Front-end yields and central bank guidance: what can explain the disconnect?

The increase in advanced economies' front-end government yields between late September and late October exhibited signs of a disconnect from central bank policy guidance. This is because central banks had expressed the view that inflationary pressures were temporary, and policy rate increases, according to their guidance, were still some time away. In principle, two drivers could have accounted for the disconnect: investors' disagreement with respect to central banks' inflation outlook, or a misunderstanding of their reaction function. This box examines these drivers and provides suggestive evidence that the disconnect was more likely to have stemmed from disagreements on the inflation outlook.

This box examines these drivers and provides suggestive evidence that the disconnect was more likely to have stemmed from disagreements on the inflation outlook. ,

,

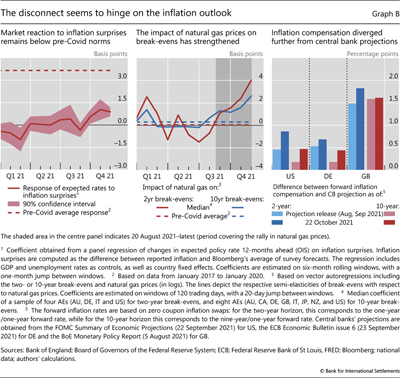

The shifts in advanced economies' (AEs) fixed income markets did not appear to be driven by any questioning of central bank guidance. If investors doubted the guidance, inflationary surprises – ie differences between realised inflation and the market consensus expectations – would have raised market-implied measures of expected policy rates. In fact, the sensitivity of such a measure (12 months ahead) to inflation surprises has been close to zero throughout this year (Graph B, left-hand panel, solid line). Indeed, this sensitivity was much lower than before the pandemic, when most central banks were on a path to normalising monetary conditions (dashed line). Taken at face value, these findings suggest that investors seemed convinced that, by and large, central banks were sticking to their guidance by "looking through" short-term inflation realisations.

By contrast, the outlook for inflation seems to loom large in bond market pricing. Inflation compensation (or break-evens) across AEs was particularly sensitive to changes in energy prices in recent months, notably in the wake of the extraordinary rally in the price of natural gas. The sensitivity of AE inflation break-evens to gas prices – which can drive inflationary pressures through wholesale electricity costs – has become much larger in recent months than in the pre-Covid period (Graph B, centre panel, solid vs dashed lines). Remarkably, both short- and long-term break-evens have shown a large sensitivity to the price of this energy source, in turn suggesting that investors were concerned not only about the immediate impact of gas prices but also about the lingering effects.

The material increase in the gap between inflation compensations – as captured by break-even rates – and central bank inflation projections during October can be seen as a further indication of disagreement on the outlook. The relatively large widening of the gap in October (Graph B, right-hand panel) points to a significant change in the attitude or perceptions of investors with regard to the inflationary outlook. That change seems to have transpired irrespective of the magnitude of the inflation surprises observed in October. The variations in an already complex inflationary outlook reduced investors' incentives to hold nominal bonds that were providing deeply negative yields in real terms (ie after inflation).

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  The authors thank Claudio Borio, Stijn Claessens, Andreas Schrimpf, Hyun Song Shin and Nikola Tarashev for helpful comments and discussions.

The authors thank Claudio Borio, Stijn Claessens, Andreas Schrimpf, Hyun Song Shin and Nikola Tarashev for helpful comments and discussions. Granted, price shifts due to investor repositioning, or other technical issues reflected in impaired arbitrage, may have exacerbated the disconnect.

Granted, price shifts due to investor repositioning, or other technical issues reflected in impaired arbitrage, may have exacerbated the disconnect.  Other bottlenecks may be playing a role in the surge of inflation compensation as well, especially the shortage of semiconductors constraining several areas of manufacturing, and logistical bottlenecks that brake international trade and clog global value chains. See D Rees and P Rungcharoenkitkul, "Bottlenecks: causes and macroeconomic implications", BIS Bulletin, no 48, November 2021.

Other bottlenecks may be playing a role in the surge of inflation compensation as well, especially the shortage of semiconductors constraining several areas of manufacturing, and logistical bottlenecks that brake international trade and clog global value chains. See D Rees and P Rungcharoenkitkul, "Bottlenecks: causes and macroeconomic implications", BIS Bulletin, no 48, November 2021.