International business of banks in China

As part of China's commitments as a member of the Committee on the Global Financial System and the G20, the State Administration of Foreign Exchange (SAFE) has been working with the BIS to compile data on the international business of banks in China for reporting the locational banking statistics (LBS). In March 2016 SAFE started to publish some of these data. Once the full details are available, these data will be included in the LBS published by the BIS. The future inclusion of China in the LBS-reporting population will result in a 3% increase in reporting banks' aggregate cross-border assets and a 4% increase in cross-border liabilities.

In March 2016 SAFE started to publish some of these data. Once the full details are available, these data will be included in the LBS published by the BIS. The future inclusion of China in the LBS-reporting population will result in a 3% increase in reporting banks' aggregate cross-border assets and a 4% increase in cross-border liabilities.

The data published by SAFE capture the positions of all commercial and investment banks in China, including the government-owned policy banks (eg China Development Bank and Export-Import Bank of China) and the mainland affiliates of foreign-controlled banks. The central bank's assets and liabilities are excluded.

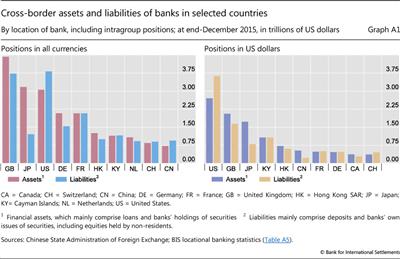

China's data confirm that banks on the mainland are becoming an increasingly important source of international bank credit. At end-December 2015, they were the tenth largest creditors in the international banking system, with cross-border assets of $722 billion (Graph A1, left-hand panel). They are an especially important source of US dollar credit: their cross-border dollar assets totalled $529 billion, larger than those of banks in all but five countries (Graph A1, right-hand panel).

Unlike in the other large countries that are creditors in the international financial system, such as Germany and Japan, the banking sector in China is a net debtor in the international market. At end-2015, the cross-border liabilities of banks on the mainland amounted to $944 billion, which was $222 billion more than their cross-border assets. This net debtor position is partly explained by the offshore listings of several of the largest Chinese banks. About one third of their cross-border liabilities, or $320 billion, comprised instruments other than loans, deposits and debt securities. These other instruments mostly represented the market value of Chinese banks' equities traded in Hong Kong SAR and on other exchanges.

Another explanation for the relatively large size of Chinese banks' liabilities is the channelling of offshore renminbi deposits to the mainland - for example, renminbi deposits placed with banks in Hong Kong SAR, which are in turn deposited with banks on the mainland. At end-2015, mainland banks reported that their renminbi-denominated liabilities to non-residents totalled $436 billion, whereas their renminbi-denominated claims on non-residents were only $58 billion. A decline in such liabilities accounted for a sizeable portion of the total capital outflows from China in 2015, as firms and households outside the mainland reduced their demand for renminbi deposits in response to waning incentives for holding long-renminbi, short-US dollar positions.

Turning to their US dollar positions, banks in China were large net creditors: at end-2015, their cross-border US dollar assets exceeded their dollar liabilities by almost $300 billion (Graph A1, right-hand panel). At the time, only banks in Japan and the United Kingdom were larger net dollar creditors. Banks in China appeared to fund their cross-border dollar assets in part with dollars raised on the mainland from firms and households.

The new data help to shed light on potential channels of contagion from economic and financial developments in China. The consolidated banking statistics (CBS) and LBS have long been a useful source of information for monitoring the credit extended by foreign banks to borrowers in China. Foreign banks' exposure to China has increased rapidly since the late 2000s, to $694 billion at end-2015 on a consolidated ultimate risk basis (see pp 5-6). The new data from China will make it easier to monitor the dependence of borrowers abroad on credit from China. As the Great Financial Crisis of 2007-09 demonstrated, it is as important to monitor potential shocks emanating from creditors as those from borrowers. Furthermore, the existing international banking statistics underestimate the overall increase in the indebtedness of those countries relatively more reliant on credit from China.

In 2009, the International Monetary Fund and the Financial Stability Board launched an international initiative to improve the availability of key information for policymakers to assess risks across countries. This Data Gaps Initiative is endorsed by the G20 and overseen by the Inter-Agency Group of international organisations, of which the BIS is a member.

In 2009, the International Monetary Fund and the Financial Stability Board launched an international initiative to improve the availability of key information for policymakers to assess risks across countries. This Data Gaps Initiative is endorsed by the G20 and overseen by the Inter-Agency Group of international organisations, of which the BIS is a member.  See R McCauley and C Shu, "Dollars and renminbi flowed out of China", BIS Quarterly Review, March 2016, pp 26-7, www.bis.org/publ/qtrpdf/r_qt1603u.htm.

See R McCauley and C Shu, "Dollars and renminbi flowed out of China", BIS Quarterly Review, March 2016, pp 26-7, www.bis.org/publ/qtrpdf/r_qt1603u.htm.