What are the effects of macroprudential policies on macroeconomic performance?

Macroprudential policies are designed to make financial crises less likely or less severe. At the same time, they might also curb output growth by affecting credit supply and investment. Using data for a panel of 64 advanced and emerging market economies, this special feature investigates empirically the effects of macroprudential policies on long-run economic performance. We find that countries that more frequently use macroprudential tools, other things being equal, experience stronger and less volatile GDP growth. These effects are influenced by each economy's openness and financial development. Finally, we find that non-systematic macroprudential interventions tend to be detrimental to growth.1

JEL classification: G10, G21, O16, O40.

Long before the term even existed, macroprudential policies were used to address financial stability concerns, particularly among emerging market economies (EMEs). Their popularity has greatly increased in recent years, especially during and after the Great Financial Crisis (GFC) of 2007-09. Yet our understanding of these policies, and their effects on macroeconomic performance, is still open to debate. For example, while the use of macroprudential policies is typically motivated by the need to contain systemic risk and thus contribute to macroeconomic stability (IMF-FSB-BIS (2011, 2016), Galati and Moessner (2017)), it has also been suggested that these policies could harm economic activity (Sánchez and Röhn (2016)).2

Macroprudential interventions should be judged primarily on whether they reduce the occurrence of financial crises, their ultimate goal. Alas, measuring this capability remains an elusive task, given the relative infrequency of crises, and the difficulty of precisely attributing them to fundamental factors. One possible way of assessing the effectiveness of macroprudential policies is to evaluate their impact on economic growth and its volatility over the long term. These two measures of effectiveness are closely linked to economic well-being, and could thus be seen as a desirable by-product of properly conducted macroprudential policies. Furthermore, from an ex post perspective, financial crises would entail higher macroeconomic volatility. In other words, "[a] resilient economy absorbs exogenous shocks and recovers quickly" (BIS (2016)). Any assessment of macroprudential policies from this perspective should consider the potential of an intertemporal trade-off between growth and volatility. But, despite the growing body of research on the effectiveness of macroprudential policies on bank risk and lending,3 the econometric evidence for their impact on long-run growth is still limited.

Using data for a panel of 64 advanced and emerging market economies, this special feature investigates empirically the link between macroprudential policies and economic performance as measured by output volatility and growth over a five-year period. We find, first, that the more a country uses macroprudential policies, the higher is the growth rate of its per capita GDP and the less volatile its GDP growth, ie we find no evidence of a trade-off. Second, the beneficial effects of macroprudential policies on output growth and volatility are found to depend on the economy's degree of openness and financial development. For economies that are either very open or very financially developed (but not both), macroprudential policies tend to be less effective. On the other hand, with a sufficiently high degree of development and openness, macroprudential measures gain in effectiveness. The composition of the market for financial intermediation and the degree of foreign competition could play a role in generating these results (eg Cerutti et al (2017a)). Finally, we find that the non-systematic part of macroprudential interventions - that is, the part not explained by fundamentals - appears to hamper growth.

The rest of the article consists of five sections. The first presents the main channels through which macroprudential policies could affect output growth and volatility. The second section reviews the main characteristics of macroprudential tools and presents some stylised facts. The third section empirically tests the effects of macroprudential tools in moderating business cycle fluctuations and enhancing real output growth. The fourth estimates the role of non-systematic macroprudential policies on macroeconomic performance. The last section summarises the main results.

How can macroprudential policies affect output growth and volatility?

Macroprudential policies are typically designed to increase the financial system's resilience, thus reducing the systemic risks arising from financial intermediation.

It could be argued that macroprudential policies may succeed in shoring up macroeconomic stability but only at the cost of excessively curbing economic activity and long-term growth. In other words, there is a trade-off between stability and sustainable prosperity. But it might also be that no such trade-off exists: that is, more stable economies could better sustain and foster economic growth. This perspective is especially relevant from a policy viewpoint. Which of these perspectives will emerge in the data will depend, among other things, on how stabilisation is pursued.4

A number of papers have explored empirically how volatility could affect growth, and how different policies shape this relationship.5 While earlier research found a negative link between volatility and growth (eg Kormendi and Meguire (1985), Ramey and Ramey (1995)), more recent evidence suggests that it is not volatility itself, but rather policy-induced volatility that appears to hamper growth (Fatás and Mihov (2012)). On the monetary policy side, for example, Aghion et al (2012) find that countercyclical monetary policy can increase labour productivity at the industry level. Similar evidence emerges for fiscal policy. In particular, Aghion et al (2014) find that procyclical fiscal policies reduce growth, while countercyclical fiscal policies appear to boost it. In other words, properly conducted fiscal policy can support growth by smoothing the business cycle. Moreover, they find that financial factors (credit constraints, competition in the financial sector etc) are key elements in the transmission channel linking fiscal policy to growth.

The analysis of the link between macroprudential policies and growth has received less attention so far. Currently, the costs and benefits of specific macroprudential tools, such as countercyclical capital buffers or dynamic provisioning for banks, are the subject of vigorous debates between policymakers, industry representatives and academics. The main focus is on the possible short-term impact on lending margins and quantities (Jiménez et al (2016), Drehmann and Gambacorta (2012)). That said, poorly designed macroprudential policies, by limiting the ability of the market to freely allocate financial resources, could in principle reduce efficiency, eventually hampering economic growth.6

However, macroprudential measures could also boost growth. After all, they are designed to increase the financial system's resilience and tame the financial cycle (BCBS (2010)). Moreover, macroprudential tools can mitigate the adverse effects of capital flow volatility on economic growth (Neanidis (2017)) by encouraging the build-up of buffers (IMF (2017)). We can think of at least two channels through which macroprudential policies could be conducive to higher long-term growth. First, macroprudential policies can limit (if not prevent) the occurrence of financial crises, which are typically followed by slow recoveries and long periods of low productivity. Second, to the extent that macroeconomic (and financial) volatility reduces growth (as discussed above), and to the extent that macroprudential policies reduce such volatility, macroprudential policies should be positively linked to longer-term growth.

Some evidence on macroprudential policies

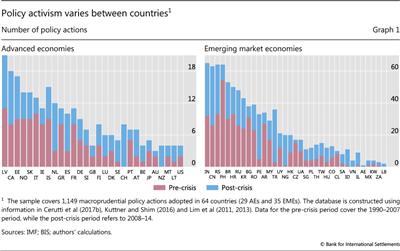

We base our analysis on the macroprudential data collected by Lim et al (2011, 2013), Kuttner and Shim (2016) and Cerutti et al (2017b), who between them counted 1,149 macroprudential policy actions adopted in 64 countries in the period 1990-2014.7 Graph 1 summarises these data and highlights the different degree of activism between advanced and emerging market economies (left- and right-hand panels, respectively), as well as before and after the GFC (red and blue bars, respectively). Macroprudential activism is clearly greater among EMEs across the whole sample than among advanced economies, and has increased over time across both groups.8 Graph 1, furthermore, provides clear evidence of a sizeable heterogeneity across countries, and also within each group, that does not appear to be simply explained by size, openness, regional or other factors, a point to which we will return at the end of this article.

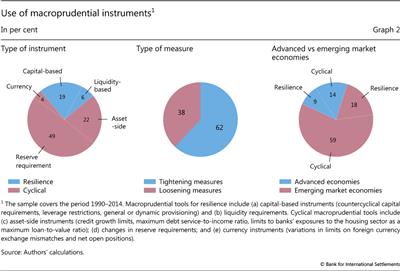

The heterogeneity across countries of tools, institutional settings and experience with macroprudential policies has motivated researchers to develop a detailed characterisation of these policies.9 In particular, provided that financial stability can be seen as the overarching goal of macroprudential policy tools, specific measures tend to be motivated by specific objectives. Borio (2011a) and Claessens et al (2013), for example, classify commonly used policy tools according to the goals for which they might be best suited. Macroprudential tools whose main objective could be enhancing the resilience of the financial sector include (a) capital-based instruments (countercyclical capital requirements, leverage restrictions, general or dynamic provisioning) and (b) liquidity-based requirements.

Instruments that, in addition, would be better suited to smoothing the credit cycle would include (c) asset-side instruments (credit growth limits, maximum debt service-to-income-ratios, limits to bank exposures to the housing sector such as maximum loan-to-value ratios); (d) changes in reserve requirements; and (e) currency instruments (limits on foreign currency exchange mismatches and net open positions).

Interestingly, only one quarter of the measures were aimed at directly increasing the financial sector's resilience. These include measures that set or adjust capital, liquidity or provisioning requirements (Graph 2, left-hand panel). By contrast, the vast majority of measures were intended to smooth the cycle - ie they were used countercyclically to mitigate an expected credit boom or credit crunch. More than half involve changes in reserve requirements. Overall, 60% of the interventions were intended to tighten financial conditions (Graph 2, centre panel). Of all the macroprudential measures adopted, 80% were taken by EMEs (Graph 2, right-hand panel).

It is important to note that since "macroprudential measures" typically affect the cost of credit, some of them could equally well be described as "non-interest rate monetary policy tools" (Kuttner and Shim (2016)). This alternative classification could appear particularly apt for reserve requirements, which have traditionally fallen within the toolbox of monetary policy instruments, both among EMEs and among advanced economies (see eg Friedman (1990)). Identifying the precise motivation (monetary policy vs macroprudential) behind these interventions is very difficult, in particular across 64 heterogeneous countries. To address this issue, our data set adopts surveys to exclude interventions that were not explicitly motivated by macroprudential objectives (Cerutti et al (2017a)). But, in any event, the key aspect we seek to uncover is whether or not these measures can be aimed at increasing macroeconomic stability, and whether they operate through the credit channel, quite independently of the specific label.

An important limitation of the available data set is that it does not quantify the size of the adjustments and refers only to their frequency.10 Mindful of this limitation, we try to build our inference in two steps. First, we use the observed frequency of macroprudential decisions as an explanatory variable for output growth and its volatility. The result could be due either to systematic (and one hopes sensible) policies, or to more erratic components, or to both. Thus, in a second stage, we try to isolate the non-systematic component of macroprudential policy interventions, and estimate its contribution to growth. We believe that these two complementary steps can shed some light, albeit tentatively, on the link between macroprudential "activism" and macroeconomic performance.11

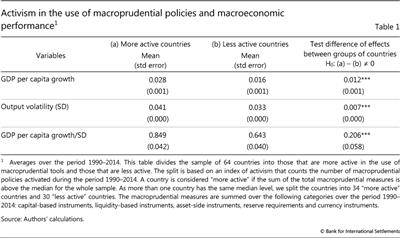

With this caveat in mind, we provide in Table 1 some first-pass evidence on the relationship between macroprudential tools, per capita GDP growth and its volatility. The table divides the sample of 64 countries into those that are more active in the use of macroprudential tools and those that are less active. The split is based on an index of activism that counts the number of macroprudential measures activated in the period 1990-2014. A country is considered "more active" if the total number of macroprudential measures is above the median for the whole sample. The data suggest that countries which used macroprudential tools more frequently are also those that experienced (i) an average GDP per capita growth that is 1 percentage point higher than that of other countries over the sample period (the results are the same for simple real GDP growth); (ii) higher output volatility; and (iii) higher overall output growth, even after controlling for this higher volatility.

This evidence is only suggestive. The rest of this article analyses these relationships more rigorously through econometric models that attempt to measure the impact of macroprudential policies after accounting for other relevant factors.

Macroprudential policies, finance and economic performance

Panel data analysis can help us derive more precise conclusions about the link between growth, macroeconomic volatility and macroprudential policies. We need to be careful in controlling for unobserved factors, whether across countries or time-varying, that might have an influence on the level and volatility of growth not captured by our set of observable variables. And we need to correct for possible reverse causality, ie that a country might choose to implement certain macroprudential policies in response to growth and volatility.

To account for possible unobserved factors we use country and time fixed effects, while we treat the reverse causality problem by using the dynamic Generalised Method of Moments (GMM) panel methodology (see eg Arellano and Bond (1991) and Blundell and Bond (1998)). More precisely, we follow the modelling approach of Beck and Levine (2004), adapting it to study the link between output growth/volatility and the use of macroprudential tools.

Our baseline econometric model is the following:

where the dependent variable Yi,t is either the five-year (non-overlapping) standard deviation of real per capita GDP growth (σΔyi,t) or the five-year (non-overlapping) average real per capita GDP growth (Δyi,t), and i and t represent country and time period respectively.12 The key variables in the specification are macroprudential activism (MaP, given by the logarithm of the five-year sum of the number of changes in MaP measures in a given country),13 indicators of financial development (FD, taken from Sahay et al (2015)),14 and openness (OPEN, where we use the Chinn and Ito (2006) index). The regressions also include interactions of these three variables. We estimate the equation for three measures of MaPi,t: the total for all tools, resilience-oriented measures, and cyclically oriented measures. Xi,t includes a set of control variables, while ηi are country fixed effects (taking care of the unobserved heterogeneity) and θt is a time fixed effect, aimed at taking care of unobserved time-varying factors common across countries. Control variables include an index for independence of the supervisory authority (Barth et al (2004)), which indicates the degree to which the supervisory authority is able to make decisions independently of political considerations (the index ranges from 0 to 1, with higher values indicating greater independence). This index could be interpreted as a proxy for policy constraints, akin to that used by Fatás and Mihov (2012). Other control variables are the average number of years of schooling (in logs), government consumption (in logs), the inflation rate, the real interest rate, the effective exchange rate and a financial crisis dummy.15

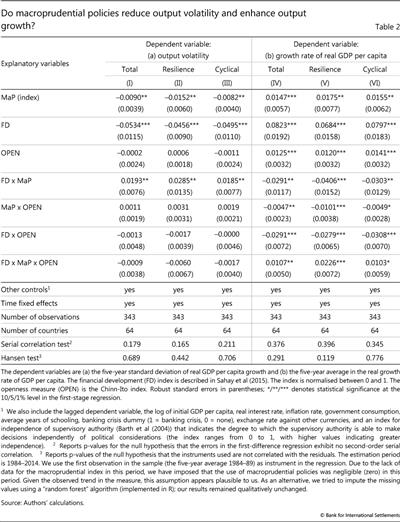

The regression results suggest that more frequent use of macroprudential measures tends to reduce economic volatility (Table 2, left-hand part, column I). Measures targeting resilience seem to be relatively more effective (compare the size of the coefficients in columns II and III). This suggests that, controlling for reverse causality, macroprudential policies tend to promote a more stable macroeconomic environment.

Key structural features of the economy - openness and financial development in particular - also appear to influence the impact of macroprudential measures. For example, assuming a totally closed economy (OPEN = 0), the coefficient on the term capturing the interaction between financial development and macroprudential activism, FDxMaP (fourth row), suggests that the more financially developed the economy is, the less effective are macroprudential policies in reducing volatility. The same conclusion would be reached for increasing openness. In contrast, macroprudential measures are more effective if both financial development and openness are sufficiently large (row seven). Putting these two results together suggests that the interaction between openness and financial development can affect the impact of policy on economic performance.16

More active macroprudential policies are also associated with higher per capita GDP growth (Table 2, right-hand part, first row). Financial development17 (second row) and openness18 (third row) also appear to have a direct positive impact on growth.19 As regards the interaction between macroprudential policies, openness and financial development, the conclusions are the same as for volatility. In isolation, greater openness or financial development each seem to dampen the positive effect of policy activism on growth. However, the coefficient on the interaction between the two structural factors with policy activism indicates a stronger effectiveness of macroprudential policies.

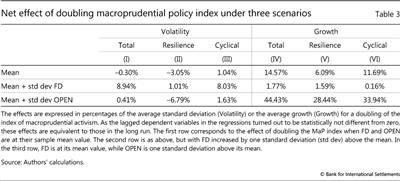

Given the complexity of these interactions, it is instructive to illustrate the results through a concrete quantitative example. In particular, Table 3 shows the net effect of doubling the macroprudential policy indices (over five years) for three different scenarios: (i) the case in which financial development and openness are at their sample mean (the average economy); (ii) the case in which openness is at the mean, while financial development is one standard deviation above the mean; and (iii) vice versa. The reported values are expressed in percentages of sample averages of the left-hand variables. So, for example, on average the effect on volatility of doubling macroprudential policy activism is about -0.30% of the average standard deviation of output growth (Table 3, first cell) and 14.57% of the average per capita output growth (fourth cell). By moving to a larger degree of financial development (one standard deviation above the mean), we observe that both volatility and growth are increased by more macroprudential policy activism (Table 3, second row). With the exception of the resilience measures, a (one standard deviation) larger degree of openness (with FD at its mean) increases the effectiveness of macroprudential policy, resulting in lower volatility and higher growth. The former effect is clearly driven by the triple interaction, suggesting that macroprudential policy tends to be particularly effective for countries with financial development and openness above their mean. Aware of the crudeness of our macroprudential policy indicators, and of having neglected statistical significance in these calculations, we take these quantitative examples with a grain of salt, and consider more noteworthy the statistical significance and direction of the estimates.

What would be the implications for our interpretation of the results if our econometric methodology did not successfully correct for reverse causality? Our interpretation would actually be strengthened in the case of the volatility regression. For example, it could be that countries experiencing faster economic growth or higher macroeconomic volatility (eg EMEs) react by adopting macroprudential policies more frequently. In this case, the true relationship would be stronger than what we actually find. As concerns the growth regression, however, the possibility of reverse causality weakens our findings. If faster economic growth were to lead to a greater use of macroprudential policies (even controlling for volatility), the true coefficient could be smaller than we show, possibly even of the opposite sign. This is an important caveat to bear in mind in interpreting our results. One way of dealing with this problem would be to use longer periods to compute average growth, as the five-year growth rates used in this article could capture periods of excessive or unsustainable growth. Unfortunately, the limited time dimension of our sample prevents us from examining growth rates over longer horizons.

Non-systematic macroprudential interventions and growth

Researchers studying other areas of policy often attempt to distinguish non-systematic, ad hoc policy actions from those based on systematic policy rules. For example, Fatás and Mihov (2012) identify the systematic component of fiscal policy by assuming that it should be related to economic activity. They then estimate a policy rule linking changes in government spending to changes in real GDP, and treat the residual as a measure of non-systematic fiscal policy. They find that the latter component contributes to growth-reducing volatility. Similarly, many analyses of monetary policy postulate a "Taylor rule" (typically linking monetary policy rates to the output gap and inflation) as the systematic policy component, and then examine the macroeconomic impact of the estimated residual (Taylor (1993)).

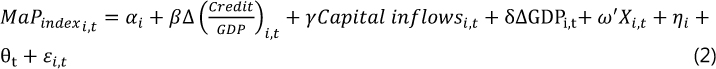

Following this literature, we attempt to measure the non-systematic component of macroprudential policy. In particular, we estimate the following regression:

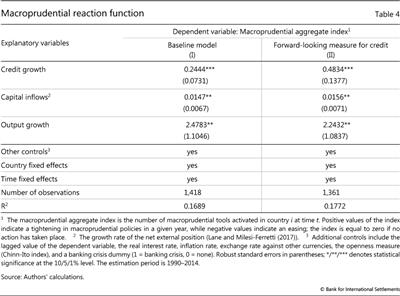

where MaP_indexi,t is the macroprudential aggregate index, in country i at time t, which allows us to evaluate the overall effectiveness of macroprudential tools when more than one measure is activated. Differently from regression (1), we consider in this case not only the number of macroprudential policy tools activated but also their sign, in order to identify their countercyclical properties. Positive values of the index indicate a net tightening in macroprudential policies in a given year, while negative values indicate an easing. The index is equal to zero if no action has taken place or if the actions balance each other out.20 The model includes as main explanatory variables the growth rates of the credit-to-GDP ratio, real GDP growth and net capital inflows.21 We include country and time fixed effects, and a vector of additional controls (Xi,t): the effective exchange rate, the real interest rate, the inflation rate, an openness measure (Chinn-Ito index) and a banking crisis dummy (1 = banking crisis, 0 = none).

In line with our expectations, we find that actual macroprudential policies are tightened when the growth rates of credit-to-GDP, real GDP and net capital inflows increase, and vice versa (Table 4). We also include a forward-looking measure for the growth of the credit-to-GDP ratio (based on its past value and monetary policy conditions) to capture the fact that policymakers could base their decision on projections. This inclusion does not change the results (Table 4, column II).

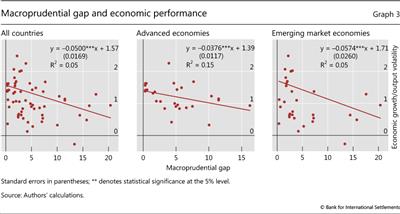

Our measure of "non-systematic" macroprudential policy is given by εi,t, ie the residual in equation (2). We use this residual to construct a measure of the "macroprudential gap", which we define as the cumulative sum of non-systematic macroprudential policy actions over the sample period. In particular, we measure the macroprudential gap as the sum over the whole period of the absolute value of εi,t, divided by the average level of the MaP_index. Ideally, we would want to calculate the residual of an hypothetical regression of changes in values of MaP instruments. Since we only observe the frequency and sign of MaP changes, our residual can be seen only as a very rough approximation. Our measure must be interpreted as the non-systematic (or non-fundamental) component of decisions about changing MaPs, ie the error one would commit by predicting a change (up or down) in MaP, conditional on the explanatory variables in the regression.

The left-hand panel of Graph 3 plots this macroprudential gap on the horizontal axis against the ratio of GDP per capita growth to its standard deviation on the vertical axis. This measure captures the fact that both higher growth and macroeconomic stability are typically indicators of good economic performance. The regression line shows a negative correlation between these two variables. This suggests that countries with a wider macroprudential gap experienced worse macroeconomic performance over the sample period (lower growth relative to volatility). This result is also statistically significant when the sample is split between advanced and emerging market economies (centre and right-hand panels, respectively).

An important caveat should be mentioned at this point. As with all estimates of reduced-form policy functions (whether fiscal, monetary or macroprudential), there is a considerable risk of not adequately capturing the true policy reaction function. General equilibrium reasoning suggests that many variables will be correlated with macroprudential intervention, so that a number of candidate empirical rules are conceivable. Given the nature of our data, and in particular the lack of detail concerning the values of macroprudential interventions, we do not pursue more sophisticated identification schemes in this article.

Conclusions

The main aim of macroprudential tools is to reduce systemic risks and the frequency of deep financial crises. Effective policy interventions should thus be reflected in a more stable economy. Yet it has been argued that macroprudential measures achieve higher stability at the cost of a suboptimal level of credit and investment, which could hinder long-run economic growth. The debate on the existence and strength of such effects - and thus on the net benefits of macroprudential interventions - is still open.

This feature attempts to shed light on these crucial policy questions. It investigates empirically the link between macroprudential policies and two key measures of economic performance: growth and its volatility. We find that the more active a country is in the use of macroprudential measures, the higher and less volatile is its per capita GDP growth. However, these beneficial effects depend crucially on the country's stage of financial development and degree of openness. When either, but not both, of these structural features is particularly advanced, the beneficial effect of macroprudential measures on volatility appears to be dampened, if not reversed. For particularly open and financial developed countries, the net effect of macroprudential interventions on economic activity is especially beneficial. Further research is needed to shed light on the possible causes of these empirical regularities.22

Finally, we find that a measure of non-systematic macroprudential policy tends to be negatively correlated with GDP growth relative to its volatility. This result could suggest that macroprudential policies, like any therapy, can have side effects and must be properly administered.

References

Acemoğlu, D and F Zilibotti (1997): "Was Prometheus unbound by chance? Risk, diversification and growth", Journal of Political Economy, August, vol 105, no 4, pp 709-51.

Agénor, P-R, E Kharroubi, L Gambacorta, G Lombardo and L Pereira da Silva (2017): "The international dimensions of macroprudential policies", BIS Working Papers, no 643, June.

Agénor, P-R and L Pereira da Silva (2017): "Capital requirements, risk-taking and welfare in a growing economy", BIS Working Papers, forthcoming.

Aghion, P, G Angeletos, A Banerjee and K Manova (2010): "Volatility and growth: credit constraints and the composition of investment", Journal of Monetary Economics, vol 57, no 3, pp 246-65.

Aghion, P, E Farhi and E Kharroubi (2012): "Monetary policy, liquidity, and growth", NBER Working Papers, no 18072.

Aghion, P, D Hemous and E Kharroubi (2014): "Cyclical fiscal policy, credit constraints, and industry growth", Journal of Monetary Economics, vol 62, pp 41-58.

Altunbas, Y, M Binici and L Gambacorta (2017): "Macroprudential policy and bank risk", BIS Working Papers, no 646, June.

Angelini, P, S Neri and F Panetta (2014): "The interaction between capital requirements and monetary policy", Journal of Money, Credit and Banking, vol 46, no 6, pp 1073-112.

Arellano, M and S Bond (1991): "Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations", Review of Economic Studies, vol 58, no 2, pp 277-97.

Baldwin, R (2004): "Openness and growth: what's the empirical relationship?", in R Baldwin and L Winters (eds), Challenges to globalization: analyzing the economics, University of Chicago Press, pp 499-526.

Bank for International Settlements (2016): "Economic resilience: a financial perspective", note submitted to the G20 on 7 November.

Barth, J, G Caprio and R Levine (2004): "Bank regulation and supervision: what works best?", Journal of Financial Intermediation, vol 13, pp 205-48.

Basel Committee on Banking Supervision (2010): An assessment of the long-term impact of stronger capital and liquidity requirements, August.

Bech, M, L Gambacorta and E Kharroubi (2014): "Monetary policy in a downturn: are financial crises special?", International Finance, vol 17, no 1, pp 99-119.

Beck, T and R Levine (2004): "Stock markets, banks, and growth: panel evidence", Journal of Banking and Finance, vol 28, no 3, pp 423-42.

Bekaert, G and A Popov (2012): "On the link between the volatility and skewness of growth", NBER Working Papers, no 18556.

Blundell, R and S Bond (1998): "Initial conditions and moment restrictions in dynamic panel data models", Journal of Econometrics, vol 87, no 2, pp 115-43.

Borio, C (2011a): "Implementing a macroprudential framework: blending boldness and realism", Capitalism and Society, vol 6, no 1.

--- (2011b): "Central banking post-crisis: What compass for uncharted waters?", BIS Working Papers, no 353, September.

Borio, C and M Drehmann (2009): "Assessing the risk of banking crises - revisited", BIS Quarterly Review, March, pp 29-46.

Boyd, J and E Prescott (1986): "Financial intermediary-coalitions", Journal of Economic Theory, vol 38, no 2, April, pp 211-32.

Buch, C (2017): "Data needs and statistics compilation for macroprudential analysis", keynote remarks at the Irving Fisher Committee-National Bank of Belgium Workshop.

Cecchetti, S and E Kharroubi (2012): "Reassessing the impact of finance on growth", BIS Working Papers, no 381, July.

Cerutti, E, S Claessens and L Laeven (2017a): "The use and effectiveness of macroprudential policies: new evidence", Journal of Financial Stability, vol 28, pp 203-24.

Cerutti, E, R Correa, E Fiorentino and E Segalla (2017b): "Changes in prudential policy instruments - a new cross-country database", International Journal of Central Banking, vol 13, no 1, pp 477-503.

Chinn, M and H Ito (2006): "What matters for financial development? Capital controls, institutions, and interactions", Journal of Development Economics, vol 81, no 1, pp 163-92.

Claessens, S, S Ghosh and R Mihet (2013): "Macro-prudential policies to mitigate financial system vulnerabilities", Journal of International Money and Finance, vol 39, pp 153-85.

Demirgüç-Kunt, A, E Detragiache and O Merrouche (2013): "Bank capital: Lessons from the financial crisis", Journal of Money, Credit and Banking, vol 45, no 6, pp 1147-64.

Diamond, D (1984): "Financial intermediation and delegated monitoring", Review of Economic Studies, vol 51, no 3, pp 401-19.

Dixit, A and R Pindyck (1994): Investment under uncertainty, Princeton University Press.

Drehmann, M and L Gambacorta (2012): "The effects of countercyclical capital buffers on bank lending", Applied Economic Letters, vol 19, no 7, pp 603-8.

Elliott, D, S Salloy and A Santos (2012): "Assessing the cost of financial regulation", IMF Working Papers, no 233.

Elliott, D and A Santos (2016): "Estimating the cost of financial regulation", IMF Staff Discussion Notes, no 12/11.

Fatás, A and I Mihov (2012): "Fiscal policy as a stabilization tool", CEPR Discussion Papers, no DP8749, January.

Fender, I and U Lewrick (2016): "Adding it all up: the macroeconomic impact of Basel III and outstanding reform issues", BIS Working Papers, no 591, November.

Friedman, B (1990): "Targets and instruments of monetary policy", Handbook of Monetary Economics, vol 2, pp 1185-230.

Galati, G and R Moessner (2017): "What do we know about the effects of macroprudential policy?", Economica, forthcoming.

Gambacorta, L, J Yang and K Tsatsaronis (2014): "Financial structure and growth", BIS Quarterly Review, March, pp 21-35.

Greenwood, J and B Smith (1996): "Financial markets in development, and the development of financial markets", Journal of Economic Dynamics and Control, vol 21, pp 145-81.

International Monetary Fund (2017): "Increasing resilience to large and volatile capital flows: the role of macroprudential policies", IMF Policy Paper, July.

International Monetary Fund and Financial Stability Board (2009): "The financial crisis and information gaps", Report to the G-20 Finance Ministers and Central Bank Governors, October.

International Monetary Fund, Financial Stability Board and Bank for International Settlements (2011): "Macroprudential policy tools and frameworks", Update to G20 Finance Ministers and Central Bank Governors, February.

--- (2016): "Elements of effective macroprudential policies: Lessons from international experience", Joint Report, August.

Jensen, M (1993): "The modern Industrial Revolution, exit, and the failure of internal control systems", Journal of Financial Economics, vol 3, pp 305-60.

Jensen, M and W Meckling (1976): Theory of the firm: managerial behavior, agency costs and ownership structure, Harvard University Press.

Jiménez, G, S Ongena, J-L Peydró and J Saurina (2016): "Macroprudential policy, countercyclical bank capital buffers and credit supply: evidence from the Spanish dynamic provisioning experiments", Journal of Political Economy, forthcoming.

Kormendi, R and P Meguire (1985): "Macroeconomic determinants of growth: cross-country evidence", Journal of Monetary Economics, vol 16, no 2, pp 141-63.

Kuttner, K and I Shim (2016): "Can non-interest rate policies stabilise housing markets? Evidence from a panel of 57 economies", Journal of Financial Stability, vol 26, pp 31-44.

Laeven, L and F Valencia (2012): "Systemic banking crises: an update", IMF Working Papers, no 163.

Lane, P and G Milesi-Ferretti (2017): "International financial integration in the aftermath of the global financial crisis", IMF Working Papers, no 17/115.

Lee H-Y, L Ricci and R Rigobon (2004): "Once again, is openness good for growth?", Journal of Development Economics, vol 75, pp 451-72.

Levine, R (2005): "Finance and growth: Theory and evidence", in P Aghion and S Durlauf (eds), Handbook of Economic Growth, vol 1A, Elsevier, pp 865-934.

Lim, C-H, A Costa, F Columba, P Kongsamut, A Otani, M Saiyid, T Wezel and X Wu (2011): "Macroprudential policy: what instruments and how to use them? Lessons from country experiences", IMF Working Papers, no 11/238, November, pp 1-85.

Lim, C-H, I Krznar, F Lipinsky, A Otani and X Wu (2013): "The macroprudential framework: policy responsiveness and institutional arrangements", IMF Working Papers, no 13/166, July.

Macroeconomic Assessment Group (2010a): Assessing the macroeconomic impact of the transition to stronger capital and liquidity requirements - Interim Report, Financial Stability Board and Basel Committee on Banking Supervision, August.

--- (2010b): Assessing the macroeconomic impact of the transition to stronger capital and liquidity requirements - Final Report, Financial Stability Board and Basel Committee on Banking Supervision, December.

--- (2011): Assessment of the macroeconomic impact of higher loss absorbency for global systemically important banks, Financial Stability Board and Basel Committee on Banking Supervision, October.

Neanidis, K (2017): "Volatile capital flows and economic growth: the role of macro-prudential regulation", University of Manchester, Discussion Paper Series, no 215.

Ramey, G and V Ramey (1995): "Cross-country evidence on the link between volatility and growth", American Economic Review, vol 85, no 5, pp 1138-51.

Reinhart, C and K Rogoff (2009): "The aftermath of financial crises", American Economic Review, no 99, May, pp 466-72.

Rodríguez, F and D Rodrik (2000): "Trade policy and economic growth: a skeptic's guide to the cross-national evidence", NBER Macroeconomics Annual, no 15, pp 261-325.

Sahay, R, M Čihák, P N'Diaye, A Barajas, R Bi, D Ayala, Y Gao, A Kyobe, L Nguyen, C Saborowski, K Svirydzenka and S Yousefi (2015): "Rethinking financial deepening: stability and growth in emerging markets", IMF Staff Discussion Notes, no SDN/15/08.

Sánchez, A and O Röhn (2016): "How do policies influence GDP tail risks?", OECD Economics Department Working Papers, no 1339.

Stiglitz, J and A Weiss (1983): "Incentive effects if terminations: applications to credit and labor markets", American Economic Review, vol 73, no 5, pp 912-27.

Taylor, J (1993): "Discretion versus policy rules in practice", Carnegie-Rochester Conference Series on Public Policy, vol 39, pp 195-214.

1 The authors would like to thank Pierre-Richard Agénor, Yavuz Arslan, Claudio Borio, Stijn Claessens, Benjamin Cohen, Dietrich Domanski, Mathias Drehmann, Ingo Fender, Enisse Kharroubi, Hyun Song Shin, Nikola Tarashev and Kostas Tsatsaronis for useful comments and suggestions. The views expressed are those of the authors and do not necessarily reflect those of the BIS.

2 See also Fender and Lewrick (2016) for a cost-benefit analysis of Basel III reforms.

3 Agénor and Pereira da Silva (2017) study the impact that regulatory constraints arising from macroprudential policy may have on the risk-taking incentives of financial intermediaries, and how this might lead to suboptimal levels of lending.

4 It has been argued that low volatility for long periods of time does not necessarily mean that financial imbalances are not building up, and that this "can lull policymakers into a false sense of security" (Borio and Drehmann (2009)). For example, Borio (2011b) suggests that "after all, the seeds of the global financial crisis were sown during the Great Moderation."

5 One channel through which volatility could affect growth runs through investment decisions (Dixit and Pindyck (1994), Aghion et al (2010)).

6 Angelini et al (2014) point out that even countercyclical macroprudential policies, which dampen macroeconomic volatility by restricting banking activity in the boom phase, could have a negative impact on the steady state level of output and investment. Evaluating the effects of recent changes of regulation more generally, Elliott et al (2012) and Elliott and Santos (2016) point to the quantitatively small negative effects of Basel III regulation on GDP growth. See also MAG (2010a, b, 2011).

7 As our various macroprudential data sets cover different periods, we used Cerutti et al (2017b) only for the years 2013 and 2014. We checked the robustness of our results by considering different approaches to merging the data and by using imputation methods to merge the data for the years 2013 and 2014. The virtually identical results are available upon request from the authors.

8 Activism across EMEs displays a marked upward trend, which might have reached its peak around the time of the GFC. See Altunbas et al (2017) for a more detailed description.

9 See Demirgüç-Kunt et al (2013) for an overview. In response to the paucity of macroprudential data, the G20 in 2009 promoted the Data Gaps Initiative (IMF-FSB (2009); see also Buch (2017)).

10 In general, knowledge of the frequency of policy decisions (eg monetary or fiscal) by itself would not reveal much about the links between policy and economic outcomes. For example, frequent policy interest rate changes could be due to frequent changes of the underlying fundamentals, or to erratic policy decisions - two alternatives with economic implications that are likely to be opposite. With sufficient data at hand, one could hope to disentangle the two cases, and thus sharpen the inference on the economic implications of policy. But this is not feasible with our data set.

11 Different systematic policies can, of course, deliver very different outcomes. In an interconnected world, furthermore, it is the combination of policies across countries that determines the outcome - for example, whether or not countries take an inward-looking perspective. In relation to macroprudential policies, Agénor et al (2017) provide two theoretical characterisations of policies (cooperative and non-cooperative) with strikingly different outcomes. Empirically, we are bound to focus our attention on the identification of actual policies as opposed to describing alternative hypothetical outcomes.

12 The results presented in this paper are based on annual GDP data. An appendix, available from the authors on request, reports results based on quarterly GDP data. Using quarterly data does not affect the results qualitatively, although there are some quantitative differences. The case for using quarterly data was particularly strong for the calculation of output growth volatility, given the short window (five years). Yet the comparison of annual and quarterly data suggests that annual data are more reliable for a number of EMEs, especially in the early part of the sample. Bekaert and Popov (2012), in a growth/volatility analysis involving many countries, made the same choice. Furthermore, they opted for a five-year window to calculate GDP growth moments, as we do in this paper.

13 The logarithm helps reduce the effect of tail observations. Our results are robust to alternative specifications, including a specification in levels and a specification that reduces tail observations by winsorising the macroprudential policy index at the 1% level. Note that both a tightening and a loosening of the macroprudential instrument count for one change each, as we consider the number of changes as opposed to the direction of changes.

14 The financial development index (FD) is constructed by aggregating six sub-indices for the "depth", "access" and "efficiency" of financial institutions and financial markets. The weights are obtained from principal component analysis, reflecting the contribution of each underlying series to the variation in the specific sub-index. The FD index is normalised between 0 and 1.

15 The introduction of the crisis dummy aims at sharpening the inference on the effects of macroprudential policies on economic performance, as macroprudential policy activism tended to be higher during the GFC. The crisis dummy takes the value of 1 if the country is in a financial crisis in a given year. To date a financial crisis, we rely on a combination of Borio and Drehmann (2009), Laeven and Valencia (2012) and Reinhart and Rogoff (2009). Following Bech et al (2014), the dummy takes the value of 1 in the crisis year and in all the subsequent years of falling real GDP. As an additional robustness test, we also run the regressions excluding the observations referring to financial crisis periods. This reduces the number of observations from 343 to 249. The results, not reported for the sake of brevity, are very similar.

16 The effective exchange rate regime does not appear to have systematically affected the degree of macroeconomic volatility in our sample, as the estimated coefficients are statistically insignificant. Similar results are obtained using a dummy for the exchange rate regime (fixed or floating), as the frequency of macroprudential intervention might be related to foreign exchange interventions in some countries, at least in some periods.

17 Other researchers have found a similar result. The link between finance and growth is typically explained by (i) the reduction of the cost of acquiring and processing information and thereby improving resource allocation (Diamond (1984), Boyd and Prescott (1986)); (ii) monitoring investments and exerting corporate governance after providing finance (Stiglitz and Weiss (1983), Jensen and Meckling (1976)); (iii) facilitating the trading, diversification and management of risk and pooling of saving (Acemoğlu and Zilibotti (1997)); and (iv) easing the exchange of goods and services (Greenwood and Smith (1996)). For a review, see Levine (2005). Cecchetti and Kharroubi (2012) find that the level of financial development is positively correlated with GDP growth up to a point, after which it has a negative effect. Similar results are found in Gambacorta et al (2014).

18 The literature is not unanimous on the positive impact of openness on growth (Rodríguez and Rodrik (2000), Baldwin (2004)). The possibility that higher growth induces openness (reverse causality) calls for caution in the interpretation of findings. Attempts to deal with this issue appear to confirm the influence of openness, albeit not a particularly strong one (eg Lee et al (2004)).

19 We also tested the direct impact of GDP growth volatility on the level of GDP growth, finding a negative but not statistically significant sign (not reported for the sake of brevity). All other results remain unchanged. This result is consistent with the finding of Fatás and Mihov (2012), who report that the impact of GDP volatility on growth is insignificant once policy volatility is included separately in the regression.

20 Following Kuttner and Shim (2016), we calculate the aggregate macroprudential index summing up all the different dummies for the various macroprudential tools. This means that if multiple actions in the same direction are taken within a given year, the variable could take on the values of 2 or -2, or even 3 and -3. It also means that a tightening action and a loosening action taken within the same year could cancel each other out. This indicator weights each tool in the same way and will be considered in our baseline regression.

21 The capital inflows are measured as growth rate of the net external position, and are taken from Lane and Milesi-Ferretti (2017).

22 The result for the interaction of macroprudential policies and openness suggests that the international dimensions of macroprudential policies could play an important role. The international effects of macroprudential policies and the role of cooperation go beyond the scope of this feature, but some preliminary results reported in Agénor et al (2017) indicate that the gains from cooperation could be sizeable. Nevertheless, their magnitude could be asymmetrical, pointing to potential political economy obstacles to such cooperation.