Central securities depositories and securities settlement systems

A central securities depository (CSD) and a securities settlement system (SSS) are two types of financial market infrastructure that are critical to the settlement of securities. A CSD provides securities accounts, central safekeeping services and asset services, which may include the administration of corporate actions and redemptions, and plays an important role in helping to ensure the integrity of securities issues (that is, to ensure that securities are not accidentally or fraudulently created or destroyed or their details changed). An SSS is an entity that enables ownership of securities to be transferred and settled by book entry according to a set of predetermined multilateral rules. In many instances, a CSD also serves as an SSS.

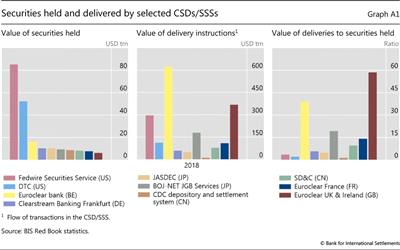

The BIS's Red Book statistics provide annual data on CSDs and SSSs in jurisdictions that are members of the Committee on Payments and Market Infrastructures. By value of securities held, the largest CSD/SSS is the Fedwire Securities Service for US government and agency securities (Graph A1, left-hand panel). By value of deliveries, the most active CSD/SSS is Euroclear Bank, based in Belgium (centre panel). Euroclear Bank is an international CSD that facilitates the holding of securities across borders. In terms of deliveries relative to securities held, turnover is highest at Euroclear UK & Ireland, which mainly provides services for equities and debt securities issued in the United Kingdom and Ireland (right-hand panel). The differences in value of securities held and delivery instruction are due to the fact that different CSD/SSSs settle different types of securities (ie equities or debt securities) that are used for different purposes (eg for trading or as buy and hold investments).

Settlement in Japan

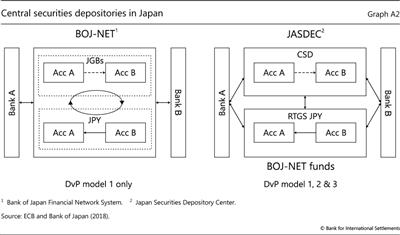

Japan is an example of how account-based settlement works. Japan has two CSDs, which also serve as SSSs. The Bank of Japan Financial Network System (BOJ-NET) settles trades in Japanese government bonds (JGBs) held in its book-entry system. BOJ-NET is also the real-time gross settlement system for Japanese yen. The second CSD/SSS is Japan Securities Depository Center (JASDEC). It is a CSD for debt and equity securities issued by the private sector. Whereas BOJ-NET transfers JGBs and cash within a single platform, settlement of securities held at JASDEC requires coordination with BOJ-NET for the transfer of cash (Graph A2). This coordination is automated by locking securities to be delivered in accounts at JASDEC until final settlement of cash has occurred at BOJ-NET, after which the deliveries are completed. If the cash transfer fails to settle by a specified time, then the lock on the securities is removed so that the seller regains control of those securities. This ensures that securities delivery occurs if and only if the corresponding cash transfer occurs.

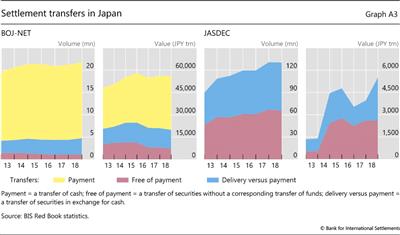

In 2018, BOJ-NET handled about 17 million transfers, with over 4 million being related to transfers of securities. In total, the transfers were worth some JPY 55,000 trillion (Graph A3). In comparison, JASDEC processed over 120 million transfers in 2018, worth JPY 5,500 trillion. In JASDEC, about half of both the volume and value related to transactions involving the delivery of securities in return for payment.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.  For details, see CPMI and IOSCO, Principles for financial market infrastructures, April 2012.

For details, see CPMI and IOSCO, Principles for financial market infrastructures, April 2012.