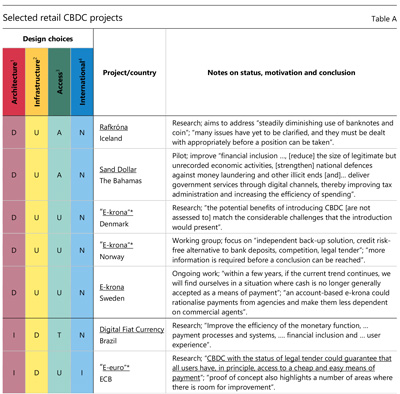

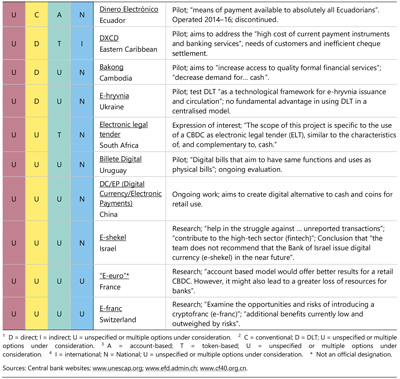

Taking stock: ongoing retail CBDC projects

Among the many central banks that are exploring the possibility of a retail CBDC (Boar et al (2020)), several have published research or statements on the related motivations, architectures, risks and benefits. The table below shows 17 selected projects or reports published before 19 February 2020. It does not cover wholesale CBDCs or cross-border payment projects that do not involve a CBDC. When it comes to the four main design choices (Graph 1 in the main text), many central banks are still considering multiple options, and it is not always possible to classify them. Regarding their architecture (Graph 2 in the main text), five projects focus on a direct CBDC, two on an indirect CBDC, and 10 investigate several designs or do not specify the architecture.

As for infrastructure (Graph 3 in the main text), only one project focuses on a conventional technology, whereas five focus on DLT. However, experience with the latter technology has not always been encouraging. Sveriges Riksbank (2018) notes that DLT still suffers from inadequate performance and scalability. The National Bank of Ukraine (2019) concludes that DLT may offer no fundamental advantages in a centralised issuance system. More generally, ECCB (2020) notes that DLT could not ensure cash-like resilience in the case of prolonged electricity outages.

On the access technology (Graph 4 in the main text), three projects provide for access based on digital tokens, whereas three focus on account-based access.

Regarding the focus on cross-border interlinkages, no CBDC project has an explicit focus on payments beyond the central bank's jurisdiction. It is noteworthy that several central banks are working on cross-border payment trials with a consumer focus in parallel to their CBDC efforts. Moreover, wholesale initiatives such as Project Jasper (Bank of Canada), Project Ubin (Monetary Authority of Singapore), Project Stella (ECB and Bank of Japan) and Project Lion Rock-Inthanon (Hong Kong Monetary Authority and Bank of Thailand) might potentially help support more efficient retail transactions through the banking system.

Only very few projects have already been completed, with considerable variation in the results. A few jurisdictions, including Denmark and Switzerland, have determined that, currently, the costs of a retail CBDC would outweigh the benefits. A larger number continues to actively develop retail CBDCs; Boar et al (2020) find that over a third of all surveyed central banks say that issuing a retail CBDC is a medium-term possibility. Looking ahead, the overall conclusion from a technological perspective is that a rich set of technical designs are currently under consideration. This underscores the need for international coordination to share experience.