The Shanghai-Hong Kong Stock Connect programme

(Extract from pages 10-11 of BIS Quarterly Review, December 2014)

On 10 April 2014, the China Securities Regulatory Commission (CSRC) and the Securities and Futures Commission (SFC) of Hong Kong SAR announced Shanghai-Hong Kong Stock Connect, a pilot programme aimed at establishing mutual stock market access between mainland China and Hong Kong. On 17 October, the CSRC and SFC signed a memorandum of understanding (MoU) and agreed on the principles and arrangements for cross-boundary regulatory and enforcement cooperation under the programme. On 10 November, the CSRC and SFC approved the launch of the Stock Connect on 17 November 2014.

The Stock Connect - also known as the "Through Train" - will allow trading of shares between the Shanghai Stock Exchange (SSE) and Stock Exchange of Hong Kong Limited (SEHK). In the Shanghai-to-Hong Kong "southbound trading link", mainland investors can trade in up to 266 eligible stocks listed in Hong Kong, up to a daily quota for (net) purchases of RMB 10.5 billion, and an aggregate quota of RMB 250 billion. The shares qualified for trading represent 82% of the SEHK's market capitalisation. In the Hong Kong-to-Shanghai "northbound trading link", global investors can trade in up to 568 eligible stocks listed in Shanghai, up to a daily quota for (net) purchases of RMB 13 billion, and an aggregate quota of RMB 300 billion, with the shares qualified for trading representing 90% of the SSE's market capitalisation. The quotas constrain only buy orders; sell orders are always allowed. The quotas are open to future adjustments.

In the Hong Kong-to-Shanghai "northbound trading link", global investors can trade in up to 568 eligible stocks listed in Shanghai, up to a daily quota for (net) purchases of RMB 13 billion, and an aggregate quota of RMB 300 billion, with the shares qualified for trading representing 90% of the SSE's market capitalisation. The quotas constrain only buy orders; sell orders are always allowed. The quotas are open to future adjustments.

The programme needs to ensure that brokers comply with the rules and regulations in two very different markets. Preparing and streamlining operations for the Stock Connect brought significant challenges and required extensive cooperation by the respective regulators. One major issue was taxation. On 14 November, China's Finance Ministry, State Administration of Taxation and the CSRC announced that capital gains levies would be waived for an unspecified period for northbound investors, and for three years for southbound individual investors. Investors on both sides would be exempt from the business taxes on stock trading.

The Stock Connect can be an important landmark for China's capital account liberalisation process. The SSE has the seventh highest market capitalisation in the world, with $2.96 trillion at the end of October 2014, yet it remains relatively closed. Foreign institutional investors could only access China through the Qualified Foreign Institutional Investor (QFII) and RMB QFII (RQFII) programmes under an existing MoU between the firm's home nation and China; these require regulatory approval and are subject to strict, individually granted trading quotas. The Stock Connect represents a significant addition to the existing programmes, and opens up China's capital markets to an unprecedented degree:

- While the existing schemes focus on one-way flows, the Stock Connect relaxes restrictions on capital flows in both directions: northbound trading is open to all investors, and southbound trading to mainland institutional investors and individual investors with securities and cash balances of at least RMB 500,000.

- Northbound trading will be quoted in renminbi but settled in offshore renminbi, and southbound trading will be quoted in Hong Kong dollars but settled in onshore renminbi. Trading and settlement in renminbi will encourage its further use.

- At RMB 1.1 trillion, Hong Kong's liquidity pool consisted of renminbi deposits and certificates of deposit, and was large enough to meet the projected demand under the Stock Connect. Yet the People's Bank of China moved to abolish the daily RMB 20,000 per person conversion cap for Hong Kong residents, effective on 17 November. This would facilitate their participation and encourage local financial institutions to introduce more renminbi investment products. But renminbi transfers to onshore bank accounts remain subject to a daily limit of RMB 80,000 per person, limiting the likely impact on cross-boundary capital flows.

- Mainland firms not participating in the Qualified Domestic Institutional Investor programme can now raise funds globally, as their shares become accessible to global investors under the new programme.

- Compared to the QFII and RQFII programmes, trading via the Stock Connect has no lockup or repatriation restrictions.

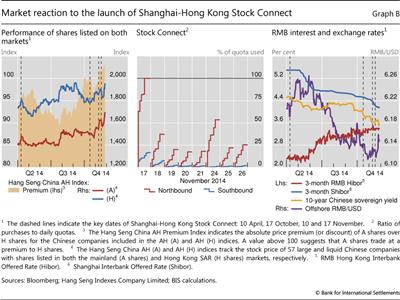

The Stock Connect has been expected to narrow the price differences for shares of Chinese companies listed in both markets, ie the A shares listed on mainland exchanges, and the H shares listed in Hong Kong. The shares are traded separately, with heavy restrictions on foreign access to A shares, and investors' ability to arbitrage the two markets was limited. As the widely anticipated launch of the Stock Connect neared, the price differences between the A and H shares narrowed significantly over the third quarter of 2014, briefly achieving parity in early October (Graph B, left-hand panel). When the launch date was confirmed on 10 November, the price discount on A shares quickly turned into a premium, reflecting investors' strong demand for those shares. Indeed, initial trading was lopsided, with the northbound trading volume hitting the daily quota limit by 14:00 local time on the first day, while southbound trading ended the day reaching RMB 1.768 billion, just 17% of the quota (Graph B, centre panel). Trading volumes declined in the following days; the daily quota used by northbound investors dropped to 17.5% on 20 November, but stabilised towards 25% on day 26 after a strong rebound on day 24. Several factors might have contributed to weak trading, eg investors' unfamiliarity with the new system, lack of expertise on A and H shares, and concerns over adequate investor protection.

The effects of the Stock Connect may spill over to other assets, despite the fact that both funds and securities stay in the "closed loop" of the two settlement systems: once a northbound investor sells her A shares bought through the Stock Connect, the resulting funds go back to her bank account in Hong Kong. She will not be able to use the proceeds to invest in other types of mainland assets. Even so, QFII and RQFII investors can now free up part of their quotas originally destined for equities to invest in eg fixed income assets. In fact, the 10-year Chinese government bond yield fell following the major announcements (Graph B, right-hand panel). In addition, the gap between onshore and offshore renminbi interest rates has narrowed since May 2014. Yet initial weak Stock Connect trading contributed to a rise in the offshore RMB/USD rate as renminbi enthusiasm waned.

So far, the Stock Connect has operated smoothly. As currently designed, it applies only to equities traded on the two exchanges, although in principle trading quotas could be increased and the programme expanded to other exchanges, instruments and asset classes. Ultimately, the Stock Connect may encourage a convergence of market rules, accounting and information disclosure standards between the SEHK and mainland exchanges. The Stock Connect is also expected to bring greater transparency to the mainland market and enhance corporate governance at Chinese firms.