Dollar deposits of central counterparties

Central counterparties (CCPs) accumulated an extraordinary amount of liquid assets via initial margin calls amid the March 2020 turmoil. Global CCPs' initial margins increased by 50% in Q1 2020, reaching $831 billion at end-March 2020 (ISDA (2020)). For CCPs that clear US dollar-denominated products, a substantial part of these liquid assets are dollar-denominated.

Global CCPs' initial margins increased by 50% in Q1 2020, reaching $831 billion at end-March 2020 (ISDA (2020)). For CCPs that clear US dollar-denominated products, a substantial part of these liquid assets are dollar-denominated. All CCPs can deposit these assets at banks, in either unsecured or secured form, via reverse repos.

All CCPs can deposit these assets at banks, in either unsecured or secured form, via reverse repos. Alternatively, CCPs eligible for deposit accounts at the Federal Reserve can place their funds there. This box uses CCP quantitative disclosures to assess how their dollar deposits responded to the pandemic.

Alternatively, CCPs eligible for deposit accounts at the Federal Reserve can place their funds there. This box uses CCP quantitative disclosures to assess how their dollar deposits responded to the pandemic.

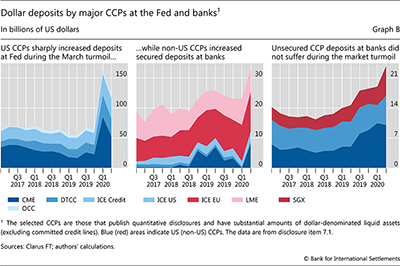

Deposits at the Fed by qualified US CCPs ballooned in Q1 2020, while their secured deposits at banks – mainly reverse repos – contracted significantly. The contrast was particularly stark for CME: its deposits at the Fed increased from $23 billion at end-2019 to $85 billion at end-March 2020 (Graph B, left-hand panel). At the same time, it halted its repo activity with banks, which recovered sharply thereafter (centre panel, dark blue area). Large yet less dramatic changes were observed for other US CCPs, such as DTCC, ICE Credit and ICE US.

Despite the decline in secured deposits by US entities, CCPs' overall secured deposits at banks remained unchanged in Q1 2020 at $23 billion. This is because non-US CCPs, which have no deposit accounts at the Fed, increased their secured dollar deposits at banks in Q1 2020 (Graph B, centre panel, red areas). In contrast to secured deposits, the changes in unsecured deposits were relatively small in Q1 2020 (right-hand panel).

The substantial shift of US CCPs from secured deposits with banks towards deposits at the Fed underscores the importance of continuous monitoring of the interconnectedness between CCPs and other financial market participants. The shift in March could reflect multiple factors, including high volatility and low rates in repo markets – which were equal to the deposit rate at the Fed at end-March – as well as potential operational convenience (eg instantaneous settlement). The growing footprint of CCPs heightens the need to better understand these factors.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  Eight CCPs in our sample have substantial dollar-denominated liquid assets. Five are US CCPs: Chicago Mercantile Exchange (CME), Depository Trust & Clearing Corporation (DTCC), Intercontinental Exchange Clear Credit (ICE Credit), Intercontinental Exchange Clear US (ICE US) and Options Clearing Corporation (OCC). The three non-US CCPs are: Intercontinental Exchange Clear Europe (ICE EU), London Metal Exchange (LME) and Singapore Exchange (SGX).

Eight CCPs in our sample have substantial dollar-denominated liquid assets. Five are US CCPs: Chicago Mercantile Exchange (CME), Depository Trust & Clearing Corporation (DTCC), Intercontinental Exchange Clear Credit (ICE Credit), Intercontinental Exchange Clear US (ICE US) and Options Clearing Corporation (OCC). The three non-US CCPs are: Intercontinental Exchange Clear Europe (ICE EU), London Metal Exchange (LME) and Singapore Exchange (SGX).  Some jurisdictional regulations restrict CCPs' unsecured deposits at banks.

Some jurisdictional regulations restrict CCPs' unsecured deposits at banks.