US Treasuries and equity sell-offs: is the hedge faltering?

Over the past two decades, US Treasuries have served as a hedge against equity risk. However, this attribute has been called into question, as bond and equity markets have experienced simultaneous sell-offs in recent years. In this box, we focus on the hedging properties of US government bonds in the context of stock sell-offs, ie their status as safe haven assets. We find that this status has indeed weakened in recent years. Possible contributing factors are the Federal Reserve's limited easing space and bond dealers' reduced appetite to intermediate.

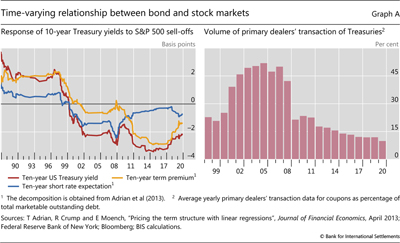

The turn of the century witnessed a marked change in the behaviour of US Treasuries during large equity sell-offs (corresponding to daily returns below the 5th percentile). Before the 2000s, 10-year US government bond yields tended to increase by 2 basis points when the S&P 500 index dropped by 1% (Graph A, left-hand panel, red line), which meant that bond and stock prices declined together. After that, US Treasuries became an effective hedge to stock market losses, as yields generally declined (and hence bond prices rose) during equity market downturns. The timing of the shift is in line with that found in the literature.

This shift reflects a change in the correlation between inflation and economic activity, which seems related to the changing interactions between monetary policy and the business cycle. Until the 1980s, recessions had been brought about mostly by central banks tightening in the face of inflationary pressures. Correspondingly, investors expected periods of low economic activity - and the attendant low stock prices - to go hand in hand with high inflation and/or high interest rates. This translated into higher Treasury yields and low bond prices. The interaction changed afterwards. Recessions became more likely to follow financial busts,

Until the 1980s, recessions had been brought about mostly by central banks tightening in the face of inflationary pressures. Correspondingly, investors expected periods of low economic activity - and the attendant low stock prices - to go hand in hand with high inflation and/or high interest rates. This translated into higher Treasury yields and low bond prices. The interaction changed afterwards. Recessions became more likely to follow financial busts, to which authorities tended to respond by loosening monetary policy, and often persistently so.

to which authorities tended to respond by loosening monetary policy, and often persistently so. Eventually, falling stock prices started being associated with low interest rates and high bond prices, making Treasuries a hedge against downside risk in the equity market.

Eventually, falling stock prices started being associated with low interest rates and high bond prices, making Treasuries a hedge against downside risk in the equity market.

The key role of monetary policy expectations in those dynamics have affected, over time, different components of long-term Treasury yields. When interest rates were the primary monetary policy tool - that is, before the effective zero lower bound (ZLB) became a constraint - expectations of short-term rates drove the relationship between those yields and equity returns (Graph A, left-hand panel, blue line). Later, when the central bank resorted to asset purchases at the ZLB, term premia became the main driver of this relationship (left-hand panel, yellow line).

Signs have emerged that the effectiveness of US Treasuries as a hedge to large equity losses may have declined in recent years. The response of 10-year yields to S&P 500 sell-offs has become more muted since 2018 (Graph A, left-hand panel, red line), possibly reflecting the Federal Reserve's limited easing space. As Fed officials have consistently communicated their reluctance to introduce negative interest rates, this not only puts a floor under short-term rates but also limits the potential decline of long-term nominal yields, regardless of any additional easing measures considered.

The diminished effectiveness of the hedge could also reflect in part dealers' waning appetite to smooth transient supply or demand shocks in the US Treasury secondary market, even outside periods of generalised stress. As discussed elsewhere, their participation in this market has steadily receded since the Great Financial Crisis of 2007-09, while other market participants, such as hedge funds and principal trading firms, have emerged as liquidity providers (Graph A, right-hand panel).

As discussed elsewhere, their participation in this market has steadily receded since the Great Financial Crisis of 2007-09, while other market participants, such as hedge funds and principal trading firms, have emerged as liquidity providers (Graph A, right-hand panel). And these new participants have behaved in a more opportunistic manner, being less willing to step in when liquidity is most needed. All else equal, the resulting impairment of fair-weather liquidity conditions would increase liquidity premia and drive yields up (and prices down).

And these new participants have behaved in a more opportunistic manner, being less willing to step in when liquidity is most needed. All else equal, the resulting impairment of fair-weather liquidity conditions would increase liquidity premia and drive yields up (and prices down).

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  See R Clarida, "Monetary policy, price stability, and equilibrium bond yields: success and consequences", remarks at the High-level Conference on Global Risk, Uncertainty and Volatility, November 2019.

See R Clarida, "Monetary policy, price stability, and equilibrium bond yields: success and consequences", remarks at the High-level Conference on Global Risk, Uncertainty and Volatility, November 2019.  See J Campbell, C Pflueger and L Viceira, "Macroeconomic drivers of bond and equity risks", Journal of Political Economy, vol 128, no 8, August 2020.

See J Campbell, C Pflueger and L Viceira, "Macroeconomic drivers of bond and equity risks", Journal of Political Economy, vol 128, no 8, August 2020.  See C Borio, M Drehmann and D Xia, "The financial cycle and recession risk", BIS Quarterly Review, December 2018.

See C Borio, M Drehmann and D Xia, "The financial cycle and recession risk", BIS Quarterly Review, December 2018.  See M Drehmann, C Borio and K Tsatsaronis, "Characterising the financial cycle: don't lose sight of the medium term!", BIS Working Papers, no 380, June 2012; and J Powell, "New economic challenges and the Fed's monetary policy review", remarks at the Jackson Hole Symposium, August 2020.

See M Drehmann, C Borio and K Tsatsaronis, "Characterising the financial cycle: don't lose sight of the medium term!", BIS Working Papers, no 380, June 2012; and J Powell, "New economic challenges and the Fed's monetary policy review", remarks at the Jackson Hole Symposium, August 2020.  See Z He, S Nagel and Z Song, "Treasury inconvenience yields during the COVID-19 crisis", NBER Working Papers, no 27416, June 2020.

See Z He, S Nagel and Z Song, "Treasury inconvenience yields during the COVID-19 crisis", NBER Working Papers, no 27416, June 2020.  See T Adrian and J Kiff, "Market liquidity, leverage, and regulation ten years after the crisis", World Economic Forum, December 2018.

See T Adrian and J Kiff, "Market liquidity, leverage, and regulation ten years after the crisis", World Economic Forum, December 2018.