, 2022.

A Fuster, D Lucca, J Vickery, "Mortgage-backed securities", Federal Bank of New York Staff Reports, no 1001, 2022.  S Pellerin, D Price, S Sabol and J Walter, "Assessing the risks of mortgage REITs", Federal Reserve Bank of Richmond Economic Brief, no 13-11, 2013.

S Pellerin, D Price, S Sabol and J Walter, "Assessing the risks of mortgage REITs", Federal Reserve Bank of Richmond Economic Brief, no 13-11, 2013.  K Pence, "Liquidity in the mortgage market: How does the COVID-19 crisis compare with the global financial crisis?", Real Estate Economics, vol 50, no 6, 2022.

K Pence, "Liquidity in the mortgage market: How does the COVID-19 crisis compare with the global financial crisis?", Real Estate Economics, vol 50, no 6, 2022.  A Carstens, "Non-bank financial sector: systemic regulation needed", BIS Quarterly Review, December 2021, pp 1–6.

A Carstens, "Non-bank financial sector: systemic regulation needed", BIS Quarterly Review, December 2021, pp 1–6.