The Great Depression

(Extract from page 38 of BIS Quarterly Review, March 2015)

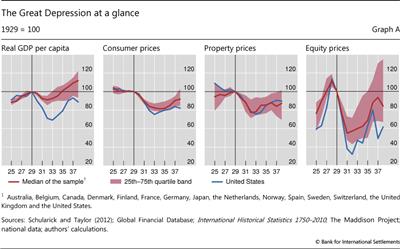

The perception that deflation is very costly is shaped to a large extent by the Great Depression, and in particular by the US experience. Especially in that country, the Great Depression followed a period of surging asset values, for both stock and house prices, a credit boom and robust output growth. Inflation was low or negative, reflecting strong increases in productivity, and interest rates were low. This period of apparent prosperity was brought to an end by the Wall Street Crash of October 1929. An unprecedented financial and economic meltdown followed, characterised by asset price collapses, bank panics, massive real economic contraction, mass unemployment, and dramatic goods and services price deflations in many countries. Between 1929 and 1933, real output in the United States dropped by almost one third and consumer prices by almost a quarter (Graph A). At the same time, nominal wages (hourly earnings in manufacturing) also fell by about one fifth, while the unemployment rate rose from 3% to 25%.

Especially in that country, the Great Depression followed a period of surging asset values, for both stock and house prices, a credit boom and robust output growth. Inflation was low or negative, reflecting strong increases in productivity, and interest rates were low. This period of apparent prosperity was brought to an end by the Wall Street Crash of October 1929. An unprecedented financial and economic meltdown followed, characterised by asset price collapses, bank panics, massive real economic contraction, mass unemployment, and dramatic goods and services price deflations in many countries. Between 1929 and 1933, real output in the United States dropped by almost one third and consumer prices by almost a quarter (Graph A). At the same time, nominal wages (hourly earnings in manufacturing) also fell by about one fifth, while the unemployment rate rose from 3% to 25%.

While the Great Depression was a global phenomenon, output generally contracted much more severely in the United States than elsewhere (Graph A, first panel). In the 15 countries in our sample, output, goods and services prices and asset prices fell substantially, but the cross-country dispersion is considerable. The median drop in real output between 1929 and 1933 was roughly 7%, much smaller than in the United States. And output recovered much faster too: by 1938, the median output per head in the group of economies for which data are available stood about 12% above its 1929 value, while it was still about 11% below in the United States.

Over this period, consumer prices behaved in a more similar way across countries (Graph A, second panel). The median price decline was about 18%, with a relatively narrow interquartile range across economies. The graph also shows that price levels were already on a declining trend before the onset of the Great Depression, consistent with our observation that persistent price deflation started in most countries during the early or mid-1920s. By contrast, property and equity prices in most countries peaked just before the economic contraction (Graph A, third and fourth panels). The median decline in house prices between 1929 and 1933 was about 22%; that in equity prices from their 1928 peak was about 51% by 1931 and in the United States no less than 67%.

The extensive literature on the Great Depression includes Friedman and Schwartz (1965), Bernanke (1983, 1995), Bernanke and James (1991), Eichengreen (1992) and Temin (1989).

The extensive literature on the Great Depression includes Friedman and Schwartz (1965), Bernanke (1983, 1995), Bernanke and James (1991), Eichengreen (1992) and Temin (1989).