Second-round effects feature less prominently in inflation dynamics

This box empirically examines how the importance of relative price "shocks" has changed across high and low inflation regimes. It also notes what the analysis can say about current conditions, given questions about the implications of the recent spate of sizable price increases for future inflation.

The construction of relative price shocks involves two steps. In the first step, we obtain relative price levels by estimating the following regression for each narrowly defined PCE sector:

where Δpi,t denotes the monthly log-difference of the price index in sector i and PC1t is the first principal component of Δpi,t estimated across all 131 sectors. The above regression is estimated separately on two non-overlapping subsamples: January 1960–December 1985, a regime of high and volatile inflation; and January 1986–December 2019, a regime of low and stable inflation. To construct relative price levels for each subsample, we cumulate the estimated residuals ϵi,t within each sector, thereby constructing (log) relative price levels, denoted by rpi,t, which are unrelated to fluctuations in the regime-specific common inflation component.

In the second step, we analyse how the pass-through of "salient" and positive relative price shocks to core PCE inflation – the Fed's preferred inflation measure – varies across the two inflation regimes. All else equal, these changes are the most likely to pass through: being large, they are more noticeable; and being positive, they tend to constrain consumers more than decreases. Similar considerations may apply to the decisions of producers, which ultimately underlie changes in the prices of the consumer basket.

We implement these ideas empirically using the non-linear transformation developed by Hamilton (2003) to analyse the impact of oil price shocks on the real economy. Specifically, we define a salient relative price increase in sector i in month t, denoted by  , as

, as

where,  is the largest (max) (log) relative price over the previous 12 months.

is the largest (max) (log) relative price over the previous 12 months.

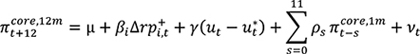

With these shocks in hand, we estimate the following "pass-through" regression:

where  is the 12-month core PCE inflation recorded 12 months ahead. The coefficient of interest in this specification is Βi, which measures the extent to which a salient relative price increase in a narrowly defined sector in month t feeds into core PCE inflation over the subsequent 12 months. The pass-through estimates filter out the influence of business conditions, as proxied by the deviation of employment from an indicator of full employment

is the 12-month core PCE inflation recorded 12 months ahead. The coefficient of interest in this specification is Βi, which measures the extent to which a salient relative price increase in a narrowly defined sector in month t feeds into core PCE inflation over the subsequent 12 months. The pass-through estimates filter out the influence of business conditions, as proxied by the deviation of employment from an indicator of full employment  , and control for lagged core inflation dynamics.

, and control for lagged core inflation dynamics.

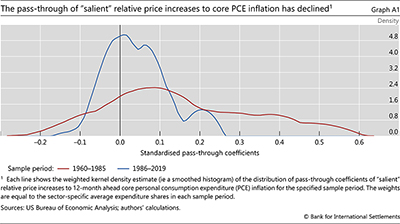

The results indicate that the pass-through of salient relative price increases has declined substantially with the transition to a low inflation regime (Graph A1). The distribution of pass-through estimates  's for the low inflation environment is much more concentrated around zero; in addition, the estimates are generally not statistically significant during this period. Put differently, the likelihood and size of second-round effects from relative price increases have diminished substantially.

's for the low inflation environment is much more concentrated around zero; in addition, the estimates are generally not statistically significant during this period. Put differently, the likelihood and size of second-round effects from relative price increases have diminished substantially.

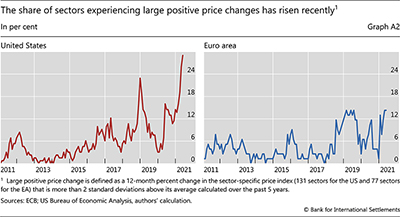

To see how this analysis can shed light on the current outlook, we need to look at what is behind the recent elevated readings of overall inflation. These readings have been driven mainly by large hikes in the prices of a relatively small number of pandemic-affected goods and services. In the United States and euro area, for example, the share of narrowly defined expenditure categories that registered outsize price changes in recent months – most of which involve goods and services affected by the pandemic – has increased considerably relative to recent historical norms (Graph A2).

In the United States and euro area, for example, the share of narrowly defined expenditure categories that registered outsize price changes in recent months – most of which involve goods and services affected by the pandemic – has increased considerably relative to recent historical norms (Graph A2).

A key question then is whether these large price increases in a relatively small share of the consumption basket will feed into more generalised inflation. Indeed, the second-round effects from rising energy prices feature prominently in explanations of the rise in global inflation in the 1970s. However, we currently live in a different monetary policy regime.

All else equal, the analysis in this box stresses that the recently observed price increases could be transient. This is because, assuming that past patterns continue to prevail, the pass-through of relative price shocks into inflation would be small in the current environment in which inflation has been enduringly low and stable as part of a credible monetary policy regime. At the same time, the "all-else-equal" clause is important. In particular, the post-pandemic increase in inflation is rather unusual, having taken place as part of the post-Covid normalisation process and on the back of unprecedented fiscal and monetary stimulus. The analysis here is just one piece of the jigsaw puzzle, which requires a much more holistic assessment (eg BIS (2021)).

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements or the Bank of Thailand.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements or the Bank of Thailand.  The unemployment gap is defined as the difference between the civilian unemployment rate and its estimate of the natural rate, where the latter is taken from the FRB/US model, a large-scale macroeconometric model of the US economy used by the Fed.

The unemployment gap is defined as the difference between the civilian unemployment rate and its estimate of the natural rate, where the latter is taken from the FRB/US model, a large-scale macroeconometric model of the US economy used by the Fed.  Admittedly, the rise in inflation is not entirely due to increases in the prices of pandemic-affected goods and services. Surging commodity prices have also contributed to higher inflation on the back of strong recoveries in China and in many advanced economies.

Admittedly, the rise in inflation is not entirely due to increases in the prices of pandemic-affected goods and services. Surging commodity prices have also contributed to higher inflation on the back of strong recoveries in China and in many advanced economies.