International corporate debt and global financial conditions: a strengthening link for emerging market economies

Bond markets have driven the "second phase of global liquidity" after the Great Financial Crisis (GFC). This phase was most visible in the market for the debt of non-financial corporates (NFCs), especially those from emerging market economies (EMEs) (Shin (2013)). In parallel, bond markets became more sensitive to global financial conditions (Avdjiev et al (2020)). In this box, we analyse the post-GFC link between NFCs' issuance of international debt securities (IDS), on a nationality basis, and two commonly used indicators of global financial conditions: the US dollar nominal effective exchange rate (NEER) and an indicator of the "global financial cycle" (GFCy).

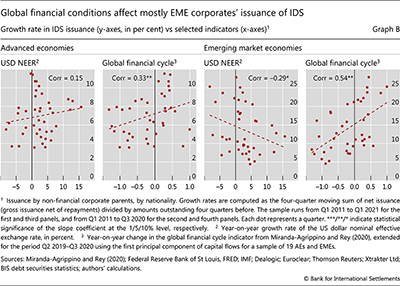

Evidence about the post-GFC link between IDS issuance by AE NFCs and global financial conditions is mixed. Using the dollar's strength as an indicator suggests that this link has been weak (Graph B, first panel). The relationship with the GFCy indicator is somewhat stronger, indicating that a loosening of financial conditions (a rise in the GFCy) goes hand in hand with higher IDS issuance (Graph B, second panel).

The corresponding relationships have been almost twice as strong for EME NFCs. Nominal US dollar appreciations have been systematically linked with lower IDS issuance by these entities (Graph B, third panel). This is in line with recent research highlighting the financial channel of exchange rates, whereby a depreciation (appreciation) of the global reserve currency has expansionary (contractionary) implications. Likewise, upswings in the GFCy indicator have been tightly linked with higher IDS issuance by EME corporates post-GFC (Graph B, fourth panel).

Likewise, upswings in the GFCy indicator have been tightly linked with higher IDS issuance by EME corporates post-GFC (Graph B, fourth panel).

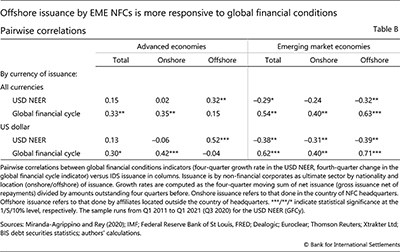

The role of "offshore" affiliates (ie those located outside the country of headquarters) in driving these relationships was small for AE NFCs but large for EME NFCs (Table B, first two rows). Such affiliates actually generate a positive relationship between IDS issuance by AE NFCs and USD strength. For non-US NFCs in particular, this is consistent with the trade channel of exchange rates, whereby an appreciation of the dollar increases the competitiveness of the parent company, leading it to finance its expansion by issuing debt through an offshore affiliate. In turn, it is debt issuance from the country of nationality ("onshore") that accounts for the positive relationship between AE NFCs' international borrowing and the GFCy indicator. For EME NFCs, by contrast, offshore affiliates have driven the strong links with both the USD NEER (negative) and the GFCy (positive). Most of these patterns are more pronounced if we zoom in on issuance denominated in US dollars (third and fourth rows).

Such affiliates actually generate a positive relationship between IDS issuance by AE NFCs and USD strength. For non-US NFCs in particular, this is consistent with the trade channel of exchange rates, whereby an appreciation of the dollar increases the competitiveness of the parent company, leading it to finance its expansion by issuing debt through an offshore affiliate. In turn, it is debt issuance from the country of nationality ("onshore") that accounts for the positive relationship between AE NFCs' international borrowing and the GFCy indicator. For EME NFCs, by contrast, offshore affiliates have driven the strong links with both the USD NEER (negative) and the GFCy (positive). Most of these patterns are more pronounced if we zoom in on issuance denominated in US dollars (third and fourth rows).

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  The strength of the dollar can reflect shifts in the monetary policy stance. The "global financial cycle" refers to the common factor in global asset prices – itself affected by global risk aversion and US monetary policy – that reflects financial activity on a global scale (Miranda-Agrippino and Rey (2020)). Using the VIX as an alternative indicator of financial conditions delivers similar results.

The strength of the dollar can reflect shifts in the monetary policy stance. The "global financial cycle" refers to the common factor in global asset prices – itself affected by global risk aversion and US monetary policy – that reflects financial activity on a global scale (Miranda-Agrippino and Rey (2020)). Using the VIX as an alternative indicator of financial conditions delivers similar results.  The financial channel of the US dollar exchange rate can operate through credit demand and/or supply. A dollar appreciation can negatively affect credit demand by weakening the balance sheets of currency-mismatched dollar borrowers. It can also reduce credit supply by increasing the risk faced by financial intermediaries with exposures to borrowers with dollar mismatches. To the extent that the higher risk tightens intermediaries' capital constraints, it would reduce the financial system's lending capacity (Avdjiev et al (2019)).

The financial channel of the US dollar exchange rate can operate through credit demand and/or supply. A dollar appreciation can negatively affect credit demand by weakening the balance sheets of currency-mismatched dollar borrowers. It can also reduce credit supply by increasing the risk faced by financial intermediaries with exposures to borrowers with dollar mismatches. To the extent that the higher risk tightens intermediaries' capital constraints, it would reduce the financial system's lending capacity (Avdjiev et al (2019)).  Because of the higher costs of hedging EME risks, local borrowers tend to have greater currency mismatches and the unhedged portions of EME bonds on international investors' portfolios tend to be larger. This makes EMEs structurally more vulnerable to global financial conditions (BIS (2019)).

Because of the higher costs of hedging EME risks, local borrowers tend to have greater currency mismatches and the unhedged portions of EME bonds on international investors' portfolios tend to be larger. This makes EMEs structurally more vulnerable to global financial conditions (BIS (2019)).  The first columns in the "All currencies" part of this table report the correlations in Graph B.

The first columns in the "All currencies" part of this table report the correlations in Graph B.