The FRAME repository: options and lexicon

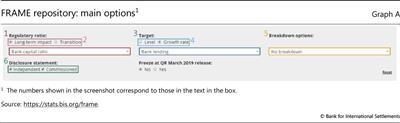

FRAME (https://stats.bis.org/frame) enables users to plot the distributions of the estimated effects of a given regulation on a number of variables. This box briefly presents the main options available and terms used (Graph A).

1. Regulatory ratio: refers to the bank's balance sheet ratio subject to the regulation (eg capital ratio, LCR, NSFR). While ideally the estimates are based on the changes in the minimum regulatory requirements and individual banks' exposure to those changes, there are, in practice, too few regulatory changes and too little detailed supervisory information to allow for a precise analysis. In FRAME, 85% of the estimates are currently based on changes in the observed ratios, rather than on changes in the minimum regulatory requirement. This proportion is expected to diminish as supervisory data and longer time series become available.

2. Transition and long-term impact: refer to the cost/gain of the transition towards a tighter standard and the final effects of a higher minimum regulatory ratio. The impact estimates are standardised, to capture the transitory effect of banks increasing their regulatory ratio by 1 percentage point, or the long-term effects of the regulatory ratio being 1 percentage point higher. In microeconometric studies, transitory effects are often derived by exploiting the time series dimension of the data (eg by comparing the situation of a given bank at two points in time), whereas the long-term impact is often derived from the cross-sectional dimension of the data (eg by comparing the situations of two or more otherwise similar banks at a given point in time). Long-term impacts may also be derived from simulating estimated or calibrated macro models.

Long-term impacts may also be derived from simulating estimated or calibrated macro models.

3. Target: the variable on which the regulation has the impact. Importantly, this term does not refer to any objective of the regulation considered.

4. Level and growth rate: whether the target is a level or a growth rate, ie whether estimates capture the effects on the growth rate of economic aggregates (eg bank lending, investment, GDP) or their level, with the effects accordingly reported as a percentage point variation in growth rate, or as a percentage variation of the level.

5. Breakdown options: the multiple splits of the estimates in FRAME. These include:

- Actual or minimum regulatory ratio: whether the estimated effect is that of a change in the observed ratio, or of a change in the minimum regulatory ratio, with the latter typically derived either from calibrated or estimated macro models, or from micro data on individual banks' exposure to the change in regulation (eg Pillar 2 information, Basel III liquidity ratios).

- Regulatory ratio - detail: definition of the regulatory ratio, or proxy for it, used in the study.

- Regime: whether the estimated effect holds in crisis or normal times.

- Equilibrium type: whether the estimated effect accounts for general equilibrium (second-round) effects. In most cases, microempirical studies are classified as "partial equilibrium". Macroempirical studies and estimates from general equilibrium macro models are classified as "general equilibrium".

- Peer review: whether the study has been peer-reviewed, ie published in an academic journal.

- Mean of the regulatory ratio: refers to the mean of the regulatory ratio over the sample used for the estimation, allowing one to assess how the marginal effect of a change of a regulatory standard varies with its tightness.

- Statistical significance: whether the estimate is statistically significant at the 5% threshold.

Methodology: the methodology used in the study, eg estimation, macro model, theory.

6. Disclosure statement: whether the authors of the study had relevant or material financial interests that relate to their analysis (eg research sponsored or commissioned by lobbying groups).

State-of- the-art microempirical studies identify the long-term impact of regulation using difference-in-difference estimates. Those typically compare the behaviour (eg lending) of two groups of banks with varied exposure to the regulation (eg different regulatory ratios), before and after a given event (eg a crisis). One prerequisite, though, is that the two groups have the same behaviour before the event, ie are comparable in terms of whether, and how far, they had started a transition towards the new requirements. Note that this terminology varies from that used in macroempirical studies, in which the transition and long-term impacts are typically related to the lag structure of the econometric model (the long-term impact being calculated, for example, as the sum of lagged coefficients).

State-of- the-art microempirical studies identify the long-term impact of regulation using difference-in-difference estimates. Those typically compare the behaviour (eg lending) of two groups of banks with varied exposure to the regulation (eg different regulatory ratios), before and after a given event (eg a crisis). One prerequisite, though, is that the two groups have the same behaviour before the event, ie are comparable in terms of whether, and how far, they had started a transition towards the new requirements. Note that this terminology varies from that used in macroempirical studies, in which the transition and long-term impacts are typically related to the lag structure of the econometric model (the long-term impact being calculated, for example, as the sum of lagged coefficients).  The precise standard errors of the estimates, as reported in the studies, are available on request (email frame@bis.org).

The precise standard errors of the estimates, as reported in the studies, are available on request (email frame@bis.org).