Markets send mixed signals

Risky asset and sovereign bond markets seemed to send mixed signals during the period under review.1 Equity indices rose further globally, with emerging market economy (EME) stocks climbing in September. In conjunction with corporate spreads remaining extremely compressed, this underpinned exceptionally accommodative financial conditions in many jurisdictions. In sharp contrast, government bond yields declined steeply in advanced economies (AEs), even as the expected monetary policy stance tightened somewhat, thus hinting at a certain degree of investor unease about the economic outlook further down the road. Concurrently, the US dollar started appreciating, conceding some ground only later in the quarter.

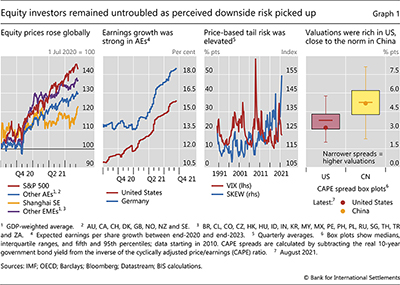

Stock markets reflected cross-country differences in the strength of the recovery. Improvements in expected earnings boosted AE benchmarks. At the same time, an elevated cost of insurance against large drops in stock prices suggested a rise in investors' concerns about tail risk. A weakening of growth prospects and a tightening of regulatory measures drove a fall in Chinese equities for most of the review period, before a more recent recovery.

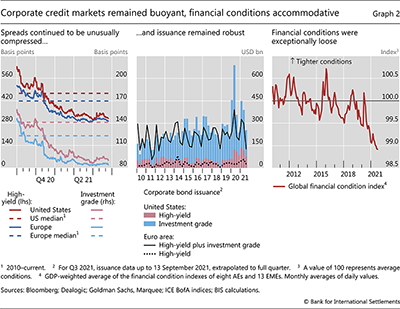

In corporate credit, risk appetite remained strong. Spreads stayed very tight by historical standards, although they widened noticeably but temporarily for the lowest-rated firms. Issuance was robust, especially for US high-yield borrowers.

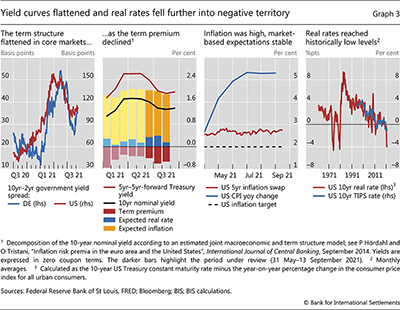

Yield curves flattened in AEs. Following decade-high inflation readings, market-based expectations of future US policy rates rose, supporting the short end of the curve. Somewhat surprisingly, the long end fell sharply. The jury is still out on the underlying drivers. They probably have to do with government bond purchases by central banks and selected non-US investors, the unwinding of leveraged positions and perceived risks to the economic outlook.

EMEs continued to face challenges on various fronts. Besides uncertainty about the evolution of the Covid-19 pandemic, two issues stood out. First, rising expected policy rates in the United States blunted the traditionally positive effect of falling long-term US yields on portfolio flows. Second, investors were concerned about country-specific developments, including a softening growth outlook in China – where sovereign yields fell as a result – and high inflation readings in many jurisdictions – notably in Latin America, where currencies weakened markedly against the US dollar.

Key takeaways

- The mood in advanced economies' equity and corporate credit markets continued to be upbeat but government bond yields declined, even as investors perceived an increased likelihood of monetary policy tightening.

- Financial conditions remained extremely accommodative, especially in the United States.

- Challenges to emerging market economies surfaced as currency weakness and portfolio outflows despite declining long-term US yields.

Risky assets add to gains even as downside worries intensify

Equity markets proved resilient in AEs, although perceived tail risks increased. In the euro area, and especially in the United States, stock indices continued their upward trend on the back of brisk expected earnings growth (Graph 1, first and second panels). However, investors appeared concerned about several developments, including the prospect of less forceful US fiscal stimulus, the lingering effects of the pandemic on the services sector and persistent supply chain disruptions in manufacturing. As a result, even though option-implied volatility remained range-bound, a common market-based indicator of tail risk – reflecting the prices of options that provide a hedge against large equity declines – spiked to an all-time high during the review period (third panel).

The pandemic shaped stock market developments in EMEs, too. In China, the main index declined slightly early in the review period, as economic activity slowed, but posted gains overall owing to a surge in September. Besides a withdrawal of support measures, regulatory actions weighed on the country's large technology sector. In other EMEs, equity prices moved sideways before following AE benchmarks higher, buffeted by the cross-currents generated by strong export demand and by restrictions aimed at fighting the resurgent virus.

Stock valuations were quite rich in some jurisdictions and sectors. In the United States, they were above historical benchmarks even after accounting for very low interest rates (Graph 1, fourth panel). In China, they were close to their long-run norm. In general, valuations were particularly elevated in growth-oriented industries, such as technology, and in fast-developing market segments related to sustainable investing (Box A).

Market buoyancy was also visible in rising house prices. The pace of appreciation was strong in AEs, particularly in the United States. Monthly US housing price increases above 2% – exceptionally high in recent history – went hand in hand with shrinking available-for-sale inventories.

The corporate bond market signalled very easy credit conditions. Spreads did inch up early in the review period, but they narrowed again and remained well below historical medians in the euro area and the United States (Graph 2, left-hand panel). In parallel, third quarter issuance was resilient, especially in the US high-yield segment (centre panel). Once the growing volume of leveraged loans is factored in, credit to the riskiest US firms stood at $3 trillion in mid-2021, double the size in 2010.

While commonly used measures indicated that global conditions were at their loosest since the Great Financial Crisis (Graph 2, right-hand panel), there were some notable cross-country differences. In particular, the progressive loosening in the United States mainly reflected the long-lived strength of equity markets. China, where declining equity valuations and trade-weighted exchange rate appreciation contributed to tight conditions, stood out from the global picture. Other EMEs also faced certain headwinds (see below).

Long-term yields fall, but perceived snapback risk lingers

In the period under review, yield curves in AEs flattened significantly. By August, about half of the steepening that had taken place earlier in the year had reversed, both in Europe and the United States (Graph 3, first panel). These dynamics reflected an increase in front-end sovereign yields, but mostly a remarkable fall in longer-term ones. This decrease reflected perceptions that extend beyond the five-year horizon, as implied forward rates dropped in line with declines in estimated term premia (second panel). Yields fell in many AEs, including those that had made progress towards scaling back asset purchases, such as Australia and Canada.

In the United States, the evolution of nominal yields resulted in record low real interest rates. During the period under review, long-term market-based measures of inflation expectations remained stable, while realised inflation was consistently high (Graph 3, third panel). As a result, the fall in long-term nominal yields drove real rates into negative territory, to levels last seen during the Great Inflation era (fourth panel).

While actual or anticipated central bank actions underpinned near-term rates, there is no such clarity as regards the key drivers of long-term yields.

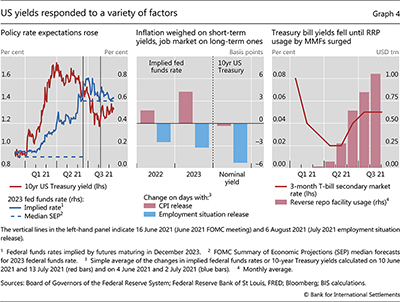

Two developments supported short-term rates. First and foremost, there was an increase in expected policy rates. The perceived likelihood of a monetary policy tightening rose (Graph 4, left-hand panel), following higher than anticipated inflation releases (centre panel, first two red columns). Second, technical factors were also at work. After the Federal Reserve raised the interest rate paid on its overnight reverse repo facility (RRP) and eased participation limits, money market mutual funds2 placed cash previously allocated to Treasury bills in the RRP, thus relieving downward pressure on front-end yields (right-hand panel).

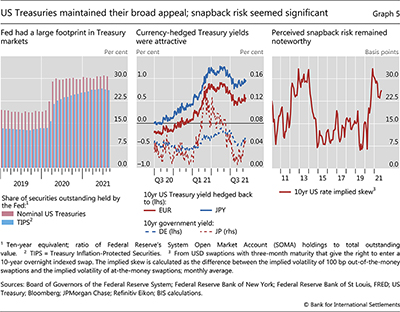

Long-term US sovereign yields fell against the backdrop of large purchases by the Federal Reserve and certain private investors. The US central bank kept its substantial footprint in the markets for nominal and inflation-protected Treasuries (Graph 5, left-hand panel). In addition, yields on US sovereign bonds continued to entice foreign investors, notably those hedging their US dollar exposures into Japanese yen and euros (centre panel). And leveraged institutions reportedly unwound large short Treasury positions – de facto wrong-footed bets on rising rates.

Treasury investors also seemed attuned to developments in the US labour market. Yields proved sensitive to signs of slack, such as high long-term unemployment and low labour force participation. Early in the review period, 10-year yields fell after reports surprised markets by revealing that such slack persisted despite very high job opening numbers (Graph 4, centre panel, third blue column). Subsequently, labour market improvements in August and September first put a floor on rates and then contributed to a slight increase.

As long-term yields fell to very low levels, perceived snapback risk remained noteworthy. Derivatives prices indicated that market participants were willing to bear relatively high costs to hedge against a sharp rise in 10-year interest rates. A measure of option-implied tail risk stood somewhat below the high levels recorded in 2013 and 2020 (Graph 5, right-hand panel).

The dollar responds to expected policy and macro outlook

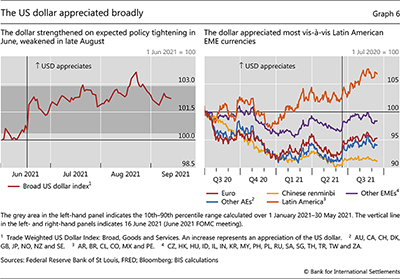

The US dollar appreciated over the period under review relative to a broad basket of trading partner currencies, with some volatility around the general trend. Early on, the strengthening reflected expectations of a tighter policy stance in the wake of the June Federal Open Market Committee (FOMC) meeting (Graph 6, left-hand panel, vertical line). Subsequently, it seemed to stem primarily from a rise in the appeal of safe assets, which confirmed the dollar's status as a risk barometer. Most recently, the US currency depreciated notably following the remarks of the Federal Reserve Chairman at the Jackson Hole conference in late August.

The US dollar's strength over the period as a whole was broad-based. Exchange rates vis-à-vis other AE currencies largely reverted to levels prevailing at the end of the first quarter, when AE yields had peaked (Graph 6, right-hand panel). The dollar appreciated the most against Latin American currencies, partly due to the macroeconomic and financial headwinds they faced (see below).

The renminbi proved remarkably resilient in recent months. Earlier in 2021, its exchange rate vis-à-vis the dollar had co-moved closely with those of other AEs and EMEs. This pattern changed and the renminbi stayed flat even as other currencies depreciated, starting roughly when the People's Bank of China raised the required reserve ratio for foreign exchange deposits, for the first time since 2007.

Headwinds grow for EMEs as the pandemic endures

Incipient recoveries in EMEs faced a variety of hurdles. On top of general concerns about the lingering pandemic and the spread of the Covid-19 Delta variant, two issues stood out. The first was the rise in expected US policy rates, which muted the traditionally beneficial effects of declining long-term US yields on portfolio flows. The second was a host of country-specific developments, including inflationary pressures, especially in Latin America, and a weaker growth outlook in China.

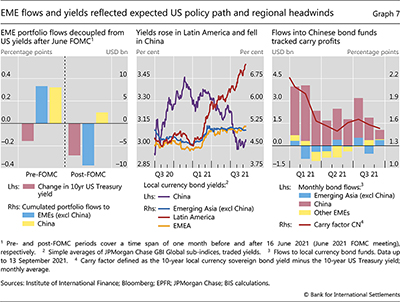

EMEs experienced strong portfolio outflows as markets reassessed the expected stance of US monetary policy. Throughout 2021, flows to these economies generally improved when US long-term rates declined. This pattern reversed sharply after the June FOMC meeting, as EMEs other than China saw outflows even when US yields fell (Graph 7, left-hand panel).

Country-specific challenges shaped diverging patterns in yields across EMEs. After rising together with AE rates earlier in the year, local yields continued to increase in Latin America as surging inflation prompted monetary policy tightening in most jurisdictions (Graph 7, centre panel). In other countries, such as Russia and South Africa, local yields remained largely flat despite rising inflation. By contrast, Chinese bond yields declined. This took place as a decelerating recovery prompted more accommodative policy and investors sought to profit from the positive yield differential between Chinese and US sovereign bonds (right-hand panel).

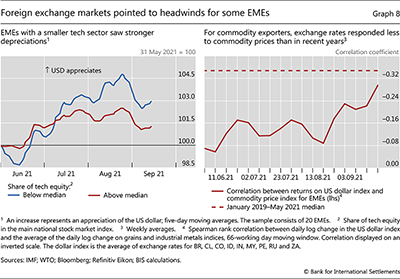

Patterns in foreign exchange markets also highlighted the predicament of some EMEs. The currencies of countries with a less developed technology sector depreciated more against the US dollar (Graph 8, left-hand panel). These countries could not benefit from strong international demand for high-technology products. In addition, in a sign that external funding pressures had built up, the exchange rates of commodity exporters were less responsive than usual to commodity prices (right-hand panel).

1 31 May to 13 September 2021.

2 The recent buoyancy of the money market mutual fund sector contrasts with the acute stress it suffered at the outbreak of the pandemic (Box B).