Margining during the Brexit episode

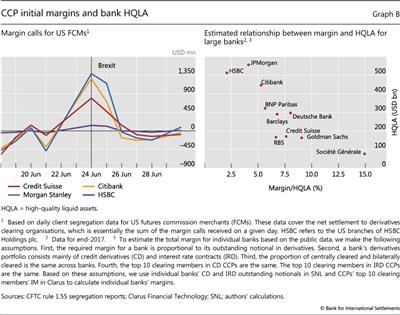

The Brexit referendum led to large margin fluctuations on 24 June 2016. The outcome surprised markets, causing sharp swings in exchange and interest rates and thereby triggering large intraday margin calls for banks in the interest rate swap markets. The margin calls in the days following the referendum are estimated to have been around $27 billion, five times greater than the previous 12-month daily average. Publicly available data on the size of these margin calls for individual banks are limited. However, according to figures reported by US institutions, Morgan Stanley and Citigroup each received more than $1 billion in margin calls for their client clearing businesses, more than twice as much as normal (Graph B, left-hand panel).

Publicly available data on the size of these margin calls for individual banks are limited. However, according to figures reported by US institutions, Morgan Stanley and Citigroup each received more than $1 billion in margin calls for their client clearing businesses, more than twice as much as normal (Graph B, left-hand panel).

While the Brexit event moved markets, it did not cause widespread turmoil or problems in specific financial institutions. It did, nonetheless, lead to large margin calls and liquidity outflows for banks. Such margin calls, if they were to happen in a more volatile environment, could subject banks to substantial liquidity strain. The reason is that margins represent a relatively large proportion of banks' total high-quality liquid assets (HQLA) (Graph B, right-hand panel). The estimated margins for individual G-SIBs range from 2.5 to 15% of HQLA. Under an adverse scenario, when liquidity is already likely to be under pressure from other sources and markets are experiencing fire sales, margin calls can represent a potentially serious source of liquidity risk. More reassuringly, however, larger institutions tend to have lower margin-to-HQLA ratios, which would tend to limit the systemic ramifications of increased margining.

This amount covers margin calls by CME Clearing, ICE Clear Credit, ICE Clear Europe, ICE Clear U.S. and LCH Clearnet Ltd. See CFTC (2016).

This amount covers margin calls by CME Clearing, ICE Clear Credit, ICE Clear Europe, ICE Clear U.S. and LCH Clearnet Ltd. See CFTC (2016).