International bond issuance, cross-currency swaps and capital flows

(Extract from page 69 of BIS Quarterly Review, December 2014)

When an EME company issues a US dollar-denominated bond in overseas capital markets and then repatriates the proceeds, one would expect that to show up as capital inflows in US dollars. However, this need not always be the case. The company or its overseas subsidiary can issue the bond and swap the proceeds into domestic currency before transferring the funds back to the headquarters. Obviously, there will be a similar increase in the headquarters' liabilities, but only the company's consolidated balance sheet would show an increase in foreign currency liabilities.

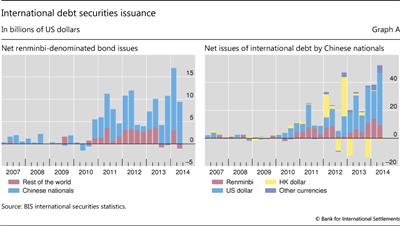

For instance, Chinese firms have primarily issued US dollar-denominated bonds abroad, whereas non-Chinese companies account for a sizeable proportion of offshore renminbi bond (CNH) issuance (Graph A). Very often, these non-Chinese entities will swap their CNH proceeds into US dollars. In doing so, they are taking advantage of the cross-currency swap markets to obtain US dollar funding at lower costs than by issuing US dollar bonds (HKMA (2014)). Similarly, cross-currency swaps offer Chinese firms a channel to get around the tight liquidity conditions in China by swapping their US dollar proceeds from bond issuance into renminbi and remitting to their headquarters.