CIP deviations and monetary policy announcements

(Extract from page 54 of BIS Quarterly Review, September 2016)

Monetary policy can boost hedging demand through both price and quantity effects. By lowering the yield curve and, in particular, by compressing the term premium and credit spreads, easing encourages investors to seek return and duration in foreign currency bonds and foreign issuers to sell bonds in the corresponding currency to obtain cheaper funding. Large-scale asset purchases strengthen these effects by withdrawing securities from the market. And so does the adoption of negative interest rates, which can result in negative yields stretching out to long maturities.

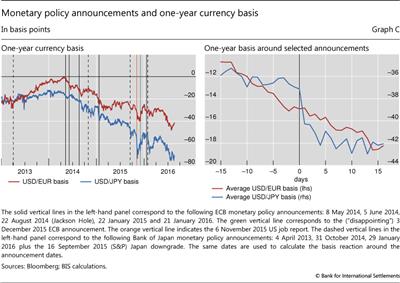

Much of the widening of the USD basis since 2014 has coincided with monetary policy easing announcements by the Bank of Japan (BoJ) and the ECB. Indeed, the widening began in earnest with the ECB's ramping-up of easing measures, including the 5 June 2014 announcement of negative rates (Graph C, left-hand panel). The announcement of ECB government bond buying (quantitative easing, QE) on 22 January 2015 also had a significant impact on the USD/JPY basis, owing perhaps to expected policy contagion or more technical factors (eg French banks' role as JPY/USD arbitrageurs). Similarly, the BoJ's Quantitative and Qualitative Monetary Easing (QQE) announcements as well as its move to negative policy rates saw the USD/JPY basis widen. In fact, the short-term announcement effects were even starker for the BoJ (Graph C, right-hand panel).

One possible explanation for the responsiveness of the basis to monetary policy announcements is that the swap dealers that provide currency hedges expect the outflows from the euro or the yen to increase when the ECB or the BoJ eases policy. This includes the flows hedged for currency risk, which push up the demand for FX swaps or cross-currency swaps. Hence, the swap dealers set higher prices for currency hedges, which results in wider CIP deviations. Conversely, when the ECB or the BoJ surprises with less easing than anticipated, dealers revise downwards the expected hedging demand coming their way, lower their prices and, hence, help narrow the basis. This happened on 3 December 2015 (green vertical line, left-hand panel): the announced ECB stimulus was lower than what market participants had expected in the run-up to the Federal Reserve's first rate hike. Such expectations had been firming during the previous month following the upbeat US jobs data release in November (orange vertical line). After the ECB announcement, market participants revised down their expected volumes of cross-currency flows out of the euro area.

See Borio and Zabai (2016) for a survey of unconventional monetary policy measures that documents and discusses these effects. On the relationship of central bank deposit rate changes and the currency basis, see Bräuning and Ivashina (2016, Table IX).

See Borio and Zabai (2016) for a survey of unconventional monetary policy measures that documents and discusses these effects. On the relationship of central bank deposit rate changes and the currency basis, see Bräuning and Ivashina (2016, Table IX).