Innovations in payments

Technological innovation is transforming payments. Domestic payments are increasingly convenient, instantaneous and available 24/7. However, shortcomings in access to payments and cross-border payments remain. Lack of access to payments is a problem in some emerging market and developing economies. Improving cross-border payments will require international coordination. Initiatives to improve cross-border payments would benefit from better data to quantify both the extent and the drivers of the problems.1

JEL classification: E42.

Technological innovation is transforming financial services and products. Payments have been and continue to be the activity most affected by technological innovation (Petralia et al (2019)). Recent years have seen the introduction of new payment methods, platforms and interfaces, and there are more projects under way.

Despite this, there are two major shortcomings in payments: access and cross-border payments. There are 1.7 billion adults globally who are tied to cash as their only means of payment, as they do not have a transaction account2 (World Bank (2018)). In addition, cross-border payments remain slow, expensive and opaque, especially retail payments such as remittances. The interaction of these two shortcomings is a particular challenge for emerging market and developing economies (EMDEs), where remittances account for a substantial proportion of GDP. Recent so-called "stablecoin" initiatives have highlighted these shortcomings and the importance of improving the access to transaction accounts and cross-border payments in particular.3

This feature provides a primer on the key concepts in payment systems. It goes on to describe how innovation is making domestic payments increasingly convenient, instantaneous and available 24/7. Next it describes the scope of the problems besetting access to accounts. Finally, it provides context on the different models of cross-border payments, which are discussed in greater detail in other articles in this issue of the BIS Quarterly Review.

Key takeaways

- Technological advances are making domestic payments safer, faster and cheaper.

- Many people still lack access to payment systems, especially in emerging market and developing economies.

- Cross-border payments are improving more slowly, partly because coordinating changes across borders is more difficult.

Statistical data: data behind all graphs

Payments: a primer4

A payment system is a set of instruments, procedures and rules for the transfer of funds between or among participants. The system encompasses both the participants and the entity operating the arrangement. Payment systems come in many shapes and sizes, and new designs continue to emerge.

The first distinguishing feature of a payment system is the type of payment it is designed to process: retail or wholesale.5 Retail payments typically relate to the purchase of goods and services by consumers and businesses. Each of these payments tends to be for relatively low value, but volumes are large. Within retail payment, there are person-to-person payments (eg transfer of money to a friend or family member), person-to-business payments (eg bill payments), business-to-person payments (eg salary payments) and business-to-business payments. These payment systems are run by both private and public sector providers.

In contrast, wholesale payments are between financial institutions - for example, payments to settle securities and foreign exchange trades, payments to and from central counterparties, and other interbank funding transactions. These are typically large-value payments that often need to settle on a particular day and sometimes by a particular time. While there are significantly fewer wholesale payments compared with retail payments, their value - both individually and in aggregate - is much larger. Given their systemic importance, wholesale payment systems are generally owned and operated by central banks.

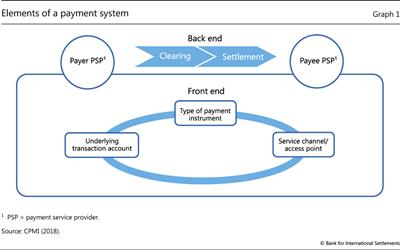

Payments usually flow through a front end via which the payer6 initiates the payment and a number of back-end arrangements that clear and settle payments (Graph 1).

The front end comprises the source of the funds (eg a bank account), the service channel used to initiate the payment (eg a mobile payment application) and the payment instrument (eg a credit transfer). The wide variety of situations in which consumers and businesses initiate payments leads to a wider variety of front ends in retail payments.

The back end comprises the arrangements for the clearing and settlement of payments. Clearing is the process of transmitting, reconciling and, in some cases, confirming transactions prior to settlement.7 Given the large volume of payments a retail payment system needs to handle, traditionally files containing batches of payment instructions are transmitted rather than the details of each payment being transmitted individually. Payment service providers (PSPs),8 such as banks, can clear transactions bilaterally, but more often this is facilitated by automated clearing houses (ACHs), which are multilateral arrangements that facilitate the exchange of payment instructions between PSPs.

Further reading

Settlement of payments is the process of transferring funds to discharge monetary obligations between two or more parties. Payments can be settled either on a gross basis individually or on a net basis as a batch. The former is known as real-time gross settlement (RTGS), since, provided the payer's PSP has sufficient funds, each payment is settled as soon as it enters the system. When the payer's PSP has insufficient funds to settle immediately, the payment is rejected or queued. The alternative is known as deferred net settlement (DNS), since the netting and settlement take place after a specified period. Hybrid systems offer a mix of RTGS and DNS settlement. For example, if a payment is queued because the payer's PSP does not have sufficient funds to settle on an RTGS basis, the system may offer liquidity saving mechanisms that attempt to settle the payment by netting or offsetting it against other payments.

The different settlement methods involve a trade-off between different risks. Because each payment in an RTGS system is settled individually on a gross basis, RTGS systems require more liquidity (funding) to operate. In contrast, the netting in DNS systems means that incoming and outgoing payments offset each other to lower the liquidity requirement. However, the flip side of this is that because DNS systems settle payments only periodically, for the period during which settlement is deferred there is a risk that it will not take place as expected (ie settlement risk).9 Settlement risk could stem from the risk of the payer or the payer's PSP defaulting prior to final settlement (ie credit risk) or being unable to settle the payment when it falls due, resulting in a delay in the receipt of funds (liquidity risk). Final settlement is a legally defined moment when funds (or other assets) have been irrevocably and unconditionally transferred. Because DNS systems settle batches of payments, the default of one PSP can affect all surviving PSPs involved in the batch. Payments involving the failed PSP would be unwound and new net obligations would be calculated. Conceivably, one of the other PSPs that had been expecting funds from the failed PSPs may not be able to meet its recalculated (higher) obligation, potentially setting off a cascade of failures.

The difference in the value and volume of payments that retail payment systems and wholesale payment systems need to handle tends to lead to differences in the design of their back-end arrangements. Box A illustrates these differences with reference to US payment systems. In almost all countries, wholesale payments are settled in RTGS systems (CPSS (2005)). In contrast, traditionally it has taken a day or more after initiation of a cashless retail payment for the funds to reach the payee. This is because retail payment systems have tended to process payments in batches, with settlement occurring on a DNS basis and PSPs releasing funds to payees only after final settlement among PSPs. However, in recent years a growing number of fast payment systems (FPSs) have been launched, in which "final" funds are available to the payee in real time or near real time on as near to a 24/7 basis as possible.10

Traditionally, most payments involve a payee and a payer that reside within the same jurisdiction and use the same currency (ie domestic payments). But owing to globalisation, the two increasingly reside in different jurisdictions, giving rise to cross-border payments. Examples of different types of cross-border payment are purchases of securities issued overseas, purchases by overseas tourists, international purchases executed over the internet and remittances.11 Many cross-border payments involve two different currencies (ie they are cross-currency payments).12

Box A

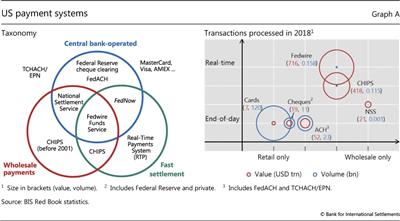

Payment systems in the United States

Domestic payment systems can be categorised along three key dimensions: payment type (wholesale or retail), operator (central bank or private sector) and settlement mode (real-time or deferred). The United States is the largest payment market in the world and has a multitude of different public and private systems. Graph A applies a simple taxonomy to US payment systems to illustrate the three key dimensions.

Wholesale systems

At the centre of the taxonomy is Fedwire Funds Service, which is the US Federal Reserve's RTGS system. It dates back to 1918, when the Federal Reserve inaugurated a network of wire communications among Reserve Banks. Fedwire has close to 6,000 direct participants and settles time-critical payments on behalf of participants and their corporate customers. CHIPS (originally, the Clearing House Interbank Payment System) is a privately operated system. It started operation in 1974 as a DNS system, but in 2001 it moved to a "hybrid" settlement model that continuously matches and nets payments. CHIPS currently has about 45 direct participants and settles large-value international and domestic payments, including those associated with commercial transactions, bank loans and securities transactions. National Settlement Service (NNS) is a multilateral settlement service owned and operated by the Federal Reserve. NSS settles interbank obligations arising in other retail payment and securities settlement systems on a net deferred basis. The files of multilateral net obligations are processed on receipt.

Retail systems

FedACH and TCHACH are ACHs that provide clearing services for electronic debit and credit transfers from retail customers, with final settlement occurring on the following banking day. FedACH is operated by the Federal Reserve while TCHACH is provided by The Clearing House, a consortium of banks. The Federal Reserve provides cheque processing services to depository institutions. Most collected cheques are settled within one business day. Card payments in the United States are processed by one of the card payment networks (eg Visa, MasterCard, American Express, Discover). They are generally settled on a net basis with a one- or two-day lag. Real Time Payments is The Clearing House's fast payment service for retail payments. It was launched in November 2017. FedNow is the Federal Reserve's new project to deliver 24/7/365 instant settlement service for retail payments. FedNow is expected to go live in 2023 or 2024.

Innovations in domestic payments

It is no small task to improve payments. Payments by their nature define a network, so any change typically requires coordination between the operator of the payment system, PSPs and third-party service providers. In addition, to be successful, new services need to be adopted by both payers and payees, who may face different incentives. This coordination problem has been more tractable in the domestic context, where individual central banks and payment operators have spearheaded innovation. This is particularly true for wholesale payment systems, which typically have fewer direct participants and where central banks have a leading role.

As a result of information and communications technology improvements and (more recently) consumer demand, domestic payments are increasingly convenient, instantaneous and available 24/7. The improvements started in wholesale payments, with the introduction of RTGS in almost every country in the 1990s (CPSS (2005)). Innovations in retail payments began to emerge in the 2000s (CPSS-IOSCO (2012)). Initially these innovations were limited to making the front end more convenient, but more recently innovations have started to address the back end and have increased the speed of retail payments.

Wholesale payments

Innovations in wholesale payments have occurred in waves over the past few decades. In 1990 there were fewer than 10 RTGS systems, whereas now there are over 176 (Bech et al (2017)).13 The introduction of RTGS decreased the credit risk from wholesale payments, but it also made them more liquidity-intensive. Consequently, the second wave of innovation involved the introduction of liquidity-saving mechanisms in the 2000s (CPSS (2005)). Some systems also introduced multicurrency functionality, which supports cross-border payments (Bech, Faruqui and Shirakami (2020, in this issue)).

Since the mid-2000s, trends have included opening up access to non-banks, expanding operating hours and improving the interoperability of systems. Traditionally, only domestic banks have been allowed to directly participate in wholesale systems. There has been a pattern of central banks opening up access to non-banks. This has the potential to increase competition. However, the number of non-banks with direct access to wholesale payment systems remains small.

Over the same period, all RTGS systems have extended their operating hours, and several jurisdictions have plans for further extensions over the next few years. Roughly a quarter of RTGS systems are now open for at least some hours on Saturday and Sunday, while in Mexico and South Africa the systems are open all day every day of the year.

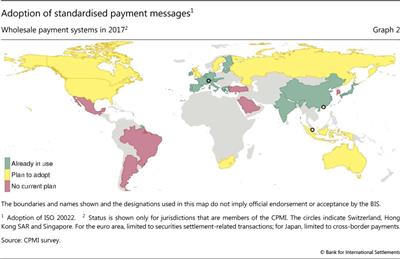

Many RTGS systems have introduced technical changes that support interoperability. Interoperability refers to the technical or legal compatibility that enables a system or mechanism to be used in conjunction with other systems or mechanisms. This can deliver cost efficiency and risk reduction for users of multiple systems by promoting straight through processing. The adoption of ISO 20022, which is an international standard for electronic data interchange between financial institutions, is helping to improve technical compatibility between wholesale payment systems. CPSS-IOSCO (2012) requires payment systems to accommodate internationally accepted communication procedures and standards. Accordingly, many of these jurisdictions currently use or have plans to adopt ISO 20022 (Graph 2). SWIFT (a global provider of financial messaging services) plans to migrate all cross-border payments sent over its network to ISO 20022 by 2025.

Retail payments

Technological developments and changes in consumer preferences have altered the retail payment landscape, and they continue to do so. Initially, much of the innovation focused on increasing consumer convenience by improving the front end. New ways of initiating payments (eg mobile and contactless payments) have been introduced, and overlay systems (eg ApplePay, PayPal, SamsungPay, GooglePay) that provide innovative customer interfaces have been launched. These systems use existing payment systems for settlement.

However, there are also a growing number of initiatives that are making back-end arrangements faster. In China, Alipay (launched in 2004) and WeChat Pay (launched in 2011) together account for 92% of mobile payments (Klein (2019)). They are both closed-loop systems, which means they provide services directly to both payers and payees. M-Pesa in Kenya is also a closed-loop system; it processes payments equivalent to just under half of Kenya's GDP (McGath (2018)). Closed-loop systems have back-end arrangements that are largely internal to their respective companies; these arrangements are simple and fast. Technological developments have also made fast retail payment systems increasingly viable (Box B).

Box B

Fast retail payment systems

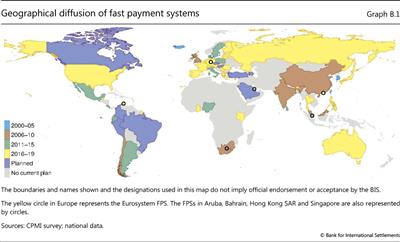

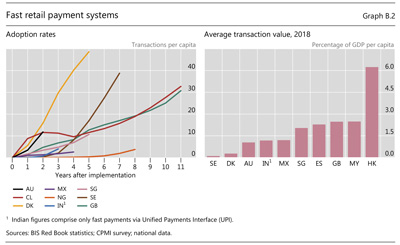

Fast (retail) payment systems (FPSs) have been (or are being) developed in many jurisdictions. An FSP is a system in which the transmission of the payment message and the availability of the final funds to the payee occur in real time or near real time on as near to a 24/7 basis as possible. While closed-loop systems can also be near real-time and available 24/7, FPSs are payment infrastructure that facilitates payments between account holders at multiple PSPs rather than just between the customers of the same PSP. Currently, 55 jurisdictions have FPSs, and this number is projected to rise to 65 in the near future (Graph B.1). While the adoption speed is fairly similar to that of wholesale RTGS systems, early adopters are predominantly emerging market rather than advanced economies.

While closed-loop systems can also be near real-time and available 24/7, FPSs are payment infrastructure that facilitates payments between account holders at multiple PSPs rather than just between the customers of the same PSP. Currently, 55 jurisdictions have FPSs, and this number is projected to rise to 65 in the near future (Graph B.1). While the adoption speed is fairly similar to that of wholesale RTGS systems, early adopters are predominantly emerging market rather than advanced economies.

Take-up and usage vary significantly across jurisdictions (Graph B.2, left-hand panel). The FPSs in Chile and the United Kingdom, which have been operating for 10 years, processed just over 30 payments per capita in 2018. In contrast, those in Sweden and Denmark were launched more recently but processed more payments per capita - 40 and 48, respectively - in 2018. This is largely due to the popularity and strong growth in the use of mobile payment apps that are the front end of the FPS in these jurisdictions. In Australia, growth in transaction volumes has also been very rapid, reaching an annualised rate of around 12 fast payments per capita per year in just the second year of operation.

The average transaction value of faster payments varies significantly, suggesting that FPSs are used for a variety of retail payments (Graph B.2, right-hand panel). The average transaction value of fast payments in Denmark and Sweden are less than 0.3% of GDP per capita, indicating they are used mainly for person-to-person payments. At the other end of the scale, the average transaction value of fast payments in Hong Kong SAR is over 6%, suggesting that they are used mainly for payments involving businesses (eg payment of rent).

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.  Committee on Payments and Market Infrastructures, Fast payments - enhancing the speed and availability of retail payments, November 2016.

Committee on Payments and Market Infrastructures, Fast payments - enhancing the speed and availability of retail payments, November 2016.

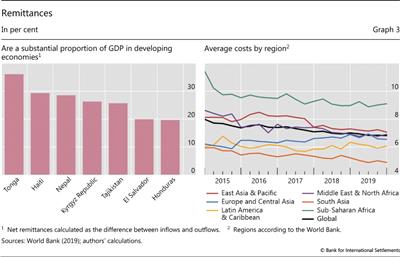

The shortcomings

Despite the innovations described above, there are two major shortcomings: access by consumers to transaction accounts and cross-border payments. Access is largely a problem for a subset of jurisdictions, and in EMDEs these two shortcomings interact where remittances account for a substantial proportion of GDP (Graph 3, left-hand panel). If the payee or the payer does not have a transaction account, their choice of remittance provider is restricted, and the networks of physical locations required to support cash payments are expensive (The Economist (2019)). Despite a G20 commitment to reduce the cost of remittances to 5% or less by 2014 (G20 (2011)), on average costs remain around 6.8% (Graph 3, right-hand panel). It is also significantly more expensive to remit money to certain regions. For example, the costs of remittances to Sub-Saharan Africa have remained around 9% for the last two years.

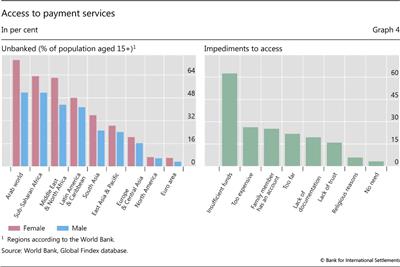

Access to accounts

In large parts of the world, many people do not have access to transaction accounts. While almost all adults in North America, Europe and other advanced economies have a transaction account, in many EMDEs 25% or more of adults have no such account (Graph 4, left-hand panel). In Africa and the Arab world, the share not having an account exceeds 50%. Everywhere, the problem is much worse for women.

Financial exclusion is often part of a much wider social exclusion, with individuals also lacking access to education, insurance and healthcare. Payments are the gateway to other financial services, such as savings accounts, credit or insurance, which allow individuals to invest and protect their income against risks. Access to a basic bank account has been shown to reduce poverty, as it promotes saving and supports better financial management (Iqbal et al (2019), World Bank (2017)).

There are a range of reasons why the unbanked do not have access to transaction accounts. The major ones relate to the direct and indirect cost (eg cost of visiting a branch or other point of service) of access, lack of documentation and lack of trust (Graph 4, right-hand panel). While innovations in payments can provide an incentive to open a transaction account, there is also a need for broader initiatives around identity and financial literacy.14 An example of such an initiative is the Aadhaar programme in India, which provides all residents with a biometric identity so that they can prove who they are (D'Silva et al (2019)).

Cross-border payments

Cross-border payments are vital for global commerce and finance and for migrants who send remittances home. However, they are generally slower, more expensive and more opaque than domestic payments (CPMI (2018)).

Unlike for access, where the World Bank has carefully quantified the extent of the problem and its drivers, for cross-border payments there are limited data available to analyse the problems. The World Bank monitors remittances (Graph 5), but these are only a subset of cross-border payments. McKinsey (2016) found that the average cost for a US bank of executing a cross-border payment is more than 10 times that for a domestic payment. However, differences in remittance costs across regions (Graph 3) suggest that this average may mask significant variation in the costs of cross-border payments. A survey by the CPMI (2018) indicates that it can take up to seven days to complete a cross-border payment, yet SWIFT recently demonstrated that it is possible to complete a cross-border payment in 13 seconds (SWIFT (2019)).

While there is a lack of data to measure the problem, its underlying reasons - additional compliance costs and more complex back-end arrangements - are well understood. Complying with multiple regulatory regimes adds to costs, and the risk of money laundering and terrorist financing can be more difficult to manage for cross-border payments. Where possible, public and private sector efforts have sought to minimise the additional costs by standardising processes and clarifying expectations.15 Back-end arrangements for cross-border payments are more challenging due to a lack of standardisation of messaging formats, different operating hours in different jurisdictions, and the need to settle in different currencies (CPMI (2018)).

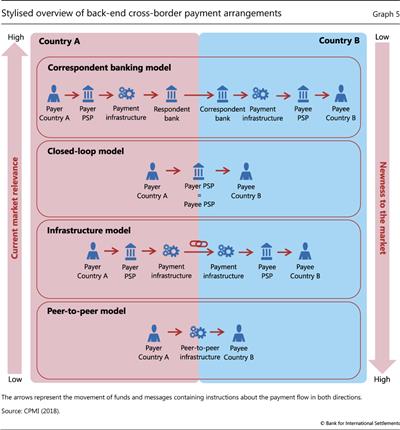

Arrangements for cross-border payments can be classified into four models: correspondent banking, closed loop, infrastructure and peer-to-peer (Graph 5).

Correspondent banking

Correspondent banking is an arrangement whereby one bank (the correspondent) holds deposits owned by other banks (the respondents) and provides payment and other services to them. For example, a customer of PSP A in country A (shaded pink in Graph 5) wants to pay someone who uses PSP B in country B (shaded blue in Graph 5), but PSP A does not have an account in country B and PSP B does not have an account in country A. As a result, it is not possible to execute a direct payment. Thus, to move the funds from country A to country B, PSP A pays respondent bank A in country A, which has an account at correspondent bank B in country B. Once respondent bank A receives the funds, it transfers them to its account at correspondent bank B to fund the payment to PSP B in country B. This is facilitated by correspondent B, which is a participant in the payment infrastructure in that country.

Correspondent banking is the traditional back-end arrangement for cross-border payments. Today most cross-border payments flow this way. However, correspondent banking relationships are declining globally. Rice, von Peter and Boar (2020, in this issue) analyse the drivers for this decline.

Closed loop

The second model is a closed loop. This is sometimes known as an in-house or intragroup transfer system because there is a single central PSP that provides services to both the payee and the payer.16 Western Union and MoneyGram have a long history of providing remittances via closed-loop systems; they have a physical presence in each of the jurisdictions they serve and do not require users to open an account. More recently, AliPay and WeChat Pay have been very successful using a closed-loop model for domestic payments in China. Nevertheless, this is unlikely to be a feasible global solution. It would require payees and payers around the world to all use the same PSP, which would be a coordination challenge and lead to concentration risk.

Closed loops are mainly improving particular niche cross-border payments. AliPay and WeChat Pay are increasingly partnering with overseas payment operators to allow Chinese travellers to use their mobile payments application whilst abroad. Other fintech firms, such as Revolut and Transferwise, provide services in currency pairs for which there is high turnover, using incoming payments to fund outgoing payments in the same currency to minimise costs.

Infrastructure

As the name suggests, the infrastructure model involves building a payment system or linking payment systems to operate cross-border. The link facilitates (remote) access to domestic systems for banks located abroad. For example, Directo a México links FedACH in the United States with the Mexican RTGS system to facilitate remittances from the US to Mexico. Bech, Faruqui and Shirakami (2020, in this issue) explain the different ways infrastructure can be used to facilitate cross-border payments.

Peer-to-peer

In contrast to the other models, peer-to-peer arrangements cut out the financial intermediary PSPs between the payer and the payee.

There are some private initiatives. So-called "stablecoins" such as Libra are examples of the genre. Libra is a consortium led by Facebook that proposed a private global stablecoin. Libra's initial proposal involved creating its own unit of account, avoiding the need to deal with different currencies when settling cross-border payments. Further detail and analysis of these initiatives is set out in G7 (2019).

In addition, central banks are undertaking extensive work on central bank digital currencies (CBDCs) that could support cross-border payments. The Bank of Thailand and the Hong Kong Monetary Authority (2020) recently completed a proof of concept to that effect for wholesale payments. In a recently published survey, central banks rated improving the efficiency of cross-border payments as a "somewhat important" reason for establishing CBDCs. However, in general, the safety and efficiency of domestic payments were the most highly rated motivation (Boar et al (2020)). Auer and Böhme (2020, in this issue) set out the design options for retail CBDC and investigate how they could become a widely usable and trusted means of payment.

Bech, Hancock, Rice and Wadsworth (2020, in this issue) also analyse peer-to-peer arrangements, focusing on how their use could change the clearing and settlement arrangements for securities.

Conclusion

Innovation in domestic payments continues to occur. Wholesale systems are opening up access to non-banks, extending operating hours and improving the interoperability of systems. Fast or instant retail payment systems have been or are being developed in many jurisdictions. However, shortcomings in access and cross-border payments remain.

Access issues can be addressed through targeted interventions in individual jurisdictions. Quantification of the extent and relative importance of the various drivers facilitates such interventions. Fintech is also likely to improve universal access to and frequent usage of transaction accounts.

The way to address the problems surrounding cross-border payments is less clear. First, more data are needed to help understand the extent and the drivers of the problems. Initiatives to improve cross-border payments would benefit from being able to quantify both the relative importance and the costs and benefits of the various types of back-end arrangements. Second, coordinating efforts to address the issues besetting cross-border payments is more challenging. There are more stakeholders involved and no organisation with a clear leadership role. In 2020, the G20 took on a leadership role when it decided to give priority to enhancing cross-border payments (Carstens (2020, in this issue)).

References

Auer, R and R Böhme (2020): "The technology of retail central bank digital currency", BIS Quarterly Review, March, pp 85-100.

Bank of Thailand and Hong Kong Monetary Authority (2020): Inthanon-LionRock: leveraging distributed ledger technology to increase the efficiency of cross-border payments, January.

Bech, M, U Faruqui and T Shirakami (2020): "Payments without borders", BIS Quarterly Review, March, pp 53-65.

Bech, M, J Hancock, T Rice and A Wadsworth (2020): "On the future of securities settlement", BIS Quarterly Review, March, pp 67-83.

Bech, M, Y Shimizu and P Wong (2017): "The quest for speed in payments", BIS Quarterly Review, March, pp 57-68.

Boar, C, H Holden and A Wadsworth (2020): "Impending arrival - a sequel to the survey on central bank digital currency", BIS Papers, no 107, January.

Carstens, A (2020): "Shaping the future of payments", BIS Quarterly Review, March, pp 17-20.

Committee on Payment and Settlement Systems (1997): Real-time gross settlement systems, March.

--- (2005): New developments in large-value payment systems, May.

Committee on Payment and Settlement Systems and International Organization of Securities Commissions (2012): Principles for financial market infrastructures, April.

Committee on Payments and Market Infrastructures (2016): Fast payments - enhancing the speed and availability of retail payments , November.

--- (2018): Cross-border retail payments, February.

Committee on Payments and Market Infrastructures and World Bank Group (forthcoming): Payment aspects of financial inclusion in the fintech era.

D'Silva, D, Z Filková, F Packer and S Tiwari (2019): "The design of digital financial infrastructure: lessons from India", BIS Papers, no 106, December.

The Economist (2019): "The cost of cross-border payments needs to drop", 13 April.

Financial Stability Board (2018): FSB action plan to assess and address the decline in correspondent banking: progress report to the G20 Summit of November 2018, November.

G7 Working Group on Stablecoins (2019): Investigating the impact of global stablecoins, October.

G20 (2011): "Building our common future: renewed collective action for the benefit of all", Summit Final Declaration.

Iqbal, K, P Roy and S Alam (2019): "The impact of banking services on poverty: evidence from sub-district level for Bangladesh", Journal of Asian Economics.

Klein, A (2019): Is China's new payment system the future?, Brookings Institution, June.

McGath, T (2018): "M-PESA: how Kenya revolutionized mobile payments", N26 Magazine, April.

McKinsey (2016): Global payments 2016: strong fundamentals despite uncertain times.

Petralia, K, T Philippon, T Rice and N Véron (2019): "Banking disrupted? Financial intermediation in an era of transformational technology", Geneva Report on the World Economy, no 22.

Rice, T, G von Peter and C Boar (2020): "On the global retreat of correspondent banks", BIS Quarterly Review, March, pp 37-52.

SWIFT (2019): "SWIFT sees success with global instant cross-border payments with Singapore's FAST", press release, 18 July.

World Bank (2017): Financial inclusion and inclusive growth: a review of recent empirical evidence, April.

--- (2018): The Global Findex database 2017: measuring financial inclusion and the fintech revolution.

--- (2019): Remittance Prices Worldwide.

1 We thank Raphael Auer, Claudio Borio, Stijn Claessens, Marc Hollanders, Wenqian Huang, Hyun Song Shin, Takeshi Shirakami and Philip Wooldridge for helpful comments and suggestions. We are also grateful to Ismail Mustafi, Róbert Szemere and Luis López Vivas for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 An account (including e-money/prepaid accounts) held with a bank or other authorised payment service provider that can be used to make and receive payments and to store value.

3 A stablecoin is a cryptoasset that seeks to stablise the price of the "coin" by linking its value to that of an asset or pool of assets (G7 (2019)).

4 This section draws heavily on the online glossary maintained by the Committee on Payments and Market Infrastructures (CPMI), as well as CPSS (1997, 2005), CPSS-IOSCO (2012) and CPMI (2016, 2018).

5 Most jurisdictions have separate systems to process retail and wholesale payments. Two notable exceptions are Mexico and Switzerland, where both retail and wholesale payments are processed by the same system.

6 In some circumstances, the payee can initiate the payment, eg a direct debit.

7 If payments are settled on a net basis, clearing can also involve the calculation of net positions for settlement.

8 In addition to banks, there are non-bank PSPs that provide payment services but do not take deposits and use these deposits to make loans. Non-bank PSPs include operators of payment systems (eg Visa, MasterCard, AliPay, WeChat Pay) and participants in payment systems (eg Adyen, First Data).

9 If the payment is in exchange for some other good or service that has already been delivered, the payee will be exposed to settlement risk from the time of delivery until they receive "final" funds. Depending on when the failure occurs and the relevant legal arrangements, settlement risk may be borne by the payee, one of the PSPs or the payment system operator (if that operator guarantees settlement).

10 In some FPSs, funds are made available to the payee prior to final settlement between PSPs, which exposes the PSPs to credit risk. For further details on the settlement arrangements for FPSs, see Bech et al (2017).

11 Remittances are person-to-person payments of relatively low value. They can be domestic, but for the purposes of this article the term is used to refer to cross-border ones.

12 Payments between two countries within the euro area are an example of a cross-border payment that is not a cross-currency payment.

13 This includes Canada, which has a hybrid system that is considered the equivalent of RTGS in terms of settlement risk.

14 CPMI and World Bank (forthcoming) identifies the impact of fintech developments on universal access to and frequent usage of transaction accounts.

15 For further details, see FSB (2018).

16 While a multinational bank may provide services to both the payer and the payee in a particular transaction, unlike in closed-loop systems users are not restricted to making payments to someone with an account at that bank.