Inventory levels and asset price sensitivity: catching the falling knife?

(Extract from page 107 of BIS Quarterly Review, March 2015)

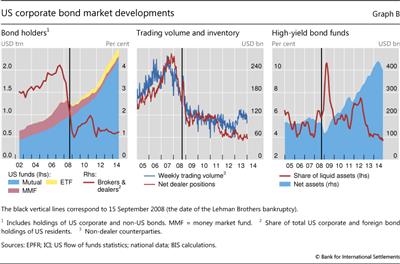

Analysts often point to shrinking dealer inventories of corporate and high-yield bonds and how they compare with flows into fixed income investment funds, particularly those that claim to provide "daily liquidity", such as mutual funds and exchange-traded funds (ETFs). US fund holdings have grown by more than $1 trillion over the past five years. At the same time, net dealer holdings have contracted significantly since the onset of the financial crisis (Graph B, left-hand and centre panels). Do these developments mean that markets are less resilient to shocks, ie that liquidity risks have increased? And how important are market-making trends in determining the liquidity of these markets?

One reading of shrinking dealer inventory is that market-makers are less likely to accommodate any sales from return-sensitive investors. For example, in today's low interest rate environment, what would happen if many investors wanted to trim their bond holdings because they expected yields to rise? The key factors here are market-maker risk limits and whether market-makers were prepared to maintain or increase inventories in response to a shock. Lower risk tolerance and tighter capital management among market-makers clearly lower their willingness to commit their balance sheets. Yet an important notion is that one cannot expect market-makers to deliberately expose themselves to losses when market valuations change (often referred to as "catching the falling knife"). Dealers tend to cut back their inventory decisively when markets are stressed. Indeed, that is what happened when US bond yields spiked in mid-2013 (Adrian et al (2013)). Thus, market-makers are not likely to accommodate broad changes in market sentiment, even if they readily provide liquidity under normal circumstances.

In the current environment, therefore, narrow bid-ask spreads for market-makers should not be seen as a sign that liquidity risks are low. Nor do lower inventories imply increased liquidity risks, as suggested by rising trading volumes over recent years (Graph B, centre panel). Instead, strong demand in fixed income markets has meant that liquidity risks have shifted to investors. While many of these are well equipped to bear these risks, there are signs that liquidity buffers have been trending down in some market segments (Graph B, right-hand panel). This suggests that some asset managers may be ill-prepared to manage bigger swings in market sentiment.