Cross-border investments in global debt markets since the crisis

(Extract from pages 18-19 of BIS Quarterly Review, March 2014)

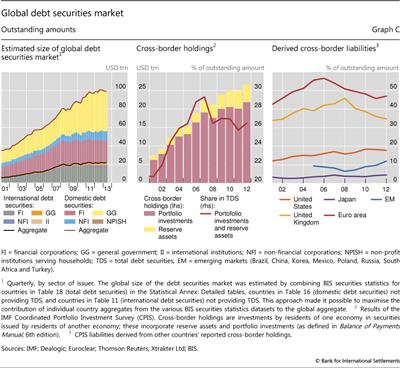

Global debt markets have grown to an estimated $100 trillion (in amounts outstanding) in mid-2013 (Graph C, left-hand panel), up from $70 trillion in mid-2007. Growth has been uneven across the main market segments. Active issuance by governments and non-financial corporations has lifted the share of domestically issued bonds, whereas more restrained activity by financial institutions has held back international issuance (Graph C, left-hand panel).

Growth has been uneven across the main market segments. Active issuance by governments and non-financial corporations has lifted the share of domestically issued bonds, whereas more restrained activity by financial institutions has held back international issuance (Graph C, left-hand panel).

Not surprisingly, given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers (Graph C, left-hand panel). They mostly issue debt in domestic markets, where amounts outstanding reached $43 trillion in June 2013, about 80% higher than in mid-2007 (as indicated by the yellow area in Graph C, left-hand panel). Debt issuance by non-financial corporates has grown at a similar rate (albeit from a lower base). As with governments, non-financial corporations primarily issue domestically. As a result, amounts outstanding of non-financial corporate debt in domestic markets surpassed $10 trillion in mid-2013 (blue area in Graph C, left-hand panel). The substitution of traditional bank loans with bond financing may have played a role, as did investors' appetite for assets offering a pickup to the ultra-low yields in major sovereign bond markets.

Financial sector deleveraging in the aftermath of the financial crisis has been a primary reason for the sluggish growth of international compared to domestic debt markets. Financials (mostly banks and non-bank financial corporations) have traditionally been the most significant issuers in international debt markets (grey area in Graph C, left-hand panel). That said, the amount of debt placed by financials in the international market has grown by merely 19% since mid-2007, and the outstanding amounts in domestic markets have even edged down by 5% since end-2007.

Who are the investors that have absorbed the vast amount of newly issued debt? Has the investor base been mostly domestic or have cross-border investments grown at a similar pace to global debt markets? To provide a perspective, we combine data from the BIS securities statistics with those of the IMF Coordinated Portfolio Investment Survey (CPIS). The results of the CPIS suggest that non-resident investors held around $27 trillion of global debt securities, either as reserve assets or in the form of portfolio investments (Graph C, centre panel). Investments in debt securities by non-residents thus accounted for roughly one quarter of the stock of global debt securities, with domestic investors accounting for the remaining 75%.

The results of the CPIS suggest that non-resident investors held around $27 trillion of global debt securities, either as reserve assets or in the form of portfolio investments (Graph C, centre panel). Investments in debt securities by non-residents thus accounted for roughly one quarter of the stock of global debt securities, with domestic investors accounting for the remaining 75%.

The global financial crisis has left a dent in cross-border portfolio investments in global debt securities. The share of debt securities held by cross-border investors either as reserve assets or via portfolio investments (as a percentage of total global debt securities markets) fell from around 29% in early 2007 to 26% in late 2012. This reversed the trend in the pre-crisis period, when it had risen by 8 percentage points from 2001 to a peak in 2007. It suggests that the process of international financial integration may have gone partly into reverse since the onset of the crisis, which is consistent with other recent findings in the literature. This could be temporary, though. The latest IMF-CPIS data indicate that cross-border investments in debt securities recovered slightly in the second half of 2012, the most recent period for which data are available.

This could be temporary, though. The latest IMF-CPIS data indicate that cross-border investments in debt securities recovered slightly in the second half of 2012, the most recent period for which data are available.

The contraction in the share of cross-border holdings differed across countries and regions (Graph C, right-hand panel). Cross-border holdings of debt issued by euro area residents stood at 47% of total outstanding amounts in late 2012, 10 percentage points lower than at the peak in 2006. A similar trend can be observed for the United Kingdom. This suggests that the majority of new debt issued by euro area and UK residents has been absorbed by domestic investors. Newly issued US debt securities, by contrast, were increasingly held by cross-border investors (Graph C, right-hand panel). The same is true for debt securities issued by borrowers from emerging market economies. The share of emerging market debt securities held by cross-border investors picked up to 12% in 2012, roughly twice as high as in 2008.

The global size of debt securities market is estimated based on three sets of BIS securities statistics: TDS (total debt securities), DDS (domestic debt securities) and IDS (international debt securities). The BIS classifies a debt security as international (IDS) if any one of the following characteristics is different from the country of residence of the issuer: country where the security is registered, law governing the issue, or market where the issue is listed. All other securities are classified as domestic (DDS). From a methodological point of view, the union of the two (IDS and DDS) makes up total debt securities (TDS). See B Gruić and P Wooldridge, "Enhancements to the BIS debt securities statistics", BIS Quarterly Review, December 2012, pp 63-76.

The global size of debt securities market is estimated based on three sets of BIS securities statistics: TDS (total debt securities), DDS (domestic debt securities) and IDS (international debt securities). The BIS classifies a debt security as international (IDS) if any one of the following characteristics is different from the country of residence of the issuer: country where the security is registered, law governing the issue, or market where the issue is listed. All other securities are classified as domestic (DDS). From a methodological point of view, the union of the two (IDS and DDS) makes up total debt securities (TDS). See B Gruić and P Wooldridge, "Enhancements to the BIS debt securities statistics", BIS Quarterly Review, December 2012, pp 63-76.  Data on cross-border investments in debt securities are sourced from the CPIS, which is conducted by the IMF as an annual voluntary portfolio investment data collection. The IMF data also incorporate information from the Securities Held as Foreign Exchange Reserves and Securities Held by International Organizations surveys (total $4.8 trillion at end-2012.) For additional information about the CPIS, see http://cpis.imf.org.

Data on cross-border investments in debt securities are sourced from the CPIS, which is conducted by the IMF as an annual voluntary portfolio investment data collection. The IMF data also incorporate information from the Securities Held as Foreign Exchange Reserves and Securities Held by International Organizations surveys (total $4.8 trillion at end-2012.) For additional information about the CPIS, see http://cpis.imf.org.  See eg P Lane and G M Milesi-Ferretti, "International financial integration", IMF Staff Papers, vol 50, for measures of international financial integration via international balance sheets (not just focusing on global debt securities as in this box). Recent evidence on the contraction of international balance sheets since the crisis is provided eg by G Ma and R N McCauley, "Global and euro imbalances: China and Germany", BIS Working Papers, no 424.

See eg P Lane and G M Milesi-Ferretti, "International financial integration", IMF Staff Papers, vol 50, for measures of international financial integration via international balance sheets (not just focusing on global debt securities as in this box). Recent evidence on the contraction of international balance sheets since the crisis is provided eg by G Ma and R N McCauley, "Global and euro imbalances: China and Germany", BIS Working Papers, no 424.