Government bond yields and the dynamics of duration supply

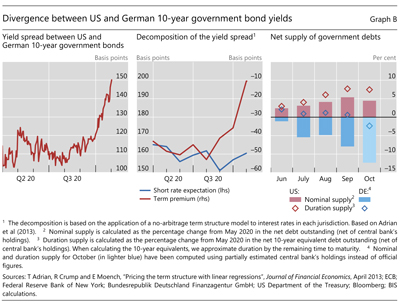

US and German 10-year government bond yields have gradually diverged since August. While US rates stepped upwards, German rates trended downwards. As a result, the 10-year yield spread has widened by about 40 basis points (Graph B, left-hand panel). In this box, we break down long-term yields into their two main components: an expectation of future short-term rates and a term premium. Based on this decomposition, we find that the widening of the spread appears to have been largely driven by diverging term premia. We argue that this divergence is explained, in part, by opposing trends in the net government supply of long-term bonds (net of central bank purchases). In addition, differing economic outlooks may have played a role.

Diverging US and German yields can reflect shifting expectations about the relative path of short-term interest rates and/or term premia. To assess the relative importance of each component, we estimate them for US and German yields using a no-arbitrage model of the respective term structures of interest rates. Then, we calculate the spreads implied by each component. From August to October, the expected rate spread barely moved, while the term premia spread increased by about 40 basis points and thus accounted for most of the yield spread widening (Graph B, centre panel).

An important driver of term premia is the net supply of government debt, defined as the debt available to private investors once purchases from price-inelastic participants, such as central banks, have been removed. For example, the net nominal supply declined after the Great Financial Crisis of 2007-09 as a result of major central banks' asset purchases. This seemed to have compressed term premia and long-term yields in these countries.

For example, the net nominal supply declined after the Great Financial Crisis of 2007-09 as a result of major central banks' asset purchases. This seemed to have compressed term premia and long-term yields in these countries. In addition to the supplied amount of debt, the supplied duration (specifically, long-term bonds) also matters for term premia.

In addition to the supplied amount of debt, the supplied duration (specifically, long-term bonds) also matters for term premia. For instance, during 2011-12 the Federal Reserve purchased long-term bonds funded by sales of shorter bonds (Operation Twist). This operation shrank the duration supply, contributing to further compression of term premia.

For instance, during 2011-12 the Federal Reserve purchased long-term bonds funded by sales of shorter bonds (Operation Twist). This operation shrank the duration supply, contributing to further compression of term premia.

Conversely, the recent widening of term premia spreads may have reflected to a considerable extent the relative increase of the net supply of long-term US sovereign bonds to the private sector. US Treasury ramped up the debt issuance after the Covid-19 outbreak. Thus, despite continued heavy purchases by the Fed, private investors had to absorb a growing amount of US government bond supply (Graph B, right-hand panel, red bars). By contrast, hefty purchases by the ECB through its own asset purchase programmes, together with contained issuance by the German government, reduced the outstanding stock of German sovereign bonds available to private investors (right-hand panel, blue bars). In fact, the euro area as a whole has seen a reduction in sovereign bond supply since June.

The US Treasury also lengthened the maturities of its debt issues. This led to an even larger increase of net supply, measured in duration terms (Graph B, right-hand panel, red diamonds). In contrast, the German government bond net duration supply has stayed relatively stable since May (right-hand panel, blue diamonds).

The expectation of heavier US government bond supply (and larger fiscal stimulus) from the next US administration may have further widened the spread before the election. As the election result made it more likely that the fiscal package would be smaller than initially expected, the yield spread saw a temporary compression before resuming its upward course.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  As a robustness check, we replicated the analysis using survey data on short rate expectations. The result suggests an even larger role of the term premia spread as the expected rate spread narrowed between Q2 and Q3 2020.

As a robustness check, we replicated the analysis using survey data on short rate expectations. The result suggests an even larger role of the term premia spread as the expected rate spread narrowed between Q2 and Q3 2020.  Other factors affecting the term premia may include business cycle conditions, the uncertainty about the projected path of short rates, and the hedging property of bonds. For a review, see B Cohen, P Hördahl and D Xia, "Term premia: models and some stylised facts", BIS Quarterly Review, September 2018.

Other factors affecting the term premia may include business cycle conditions, the uncertainty about the projected path of short rates, and the hedging property of bonds. For a review, see B Cohen, P Hördahl and D Xia, "Term premia: models and some stylised facts", BIS Quarterly Review, September 2018.  See eg B Bernanke, "Why are interest rates so low, part 4: term premiums", Brookings Institution Blog, April 2015.

See eg B Bernanke, "Why are interest rates so low, part 4: term premiums", Brookings Institution Blog, April 2015.  See D Vayanos and J-L Vila, "A preferred habitat model of the term structure of interest rates", NBER Working Papers, no 15487, November 2009.

See D Vayanos and J-L Vila, "A preferred habitat model of the term structure of interest rates", NBER Working Papers, no 15487, November 2009.