Is electronification harming market robustness?

(Extract from page 89 of BIS Quarterly Review, March 2016)

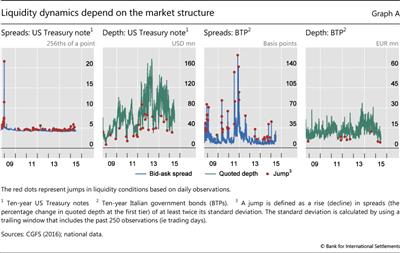

While electronic trading has clearly altered the provision of liquidity, it is difficult to assess empirically how these changes have affected market robustness, broadly defined as the market's ability to absorb shocks (eg large order imbalances). One reason is a lack of detailed data on trading activity prior to the advent of electronic trading. A second reason is that many factors can affect liquidity conditions, making it difficult to single out the impact of any individual one (CGFS (2016)). Some tentative insights, however, can be drawn from comparing electronic markets that differ with regard to how they source liquidity. Graph A depicts the bid-ask spreads and quoted depth since 2008 for 10-year US Treasury notes and 10-year Italian government bonds (buoni del tesoro poliennali (BTPs)), respectively. For the former, trading takes place on a fully automated CLOB, with PTFs accounting for a sizeable share of liquidity provision. For the latter, liquidity is exclusively provided by dealers that commit to quoting executable prices (CTT). Clearly, this comparison is subject to several caveats: each market was exposed to different conjunctural and systemic shocks (eg the euro area sovereign debt crisis), and each comprises different market participants that may be subject to varying constraints (eg funding liquidity conditions).

Keeping these big caveats in mind, some tentative observations may be drawn from the data. One is that transitory jumps in liquidity conditions occur in both markets. This reflects the fact that ETPs can help pool liquidity, but that they cannot generate liquidity when markets face order imbalances. A second observation is that liquidity conditions on the US Treasury market appear to be characterised by less volatile bid-ask spreads. While spreads do jump (the red dots in Graph A indicate changes by more than two standard deviations), they have remained in a narrow range, closely tied to the minimum tick size (1/64th of a point). Adverse changes in liquidity conditions, however, occur through adjustments in quoted depth. The BTP market, by comparison, appears to undergo larger adjustments in spreads during stressed periods, with quoted depth remaining fairly stable (Graph A, third and fourth panels).

It is difficult to judge, based on this comparison, which of the two market structures ensures more robustness. While, on the one hand, CLOBs with significant HFT presence may support trading at tight spreads throughout strained market conditions, market depth could prove shallow and fleeting if investors seek to trade large quantities. Quote-driven markets, on the other hand, benefit from the capacity of dealers to warehouse assets over an extended period of time (in contrast to the typical HFT liquidity providers), which may help absorb temporary order imbalances. Dealers, however, will seek to mitigate risks to their balance sheets by widening spreads in situations of elevated market uncertainty, implicitly charging investors for the cost of these higher risk exposures.